The largest number of branches of insurance companies (per 100,000 population) is located in Kyiv – 115, Kherson region – 124 representative offices, Zaporizhia – 49, Mykolaiv – 36, Khmelnytsky – 33, Cherkasy – 31, Ternopil-30, Chernivtsi – 28, according to the website of the National Bank of Ukraine (NBU).

At the same time, it is emphasized that in these regions the representation of insurers is 12.2 per 100,000 population.

The NBU also notes that in another eight regions of Ukraine the presence of insurers is significant (2.48 per 100,000 population). These are Lviv region with 57 representations, Odesa – 57, Vinnytsia – 34, Zakarpattia – 31, Ivano-Frankivsk – 28, Chernihiv-22, Kirovohrad – 20.

The smallest concentration of insurers (1.97 per 100,000 population) the NBU notes in Dnipropetrovsk region – 61 representative offices, Kharkiv – 44, Donetsk – 43, Poltava – 27, Rivne – 21, Zhytomyr – 20, Sumy – 20.

As reported, according to the NBU, as of March 31, 2021, the total number of insurance companies in Ukraine was 208, while on the same date a year earlier – 225. In particular, 20 insurers specialize in life insurance.

The net profit of UkrSibbank (Kyiv) in 2020 amounted to UAH 1.324 billion, which is two times less than in 2019 (UAH 2.615 billion).

According to a report on the bank’s website, net interest income for 2020 decreased by 1.3 times, to UAH 3.295 billion, while net commission income remained at UAH 1.7 billion.

By the end of 2020, the bank’s assets increased by 36%, to UAH 72.298 billion, including funds in other financial institutions – by 2.3 times, to UAH 23.5 billion, securities and investments – by 1.4 times, to UAH 18.3 billion, while loans to customers remained at the level of UAH 21 billion.

The bank’s liabilities last year increased by 1.4 times, to UAH 64.13 billion, including customer funds – by 1.4 times, to UAH 63 billion.

The bank’s equity capital in 2020 increased by 19.1%, to UAH 8.17 billion.

The charter capital remained at the level of UAH 5.07 billion.

UkrSibbank was founded in 1990. Its shareholders are BNP Paribas S.A (France), which owns 60% of the bank’s charter capital, and the European Bank for Reconstruction and Development with 40%.

According to the NBU, as of March 1, 2021, in terms of total assets (UAH 70.322 billion), UkrSibbank ranked eighth among 73 operating banks in Ukraine.

The number of banks expecting an increase in the volume of their loan portfolio over the next 12 months amounted to 78% for the corporate segment and 82% for lending to the population, according to the results of a survey conducted by the National Bank of Ukraine (NBU) on the conditions of bank lending.

“The survey participants positively assess the prospects for lending in the next 12 months: 78% of respondents predict the growth of the loan portfolio of corporations, 82% of households. These are the highest estimates of the growth of the loan portfolio of the population since 2015, however, some large banks expect a certain deterioration in its quality,” the review says.

According to the report, the optimism of the respondents regarding the further increase in funding has grown, in particular, 77% of respondents expect an increase in household deposits, 78% – funds of enterprises.

The banks note that despite expectations of the introduction of new quarantine restrictions, the demand for loans increased from business and the population, in particular, the demand for mortgages was the highest in the entire history of observations.

It is indicated that in January-March 2021, the demand for business loans increased, primarily for loans to SMEs, in hryvnias and long-term loans.

The main factors behind the revival of demand are still cited by banks as a decrease in interest rates, the need of enterprises for capital investments and working capital, as well as debt restructuring.

The banks explain the softening of the creditworthiness for business by the high level of liquidity, increased competition with other banks, as well as improved expectations regarding the overall economic activity and the development of certain industries, primarily for SMEs.

According to the survey, almost a quarter of the surveyed respondents noted an increase in the level of approval of applications for business loans and easing requirements for the size of the loan.

It is indicated that 92% of financial institutions rated the debt burden of household borrowers as average, and more than 80% of financial institutions also rated the debt burden of corporate borrowers.

The survey was conducted from March 19 to April 9, 2021 among credit managers of 23 banks, whose share in the total assets of the banking system of Ukraine is 88%.

The single counterparty exposure limit (H7, should be no more than 25%) as of March 1, was violated by Prominvestbank (82.02%), Sberbank (50.23%) and Industrialbank (49.51%), according to the website of the National Bank of Ukraine (NBU).

According to the regulator, the related party transactions exposure limit (H9, should not exceed 25%) was violated by First Investment Bank (52.02%), Unex Bank (28.17%), Megabank (27.56%) and Land Capital Bank (26.75%).

The limit on bank total long open FX position (L13-1, should be no more than 10%) was violated by Oschadbank (129.99%), Prominvestbank (114.57%), PrivatBank (95.74%) and Industrialbank (12.35%).

The limit on bank total short open FX position (L13-2, should be no more than 10%) was violated by Prominvestbank (110.36%).

FIRST INVESTMENT BANK, INDUSTRIALBANK, LAND CAPITAL BANK, MEGABANK, NBU, OSCHADBANK, PRIVATBANK, PROMINVESTBANK, REQUIREMENTS, SBERBANK, UNEX BANK, VIOLATE

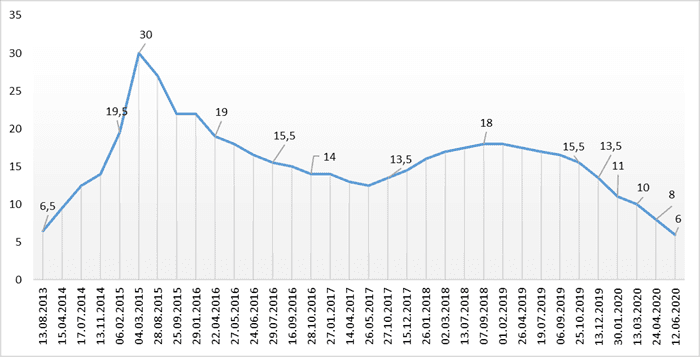

Dynamics of changes in discount rate of NBU.

NBU

The National Bank of Ukraine (NBU) on January 26 made a decision to revoke the banking license and liquidate Misto Bank (Odesa), according to the regulator’s website on Wednesday.

“The NBU, at the suggestion of the Deposit Guarantee Fund, made a decision dated January 26, 2021 No. 25-RSh to revoke the banking license and liquidate Misto Bank,” the message said.

As reported, on December 14, the NBU classified Misto Bank as insolvent due to a decrease in capital ratios by 50% or more from the minimum established level due to the loss of one of its main assets – a soybean processing plant in Kherson region, with a book value of over UAH 271 million, or almost 17% of all bank assets.

Misto Bank was founded in 1993. According to the NBU, as of January 1, 2020, the main shareholders of the financial institution were Fursin, who directly and indirectly owned 97.180668% of the bank’s shares, and Latvian citizen Igor Buimister with 1.811499%.

As of October 1, 2020, the bank ranked 53rd in terms of total assets (UAH 1.498 billion) among 74 banks operating in the country, the press service of the central bank said on Monday.