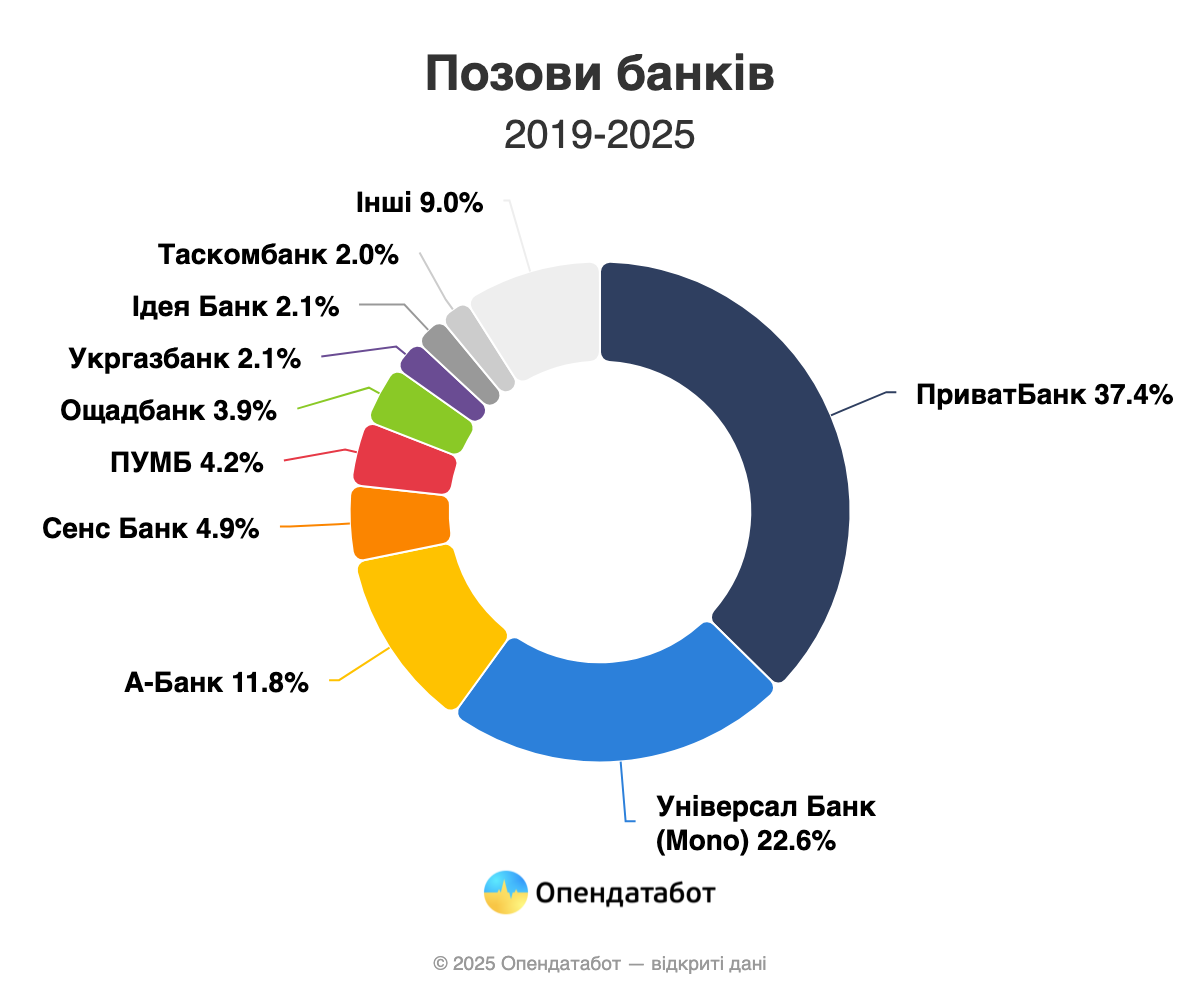

Banks are increasingly suing their debtors. According to the State Judicial Administration of Ukraine, a record 100,000 lawsuits were filed by Ukrainian banks this year. This is almost 1.5 times more than in the same period last year. In total, more than half a million lawsuits against debtors have been filed by banks over the past 7 years. Universal Bank (Mono), Privat and A-Bank account for 70% of the claims.

100,434 lawsuits against debtors were filed by Ukrainian banks. This is 1.5 times more than in the same period last year and a record for the last 7 years. A total of 511,865 lawsuits have been filed by banks since 2019.

Universal Bank/Mono (28,213 claims), A-Bank (22,221), and Privat (20,278) accounted for more than 70% of all claims this year. FUIB (9 , 225) and Sense Bank (6,831) are far behind.

In general, over the past 7 years, Privatbank has remained the unchanged leader in lawsuits against debtors – 191,353 lawsuits. It is followed by Universal Bank (115,702), A-Bank (60,421), Sense Bank (25,283) and FUIB (21,476).

TASKOMBANK saw the largest increase in the number of claims this year, up 3.5 times. PrivatBank (1.8 times), Kredobank (1.7 times), Accent Bank (1.6 times), and Sens Bank (1.6 times) also saw a significant increase.

At the same time, many banks have significantly reduced the number of court appeals. Unex Bank (4 times), Credit Agricole (2 times) and Ukrgasbank (2 times) showed the biggest drop.

It is worth noting that the ranking of the most “litigious” banks has been updated this year. New players entered the top – Radabank and Bank Alliance, which were not on the list last year. Instead, Accordbank and Unex Bank dropped out of the top twenty.

https://opendatabot.ua/analytics/banks-courts-2025

Ukrainian courts are considering 443 cases on claims filed by NPC Ukrenergo against its debtors for a total principal debt of about UAH 50 billion, the company’s website reported on Friday.

At the same time, Ukrenergo called on the National Energy and Utilities Regulatory Commission to reconsider its decisions prohibiting the application of penalties to debtors and entities that postpone payments for the company’s services.

“The Commission’s decisions deprived the company of key tools for working with debtors. In particular, the NEURC Resolution No. 332 of February 25, 2022 (clause 16) prohibits “the accrual and collection of penalties provided for by contracts concluded in accordance with the law on the electricity market between participants in this market,” NPC said.

According to the company, by its decisions, the NEURC actually allowed the debtors not to pay Ukrenergo for the services provided, primarily for transmission and dispatching, depriving them of the “punishment” for late payment and accumulation of debts.

They also noted that in July 2022, Ukrenergo officially asked the NEURC to check companies that systematically fail to pay for electricity transmission services, but as a result, it has not been able to receive payments in full from the largest debtors for more than a year.

“The reason is that the Commission ordered to postpone payment for electricity transmission services for them. In 2023, by its decision, NEURC extended the possibility of postponing payments to Ukrenergo to large debtors,” explained NPC.

As reported, two days earlier, NEURC stated that the solution to the issue of debts in the electricity market is not to set a new tariff for transmission services, as Ukrenergo insists, but to establish effective economic activity, in particular, the company’s claim work with debtors for the payment of transmission tariffs, dispatch control and services in the balancing market, whose debts amounted to UAH 48.8 billion at the end of September.

For its part, Ukrenergo said that “realizing the sensitivity of the issue of electricity cost for Ukrainian business, it has prepared and sent to the NEURC three options for changing the company’s tariffs for transmission and dispatching services.”

“To cover its debts in the electricity market, Ukrenergo attracted loans from state and international banks and issued green bonds worth UAH 45.79 billion.

As of the end of October, the company’s receivables amounted to approximately UAH 60 billion, while its payables amounted to UAH 50 billion.