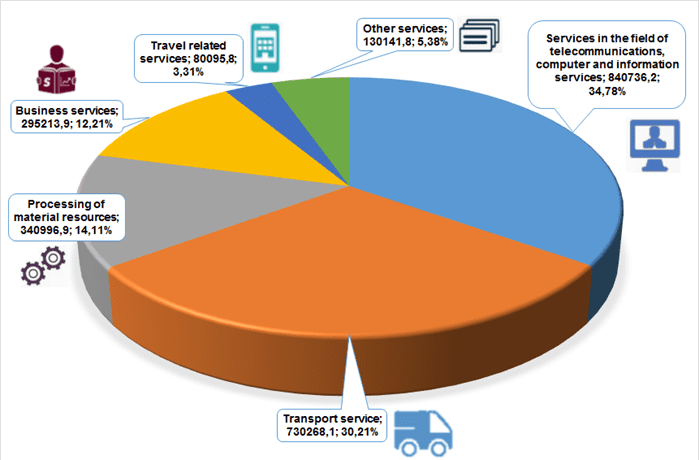

STRUCTURE OF EXPORT OF SERVICES in Jan-March 2021 (GRAPHICALLY)

The U.S. Department of Agriculture (USDA) in its June report has improved the projections for the export of Ukrainian sunflower oil in 2021/22 marketing year (September-August) by 1.02 million tonnes (a rise of 18.9% compared to 2020/21), to 6.4 million tonnes, its production – by 1.05 million tonnes (a rise of 17.7%), to 6.98 million tonnes.

According to a report published on the USDA website, the projection for sunflowerseed production in Ukraine in the current marketing year has been improved by 2.6 million tonnes (a rise of 18.5%), to 16.7 million tonnes.

In its June report, the USDA improved its forecast for Ukraine’s exports of sunflowerseed meal in 2021/22 by 0.7 million tonnes (a rise of 15.2% versus 2020/21), to 5.3 million tonnes, its production – by 1.01 million tonnes (a rise of 17.7%), to 6.71 million tonnes.

According to the USDA, Ukraine in 2021/22 will remain the main world exporter of sun sunflowerseed flower oil, while world production of sunflowerseed oil will grow by 10.2%, to 21.15 million tonnes.

Exports of Ukrainian organic products to the countries of the European Union in 2020 decreased by 23.1% compared to 2019, to 217,210 tonnes. According to the June report of the European Commission, last year Ukraine ranked fourth in the world among suppliers of organic products to this market, its total share of supplies amounted to 7.8%.

Organic cereals (excluding wheat and rice cereals) became the main Ukrainian export crop to the EU organic market, their exports in 2020 sank by 44%, to 82,900 tonnes. Despite the decline, Ukraine remained the main supplier to the European Union, its share amounted to 74.4% of the total supply.

Exports of organic soybeans from Ukraine to the EU in 2020 increased by 67.8% compared to 2019, to 28.7% (21% of the world exports to Europe), organic oilseeds decreased by one third, to 19,300 tonnes (14.1%), oilseed meal – by 9.4%, to 7,400 tonnes (3.2%).

In 2020, Ukraine also exported 5.9% more fresh and dried organic vegetables to the EU than in 2019, 15,500 tonnes, while the export of fresh, chilled and dried organic vegetables decreased by 13.2%, to 5,400 tonnes.

As reported, the Ministry of Economy in April 2021 planned to allocate UAH 50 million for the development of organic production, the amount of state support may increase due to the redistribution of funds from other state programs.

The ministry intends to provide financial support to organic producers in the amount of UAH 5,000 per hectare of cultivated land (but not more than 20 hectares per farm), as well as for one animal (cattle). In addition, farmers will receive refunds of up to 30% of the cost of certification of organic production.

Ukraine since the beginning of the 2020/2021 marketing year (July-June) and as of June 9, 2021 had exported 42.61 million tonnes of grain and leguminous crops, which is 22.4% less than on the same date of the previous MY.

According to the information and analytical portal of the agro-industrial complex of Ukraine, to date, 16.04 million tonnes of wheat, 21.77 million tonnes of corn, and 4.15 million tonnes of barley have been exported.

As of the indicated date, 113,800 tonnes of flour were also exported.

According to the Ministry of Agrarian Policy, Ukraine exported 56.72 million tonnes of grain and legumes in the 2019/2020 MY.

As reported, the Ministry of Economy in February predicted a decline in exports of grains and legumes in the 2020/2021 MY by 20.5% compared to the previous MY, to 45.4 million tonnes.

Ukraine and Egypt are discussing the possibility of joint production between enterprises and export to the African market, Ambassador Extraordinary and Plenipotentiary of the Arab Republic of Egypt Ayman Ahmed Mokhtar Elgammal has said in an exclusive interview to Interfax-Ukraine.

Egypt is a member of a number of free trade areas in African and Arab countries, he said. The official added that, for example, they invited the Ukrainian government to invest in the Suez Canal Economic Zone (SCZone).

According to the ambassador, Ukrainian enterprises will be able to manufacture products in Egypt and benefit from Egyptian free trade agreements in the region.

This will also be the topic of a meeting of the intergovernmental technical committee in June, he added.

At the same time, he clarified that so far no proposals have been received from Ukrainian companies on investments in SCZone.

At the same time, various organizations in Ukraine, in particular Ukrmashbud and its member companies, have asked to open their representative offices in Egypt for the joint production of high-tech goods of heavy engineering, the ambassador said.