The expenses of the Ministry of Finance of Ukraine under the “payments on value recovery instruments (VRI)” item in December 2021 amounted to UAH 4.635 billion, the State Treasury said in a report on the execution of the state budget on Friday.

According to the National Bank’s average official hryvnia-to-U.S. dollar exchange rate for December, this corresponds to about $170 million, which was probably used to buy out VRI on the market.

The Ministry of Finance did not comment on these December changes in the item of state budget expenditures to Interfax-Ukraine.

In total, over the past year, expenses under this item totaled UAH 5.633 billion, with an updated plan for the year of UAH 6.755 billion, while the original plan was UAH 1.155 billion.

Within its framework, in May, Ukraine, according to the Ministry of Finance, made the first payment on VRI issued as part of the restructuring of Ukraine’s public debt in 2015, which amounted to $40.751 million.

The May report of the State Treasury indicated the amount of expenses UAH 1.123 billion, but a month later it was reduced by 11%, to UAH 997.72 million, probably taking into account the partial buyout of about 11% of VRI by the Ministry of Finance in August 2020.

VRI were issued as part of the restructuring of Ukraine’s public debt in 2015 instead of eurobonds for a nominal amount of about $3.239 billion (20% of the restructuring volume) and are not part of the country’s public debt. Payments under VRI are made annually in cash in U.S. dollars, depending on the growth dynamics of Ukraine’s real GDP in 2019-2038, but after two calendar years, that is, between 2021 and 2040.

If GDP growth for the year is below 3% or real GDP is less than $125.4 billion, then there will be no payments on securities. If the growth of real GDP is from 3% to 4%, the payment on securities will be 15% the value of the GDP growth between 3-4%, and if it is higher than 4%, then 40% of the value of the GDP growth above 4% is paid. In addition, payments are capped at 1% of GDP from 2021 to 2025. The absence of any restrictions on payments after 2025 in the event of rapid GDP growth has been criticized by individual politicians and experts within the country.

Quotations of VRI in December fluctuated within 90.7% -95.3% of the nominal value – one of the lowest levels in the past year. At the same time, as a result of the escalation of the situation around Ukraine and the sale of Ukrainian assets caused by it, the value of VRI decreased in January 2022 and dropped to 66.7% of the nominal value this week. This is the lowest level since the beginning of the summer of 2019, not counting the short dip in value at the beginning of the COVID-19 pandemic. On Thursday, January 27, amid positive news, VRI rose by 9.4% to 73.5% of the nominal value.

Taking into account the quotes in December and the volume of expenditures made, it is possible to roughly estimate the volume of new purchases of VRI at about 5.7% of their total volume.

The growth of Ukraine’s GDP for 2021 is estimated by the National Bank of the country at 3%, which means no payments in 2023.

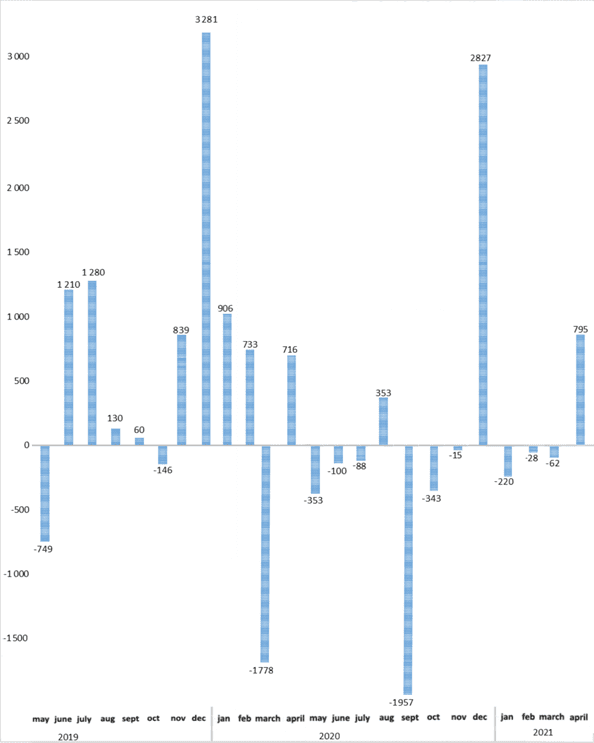

DYNAMICS OF BALANCE OF PAYMENTS OF UKRAINE (USD MLN)

DYNAMICS, DYNAMICS OF BALANCE, PAYMENTS, PAYMENTS OF UKRAINE

Ukraine’s FX payments on public debt will exceed $10 billion in the next 12 months, the National Bank of Ukraine said in its June Financial Stability Report.

“In the next 12 months, only FX payments by the government and the NBU on the state and guaranteed debt will exceed $10 billion. In the hryvnia segment of the market, repayment of principal and interest in the second half of the year will exceed UAH 130 billion,” the central bank said on its website.

The regulator said that the schedule of debt payments in the next three years remains tight. However, the load is distributed relatively evenly, which should not create significant problems for the Ministry of Finance, although the average volume of auctions should still grow.

According to the report, the financing needs may be mitigated by the additional issue of special drawing rights (SDRs) in the amount of $650 billion being discussed by the International Monetary Fund (IMF) to support the global economic recovery.

“If the IMF Executive Board approves the decision, Ukraine will increase its FX reserves by about $2.7 billion, the NBU said in the report.

TAS Insurance Group (Kyiv) paid out UAH 101.57 million of compensation under concluded insurance contracts in April, which is 55.4% more than the corresponding figure for the second month of spring 2020, according to the insurer’s website.

According to a press release, 39.08% of the company’s payments in April fell, in particular, on OSAGO (UAH 39.7 million), which is 56.8% more than in the reporting period last year.

In turn, the share of KASKO in the April portfolio of the insurer’s payments amounted to 32.02%, or UAH 32.53 million (more by 62.3%)

Even more – by 95.1% – the volume of payments under voluntary medical insurance contracts increased: UAH 16.84 million were paid under them in April, which is 16.58% of the total amount of the insurer’s indemnities for the specified period.

According to Green Card policies, TAS paid UAH 10.39 million in April, which is 10.23% of the company’s total payments for the month and is 12.9% more than the corresponding figure for the reporting period of 2020.

Under other insurance contracts, TAS Insurance Group paid out UAH 2.11 million of indemnities in April.

Metinvest Group, taking into account associated companies and joint ventures, is expected to increase the payment of income tax by more than seven times in January-June 2021, year-over-year, to UAH 10.2 billion, a source in the tax authorities told Interfax-Ukraine.

In turn, Metinvest confirmed to the agency information about a significant increase in income tax payments in the first half of 2021.

“Enterprises of the Metinvest group will pay income tax in the first half of 2021, replenishing the national budget by UAH 10.2 billion (compared to the first half of 2020, the income tax paid was about UAH 1.4 billion). Thus, according to the results of the first half of the year, income tax payments increased by 7.4 times. This unprecedented increase in tax payments during coronavirus pandemic will help support the cities where Metinvest enterprises operate, pay salaries in full and on time communal and medical workers,” the company told the agency.

At the same time, the group said that Metinvest is one of the largest taxpayers in Ukraine. Thus, in 2020, the company increased its tax payments by 5%, to UAH 22.1 billion year-over-year. Earlier, the group said that over 15 years of its work, it transferred UAH 165 billion to the budgets of all levels.