The total debt of insolvent VAB Bank and bank Financial Initiative of Oleh Bakhmatiuk to the state is UAH 29.3 billion, including a UAH 11 billion debt to the Deposit Guarantee Fund, a UAH 10.6 billion debt to the National Bank of Ukraine (NBU) and a UAH 7.7 billion debt to three state-run banks. According to a posting of the NBU press service on Facebook on Friday, the debt of the former owner of VAB Bank and Financial Initiative Bank to the central bank was secured by his personal guarantee to repay a total amount of UAH 8.6 billion and property guarantees of Bakhmatiuk’s companies.

“In order for these guarantees to turn into a real refund, the NBU filed more than 50 lawsuits against him and his companies,” the regulator said.

The central bank said that as of October 15, 19 court decisions on Bakhmatiuk’s guarantee agreements regarding the bank Financial Initiative were made in favor of the National Bank and entered into legal force, while there are no decisions regarding the VAB bank.

“Nineteen victories have not yet allowed for the repayment of debts: the sale of property by the State Enforcement Service is surprisingly sluggish,” the regulator said.

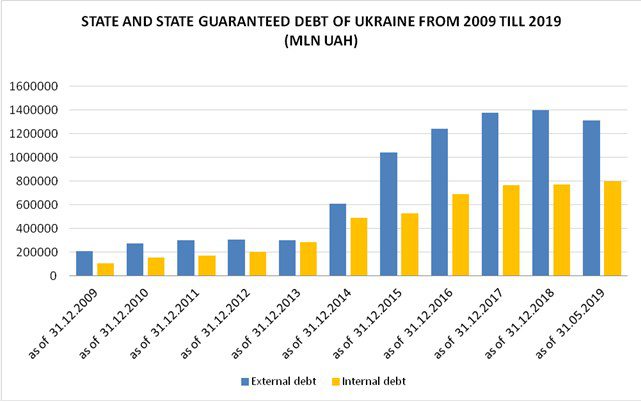

State and state guaranteed debt of Ukraine from 2009 till 2019 (mln UAH)

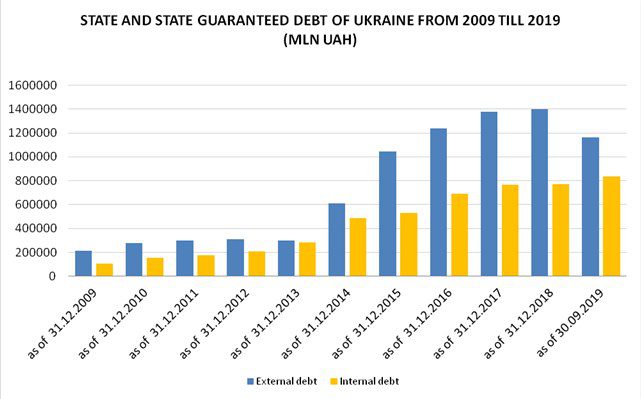

The total state (direct) and state-guaranteed debt of Ukraine in September 2019 increased by 1.26%, or by $1.03 billion, to $82.95 billion, according to data on Finance Ministry’s website.

According to the ministry, the state debt in the national currency decreased by 3.36%, to UAH 1.997 trillion.

In September, direct government debt in U.S. dollars rose by 1.77%, to $72.99 billion (in hryvnias it fell by 2.86%, to UAH 1.758 trillion), in particular external debt decreased by 2.88%, to $38.66 billion.

The state-guaranteed debt last month decreased by 2.36%, to $9.95 billion (in hryvnias decreased by 6.81%, to UAH 239.73 billion), in particular external one fell by 2.72%, to $9.49 billion.

In general, since the beginning of the year, the aggregate public debt of Ukraine increased by 5.91%, or by $4.63 billion, however, in hryvnia equivalent, due to the strengthening of the national currency, it decreased by 6.72%, or by UAH 143.92 billion.

According to the Finance Ministry, the share of liabilities in U.S. dollars of the overall structure of Ukraine’s public debt fell to 39.58% in September, in euros it decreased to 9.93%, in Canadian dollars to 0.18%, in special borrowing rights to 13.46%, in yen to 0.69%, while in hryvnias it increased to 36.15%.

The official hryvnia exchange rate, according to which the Finance Ministry calculates the national debt, strengthened in September to UAH 24.08/$1 compared to UAH 27.688/$1 at the beginning of the year.

JSC Ukrzaliznytsia (Kyiv) has made another payment on eurobonds in the amount of $150 million, head of the company Yevhen Kravtsov said on his Facebook page. He noted that in 2019 the company already paid off 60% of the principal amount ($300 million) on eurobonds raised in 2013. Ukrzaliznytsia intends to repay the remaining $200 million in the next two years.

“This is the second payment this year. We are paying on schedule,” Kravtsov added.

As reported, in March 2019 Ukrzaliznytsia repaid the first part of its $150 million eurobonds and paid coupon income on them, receiving funds for these purposes at Oschadbank and the State Agency of Ukraine for Infrastructure Projects.

KSG Agro Holding has signed an agreement on the restructuring of a loan debt to Germany’s Landesbank Baden-Wuerttemberg (LBBW).

The amount of the loan provided in October 2012 was EUR11.5 million, the balance of the debt was EUR8.3 million, the holding’s press service said. Some 33% of the debt, which is EUR3.2 million, is to be repaid. The agricultural holding borrowed the funds to buy equipment from the German company Big Dutchman for its pig farm in the village of Nyva Trudova in Dnipropetrovsk region (LLC Rantier).

“Successful restructuring means available working capital, which will be spent on developing existing projects and launching new ones in the field of crop production and pig breeding,” Chairman of the KSG Agro Holding’s Board of Directors Serhiy Kasyanov said.

As reported, KSG Agro in April 2019signed an agreement on loan restructuring to Big Dutchman with a decrease in debt from EUR4.8 million to EUR1.03 million.

KSG Agro in the first quarter of 2019 increased net profit by 1.6 times, to $3.46 million, while revenue fell by 12.5%, to $3.4 million. Financial income for the three months of 2019 included $4.3 million in profit from restructuring.

State and state guaranteed debt of ukraine from 2009 till 2019 (mln uah)