Revised data on bank profits and taxes published

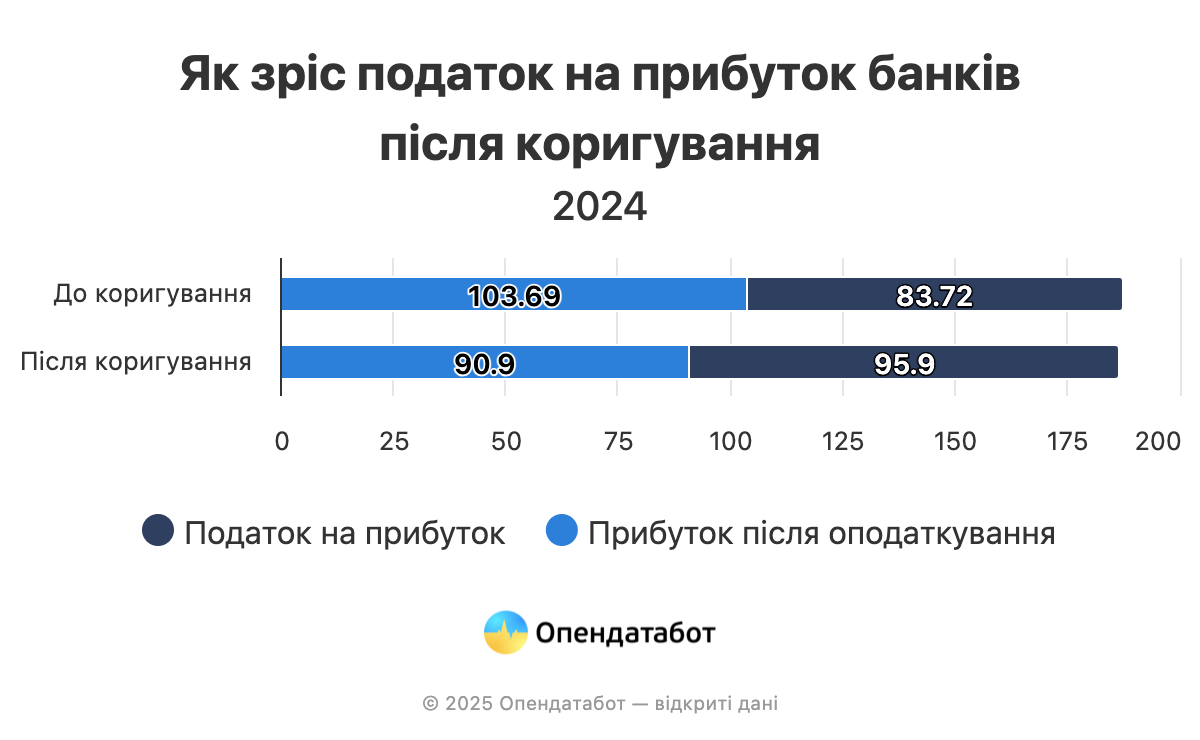

The National Bank of Ukraine has published the final version of the banks’ balance sheet reports for 2024, which takes into account adjusting entries. Pre-tax profit decreased by 1% compared to the previous report, while tax payable increased by almost 15%. The total after-tax profit of banks decreased to UAH 90.9 billion. 93% of the additional charges fell on state-owned banks.

The total pre-tax profit of Ukrainian banks for 2024 amounted to UAH 186.8 billion, almost the same as in the previous NBU data. However, after-tax profit fell significantly, by UAH 12.8 billion (i.e., 12%), and now stands at UAH 90.9 billion.

This was due to a significant additional income tax assessment, which ultimately increased by 15% and reached UAH 95.9 billion. Accordingly, taxes will eat up 51% of profits. For comparison, in 2023, this figure was 48%, and in 2022, only 25%.

93% of all additional charges fell on state-owned banks, which is 11.78 billion UAH in additional taxes. Oschadbank paid the most: its income tax after adjustment increased 2.5 times, from 4.3 to 10.66 billion UAH (+6.36 billion UAH).

Ukreximbank paid an additional UAH 2.94 billion — its tax increased 15 times. Sens Bank (formerly Alfa-Bank) — 58 times, to UAH 1.97 billion (+UAH 1.94 billion). The only state-owned bank where the tax decreased was Ukrgasbank: -UAH 455 million.

Banks with foreign capital were charged a total of only UAH 118.57 million.

Banks with private capital were charged UAH 1.34 billion, with the largest amounts going to A-Bank (+UAH 541 million), Bank Pivdenny (+UAH 308 million), and MTB (+UAH 225 million).

The largest increase in income tax after adjustment was recorded by the Ukrainian Bank for Reconstruction and Development, which rose 84 times, from UAH 247,000 to UAH 20.76 million.

Overall, income tax after adjustment increased for 22 banks, by UAH 12.7 billion. At the same time, it decreased by UAH 513.4 million in 12 banks (88.8% of which fell on Ukrgasbank). As a result, the amount of tax exceeded the net profit of banks by UAH 5 billion.

https://opendatabot.ua/analytics/banks-fee-2024

Shareholders of Arsenal Insurance (Kyiv) decided at a meeting on May 7 to allocate UAH 34.705 million of undistributed profits for 2021 and UAH 15.395 million for 2022 to dividend payments, the company reported in the information disclosure system (NSSMC).

As stated in the report, the dividend per ordinary share will be UAH 167. Dividends will be paid directly to shareholders in proportion to the number of shares held by each of them from May 29 to June 27, 2025.

Insurance Company Arsenal Insurance is the successor to Insurance Company Arsenal-Dnipro, which has been operating in Ukraine since 2005. It is represented in all regional centers and some major cities of the country.

According to the NBU, the company is one of the top ten insurers in Ukraine in terms of premiums collected for the first nine months of 2024.

In 2024, coffee producer Galka PrJSC (Lviv) reduced its profit by 7.5% to UAH 2.7 million compared to 2023.

According to the decision of the shareholders’ meeting published in the information disclosure system of the National Securities and Stock Market Commission (NSSMC), it was decided to pay dividends in the amount of UAH 4,497,204, which is UAH 12.85 per ordinary registered share.

The Management Board was obliged to compile a list of persons entitled to receive dividends by April 23, 2025, and to pay dividends directly to shareholders within six months from the date of the general meeting’s decision to pay dividends by transferring them to shareholders’ bank accounts or, at their request, at the company’s cash desk.

“Pay the entire amount of dividends in full. To notify the persons entitled to receive dividends of the date, amount, procedure and term of their payment by posting a relevant notice on the company’s website,” the minutes of the general meeting read.

According to the Opendatabot service, in 2024, Galka slightly increased its revenue to UAH 5.274 million, which actually corresponds to the pre-war level of UAH 5.29 million in 2021. Debt obligations increased by 20.2% to UAH 504.2 thousand, while assets decreased by 6.6% to UAH 24.11 million.

Galka PrJSC was established in 1994 on the basis of a Lviv coffee factory that started its operations in 1932 as the Lviv Cooperative Factory of Coffee Additives “Suspilny Promyshl”. Since its inception, the company has specialized in the production of chicory and malt coffee “Luna”, as well as Prajin coffee substitutes. In 1971, the company installed Niro Atomizer equipment for the production of instant coffee, which Lviv Coffee Factory began exporting. The capacity of the Ukrainian-English manufacturer Galka is currently 120 thousand packs of coffee per day.

The major shareholders are Yaroslav Volynets (8.9%) and Lydia and Andriy Volynets (6.9% each), Natalia, Olga and Yuriy Dubovy (7.7% each), Roman and Volodymyr Pasternak (7.1% and 7.6%), Iryna Popovych (7.1%), and Galka Holding LLC (19.39%).

The profits of Ukrainian banks in January-February 2023 amounted to 21.5 billion UAH, which is 2.2 times more than during the same period in 2022 (9.9 billion UAH), the press service of the National Bank of Ukraine (NBU) said on Tuesday.

The regulator noted that bank revenues for the two months increased by 33% to 65.8 billion UAH, and expenses – by 12%, to 44.3 billion UAH.

At the same time, the fee and commission income increased twofold, to 15.582 billion UAH.

The result of revaluation and purchase and sale operations increased 2.4 times up to UAH 4.649 billion against UAH 1.9 billion during the same period last year.

At the same time, deductions to the reserves decreased 2.3 times, to UAH 2.517 billion, and commission expenses went down by 11.9%, to UAH 7.5 billion.

As reported, the Ukrainian banks in 2022, net profit reduced by 3.1 times – to 24.716 billion UAH compared with 77.376 billion UAH in 2021.

Verkhnedniprovsk casting and mechanical plant PJSC (Dnipropetrovsk oblast) increased its net profit by 2.9 times in 2021 in comparison with the previous year – up to UAH 5.823 mln.

According to the company announcement in the information disclosure system of the National Securities and Stock Market Commission on the remote annual meeting of shareholders on December 20, the undistributed profits of the company at the end of last year reached 105,4 thousand UAH.

The shareholders intend to summarize the company’s results in 2021, approve the report and approve significant deals of the company.

Verkhnedniprovskiy Casting and Mechanical Plant PJSC was founded in 1898 and is one of the largest Ukrainian producers of alloys and non-ferrous metals products. Current capacity of stamped and die-cast shops exceeds 100 tons of finished products per month. Availability of all necessary infrastructure and vertical integration of the enterprise allow the plant to implement large customized projects for manufacturing enterprises not only in Ukraine, but also in Europe, Asia and America.

According to the NDU, as of the fourth quarter of 2021, a physical person Andrey Cherniy owns 50% of shares in PrJSC, another physical person Anastasia Fedorova – 49.4187%.

The authorized capital of PrJSC is 2 279,5 thousand UAH, the nominal value of one share is 1,05 UAH.

Source: https://vlmz.com/

Ukrainian banks’ profits in January-September 2022 amounted to 7.4 billion UAH, which is 6.9 times less than in the same period last year (51.4 billion UAH), the press service of the National Bank of Ukraine (NBU) said on Monday.

According to the report, losses of Ukrainian banks in September amounted to 1 billion UAH, while August’s profit amounted to 5.05 billion UAH.

The regulator noted that banks’ revenues in September increased by 13.3%, while expenses increased by 13.1%.

According to the regulator, banks’ income for nine months of this year increased by 30.8% against the same period last year – up to 255.08 billion UAH. At the same time, the fee and commission income decreased by 16% – to UAH 59.8 billion (whereas over the same period last year it increased by 28%).

At that the result from revaluation and purchase and sale operations was positive and made UAH 37.1 billion, while over the same period of previous year it was negative and made UAH 2.4 billion.

At the same time expenses of banking system in January-September 2022 increased by 72.5% compared with this index in 2021 – up to 247.7 billion UAH, including deductions to reserves – 12.9 times, up to 99 billion UAH. At the same time, the commission expenses increased by 2% up to UAH 25 billion,

As reported, the Ukrainian banks in 2021 doubled the net profit – up to 77.5 billion UAH, compared with 41.3 billion UAH in 2020.