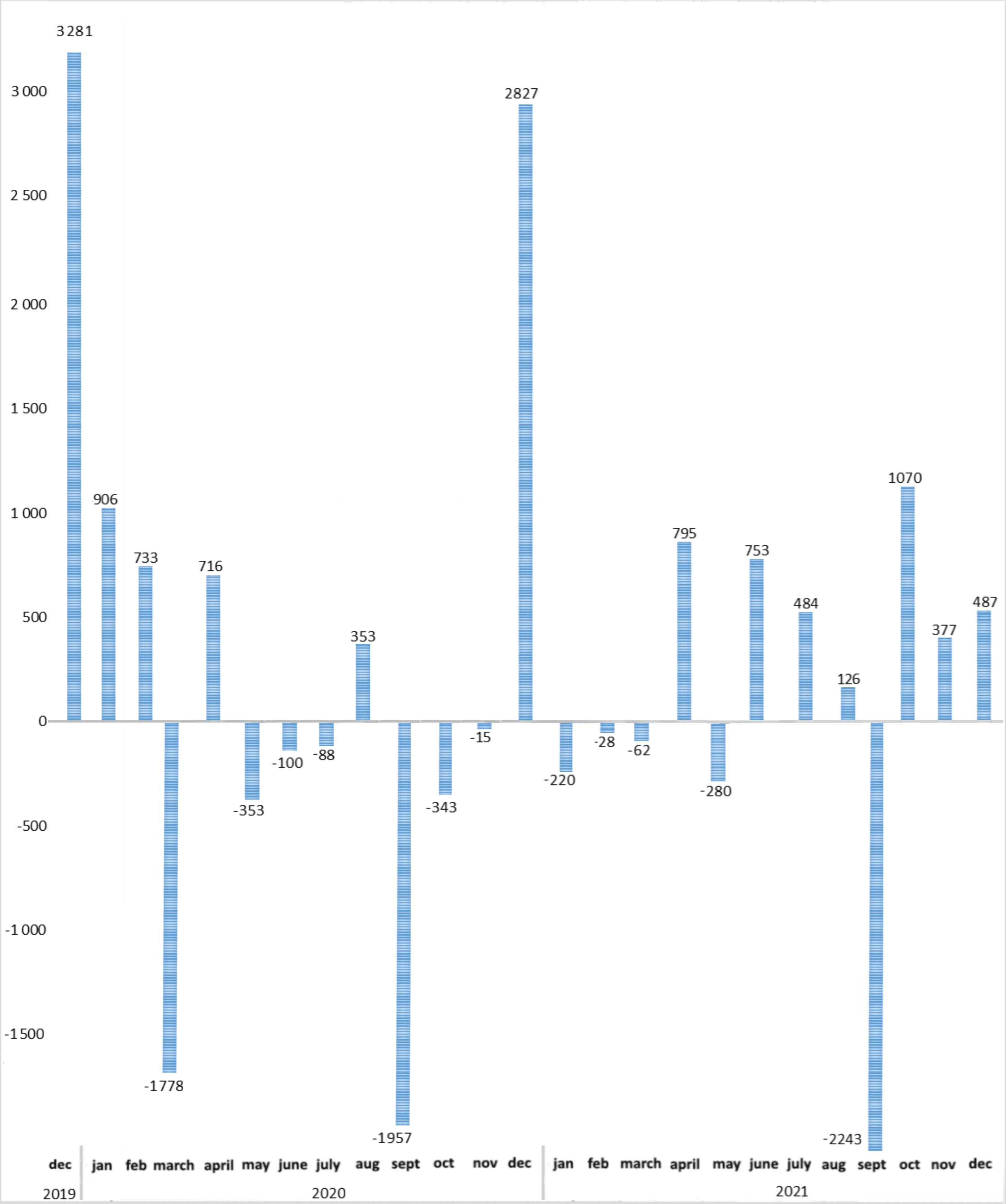

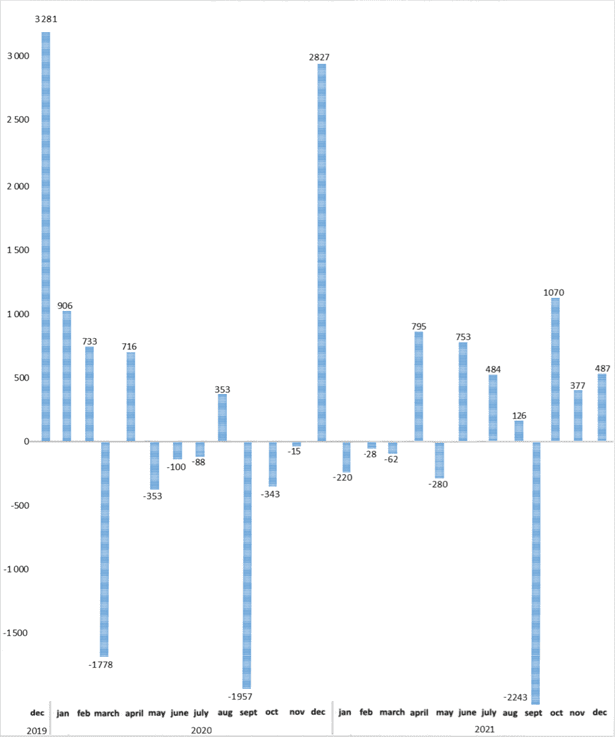

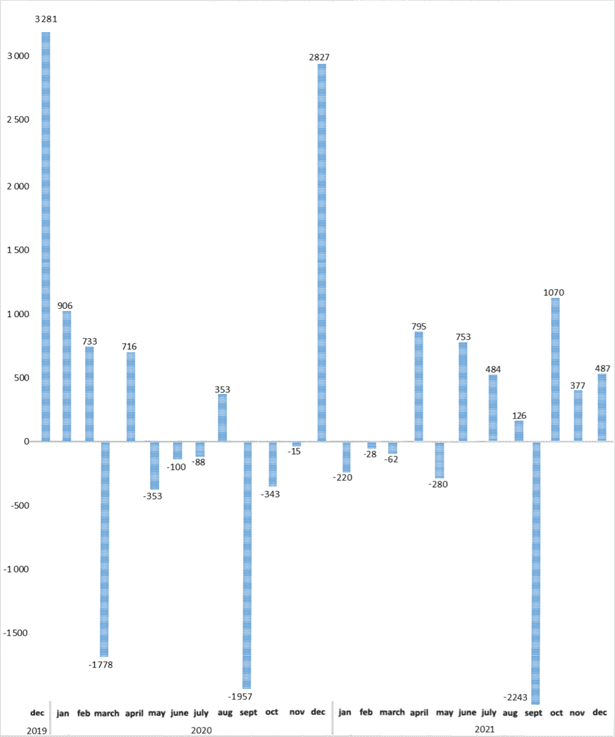

Dynamics of balance of payments of Ukraine (USD mln)

NBU

Gross insurance premiums of PJSC “Insurance company “Kraina” (Kyiv) in 2021 amounted to UAH 642.139 million, which is 16.7% more compared to 2020, Expert-Rating reports in the information on updating the company’s rating at the level of “uaAA+” on the national scale at the end of 2021.

According to the agency, the share of the company’s insurance premiums owned by reinsurers increased by 24.75%, and their share in the structure of the company’s gross premiums increased by 0.17 percentage points. up to 2.52%.

In 2021, JSC IC “Kraina” made UAH 354.31 million of insurance payments and indemnities, which exceeded the amount of payments for 2020 by 30.62%. In turn, the level of payments of the insurer increased to 55.18%, which exceeds the average indicator for the insurance market of Ukraine.

At the end of 2021, the company received a net profit in the amount of UAH 0.81 million, which is 93.29% less than in 2020. At the same time, the insurer received a loss from operating activities in the amount of UAH 8.62 million, while at the end of 2020, an operating profit was received in the amount of UAH 33.71 million.

In 2021, the equity capital of IC Krajina increased by 1.80% to UAH 152.296 million, and its gross liabilities increased by 13.64% to UAH 184.61 million. The high growth rates of gross liabilities led to a decrease in the level of coverage of the insurer’s liabilities by equity capital by 9.59 percentage points. up to 82.50%.

The volume of cash and cash equivalents during the analyzed period increased by 5.63% and amounted to UAH 90.71 million, while the indicator of coverage of the insurer’s obligations by cash decreased by 3.73 percentage points. up to 49.14%.

At the same time, the Agency notes that as of December 31, 2021, the insurer invested UAH 17.710 million in government bonds, which had a positive effect on the provision with liquid assets, which together covered 58.73% of the insurer’s liabilities.

The agency notes that, according to the reports provided by IC Krajina, as of the end of .2021, the insurer adhered to the criteria and standards established by law for solvency and capital adequacy, liquidity, profitability, asset quality and riskiness of the insurer’s operations.

IC “Kraina” has been operating in the insurance market of Ukraine since 1994. It has licenses for 23 types of insurance.

In January 2022, member insurance companies of the Motor (Transport) Insurance Bureau of Ukraine (MTIBU) concluded 590.5 thousand contracts of compulsory civil liability insurance of land vehicle owners (OSAGO), which is 1.04% more than in January 2021.

According to the data published on the MTIBU website, out of the total volume of contracts, 273.3 thousand were concluded in electronic form, which is 5.05% more than in the first month of 2021.

Members of the Bureau increased the collection of insurance payments under OSAGO policies by 16.68% compared to the same period last year – up to UAH 522.7 million, including for electronic contracts – in the amount of UAH 271.2 million, which is 23.16% more, than a year earlier

The total amount of accrued insurance claims under internal insurance contracts for January 2022 increased by 9.72% to UAH 287.2 million. Including UAH 57.4 million was paid using the Europrotocol, which is 19.3% more than a year earlier.

The Bureau also recorded an increase in the number of settled claims for insurance compensation by 4.93% – up to 13.461 thousand, including 5.221 thousand (+14.2%) using the “Europrotocol”.

MTIBU is the only association of insurers that provides compulsory insurance of civil liability of owners of ground vehicles for damage caused to third parties. Bureau members are 49 insurance companies.

Dynamics of balance of payments of Ukraine (USD mln)

NBU

Dynamics of balance of payments of Ukraine (USD mln)

NBU