Businessman Vasyl Khmelnytsky is looking for a partner for the joint development of Kyiv Sikorsky International Airport (Zhuliany).

“I am now looking for a partner in the airport [Kyiv International Airport]. But it is important for me not just to sell the airport, but to find partners who have a slot of aircraft, who have a reputation in this business, who have cheap loans, who will do the right strategy for the airport. I need their experience,” Vasyl Khmelnytsky said during an interview with co-owner and CEO of TIS port Andriy Stavnitser.

The businessman also stressed that synergy with a partner is important to him.

As reported, Khmelnytsky announced that he plans to continue investing in Kyiv airport.

Kyiv International Airport is located 7 km from the center of the capital. It ranks second in Ukraine in terms of the number of flights and passenger traffic. The airport has three terminals with a total area of 21,000 square meters. The airport runway allows accepting aircraft such as Boeing-737, Airbus A-320. However, even with the A-320, there are loading restrictions on long haul flights.

Based on the results of the 2010 investment tender, the airport is managed by Master-Avia, which has entered into a 49-year lease agreement for the airport property. According to the company, during this time it has invested more than $ 50 million in the creation of new airport infrastructure and is still using all available resources to pay off the loan. The beneficiaries of the company, according to the unified state register of legal entities and individual entrepreneurs, are Vasyl Khmelnytsky and Kostrzhevsky.

In March 2019, Khmelnytsky said that his UFuture business group owns 90% of the shares of Master-Avia LLC, another 10% in the company belongs to Khmelnytsky’s partner Denys Kostrzhevsky.

Master-Avia owns terminals and the apron, and the airfield and the runway are on the balance sheet of municipal enterprise Kyiv International Airport (Zhuliany).

The city of Odesa in June this year attracted five-year loans from the state-owned Oschadbank, Ukreximbank and Ukrgasbank for a total of UAH 1.2 billion, and the cities of Lviv, Novomoskovsk and Khmelnytsky – three more five-year loans for UAH 350 million.

According to the information of the Ministry of Finance on its website, apart from Khmelnytsky, all loans were obtained at a floating rate pegged to the key policy rate of the National Bank of Ukraine.

In the case of Odesa, the loan price was the NBU key policy rate + 4.5%: Oschadbank and Ukreximbank each allocated UAH 450 million, and Ukrgasbank – UAH 300 million.

Lviv managed to attract funds the cheapest of all – UAH 220 million from Ukrgasbank at the NBU key policy rate + 2.5%, while the smaller city – Novomoskovsk (Dnipropetrovsk region) raised UAH 70 million from Ukreximbank at the NBU key policy rate + 5.3%.

Khmelnytsky was able to get UAH 60 million from Ukrgasbank at 11.9%.

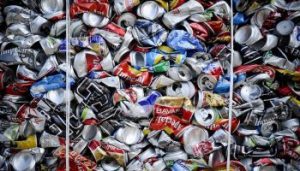

The European Bank for Reconstruction and Development (EBRD) a part of the Green Cities Framework 2 will provide a senior loan of up to EUR 28.5 million to Communal Enterprise Spetskomuntrans to finance the rehabilitation and modernisation of solid waste infrastructure in the City of Khmelnytsky estimated at EUR 36.5 million.

The decision was made by the bank’s board on September 2, EBRD Senior External Relations Advisor Anton Usov has told Interfax-Ukraine.

The senior loan split into several tranches co-financed by up to EUR 5.0 million investment grant from the EU Neighbourhood Investment Platform and up to EUR 3.0 million local contribution.

The phase I of the project will address the city’s urgent investment needs with respect to the rehabilitation of the existing landfill, the construction of a new engineered sanitary landfill in compliance with the EU standards adjacent to the old one, the acquisition of new landfill equipment to ensure sustainable operation of the new landfill, and improvements of the solid waste collection and transportation systems co-financed from the city’s budget.

The phase II of the project includes the construction of a new material recovery facility for non-organic waste and a separate composting facility for pre-sorted organic waste that will reduce the share of solid waste going to the landfill by promoting recycling and providing a modern solid waste management infrastructure with respect to sorting and composting. The project will ensure that a long-term, sustainable solid waste management strategy is properly implemented.

EBRD, KHMELNYTSKY, LOAN, PROBLEM, WASTE

The European Bank for Reconstruction and Development (EBRD), under the Green Cities project, intends to provide Spetskomuntrans Communal Enterprise with a loan of EUR 28.5 million to finance the project for the rehabilitation and modernization of solid waste infrastructure in the city of Khmelnytsky, valued at EUR 36.5 million

According to information on the bank’s website, the decision on the project can be made on July 8, 2020. Now the project is under consideration.

The loan split into several tranches co-financed by up to EUR 5 million investment grant from the EU Neighborhood Investment Platform and up to EUR 3 million local contribution.

The project includes two phases. The phase I of the Project will address the city’s urgent investment needs with respect to the rehabilitation of the existing landfill, the construction of a new engineered sanitary landfill in compliance with the EU standards adjacent to the old one, the acquisition of new landfill equipment to ensure sustainable operation of the new landfill and improvements of the solid waste collection and transportation systems, co-financed from the city budget.

The phase II of the project includes the construction of a new material recovery facility for non-organic waste and a separate composting facility for pre-sorted organic waste. The EBRD said that this will reduce the share of solid waste going to the landfill.

Spetskomuntrans Communal Enterprise is responsible for the collection, treatment and disposal of municipal solid waste in Khmelnytsky. The company has contracts with more than 92,000 households and almost 3,000 commercial and public organizations for waste removal and disposal. The company is also an operator of the existing landfill located in the territory of the city.

EBRD, EUR, KHMELNYTSKY, LOAN, MLN

Average vacancy of business centers in Khmelnytsky was 6.7% by August 2019 and by late 2020 it is planned to expand total supply of office space by 24,100 square meters thanks to the launch of eight new business centers, UTG consulting company (Kyiv) has reported.

“In 2018, supply in Khmelnytsky was expanded with two business centers with a lettable area of 8,400 square meters: Luxury class B business center (GLA is 3,700 0 square meters) and Parus class A business center (GLA is 4,700 square meters) However, the main increase in office space in the city was seen in 2016, when 26.4% of the total market supply was built or reconstructed and put into operation, or in absolute terms – lettable area of 12,400 square meters,” UTG Senior Analyst Oksana Gavrilevich told Interfax-Ukraine.

According to her, as of August 2019 in Khmelnytsky there were 19 office buildings with a total lettable area of 51,100 square meters, which corresponds to an indicator of 187.8 square meters per 1,000 inhabitants.

In the structure of supply, business centers of class A occupy 9.2% of the total supply (4,700 square meters), class B – 52.4% (26,800 square meters) and class C – 38.4% (19,600 square meters).

The average vacancy rate in the city’s business centers in August 2019 in terms of classes was: 19% for class A, 7.3% for class B and 2.9% for class C.

The requested rental rates (excluding VAT and OPEX) in office premises in August were: for class A – UAH 300 per square meter ($12), class B – UAH 142 per square meter ($ 5.7), class C – UAH 94.7 per square meter ($3.8).

“For the coming years, office premises are announced for commissioning only in class B. Given the timely commissioning of new projects, by the end of 2021, the total leased area of the city’s business centers will be 65,300 square meters, or 239.8 square meters per 1,000 inhabitants,” Gavrilevich said.

Reikartz Hotel Management LLC (Kyiv), the managing company of the national hotel chain Reikartz Hotel Group, has signed an agreement to manage the Soniachny Provans (Sunny Provence) hotel in Sataniv (Khmelnytsky region), which has become part of the network under the Vita Park brand.

“The Soniachny Provans hotel in Khmelnytsky region has become a new member and the seventh resort hotel in the Reikartz Hotel Group chain. From August 1, the hotel starts operating under the name Vita Park Soniachny Provans ” Reikartz said on its website.

According to the report, the hotel has 99 rooms of various categories, as well as a restaurant, a conference room, a swimming pool, as well as a SPA center.

“Work on the implementation of operating, sales and marketing standards is already underway. The company plans not only to develop a finished product, but also expand the range of services for guests. Soon, a full-fledged Swedish line and a team of animators will begin to work in the hotel,” the operating director of Reikartz Hotel Group, Andriy Dema, said.

Reikartz Hotel Management LLC was established in 2008.