The Netherlands has increased its total financial assistance to Ukraine through the Energy Support Fund to EUR100 million, allocating additional funds to strengthen energy resilience and support critical infrastructure, according to First Deputy Prime Minister and Minister of Energy of Ukraine Denys Shmyhal.

“The Netherlands has increased its total assistance provided through the Ukraine Energy Support Fund to EUR 100 million. The Netherlands will allocate an additional EUR 35 million,” according to a statement posted on social media.

The purpose of the additional funding is to ensure a stable power supply to critical infrastructure facilities after Russian attacks, in particular by installing solar power plants on the roofs of buildings as part of the “Ray of Hope” initiative.

In 2025, Ukraine imported 12.85 thousand tons of cut flowers, which is 8.5% more than in 2024 (11.84 thousand tons), according to the State Customs Service.

According to the published statistics, in monetary terms, the volume of imports last year increased by 14.2% to $64.48 million, compared to $56.46 million a year ago.

The Netherlands remains the undisputed leader in supplies, providing almost three-quarters of the Ukrainian market, or 72.4% of supplies in monetary terms, or $46.68 million. Ecuador (12.8%, or $8.25 million) and Kenya (6.2%, or $4.00 million) also lead in flower supplies to Ukraine. In 2024, this trio remained the same with similar shares of supplies: the Netherlands (71.1%), Ecuador (13.5%), and Kenya (5.8%).

Flower exports from Ukraine in 2025 remained symbolic, amounting to only $184,000 at the end of the year, which is 12.5% less than in 2024 ($210,000). The main buyers of Ukrainian flowers were Moldova (59% or $108,600), Georgia (23% or $42,300), and Lithuania (10% or $18,400). A year ago, the composition of the top three buyers was slightly different: Moldova was also the leader (58% or $121,800), but it was followed by Poland (17% or $35,700) and Lithuania (12% or $25,200).

As reported, in 2021, Ukraine introduced a special three-year duty on imports of cut fresh roses, regardless of the country of origin and export. The duty rate in the first year of its application was 56%, in the second — 44.8%, and in the third — 35.84%.

Based on the results of the duty’s impact provided by the Ministry of Economy, the Interdepartmental Commission on International Trade (ICIT) concluded in 2025 that the application of special measures had a positive effect on the activities of domestic producers, but did not completely eliminate the consequences of the damage caused to them. Recommendations to extend the duty were forwarded to the ministry.

In January-December 2025, Ukraine imported 138,410 tons of potatoes, which is 5.3 times (+431.3%) more than in 2024, when 26,050 tons were imported into the country, according to the State Customs Service.

According to published statistics, in monetary terms, potato imports increased 4.9 times (+391.9%) to $74.82 million compared to $15.21 million a year earlier. The main imports came from Poland (38.2%), Egypt (14.1%), and the Netherlands (10.8%).

Potato exports from Ukraine during the same period amounted to 2.38 thousand tons, which is 11.2% less than in 2024 (2.68 thousand tons). At the same time, despite the physical reduction in export volumes, in monetary terms, the sale of Ukrainian potatoes abroad was more profitable and brought in 3.1% ($584 thousand) more revenue than in 2024 ($566 thousand). The main buyers were Moldova (60.2% of all exports), Azerbaijan (35.4%), and Georgia (1.2%).

As reported, Ukraine had a poor potato harvest in the 2024 season due to drought, extremely high temperatures, and a lack of seed material.

Deputy Minister of Economy, Environment, and Agriculture Taras Vysotsky noted in a podcast by the Center for Economic Strategies that the 2025 vegetable harvest in Ukraine is sufficient and even larger than last year, so no shortage is expected in this sector.

Commenting on Ukraine’s potato imports in 2024-2025, Mykola Furdyga, director of the Potato Institute, explained that this record volume of imports was caused by the unusual weather conditions in 2024. Therefore, the state was forced to import potatoes to meet domestic food needs. European countries were eager to supply Ukraine with their products due to their attractive prices. At the same time, potatoes from Egypt did not dominate the market but occupied their traditional niche in the off-season (February-March – IF-U). In addition, Ukraine traditionally imports seed potatoes from leading breeding companies in the European Union.

Furdyga noted that since the beginning of the war, there has been a trend in Ukraine toward reducing potato cultivation in households and expanding production areas for this crop in farms and even in agricultural holdings. He explained this trend by the departure of the population from villages abroad and mobilization.

The Romanian Ministry of Defense signed a contract with the Dutch government to purchase 18 F-16 Fighting Falcon multi-role fighter jets and related equipment.

According to the ministry, the agreement was signed on Monday, November 3. The purchased aircraft will be used exclusively for training at the European F-16 Training Center in Fetești, which has become a regional training center for pilots from NATO member countries and Alliance partners.

“The purchase is being made for a symbolic price of one euro. This is a smart investment in training, cooperation, and the future,” the Romanian Ministry of Defense said.

According to the Romanian side, the transfer of the aircraft is intended to strengthen the training capabilities of allied countries’ pilots and develop defense cooperation in the region.

The DTEK energy holding company in the Netherlands has secured the seizure of assets belonging to Gazprom International Limited, a company controlled by the Russian Federation, in the form of a 50% stake in the Dutch company Wintershall Noordzee B.V., as part of the enforcement of an arbitration award.

“Gazprom International Limited appealed the seizure, but the District Court of The Hague rejected Gazprom International Limited’s appeal and upheld the seizure,” DTEK told Interfax-Ukraine news agency.

The company recalled that after the illegal occupation of Crimea in 2014, Russia also illegally seized and expropriated all assets of the energy distribution company DTEK Krymenergo, which distributed and supplied electricity in Crimea.

In 2017, DTEK Krymenergo filed a lawsuit with the International Court of Arbitration in The Hague, demanding that Russia pay damages caused by the illegal expropriation. In 2023, the international arbitration court in The Hague upheld DTEK’s claim and awarded damages of approximately $267 million from the Russian Federation, including interest, which will accrue until full payment is received.

“Since Russia did not comply with the international court’s decision and did not pay the damages awarded, DTEK initiated enforcement proceedings to recover damages from Russia in countries where Russian assets are located,” the energy holding company said.

Currently, active enforcement procedures and measures against Russia are being carried out in the United States, the United Kingdom, the Netherlands, the Czech Republic, and Israel. In addition, measures are being developed for enforcement in other jurisdictions.

As reported, in the fall of 2023, the International Court of Justice in The Hague fully upheld DTEK’s claim against Russia regarding seized assets in the illegally annexed Crimea and ordered Russia to pay the Ukrainian company compensation in the amount of $267 million. The arbitration award is enforceable under the 1958 New York Convention.

At the same time, the energy holding company noted that it plans to immediately initiate the process of recognition and enforcement of the award in the territories of those states where Russia has assets.

DTEK Krymenergo was the largest electricity supplier on the Crimean peninsula, providing more than 80% of its supply.

Wintershall Noordzee B.V. is engaged in the exploration and production of natural gas in the North Sea on the continental shelf of the Netherlands and the United Kingdom. Wintershall Noordzee B.V. is a subsidiary of the German company Wintershall Dea.

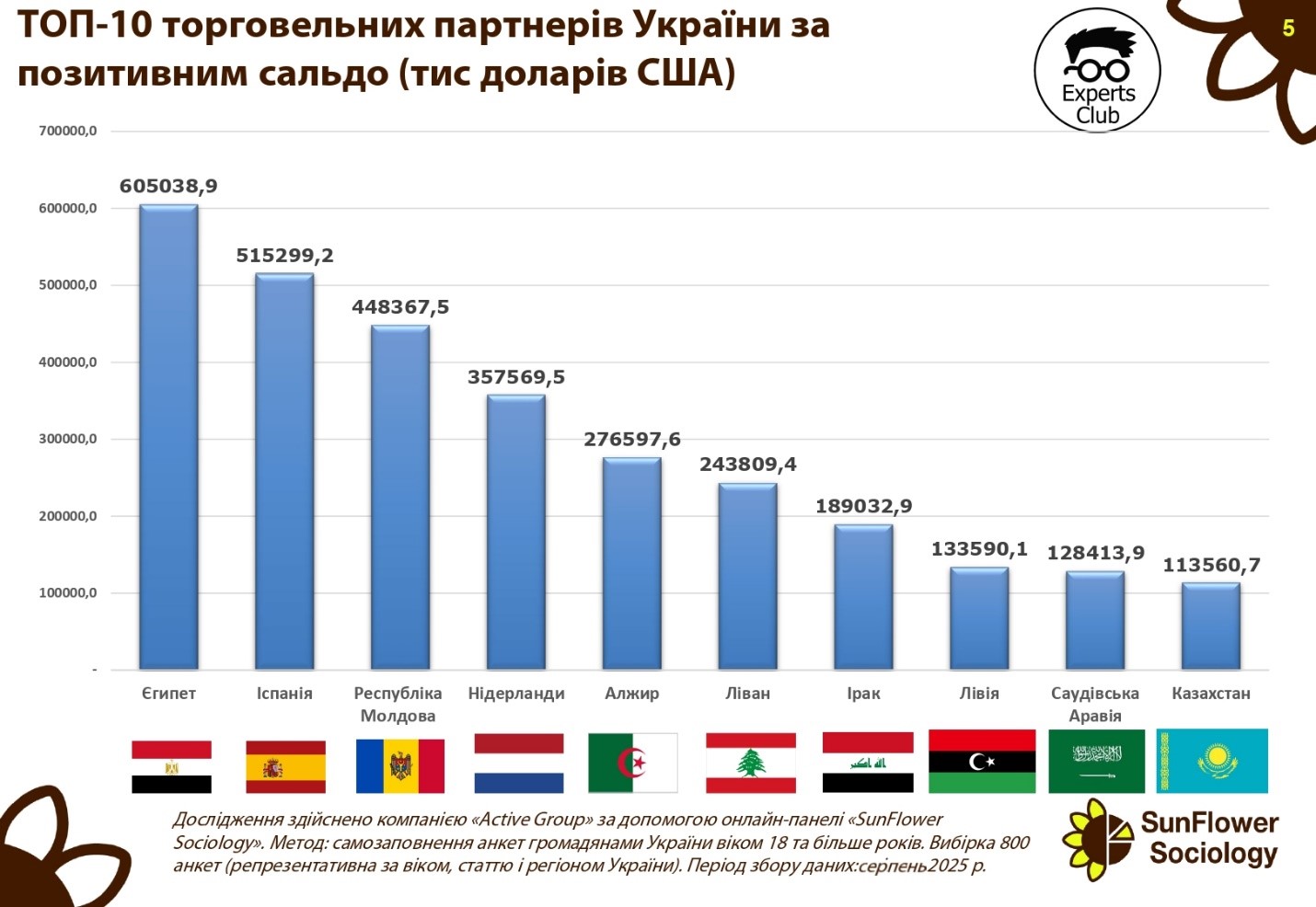

Ukraine maintains a significant positive trade balance with a number of key partners, which partially offsets the deficit in relations with China and EU countries.

The largest surplus in the first half of 2025 was recorded in trade with Egypt — $605.0 million. Spain ranks second with a balance of $515.3 million, followed by the Republic of Moldova — $448.4 million. Positive dynamics are also observed in relations with the Netherlands ($357.6 million), Algeria ($276.6 million), and Lebanon ($243.8 million).

Ukraine also has a high trade surplus with Iraq ($189.0 million), Libya ($133.6 million), Saudi Arabia ($128.4 million), and Kazakhstan ($113.6 million).

“The positive trade balance indicates that Ukraine is capable of competing effectively in international markets, especially in the agricultural sector and metallurgy. At the same time, it should be borne in mind that these markets are vulnerable to changes in the global economic situation, price fluctuations, and political factors,” emphasized Maksim Urakin, founder of Experts Club and economist.

According to him, maintaining a positive balance in relations with the countries of the Middle East and North Africa is a key element of Ukraine’s foreign trade strategy.

“Egypt, Spain, and the countries of the Arab world are stable importers of Ukrainian agricultural products. This is a strategic direction that needs to be developed further, as it creates a safety cushion for the economy against the backdrop of significant import costs,” Urakyn emphasized.

Analysts note that consolidating positions in the African and Middle Eastern markets could become a long-term factor in strengthening Ukraine’s foreign economic balance.

Agricultural exports, ALGERIA, ECONOMY, EGYPT, EXPERTS CLUB, FOREIGN TRADE, IRAQ, KAZAKHSTAN, LEBANON, LIBYA, MOLDOVA, NETHERLANDS, positive balance, SAUDI ARABIA, SPAIN, UKRAINE, МАКСИМ УРАКИН