TAS Insurance Group (Kyiv) in January-October paid 738.9 mln. UAH of indemnities under the concluded insurance contracts, which is 20.8% less than the amount of payments made in 10 months.

Most of the payments with a share of 39.96% took CMTPL – 295.3 million UAH (-15.3%), CASCO with a share of 27.36% (202.17 million UAH, -32.5%), VMI with a share of 13.05% (96.4mln UAH, -30%) compared to January-October of last year.

The company paid out UAH 114,65 mln on policies “Green Card”, which amounts to 15,52% of the total indemnities of the insurer (-1,4%).

In turn, 7,4 mln UAH have been paid out for 10 months on property insurance contracts, and 22,95 mln UAH on other insurance contracts, which is 9,5% more than the corresponding figure for the same period last year.

TAS Insurance Group (Kyiv) in January-August 2022 paid UAH 589.22 million as compensation, which is 19.3% less than in the same period a year earlier (UAH 730.58 million), according to the company’s website.

At the same time, it is noted that 27.1% of the total insurer’s payments fall on KASKO (UAH 159.66 million), 40.19% – on OSAGO (UAH 236.81 million), 14.97% – on Green Card (UAH 88.21 million).

Voluntary medical insurance accounted for 13.34% of all payments, or UAH 8.61 million.

At the same time, under property insurance agreements, TAS paid UAH 5.42 million for the specified period, which is 5.6% more than a year ago.

The volumes of payments under other insurance contracts also increased by 20.9%: in January-August of this year, TAS paid a total of UAH 20.51 million on them.

TAS was registered in 1998. It is a universal company offering customers over 80 types of insurance products for various types of voluntary and compulsory insurance. It has an extensive regional network: 28 regional directorates and branches and 450 sales offices throughout Ukraine.

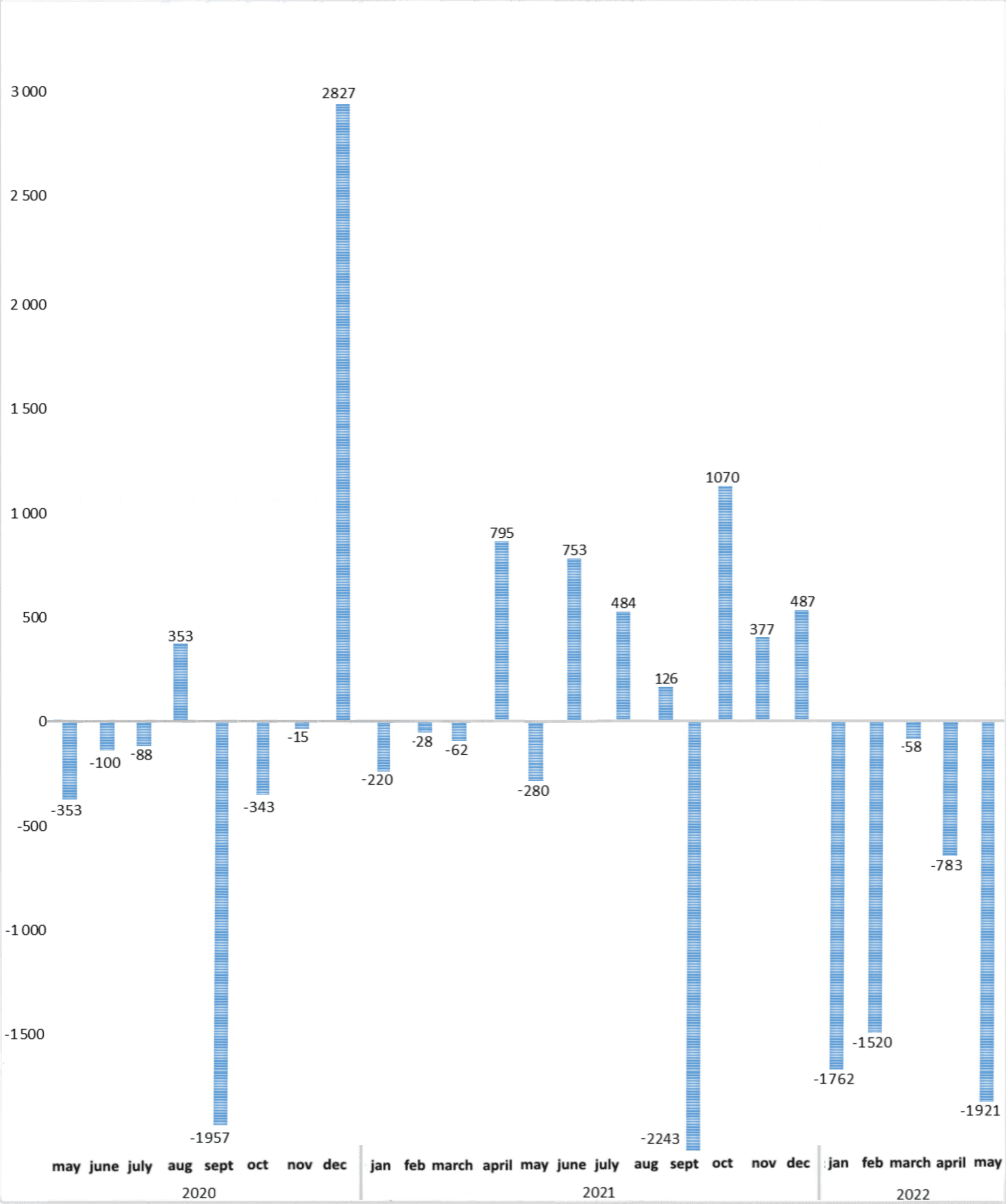

Dynamics of balance of payments of Ukraine (USD mln)

NBU

In January-July of this year, including more than five months of a full-scale war, the TAS Insurance Group paid UAH 504.11 million under concluded insurance contracts, or 22.4% less than in the same period of 2021, reported on the website of the insurer.

It is also noted that the first place in the insurer’s portfolio of payments with a share of 41.71% was taken by OSAGO, for which payments amounted to UAH 210.27 million. More than a quarter of all payments, or 27.44%, fell on CASCO – UAH 34 million.

The third position in the company’s payout portfolio with a share of 13.49% was occupied by VHI – UAH 67.99 million.

Not much less in the total amount of payments was the share of the “Green Card” – 12.79%, or UAH 64.47 million.

At the same time, under property insurance agreements, SG TAS paid UAH 4.99 million for the reporting period, which is 12.8% more than in seven months of last year.

Under other insurance contracts, the company paid UAH 18.05 million in compensation, exceeding the figure for January-July last year by 15.1%.

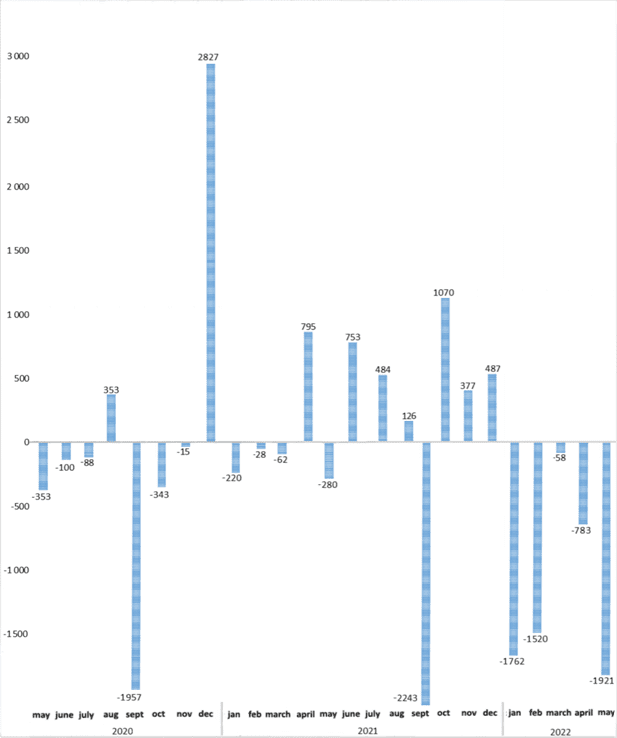

Dynamics of balance of payments of Ukraine in 2020-2022 (USD mln)

NBU

The government of Ukraine intends to extend the maturity of all Eurobonds by 24 months, as well as to defer the payment of interest income on them for the same period, the relevant Cabinet of Ministers Resolution No. 805 of July 19 was published on its website on Wednesday.

“Transactions with public debt in 2022 are carried out until August 15, 2022 by entering into the terms of the bond issue … in agreement with the bond holders …”, the document says.

According to it, “the maturity date of each bond (and for 2017 bonds ⸺ each maturity date of a portion of the 2017 bonds) is deferred for a period of 24 months from the respective final maturity date of the bonds.”

“All interest payment dates on post-deal bonds are deferred for a period of 24 months from each relevant interest payment date (and for 2018 Series 1 bonds ⸺ all interest payment dates on these bonds are deferred for a period from August 1, 2022 d.),” the resolution reads.

During these 24 months, interest income on the bonds continues to accrue at existing rates, and additional interest income is accrued on the amount of accrued basic interest income at the same rates.

“At any time during the specified delay, the total amount of accrued basic interest income and additional interest income (the amount of income of holders) on the basis of a separate decision of the Cabinet of Ministers of Ukraine may be paid to bondholders in part (or) in full,” the document says.

Likewise, at the end of the said deferral, the unpaid amount of the holders’ income at that time may be paid to the holders in full or by additional issue of the relevant bonds.

“The amount of income of holders is calculated by the Ministry of Finance, taking into account, in particular, information provided by business entities engaged by the Ministry of Finance to provide agency, advisory or other services in connection with transactions, and cannot exceed $ 3,000 million (together for all bonds paid in dollars USA) and 300 million euros (jointly for all paid in euros),” the resolution says.