The international financial service NovaPay (TM NovaPay) raised the rate on short-term deposits from private investors by 1-2 percentage points (pp) — from 1 to 3 months, and by 0.25-0.5 p.p. for deposits with a term of 4 to 9 months, according to the company’s press release on Thursday.

It is noted that the current rates as of October 23, 2025, are: 1 month — 12%; 2 months — 14%; 3 months — 15.5%; 4 months — 17%; 6 months — 17.5%; and 9 months — 17.75%.

In July, NovaPay offered 10% per annum for 1 month, 12% for 2 months, 14.5% for 3 months, 16.5% for 4 months, and 17.5% for 6 and 9 months.

The company clarified that the rate for annual deposits remained unchanged at 18%.

Since the beginning of March 2025, the National Bank has held the discount rate at 15.5% for five consecutive meetings, and before that, it increased it three times since mid-December 2024. Earlier, it had kept it at 13% for six months, to which it had been reduced from 25% in July 2023 in seven stages.

According to NovaPay CFO Igor Prykhodko, most clients invest in short and medium terms.

As reported, NovaPay launched an alternative to deposits through repo transactions with bonds of its subsidiary NovaPay Credit. They are available for purchase in the NovaPay mobile app. As of July this year, the company reported attracting UAH 1.7 billion through this mechanism.

NovaPay was founded in 2001 as an international financial service, part of the Nova group (“Nova Poshta”), providing online and offline financial services in Nova Poshta branches. According to the website, the company employs about 13,000 people in more than 3,600 Nova Poshta branches throughout Ukraine. According to the National Bank of Ukraine, the company accounts for about 35% of the total volume of domestic money transfers.

NovaPay was the first non-bank financial institution in Ukraine to receive an extended license from the NBU in 2023, which allowed it to open accounts and issue cards, and was also the first among non-banks to launch its own financial application with a wide range of financial services at the end of last year.

According to the bond prospectus, NovaPay Credit plans to increase its interest income to UAH 802.1 million this year and to UAH 1 billion 515.1 million next year, and to receive UAH 518.9 million and UAH 1 billion 30.6 million in net profit, respectively.

Last year, the company’s net profit grew to UAH 89.2 million from UAH 40.3 million a year earlier, with revenue growing to UAH 285.6 million from UAH 95.6 million.

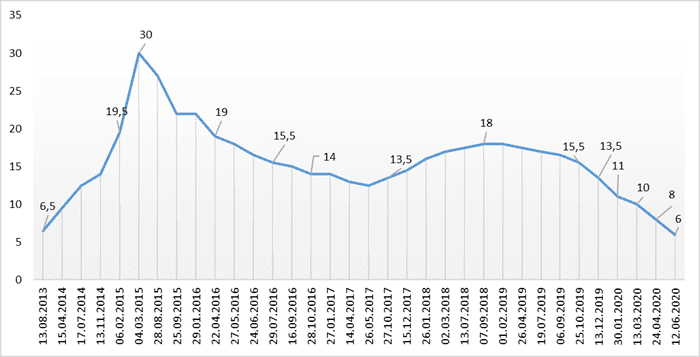

Dynamics of changes in discount rate of NBU

NBU

The Board of the National Bank of Ukraine (NBU) has retained the refinancing rate at 6%, the central bank said on Thursday.

“The Board of the NBU has decided to keep the refinancing rate unchanged at 6% per annum. On the one hand, it will keep prices from growing under conditions of economic recovery in 2021-2022, and on the other hand it will leave enough space for further decrease in cost of loans to the individual character level,” it said.

According to the statement, the central bank revised its forecast for refinancing rate for 2020 from 7% to 6% per annum with its further growth to 6.5% in 2021.

Dynamics of ukrainian discount rate changes in 1992-2019

The National Bank of Ukraine (NBU) has decided from October 25 to lower the refinancing rate to 15.5% per annum from 16.5% per annum, at which it has been since September 6 of this year.

“The National Bank continues the cycle of easing monetary policy, as it expects inflation to slow to the target of 5%,” the central bank said on Thursday.

The NBU Board said that the basis of this stable trend is the gradual weakening of fundamental pressure on prices, the sign of which is the rapid slowdown in underlying inflation.

“Tight monetary policy has become one of the reasons for the strengthening of the exchange rate and improvement of inflation expectations. This influences prices significantly and exceeds the influence of factors that, on the contrary, push prices upward, in particular, the effect of still stable consumer demand,” the regulator said.

According to its forecasts, inflation this year will drop to 6.3%, and next year it will fall into the target range and reach medium-term 5% at the end of 2020.

“As before, the sharpest decrease in the refinancing rate is expected during 2020 along with the return of inflation to the target range and the improvement of inflation expectations,” the NBU said.