Gold prices are rising on Tuesday amid a decline in the dollar and yields on U.S. government bonds on expectations of the publication of data on U.S. inflation.

Quotes of August gold contracts on the New York Comex exchange by 18:52 Q2 rose by 0.27% to $1936.2 per troy ounce.

New U.S. inflation data will be released on Wednesday. Analysts polled by Trading Economics on average forecast consumer price growth in the world’s largest economy slowed to 3.1% last month from 4% in May.

Core inflation (the CPI Core index, which excludes fuel and food prices), meanwhile, stood at 5.3% in May and is forecast to fall to 5% in June.

Ahead of the statistical release, the dollar index is down 0.1% and the yield on 10-year US Treasuries is down 1.5 basis points to 3.986%.

“We see government bond yields falling earlier in the week as investors wait for inflation to fall in June,” said StoneX analyst Fawad Razaqzada. – This has slightly boosted the comparative attractiveness of gold versus bonds.”

The world’s central banks, according to preliminary data, sold 27.4 tons of gold from international reserves in May 2023, the World Gold Council (WGC) estimated.

By comparison, sales totaled 69.4 tons in April, according to revised figures.

The largest state seller of gold in May was Turkey (62.8 tons). There were also reduced reserves in Uzbekistan (10.9 tons), Kazakhstan (2.4 tons) and Germany (1.8 tons).

They bought gold in reserves in Poland (19.9 tons), China (15.9 tons), Singapore (3.9 tons), Russia (3.1 tons), Iraq (2.3 tons), India (1.9 tons), the Czech Republic (1.8 tons) and Kyrgyzstan (1.5 tons).

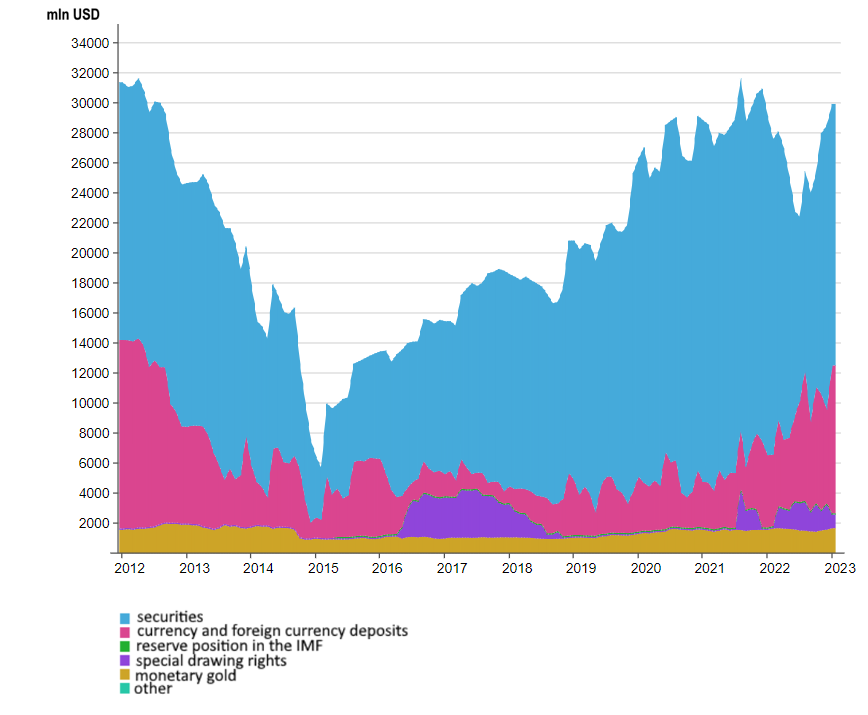

Dynamics of gold and foreign reserves of Ukraine from 2012 to 2023

Source: Open4Business.com.ua and experts.news

Growing concerns about the U.S. government debt ceiling and expectations of interest rate cuts by the Federal Reserve will support gold, analysts at RBC Capital Markets believe.

As it was reported, the talks scheduled for Friday between Congressional leaders and President Joe Biden on the national debt were postponed by agreement of the parties. Meanwhile, U.S. House Speaker Kevin McCarthy said it “should not be construed” as a failure of negotiations.

“Even with the assumption that a deal will be reached sooner rather than later, we do not rule out the possibility of panic in the financial market as the deadline approaches,” wrote RBC Capital Markets strategist Christopher Looney. – We believe that gold is the best tool for hedging in the short term.”

In addition to the government debt situation and hopes that the Federal Reserve is nearing the end of its interest-rate hike cycle, demand for gold is supported by a number of other factors, said analysts at ANZ Banking Group Ltd. Soni Kumari and Daniel Hines. Among them are geopolitical risks, concerns about the state of the U.S. banking sector, as well as the slowdown in global economic growth.

Under the influence of these factors, gold-focused exchange-traded funds will see an inflow of funds by the end of the year, analysts believe ANZ.

Quotes for June gold contracts on the New York Comex exchange fell 0.33% to $2013.8 per troy ounce by 11:07 a.m. Since the beginning of the year, the price has risen by 8.2%.

Gold continues to rise in price Wednesday and is one step away from an all-time high, MarketWatch writes.

June gold contracts on the New York Comex Exchange were up 0.49% to $2048.2 a troy ounce by 3:55 p.m. Q. The absolute record was set on August 6, 2020 at $2069.4 an ounce, according to Dow Jones Market Data.

Silver for May delivery is down 0.26% at $25.04 an ounce.

Gold is supported by recession fears and a weakening U.S. dollar.

“The market is stubbornly adhering to the prediction that U.S. rates will be cut later this year and the path of least resistance for gold is leading upward,” said XM senior investment analyst Charalampos Pissouros.

Gold and silver prices are expected to rise in 2023 amid a weaker U.S. dollar and the Federal Reserve’s easing of monetary policy, analysts believe.

The London Bullion Market Association’s (LBMA) annual survey of 30 analysts pointed to cautious optimism about the prices of the metals. Experts expect gold and silver to be 3.3% and 8.8% more expensive on average by the end of this year compared to 2022.

Among the key factors that may trigger higher prices, 43% of respondents named the decline of the U.S. dollar and the Fed’s monetary policy, while 14% mentioned inflation and 11% mentioned geopolitical factors.

Analysts predicted an average gold price of $1859.90 per troy ounce, but the range remains wide at $1594 to $2025 per ounce. That range is in line with last year’s forecast, the LBMA notes. The average gold price in 2022 was $1800.09 per ounce.

Silver prices this year are expected to rise to $23.65 an ounce from $21.73 an ounce in 2022. The lower end of the forecast is $17.50 an ounce and the upper end is $27.

Analysts are much less optimistic about palladium prices where they expect a 14.3% decline to $1809.80 per ounce in 2023. The average price in 2022 will be $2112.06 per ounce.

Meanwhile, platinum prices are expected to rise 12.5% this year from the 2022 average price of $1080.4 per ounce. The forecast range is $988-1241 per ounce.