Aviation company FED JSC (Kharkiv) ended January-March 2025 with a net profit of UAH 114.86 million, which is 4.5 times more than in the first quarter of 2024.

According to the company’s interim financial statements published in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), its net income for the period increased almost 2.3 times to UAH 306.77 million.

FED generated almost UAH 141.85 million in profit from its operating activities, which is 3.3 times more than a year ago, and its gross profit also increased 3.3 times to UAH 101.88 million.

“The positive dynamics of FED’s profitability growth is achieved through the implementation of the company’s marketing strategy approved by the Chairman of the Board for the period up to 2035. Due to the ongoing war in Ukraine, the company’s marketing strategy was adjusted due to the impossibility of achieving the set goals by the end of 2023,” the report says.

The strategy, in particular, envisages the creation of high-tech space technology, transportation equipment, revolutionary technologies for the production of hydraulic and fuel units, nanocoating technologies, innovative welding technologies, mechanical and chemical-thermal processing.

The company’s production facilities and equipment are 100% utilized.

The average number of employees is 955.

FED JSC specializes in the development, production, maintenance and repair of aviation, space and general engineering units.

As reported, in 2024, FED received UAH 181.406 million in net profit, down 43% from 2023, of which 28% (UAH 40 million) was allocated to pay dividends.

The net profit of NNEGC Energoatom JSC for 2024 amounted to UAH 1.3 billion, MP Oleksiy Honcharenko said on his Telegram channel on Tuesday.

“The Cabinet of Ministers of Ukraine has approved the results of Energoatom’s work for 2024: the company’s net profit is UAH 1.3 billion,” he wrote.

According to Honcharenko, all 100% of the profit will be used to cover the losses of previous years, and no dividends will be paid.

The government also confirmed the opinion of the independent auditor and approved the report on remuneration to the supervisory board.

As reported, Energoatom generated 53 billion kWh of electricity in 2024, which is 2% more than in 2023 and 12% more than in 2022.

In 2024, Energoatom allocated UAH 116.3 billion (excluding VAT) of its own funds, or 58% of its net income, to pay for PSO, i.e. to maintain fixed electricity tariffs for the population.

Last year, the company paid UAH 28.8 billion in tax payments to the budgets of all levels, which is 35% more than in 2023.

Currently, Energoatom operates nine power units at South Ukrainian, Rivne and Khmelnytsky NPPs with a total capacity of 7880 MW. All of them are located in the territory controlled by Ukraine.

Zaporizhzhia NPP with six VVER-1000 power units with a total capacity of 6,000 MW has not been generating electricity since September 11 of the same year after its occupation on March 3-4, 2022.

In 2024, KSG Agro received $3.662 million in operating profit against a $1.615 million loss a year earlier, according to the agricultural holding’s report on the Warsaw Stock Exchange.

According to the report, KSG Agro’s revenue from sales in 2024 increased by 17.6% to $22.103 million from $18.786 million.

“By continuing to implement the development strategy of a vertically integrated holding, we have achieved improved financial performance in two of our strategically important business areas – crop production and pig production. The main factor behind the positive dynamics was the increase in the efficiency of the pig business in 2024 by updating the herd with sows of modern efficient genetics. As confirmed by a series of tests we conducted in early 2023, the productivity of the purchased sows is quite high not only in terms of the number of litters and farrowing weight, but also in terms of pork quality,” said Sergiy Kasyanov, Chairman of the Board of Directors of KSG Agro.

According to him, based on the tests conducted, 1.3 thousand heads of the identified low-productive sows in the herd were replaced with purchased more efficient ones during the year. This allowed the holding to produce high quality piglets and ensure high dynamics of the pig breeding business.

Kasyanov added that the main drivers of KSG Agro’s further development, including in 2025, will be increasing the efficiency of crop production and increasing the productivity of the pig herd by continuing to rejuvenate the pig population.

KSG Agro, a vertically integrated holding company, is engaged in pig production, as well as the production, storage, processing and sale of grains and oilseeds. Its land bank in Dnipropetrovska and Khersonska oblasts is about 21 thousand hectares.

According to the agricultural holding, it is one of the top five pork producers in Ukraine. In 2023, it launched a “network-centric” strategy, which will shift from developing a large location to a number of smaller pig farms located in different regions of Ukraine.

In the first quarter of 2024, KSG Agro decreased its net profit by 37% to $0.96 million on a 2% decrease in revenue to $5.02 million. Its EBITDA decreased by 2% to $1.83 million.

Astarta Agro Holding, the largest sugar producer in Ukraine, increased its net profit by 34.5% in 2024 compared to 2023 to EUR83.25 million, according to the company’s report on the Warsaw Stock Exchange.

According to the report, consolidated revenue last year decreased by 1.1% to EUR612.15 million, while gross profit increased by 5.3% to EUR235.53 million and EBITDA by 9.6% to $159.35 million.

In hryvnia terms, Astarta’s revenue last year increased by 8.5% to UAH 26.531 billion, while net profit grew by 48.1% to UAH 3.634 billion.

It is noted that stable sea exports provided higher sugar sales compared to the previous year, partially offsetting the lower harvest of grains and oilseeds. Export sales of EUR395 mln accounted for 66% of consolidated revenue in 2024 compared to 53% in 2023.

The agriculture segment generated 34% of consolidated revenue or EUR209 mln in 2024 (-13% year-on-year). The main contribution was made by the sugar production segment with sales of EUR229 mln (+15% yoy), which accounted for 37% of total revenue in the reporting period. The soybean processing segment accounted for 17% of Astarta’s revenue or EUR106 million (-13% yoy). The livestock segment increased its sales by 25% yoy to EUR53 mln, accounting for 9% of total revenue in 2024.

The company attributed the increase in gross profit to a 35% or EUR 78 million increase in the fair value of biological assets and agricultural products, reflecting higher commodity prices.

Taking into account the data for the first nine months, Astarta’s financial performance in the fourth quarter of 2024 was slightly worse than in the fourth quarter of 2023.

It is also noted that operating cash flow increased in 2024 by 83% yoy to EUR167 million amid active inventory sales.

According to the report, investment cash flow increased by 30% to EUR52 million last year. The main investments were made to expand the fleet of beet harvesters, build a sugar silo and the production capacity of the soybean processing plant.

It is emphasized that Astarta’s net financial debt (excluding lease obligations) has turned into a positive cash position of EUR 21 million against EUR 39 million of debt in 2023.

As reported, in the first nine months of 2024, Astarta increased its net profit by 35.1% compared to the same period in 2023 to EUR75.60 million. The agricultural holding’s revenue increased by 12.6% to EUR441.46 million, and EBITDA by 12.8% to $131.56 million.

In 2023, the agricultural holding reduced its net profit by 5.0% to EUR61.9 million, and its EBITDA decreased by 6.1% to EUR145.77 million, while revenue increased by 21.3% to EUR618.93 million.

“Astarta is a vertically integrated agro-industrial holding company operating in eight regions of Ukraine. It includes six sugar factories, agricultural enterprises with a land bank of 220 thousand hectares and dairy farms with 22 thousand cattle, an oil extraction plant in Globyno (Poltava region), seven elevators and a biogas complex.

Obolon PrJSC, one of the largest producers of beverages in Ukraine, received UAH 1.248 million in net profit in 2024, which is 1.47 thousand times less than a year earlier, and will use it for the company’s development.

According to a report in the disclosure system of the National Securities and Stock Market Commission (NSSMC), the shareholders are to make the relevant decision at a remote general meeting on April 25.

The shareholders are proposed to approve the report of the Supervisory Board and the results of the company’s financial and economic activities for 2024, to prolong the audit services agreement with Grant Thornton Legal LLC on the existing terms, to take note of the conclusions of its audit report for 2024, and to approve the measures.

The shareholders should amend the company’s charter to elect members of the supervisory board (independent directors) and set their remuneration, and authorize the company’s president to sign civil law contracts with members of the supervisory board. It is proposed to approve Yevhen Rymar and Ihor Singayevsky as two independent directors.

Earlier, in March 2025, Obolon PrJSC changed its internal auditor to Iryna Kondratenko, who has been working as a pricing economist at the company for the past five years.

According to the Opendatabot service, in 2024, Obolon PrJSC received UAH 12.87 million in revenue, compared to UAH 10.76 billion a year earlier. At the same time, the company’s debt obligations increased by 14.9% to UAH 1.64 billion, and assets by 31.9% to UAH 9.238 billion, the number of employees by 108 people to 2164 employees. The authorized capital of the company is UAH 32.512 million.

Obolon Corporation produces beer, soft and low-alcohol beverages, mineral water, snacks, and is the country’s largest beer exporter. It has a main brewery in Kyiv and nine plants in the country’s regions.

Its main brands are Obolon, Carling, Zlata Praha, Hike premium, Zibert, Keten, Hardmix, BeerMix, Desant, Zhyhulivske, Zhyvchyk, Obolonska, and Prozora. The corporation also produces low-alcohol drinks Rio, Gin and Tonic, Lime Vodka, Whiskey Cherry, Rum-Cola, Brandy-Cola, and Ciber.

The total revenue of the top ten companies in this sector increased by 12%

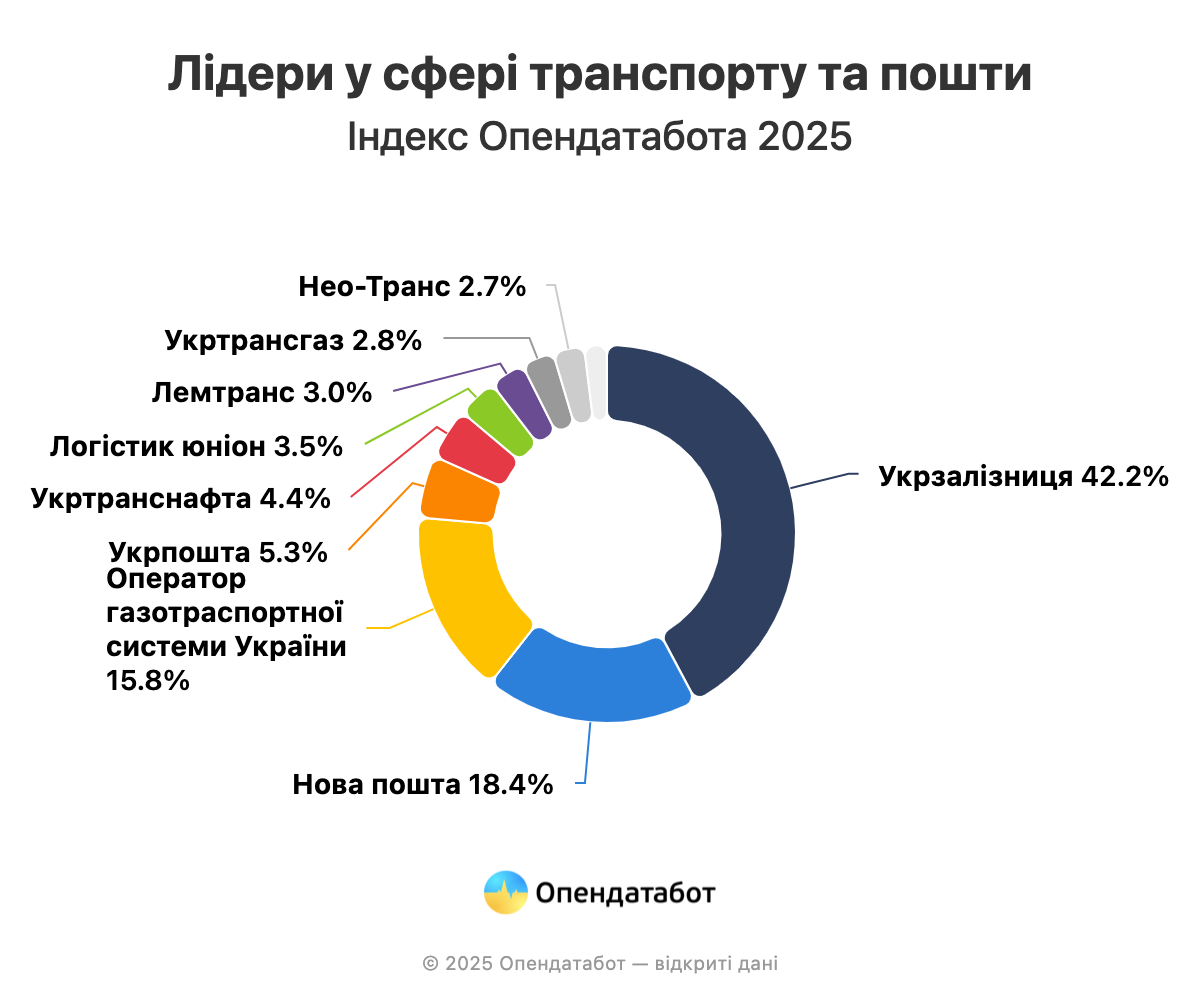

According to the Opendatabot Index, the top ten companies in the transportation and logistics sector generated more than UAH 243 billion in total revenue last year. This is 12% more than in 2023. Only 5 out of 10 companies managed to make a profit that year.

According to the Opendatabot Index, the leading companies in the field of transport and postal services earned UAH 243.67 billion in revenue. Their total revenue grew by 12% over the year.

Not everyone had a good year: 8 companies saw their revenues grow, but only 5 of the top ten managed to make a net profit. The total profit of the top five was UAH 8.16 billion, while the losses of the other four companies amounted to UAH 12.1 billion. Another company broke even last year.

Despite the fact that half of the leading companies are state-owned, they account for more than 70% of the total income of the top five: UAH 171.89 billion.

Ukrzaliznytsia, the permanent leader of the Index, received UAH 102.87 billion in revenue last year (+11% yoy). However, the company still made a loss at the end of the year: UAH 4.19 billion. Ukrtransgaz had a similar situation: its revenue decreased by almost a third, and its losses reached UAH 7.44 billion.

Ukrposhta had a more successful year. Despite the fact that the company ended the year in the red, it managed to reduce its losses by almost 2 times. Overall, Ukrposhta increased its revenue by 12% to UAH 12.98 billion last year.

“For us, this rating and its results are not just numbers on the screen. These are years of hard work by tens of thousands of people who have been implementing reforms step by step and turning Ukrposhta into a modern and successful business. Despite the challenges of the war and the fact that we are a business with a human face, guided not only by short-term financial gain but also by the welfare of Ukrainians, we succeed,” comments Igor Smelyansky, CEO of Ukrposhta.

Another state-owned company, the Ukrainian Gas Transmission System Operator, increased its revenues by 7% to UAH 38.53 billion over the year. Although net profit decreased by 8.7 times to UAH 1.27 billion, the company still ended the year in the black.

“Ukraine’s GTS operator operates stably and reliably despite numerous challenges caused by the full-scale war. The company clearly and timely fulfills its obligations to internal and external customers of natural gas transportation services. This approach ensures the financial sustainability of the Company’s development,” said Vladislav Medvedev, acting CEO of GTSOU.

The revenue of the state-owned Ukrtransnafta decreased insignificantly, but its profit dropped by 16 times to UAH 1.22 billion. It is worth noting that in the previous Index, this company was the leader in terms of profit among the top ten.

For the second year in a row, Nova Poshta, which belongs to the NOVA group, has been ranked second in the Index, with its revenue up 23% to UAH 44.78 billion. But profit, on the contrary, decreased by 1.6 times to UAH 2.5 billion.

“In 2024, Nova Poshta became the world’s best postal operator according to the World Post & Parcel Award, expanding its network to more than 37,000 service points in Ukraine and more than 87,000 in 16 European countries by the end of the year. Last year, we opened the first barrier-free post office in Ukraine and donated more than UAH 4.8 billion for humanitarian needs and support of the army. 2024 was about movement and the challenges we managed to overcome,” the company commented.

This year, another NOVA Group company, Neo-Trans, was included in the Index for the first time. It showed the fastest revenue growth among the top ten: +100% (UAH 6.5 billion). Its profit also doubled to UAH 116.55 million. Together, the two NOVA companies account for 21% of the total revenue of the leaders.

Logistician Union of the ATB group is not far behind. Thus, the company moved up several positions in the ranking, increasing its revenue by 29% and earning the largest profit of all – UAH 3.06 billion (+40%).

Lemtrans, a company of Akhmetov’s SCM Group, demonstrates stability and remains in the seventh position for the third year in a row. Its revenue increased by only 3% to UAH 7.3 billion.

This year’s Index includes another new company, Ukrainian Helicopters. Despite a 17% increase in revenue (up to UAH 872 million), which allowed it to break into the top, the business recorded a loss of UAH 52.5 million.

At the same time, two companies from Oleksandr Radavsky’s agricultural holding, Promvagontrans and Berehove Grain Receiving Enterprise, dropped out of the 2025 Index. In 2024, their revenues decreased by 2.5 and 3 times, respectively, but both of them turned a profit: +UAH 2 million and +UAH 36 million in profit.

https://opendatabot.ua/analytics/index-transport-and-mail-2025