The insurance company INGO made an insurance payment of UAH 20 million for an electronics warehouse in Kyiv that was completely destroyed as a result of a rocket and drone attack in July 2025.

According to the insurer, one of the strikes caused a large-scale fire at a warehouse complex in the Solomyanskyi district, where the company’s inventory was stored. The fire completely destroyed more than 57,000 items, mainly mobile and portable electronics, household appliances, and accessories.

The payment was made under an insurance contract for the inventory of an electronics store chain.

“This is one of the most difficult war insurance cases we have ever dealt with. The complete destruction of the warehouse meant that there were no identifiable remnants of the goods left. Therefore, we initiated an economic examination, which allowed us to document the volume of inventory and the actual cost of the damage. It was thanks to the accuracy of this process that we were able to complete the settlement in less than three months,” said Alexander Kolpakov, head of INGO’s property damage settlement department.

The assessment confirmed that at the time of the incident, the warehouse contained goods with a total value of over UAH 20 million. Thanks to the payment from INGO, the company was able to cover a significant part of the losses and resume its activities.

The payment was made on October 7, 2025.

INGO Insurance Company has been operating in the Ukrainian market for over 30 years and provides insurance solutions for businesses and individuals. It has licenses for 18 classes of insurance, is one of the market leaders in terms of premiums, assets, and insurance payments, and has an extensive service network throughout the country.

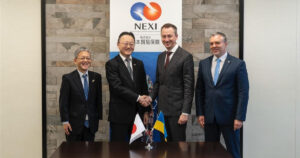

The Japan Export Credit Agency (NEXI) is ready to expand military risk insurance in Ukraine, which is key to attracting Japanese investment and technology to rebuild Ukrainian industry and infrastructure.

According to the website of the Ministry of Economy, Environment and Agriculture, this was discussed at a working meeting between a Ukrainian delegation led by Economy Minister Oleksiy Sobolev and NEXI President Atsuo Kuroda on October 21, 2025, in Tokyo.

During the meeting, it was also noted that Ukraine is preparing to introduce compensation for enterprises throughout Ukraine where insurance companies operate. A special component of direct compensation will apply to frontline regions. This will make insurance, in particular NEXI, more affordable. Ukraine is interested in using NEXI tools to insure Japanese equipment supplies as part of the Industrial Ramstein initiative.

An agreement was reached to expand cooperation with other export credit agencies, in particular the Polish KUKE and the British UKEF.

“Expanding cooperation with NEXI is a step towards unlocking Japanese investment and supporting industrial recovery. War does not cancel development, but rather the opposite. We are actively looking for solutions that allow us to attract financing and launch projects today,” said Alexei Sobolev.

The information emphasizes that NEXI already covers about half of Japanese exports and investments in Ukraine.

In January-June 2025, the PZU Group generated gross insurance income of PLN 15.2 billion across all markets, including over PLN 1.5 billion in Lithuania, Latvia, Estonia, and Ukraine, which is 6.5% higher than in the same period last year, according to the PZU website.

Net profit attributable to shareholders of the parent company in the first half of this year increased to PLN 3.23 billion (+32.1%), and in the second quarter amounted to PLN 1.47 billion (+23.3% compared to the corresponding period of 2024). Adjusted return on equity (aROE) for the first half of the year was 21.2%, which is 3.8 percentage points (pp) more than last year (in the second quarter it was 18.7%, +2.1 pp).

“We had a successful six months. We expanded our business, generating nearly PLN 1 billion in gross insurance income on an annualized basis for the first half of the year. At the same time, we significantly improved profitability in property and life insurance by several percentage points. All this led to an increase in insurance income of PLN 555 million, or almost 35% compared to the first half of the previous year. It is important to note that more than a third of this growth is due to improved insurance income in the motor third-party liability insurance segment,” commented Tomasz Tarkowski, member of the Management Board and current CEO of PZU.

At the same time, he emphasized that such good results were achieved despite the fact that PZU recorded an almost equally significant negative impact of mass insurance claims related to weather conditions, estimated at approximately PLN 240 million. After the first two quarters of this year, the value of insurance payments and insurance compensation paid by the PZU Group, together with the development of the insurance payment reserve for previous years, amounted to PLN 8.4 billion (+4.3% more than a year ago).

The PZU Group is one of the largest financial institutions in Poland and Central and Eastern Europe. The group is headed by Powszechny Zakład Ubezpieczeń SA (PZU), a company listed on the Warsaw Stock Exchange (GPW). The PZU brand’s traditions date back to 1803, when the first insurance company in Poland was founded.

In Ukraine, it is represented by the insurance companies PZU Ukraine and PZU Ukraine Life Insurance.

PJSC Ukrhazvydobuvannya (Kyiv) on August 20 announced a tender for services on insurance of drivers against accidents on transport.

As reported in the system of electronic public procurement Prozorro, the expected cost of the purchase of services is 518.014 thousand UAH. The deadline for submission of documents is August 28.

Insurance company Knyazha Vienne Insurance Group (Knyazha VIG”, Kyiv) in January-June 2025 collected UAH 1.808 billion of insurance payments, which is 58.61% more than in the same period a year earlier, net premiums amounted to UAH 1.161 billion (+17.21%). This information has been published by Standard-Rating, having confirmed the financial strength/credit rating of the insurer at the level of “uaAA+” following the results of the specified period.

According to the RA website, for the specified period receipts from individuals have grown by 61,71% – up to UAH 1,310 billion, and from reinsurers – by 77,13%, up to UAH 3,943 mln.

According to the results of the first half of 2025, the share of individuals in the gross premiums of the company amounted to 72,43%, and the share of reinsurers – 0,22%.

Insurance payments sent to reinsurers, for the first half of 2025 compared to the same period of 2024 have increased more than in 4,3 times – up to UAH 646,786 mln. Thus, the ratio of reinsurance companies’ participation in insurance premiums has increased by 22,69 p.p. up to 35,78%. – up to 35,78%.

The volumes of insurance payments and indemnities made by the company in the first half of 2025, compared to the same period of 2024, have increased by 39,11% – up to UAH 615,675 mln, the level of payments has decreased by 4,78 p.p. – to 34.05%.

Operating profit for 6M. 2025 increased 14.27 times to UAH 109.577 mln, and net profit increased 6.4 times to UAH 144.258 mln.

Assets of the company as of July 1, 2025 increased by 28.27% – to UAH 2.796 billion, shareholders’ equity – by 33.83% – to UAH 602.017 million, liabilities – by 26.82% – to UAH 2.194 billion, cash and cash equivalents – by 5.81% – to UAH 86.279 million.

RA notes that as of the beginning of Q3 2025 the company had a satisfactory level of capitalization (27,44%), and cash covered 3,93% of its liabilities. At the same time, on the reporting date the insurer has made current financial investments in the amount of UAH 1,404 billion, which consisted of government bonds (77,89% of the investment portfolio), as well as of deposits in banks with a high level of credit rating (22,11% of the portfolio). Liquid assets have covered 67,95% of insurer liabilities.

Private JSC IC Knyazha Viena Insurance Group is a part of NFG Vienna Insurance Group Ukraine, the main shareholder of which is Vienna Insurance Group AG Wiener Versicherung Gruppe (Austria).

On August 14, the Entrepreneurship Development Fund announced its intention to conclude a contract with Colonnade Ukraine for executive liability insurance. According to the Prozorro electronic procurement system, the expected cost of the service was UAH 1.05 million, and the price offered by the company, the sole participant in the tender, was UAH 995,492.

Colonnead Ukraine Insurance Company (until 2016 – QBE Ukraine Insurance Company) was founded in 1998 as the first international insurer on the Ukrainian market. SCP Luxembourg S.A.R.L. owns 100% of the insurer’s shares.