Dragon Capital investment company, one of the leading players on the Ukrainian market, forecasts real gross domestic product (GDP) growth of 3 percent in 2023, while previously it had expected a decline of 0.5 percent.

“We have already improved our forecast: we expect GDP growth of 3% this year,” the company’s founder and head Tomas Fiala said in an interview on Radio NV.

He said power outages have already stopped since mid-February, and economic results in recent months have been better than expected.

“And we hope the economy will grow, perhaps even more than 3 percent,” Fiala added.

Dragon Capital told Interfax-Ukraine that rate and inflation forecasts will also be updated soon.

Fiala noted that Ukraine’s nominal GDP in dollars fell to $160 billion in 2022 from $200 billion in 2021.

“This is the best figure in the last 10 years, more was only in 2021: GDP was $157 billion in 2020 and $160 billion in 2022,” the head of Dragon Capital said.

As reported, Ukrainian Finance Minister Sergei Marchenko late last week said he raised Ukraine’s GDP growth forecast for 2023 to 3.2%, while previously the government had estimated it at 1%, and the National Bank recently improved it from 0.3% to 2%.

Finance Minister Serhiy Marchenko said he raised Ukraine’s GDP growth forecast for 2023 to 3.2%, while previously the government estimated it at 1% and the National Bank recently improved it from 0.3% to 2%.

“Today we are in a much better economic situation compared to the period a year ago … We refrain from monetary financing in 2023, and the GDP growth forecast was raised to 3.2%,” the head of the Ministry of Finance wrote in a column of the publication “Economic truth.”

He added that inflation is falling faster than initially forecasted, from 26.6% in December 2022 to 17.9% in April 2023, but did not specify an updated inflation forecast.

Marchenko thanked business for supporting the budget in a difficult time of war, noting that while GDP fell last year by 29.1% tax revenues to the general fund of the state budget (excluding a number of factors, such as growth due to inflation and forced temporary VAT non-refund) increased by 2% – to 627.7 billion UAH.

Head of the Ministry of Finance said that on its part the Ukrainian government supports the business through a number of programs, in particular, compensation loan rates “available loans 5-7-9%”, which since the beginning of martial law loans totaling more than 106 billion UAH were granted.

Besides, the government grant program for business has been started, which has been already financed more than by 2 billion UAH, and also more than 60 billion UAH have been given from the beginning of martial law by the government guarantee program on portfolio basis.

“I am sure that with the joint efforts of entrepreneurs and the state we will be able to continue to provide funding for successful resistance to the aggressor, which is the key to our victory,” Marchenko stressed.

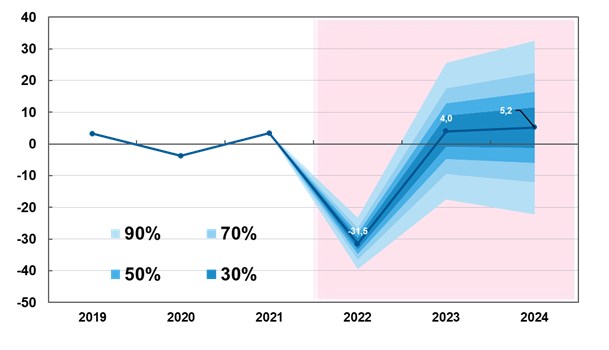

Forecast of dynamics of changes in GDP in % for 2022-2024 in relation to previous period

Source: Open4Business.com.ua and experts.news

Real GDP percentage changes over previous period in 2010-2023

Source: Open4Business.com.ua and experts.news

The National Bank of Ukraine (NBU) has improved its forecast for the country’s gross domestic product growth in 2023 to 2 percent from 0.3 percent in its January forecast, which is largely due to lower security risks, the restoration of the energy system, as well as soft fiscal policy.

“The economy will return to growth as early as this year and accelerate in the years ahead on the back of the reduced security risks in the forecast. Given the rapid recovery of the energy system, as well as the soft fiscal policy, the forecast of economic growth in 2023 has been improved from 0.3% to 2%,” the NBU said in a press release on Thursday.

It is indicated that the reduction of security risks from next year, which is allowed in the baseline scenario of the NBU forecast, will accelerate economic growth – up to 4.3% in 2024 and 6.4% in 2025.

Besides, de-occupation of territories and full opening of the Black Sea ports will gradually increase industrial production and crops.

The central bank also expects domestic demand to expand due to the return of some forced migrants.

The regulator noted that under the assumptions of the danger situation, no significant power shortages are envisaged in the future, except for local and situational deficits in the second half of the year.

At the same time, an increase in budget expenditures against the background of significant volumes of international financial aid will support economic activity and consumption.

Ukraine’s real gross domestic product fell by 29.1% in 2022 after growing 3.4% in 2021 due to full-scale Russian military aggression, the State Statistics Service said.

According to its data, Ukraine’s nominal GDP last year was markedly higher than most analysts’ forecasts and amounted to UAH 5.191 trillion.

Gosstat specified that the deflator change for 2022 as a whole amounted to 34.3%, including 36.5% in the fourth quarter, compared to 38.1% in the third quarter, 37.7% in the second quarter and 25.5% in the first quarter.

According to his data, Ukraine’s real GDP decreased by 31.4% in the fourth quarter of last year, 30.6% in the third quarter, 36.9% in the second quarter and 14.9% in the first quarter.

According to Oleksiy Blinov, head of the analytical department of Sense Bank, in dollar terms the nominal GDP for last year was about $159 billion.

For 2021, the nominal GDP of Ukraine, according to the State Statistics Committee, was equal to 5.451 trillion UAH, or more than $200 billion.