Despite the fact that the EU has sharply reduced the amount of Russian gas it imports, significant volumes are still flowing into the bloc. More than two years after Russia launched its full-scale invasion of Ukraine, its gas is still flowing into Europe.

Although the European Union has significantly reduced the amount of gas it imports from Russia, the hydrocarbon still powers some European homes and businesses, thus increasing the Kremlin’s revenues.

When the war broke out, European leaders were forced to reckon with their long-established dependence on both Russian gas and oil. Gas was a particular problem, as in 2021, 34% of EU gas came from Russia.

Central and Eastern European countries were particularly dependent. When the EU proposed a ban, German Chancellor Olaf Scholz was quick to speak out against it. “Europe has deliberately removed energy supplies from Russia from the sanctions. At the moment, Europe’s energy supply for heat production, transportation, electricity and industry cannot be ensured in any other way,” he said.

Vladimir Putin took advantage of this. Throughout 2022, Russia reduced gas imports to Europe. European leaders feared a winter energy shortage. These fears never materialized, but importantly, they meant that the EU never imposed sanctions on Russian gas.

“It was never a sanction,” says Benjamin Hilgenstock of the Kyiv School of Economics. “It was a voluntary decision of the countries, and a reasonable one, to diversify their supplies and no longer blackmail Russia,” he told DW.

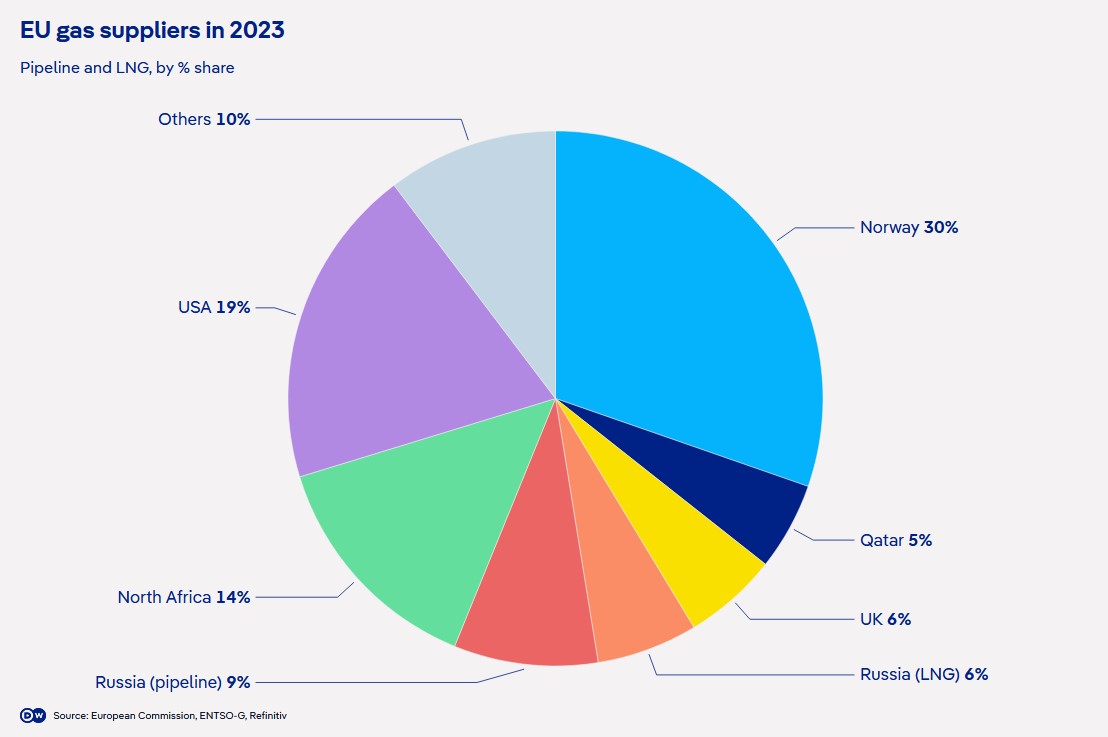

According to EU data, the share of Russian pipeline gas imported by member states has decreased from 40% of the total in 2021 to about 8% in 2023. However, if liquefied natural gas (LNG) – natural gas cooled to a liquid state so that it can be transported by ship – is included, the total share of Russian gas in the EU’s total volume last year was 15%.

One of the main ways to reduce the EU’s dependence on Russian gas has been to increase imports of LNG from countries such as the United States and Qatar. However, this has unwittingly led to a sharp increase in the supply of Russian LNG at high prices to the bloc.

According to Kpler, Russia has become the second largest supplier of LNG to the EU. In 2023, LNG imports from Russia will account for 16% of total LNG supplies to the EU, which is 40% more than in 2021.

Import volumes in 2023 were slightly down on 2022, but data for the first quarter of 2024 show that Russian LNG exports to Europe were up again by 5% year-on-year. France, Spain, and Belgium were particularly large importers. These three countries accounted for 87% of the LNG that entered the EU in 2023.

However, most of this LNG is not needed by the European market and is transshipped in European ports and then re-exported to third countries around the world, resulting in profits for some EU states and companies.

Most of the Russian LNG that comes to Europe is simply “transshipped,” says Hilgenstock. “So it has nothing to do with the supply of natural gas to Europe. It’s just European companies making money by facilitating Russian LNG exports.”

According to a recent report by the Center for Research on Energy and Clean Air

(CREA), just under a quarter of Europe’s LNG imports from Russia (22%) will be transshipped to world markets in 2023. Petras Katinas, an energy analyst at CREA, told DW that most of this LNG was sold to Asian countries.

As a result, some EU members, such as Sweden, Finland and the Baltic states, are putting pressure on the bloc to impose a complete ban on Russian LNG, which would require the consent of all member states.

The EU is currently discussing a ban on re-exporting Russian LNG from European ports. According to the Bloomberg news agency, they are also considering imposing sanctions on key Russian LNG projects, such as Arctic LNG 2, the UST Luga LNG terminal, and the Murmansk plant.

“We really should basically ban Russian LNG,” said Hilgenstock. “We don’t think it plays any significant role in Europe’s gas supply, or that it can be replaced relatively easily with LNG from other sources.” A 2023 study by the Bruegel think tank confirms this analysis.

However, Acer, the EU’s energy regulator, recently warned that any reduction in Russian LNG imports should be done in “gradual steps” to avoid an energy shock.

EU countries continue to receive Russian gas

Pipeline gas from Russia also continues to flow to the EU. Although the Nord Stream pipelines are not working and the Yamal pipeline no longer carries Russian gas to Europe, it still arrives at the Austrian gas hub of Baumgarten via pipelines that pass through Ukraine. Austrian state-owned energy company OMV has signed a contract with Russian gas company Gazprom until 2040.

In February, Austria confirmed that 98% of its gas imports in December 2023 will come from Russia. The government says that it wants to terminate the contract with Gazprom as soon as possible, but for this to happen, EU sanctions against Russian gas must be legally imposed.

Like Austria, Hungary continues to import large quantities of piped Russian gas. Hungary has also recently signed a gas deal with Turkey, but experts say that this gas, which is supplied by the Turkstream pipeline, also comes from Russia.

Gilgenstock says that some countries continue to buy Russian gas because they benefit from cheap and attractive contracts. “So if there is no embargo on Russian gas, it all depends on these countries,” he says.

For countries such as Austria and Hungary, the possible suspension of pipeline imports from Russia may ultimately depend on Ukraine. Kyiv insists that it will not extend the existing agreement with Gazprom on gas supplies through its territory. This agreement expires at the end of 2024.

Although Russian gas is still imported into Europe, its overall share of European gas imports has fallen sharply since 2021. The EU says it wants to be completely free of Russian gas by 2027, a goal that Gilgenstock believes is looking increasingly realistic.

“I think that if this whole messy story has shown us anything, it’s that we can diversify our gas and other energy supplies relatively quickly by getting off Russia,” he said.

However, in his opinion, the political environment is “not very favorable” for a full gas embargo, especially for a pipeline embargo. He cites Hungary’s EU presidency in the second half of 2024 as a potential obstacle. Budapest has closer ties to Moscow than most EU member states.

As for LNG, he is more optimistic and says that, in addition to EU action, major LNG importers such as Spain and Belgium must take action themselves.

“This illegal import of Russian gas is a huge problem, especially in terms of messaging,” he said. “And we are helping Russia with its LNG supply chain, which we shouldn’t be doing.”

In January-March 2024, Ukrgasvydobuvannya JSC increased gas production by 12% compared to the same period in 2023, Naftogaz reports on its website without specifying the final figure.

“This is the result of the launch of new productive wells, as well as effective work with the old stock. Our goal is to maintain this trend and reach production growth by the end of the year,” Naftogaz CEO Oleksiy Chernyshev said in a statement.

According to him, traditionally, the highest production rates are in the east of the country, but in the west and central regions, the plan was also exceeded.

“Every gas production department of Ukrgasvydobuvannya, despite the shelling and sometimes even the lack of electricity supply, is meeting the gas production targets for this year. At the same time, there are risks, we understand that there may be shelling. However, the company will do everything possible to continue to meet the country’s needs,” added the company’s CEO Oleh Tolmachov.

As reported, in 2022, UGV produced 12.5 bcm of natural gas (commercial), which is 3% less than in 2021. At the end of 2023, the company’s commercial gas production amounted to 13.224 billion cubic meters, which is 0.679 billion cubic meters more than in 2022.

NJSC Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.

Naftogaz of Ukraine is negotiating gas storage deals with Germany’s RWE, Norway’s Equinor, France’s TotalEnergies and Engie, the group’s CEO Oleksiy Chernyshov told Bloomberg.

According to him, there is still time to conclude agreements, as the largest volumes of gas injection usually occur in August and September.

Chernyshov also clarified that so far no foreign company that already stores gas in Ukraine has abandoned its decisions, despite the recent Russian attacks on gas infrastructure.

The company continues to serve customers and repair equipment damaged by recent rocket attacks.

The Head of the NJSC reminded that the state energy regulator has recently improved the conditions for gas storage from June 1, 2024. The new rules include shorter booking intervals for capacity – for months rather than for a whole year, which improves the attractiveness of Ukrainian storage facilities for foreign traders.

As reported, in 2023, the volume of gas from foreign traders and energy companies pumped into Ukrainian UGS facilities for storage reached 2.5 bcm. This year, Naftogaz expects to increase this figure to 4 bcm.

Metinvest Group’s Kametstal plant, which was built at the facilities of Dnipro Metallurgical Plant (DMK, Kamianske, Dnipro region), has implemented an investment project to stabilize coke oven gas pressure in the plant’s system to improve energy efficiency and energy independence.

According to a press release, Kametstal has implemented an investment project aimed at stabilizing coke oven gas pressure in the plant’s system as part of the introduction of modern technologies to improve economic efficiency and energy independence.

At the same time, it is specified that comprehensive tests of the installation of a coke oven gas storage system in gas collectors with the possibility of returning to the plant’s gas system have been completed at the site of the company’s power plant. The project is based on a modern technology for collecting excess coke oven gas that occurs in the network during the coke production process into soft gas holders to use it for the needs of the enterprise.

The infrastructure of the new complex, in addition to the pressure stabilization system equipment site, where two soft gas holders are installed – each with a filling volume of almost 580 cubic meters of gas, also includes a compressor building with two turbochargers for pumping gas and one air compressor, a condensate collection unit, technological networks and other equipment.

It is emphasized that the use of soft synthetic gas collectors is the latest approach to gas storage. Their advantages over metal ones include, first of all, an economical and less labor-intensive installation phase, as well as improved working conditions for personnel during maintenance during operation. The gas storage complex is fully automated and equipped with a preventive process safety system.

“The implementation of this investment project is another step of the enterprise and the company towards the priority goal of stable production. In the future, the coke oven gas storage unit will allow us to use this high-calorie gas more efficiently without losing its excess volumes. This is an opportunity to be more energy independent within the framework of the enterprise’s needs and increase the efficiency of production processes,” explained Mikhail Koptev, Director for Capital Construction and Investments.

“KAMETSTAL was established on the basis of PJSC Dnipro Coke and Chemical Plant (DCKhZ) and Centralized Steel Works of PJSC Dnipro Metallurgical Plant (DMK).

According to the 2020 report of Metinvest Group’s parent company, Metinvest B.V. (Netherlands) owned 100% of the shares in DCCP.

“In 2024, Gas TSO of Ukraine will create 167 new mobile teams to service gas distribution stations (GDS), the company’s press service reports.

According to it, the equipment maintenance and repair project is part of GTSOU’s strategy to improve the reliability and efficiency of the gas transmission system.

Currently, 43 mobile teams are working within its framework, each of which serves its own “bush” – several gas distribution stations and the adjacent linear part of gas pipelines. In 2024, the maintenance teams will service 819 GDSs.

A similar practice of gas infrastructure maintenance is used in Europe. In particular, GTSOU was guided by the experience of the Italian operator Snam, which maintains not only GDSs, but also the linear part and compressor stations in this way.

“Mobile maintenance is an efficient use of resources through the involvement of personnel in servicing, first of all, gas distribution systems. The application of this approach involves a number of measures, including a significant improvement in the condition of the gas distribution system. If the technical condition of the facility allows us to change the form of maintenance, we include it in the service area of the mobile maintenance unit,” explained Yuriy Zyabchenko, Chief Engineer of GTSOU.

To ensure that the work of mobile teams meets the standards of European operators, is automated and transparent, GTSOU requested and received technical assistance from USAID through the Energy Security Project to purchase a mobile application.

“Already in 2024, mobile teams will use the mobile application in their work as the main tool for recording information on the technical condition of equipment. This will help improve the quality of maintenance and repair of gas infrastructure and reduce the number of emergency shutdowns,” the operator reminded.

In 2023, Naftogaz Group increased production from workover wells by 20% compared to pre-war 2021, which was a record high for the last four years.

“This figure is 20% higher than production in pre-war 2021. I am sincerely grateful to the specialists of Ukrgazvydobuvannya and the entire team that made this result possible,” the group said on its website, citing Naftogaz CEO Oleksiy Chernyshev on Thursday.

Recently, Ukrgasvydobuvannya JSC (UGV), a part of the Naftogaz group, has overhauled and restored an old well, which now additionally produces more than 340 thousand cubic meters of gas per day.

This well had been awaiting abandonment for a long time, but in 2023, experts conducted a detailed analysis, reviewed technical and geological risks, and decided to restore the well through workovers.

“Our experts are constantly working on reviewing and analyzing old wells that can be brought back into operation due to better technical capabilities than decades ago,” commented Oleh Tolmachov, Acting CEO of Ukrgasvydobuvannya.

As reported, in 2022, Ukrgasvydobuvannya produced 12.5 bcm of natural gas (commercial), which is 3% less than in 2021. According to operational data, the company increased production by more than 0.7 bcm in 2023.

NJSC Naftogaz of Ukraine owns 100% of Ukrgasvydobuvannya shares.