Insurance companies of Ukraine in January-June 2022 collected net premiums in the amount of UAH 17.721 billion (which is 24.6% less than in the same period in 2021 (UAH 23.480 billion), according to the main performance indicators of insurance companies companies (by institutions) for the first half of 2022, published on the website of the National Bank of Ukraine (NBU).

According to the regulator, the volume of written insurance premiums collected by insurers for the specified period amounted to UAH 17.608 billion, which is 28.9% less compared to the first half of 2021 (UAH 24.780 billion).

In six months, insurers paid UAH 5.934 billion of insurance claims (which is 30.6% less than in the first half of a year earlier (UAH 8.552 billion).

As of June 30, 2022, the assets of Ukrainian insurers on the balance sheet amounted to UAH 65.474 billion, while as of the same date a year earlier – UAH 65.186 billion

The regulator also reports that in the first half of the year the volume of formed insurance reserves increased by 4% – up to UAH 36.438 billion.

According to the NBU, the total number of insurance companies in Ukraine as of June 30, 2022 is 137, while as of the same date a year earlier it was 181.

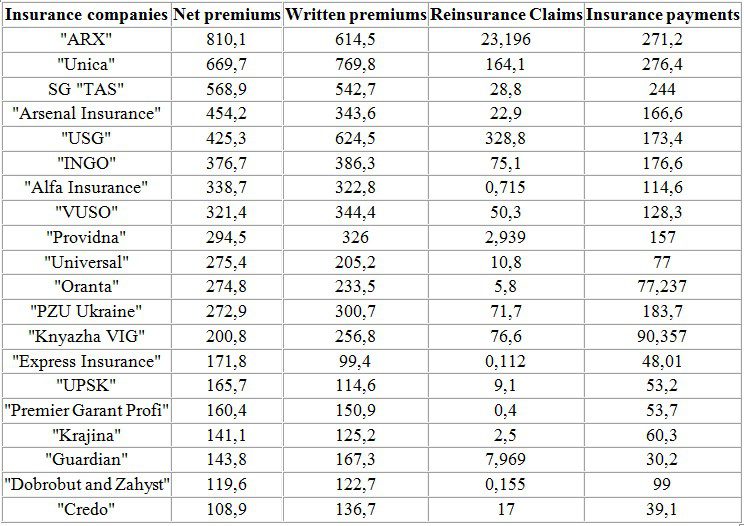

Performance indicators of the TOP-20 insurance companies for the first quarter of 2021 in terms of net premiums (UAH mln)

Data: NBU

The National Bank of Ukraine (NBU) has excluded from the registers three insurers that do not have valid licenses and one insurance broker.

As reported on the website of the regulator, PJSC Insurance Company Ukrainian Financial Alliance, ALC Insurance Company VIP Capital (the licenses of both were canceled on January 21, 2022 at the request of insurers) and PJSC Insurance Company OSTRA were excluded from the State Register of Financial Institutions. ” (licenses canceled on February 9, 2022 as a measure of influence).

In addition, from the State Register of Insurance and Reinsurance Brokers – Subsidiary “SINKO Group (UKRAINE)” on the basis of the submitted application.

IC “Ukrainian Financial Alliance” (Kyiv), registered in 2003, specializes in providing services in the field of risk insurance.

IC “VIP-Capital” (Kyiv) was registered in 2007 and specializes in providing services in the field of risk insurance.

IC “Ostra” (Odessa) is one of the first insurance companies in Ukraine. Established in December 1990 on the basis of the regional representative office of Ingosstrakh Insurance Company (RF) in Ukraine.

In January 2022, member insurance companies of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU) concluded 590.5 thousand contracts of compulsory civil liability insurance of land vehicle owners (OSAGO), which is 1.04% more than in January 2021.

According to the data published on the MTIBU website, out of the total volume of contracts, 273.3 thousand were concluded in electronic form, which is 5.05% more than in the first month of 2021.

Members of the Bureau increased the collection of insurance payments under OSAGO policies by 16.68% compared to the same period last year – up to UAH 522.7 million, including for electronic contracts – in the amount of UAH 271.2 million, which is 23.16% more, than a year earlier

The total amount of accrued insurance claims under internal insurance contracts for January 2022 increased by 9.72% to UAH 287.2 million. Including UAH 57.4 million was paid using the Europrotocol, which is 19.3% more than a year earlier.

The Bureau also recorded an increase in the number of settled claims for insurance compensation by 4.93% – up to 13.461 thousand, including 5.221 thousand (+14.2%) using the “Europrotocol”.

MTIBU is the only association of insurers that provides compulsory insurance of civil liability of owners of ground vehicles for damage caused to third parties. Bureau members are 49 insurance companies.

Drivers of vehicles registered in Ukraine who are abroad can renew the Green Card policy on the websites of insurers who are full members of the Motor (Transport) Insurance Bureau of Ukraine, according to the website of the bureau.

It is clarified that these are the sites of NASK Oranta – https://oranta.ua, UASK ASKA – https://aska.ua, IC INGO – https://ingo.ua, USK Knyazha Vienna Insurance Group” – https://kniazha.ua, “UTSK” – https://utico.ua, IC “PZU Ukraine” – https://pzu.com.ua, “SG “TAS” – https:/ /sgtas.ua, IC “USG” – https://ukringroup.ua, IC “Persha” – https://persha.ua, IC “Guardian” – https://grdn.com.ua.

Ukrainian insurance companies in January-June 2021 collected net premiums in the amount of UAH 23.480 billion, which is 25.6% more than in the same period of 2020 (UAH 18.688 billion), according to the website of the National Bank of Ukraine (NBU).

According to the regulator, the volume of gross insurance premiums collected by insurers over the specified period amounted to UAH 24.780 billion, which is 17.9% more than in the first half of 2020 (UAH 21.008 billion). Including premiums received from individuals amounted to UAH 12.944 billion (a rise of 35%), from reinsurers – UAH 1.646 billion (8.9% less).

In the six months ending June 2021, insurers paid out UAH 8.552 billion of net insurance payments, which is 28.8% more than in the first half of the year earlier (UAH 6.642 billion). The level of net payments grew from 35.5% to 36.4%.

Gross insurance payments rose by 27.3%, to UAH 8.703 billion. The level of gross payments increased from 32.5% to 35.1%. Of the total volume of gross payments, payments to individuals amounted to UAH 4.235 billion (a rise of 35.3%), to reinsurers – UAH 136.6 million (42.5% less).

The volume of insurance payments belonging to reinsurers, according to the results of the first half of the year, amounted to UAH 4.661 billion, which is 11.2% more than in the same period a year earlier, including UAH 2.729 billion to nonresident reinsures (a rise of 41.1%).

As of June 30, 2021, the assets of Ukrainian insurers on the balance sheet amounted to UAH 65.186 billion, while on the same date a year earlier – UAH 61.888 billion. The volume of assets determined by legislation to represent insurance reserves decreased by 17.3% to UAH 45.995 billion.

The regulator also said that in the first half of the year, the volume of formed insurance reserves grew by 11.7%, to UAH 35.031 billion. The volume of paid charter capital fell by 6.6%, to UAH 8.966 billion.

In the reporting period, 63.170 million insurance contracts were concluded (a rise of 9.1%).

According to the NBU, the total number of insurance companies in Ukraine as of June 30, 2021 was 181, while on the same date a year earlier it was 215, including 19 (20) life insurers. At the same time, 166 insurance companies submitted reports on their activities to the regulator.