The State Property Fund of Ukraine (SPF) has included Drohobych Saltworks in the list of enterprises to be privatized, the saltworks said on Facebook.

“Unfortunately, the enterprise cannot recover on its own, as it pays 80% of its net profit as dividends, and it has almost no funds left for recovery. Therefore, it is important to find effective solutions to preserve our heritage,” – noted in the message.

The management of the enterprise believes that the purchase of the enterprise by a private investor or transfer to the regional or city municipal ownership is one of the effective ways to preserve and restore the property. In this case, the entire income can be directed to the development of the enterprise and attract funds from outside.

“The management is ready to do everything possible to continue salt production. And yes, it is real! We will take care that the conditions of privatization include the continuation of Drohobych salt production”, – stated in the message.

Drohobych saltworks is the oldest enterprise in Ukraine, which began production in 1390. Salt at the plant is boiled from brine, which is extracted from the subsoil. Currently, the enterprise produces two types of products: “Boiled iodized kitchen salt” and “Boiled kitchen salt without additives”. After the beginning of hostilities in the East, this is practically the only enterprise in Ukraine, which is engaged in salt production. The leading retail chains of the country have established cooperation with it. Since 2019, the plant is actively developing tourism.

The State Property Fund (SPF) of Ukraine carried out the debut sale of the nationalized plant: at the repeated auction in the system “Prozorro.Sales” was sold for 103.11 million UAH plant for the production of meat casing PJSC “PentoPak” (Boryspil), said the head of the SPF Vitaly Koval.

“The buyer has 20 days to pay the cost of the lot. In addition to the proposed cost, the investor has already paid a guarantee fee of UAH 20.375 million”, – he said in Telegram.

The head of the FGI reminded that “PentoPak” was confiscated from the family of Russian-Greek oligarch Savvidi, and the funds from its sale will go to the restoration of our state in the Fund for the elimination of the consequences of Russian aggression.

The buyer was Lonikos LLC (Kiev), whose director is Larisa Ashkinazi.

According to the Opendatabot, the main activity of the company is renting and operating its own or leased real estate. Also “Lonikos” is engaged in non-specialized wholesale trade and activities of intermediaries specializing in trade in other goods.

As reported, on May 31, after the first fruitless auction scheduled on “Prozorro.Sales”, the plant was put up for a second auction at a halved price – for UAH 101.87 million.

The FGI reported that the plant provides a full cycle of production of packaging for meat processing products. “PentoPak” produces multi-layer synthetic shrink casing, using advanced technologies. The company’s customers include well-known Ukrainian brands such as Rud, Globino, Meat Guild, as well as customers from more than 30 countries.

The enterprise has preserved 193 jobs, has no debts on wages and to the budget. The company plans to modernize production and enter new markets of packaging materials for the dairy industry, fish processing and animal feed packaging.

Earlier, in February 2024, the SACS decided to confiscate Savvidi’s property and transfer 100% of PentoPak shares to the State Property Fund, as the oligarch has close ties with the Russian leadership and supports the occupation authorities in the temporarily seized territories of Ukraine.

The meat casing plant PentoPak PJSC (Boryspil) after the first fruitless auction, scheduled on “Prozorro.Sales” on May 31, is put up for a second auction at a halved price – for UAH 101.87 million.

According to information on the site “Prosorro.Sales”, a new auction is scheduled for June 10.

As reported, on May 6, the State Property Fund (SPF) of Ukraine approved the starting price of PentoPak PJSC, recovered from Russian sub-sanctioned oligarch Ivan Savvidi, in the amount of 203.7 million UAH.

As noted in the FGI, the plant provides a full cycle of production of packaging for meat processing products. “PentoPak” produces multi-layer synthetic shrink casing, applying advanced technologies. Among the clients of the enterprise are well-known Ukrainian brands such as “Rud”, “Globino”, “Meat Guild”, as well as customers from more than 30 countries of the world.

The enterprise has preserved 193 jobs, has no debts on wages and to the budget. The company plans to modernize production and enter new markets of packaging materials for the dairy industry, fish processing and animal feed packaging.

Earlier, in February 2024, the SACS decided to confiscate Savvidi’s property and transfer 100% of PentoPak shares to the State Property Fund, as the oligarch has close ties with the Russian leadership and supports the occupation authorities in the temporarily seized territories of Ukraine.

The Auction Commission has set the starting price of privatization of the state share (66.65%) in the authorized capital of LLC Investment Union Lybid, which owns Ocean Plaza shopping mall, at UAH 1.65 billion, the press service of the State Property Fund (SPF) reported.

According to the report, the starting price and terms of sale should be approved by the Cabinet of Ministers of Ukraine, FGI will prepare a draft of the relevant decision.

After the government approves the starting price, the date of the auction will be set, the agency said. The state share in the authorized capital will be put up for electronic auction in the system “Prozorro.Sales”.

As reported, the FGI plans to hold an auction on privatization of shopping mall Ocean Plaza in the second half of the year.

Ocean Plaza shopping mall was opened in Kiev in December 2012 on Antonovycha Street, 176. Its total area is 165 thousand sq. m. Investments in the facility amounted to about $300 mln. UDP Company and K.A.N. Development LLC acted as partners in the development of the project.

The mall was sold to Arkady Rotenberg’s Russian TPS-Nedvizhimost in 2012. Later, in 2019, Ukrainian businessman Vasyl Khmelnytsky indirectly through UPD Holdings Limited acquired a 33.5% stake in Ocean Plaza mall. In 2021, he sold his stake to entrepreneur Andrey Ivanov. The deal was finalized in summer 2023.

In June 2023, the Cabinet of Ministers transferred to the FGI a 66.65% stake in the authorized capital of Investment Union Lybid LLC, which owns the shopping mall, for further privatization.

AUCTION, Ocean Plaza shopping mall, STATE PROPERTY FUND, ЛИБІДЬ, ФГИ

The State Property Fund of Ukraine (SPFU) has sold a complex of buildings of the Uman Correctional Colony for UAH 29 million at a privatization auction, which is 194 times higher than the starting price.

According to SPF Chairman Vitaliy Koval on Facebook, 42 companies and entrepreneurs participated in the auction. The starting price of the lot was UAH 149.4 thousand.

According to the results of the auction on the Prozorro.Sale website, the winner of the auction was Borys Pakholyuk. According to Clarity Project, he owns a number of agricultural enterprises and farms in Cherkasy and Odesa regions.

The lot includes a complex of non-residential buildings and structures with a total area of 3.1 thousand square meters and a land plot of 0.59 hectares. The property had not been used for more than 20 years.

Koval reminded that the Ministry of Justice transfers unused penitentiary institutions to the SPF for further privatization.

Vitaliy Koval, Head of the State Property Fund of Ukraine

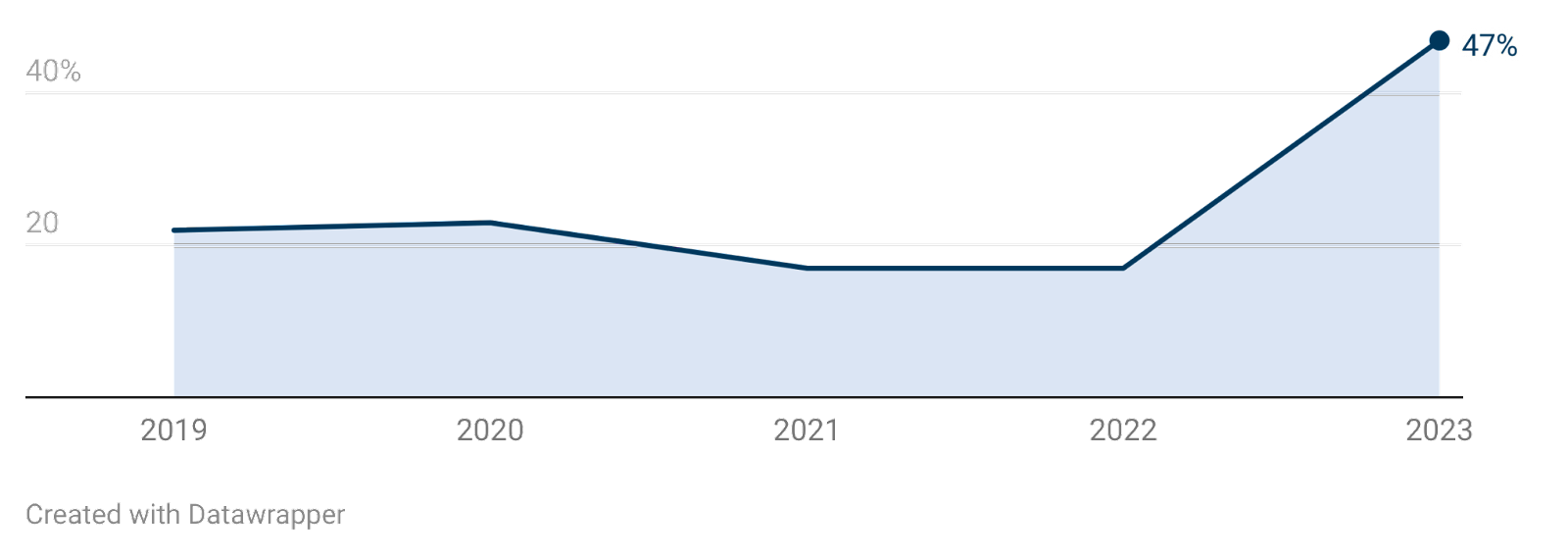

Small-scale privatization has been systematically gaining momentum over the past 5 years (from 2019 to 2023) with some interruptions, in particular due to a full-scale invasion. Last year’s performance largely surpassed all previous results and demonstrated the effectiveness and timeliness of privatization in general.

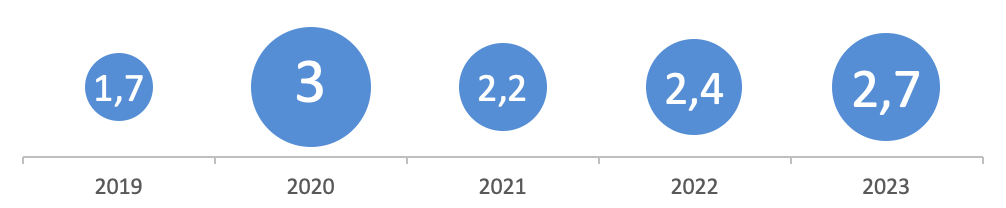

Budget revenues

As a result of small-scale privatization in 2019, which was carried out by the State Property Fund of Ukraine, the budget received approximately UAH 561 million. The following year, this amount increased almost 5 times and exceeded UAH 2.69 billion. In 2021, the budget received UAH 3.5 billion. In 2022, when there was a break in privatization until September, the Fund transferred assets worth UAH 1.74 billion to private investors in less than six months.

Last year, proceeds from the privatization of state property amounted to UAH 2.84 billion. The state has fully resumed this process and is helping to support the state budget with funds that ensure our protection and defense against the aggressor. In total, over the past 5 years, privatization revenues, excluding large-scale privatization objects, amounted to UAH 11.34 billion.

As for the price of the assets sold by the Fund, the final value of the property increased the most compared to the starting price in 2020.

Increase in the sale price of assets relative to their initial value

After the fall of this indicator in 2021, it has been growing over the past two years. Thus, in 2023, the sale price was 2.7 times higher than the initial price.

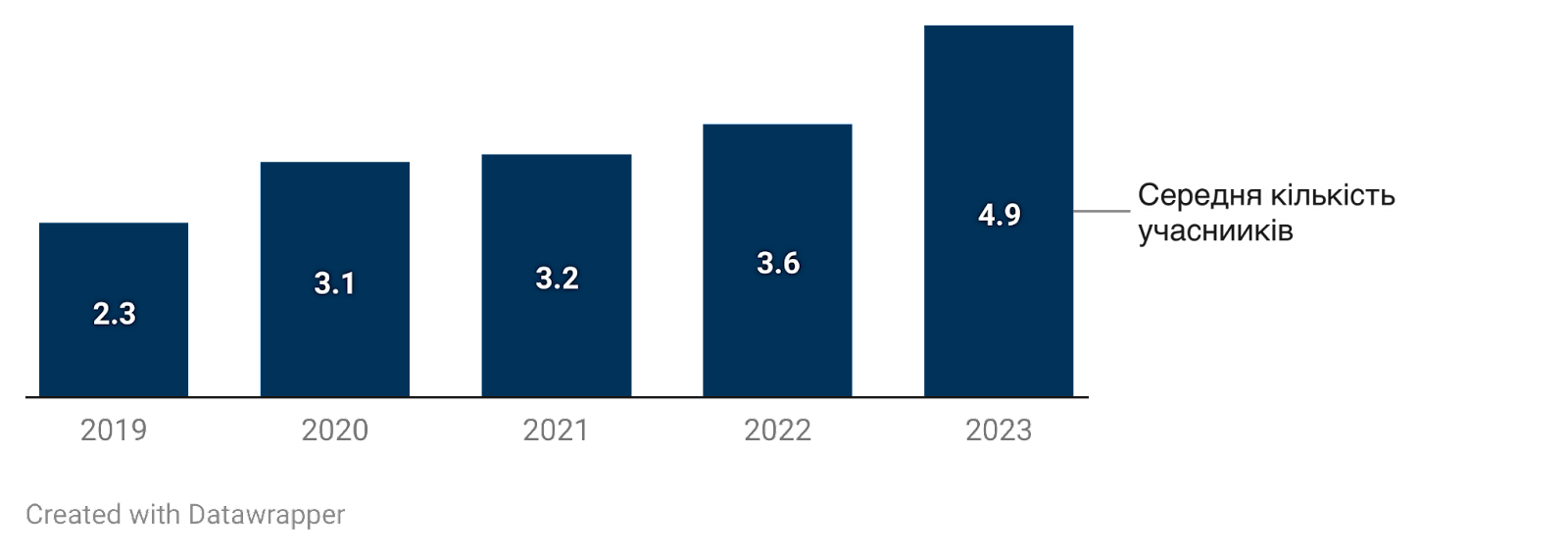

Competition in auctions

The increase in budget revenues and the growth of the final price indicate an important thing. Participants in the auctions held by the SPFU through the Prozorro.Sale system are interested in state assets and are ready to fight for them. The indicators of competitiveness in 2023 leave no doubt about this.

Average competition in privatization auctions

Over the past 5 years, competition in successful auctions has been growing steadily. But while from 2020 to 2022 its level was in the range of 3.1-3.6 bidders per auction, in 2023 almost 5 bidders competed for each lot on average.

This year, there is every chance of exceeding even such strong results: in the first quarter of 2024, more than 5 bidders took part in each successful auction on average.

Business interest in state assets

Business activity in privatization auctions is driven by many factors. Some companies need to relocate to regions far from the front line. Some entrepreneurs want to build a business on a ready-made material base, with the infrastructure, equipment and communications offered by the state when it sells, for example, single property complexes. Others need real estate, warehouses, workshops, garages, etc. to expand their current capacities.

So entrepreneurship in Ukraine is developing even in the face of war and other difficulties. And the government is striving to provide business with resources that will help it do so.

There are lots in which the market sees such great prospects and value that dozens of participants compete for them at once. The record was set in 2020, when 48 bidders competed for an unfinished garage for 50 cars in Kyiv. The second lot was non-residential premises in Uzhhorod. This auction, which had 47 bidders, took place in 2023.

As a result of this demand, the price of the first property in Kyiv increased almost 35 times (from just over UAH 1 million to UAH 36 million). And the cost of the second lot in Uzhhorod increased 818 times (from UAH 12.2 thousand to UAH 10 million).

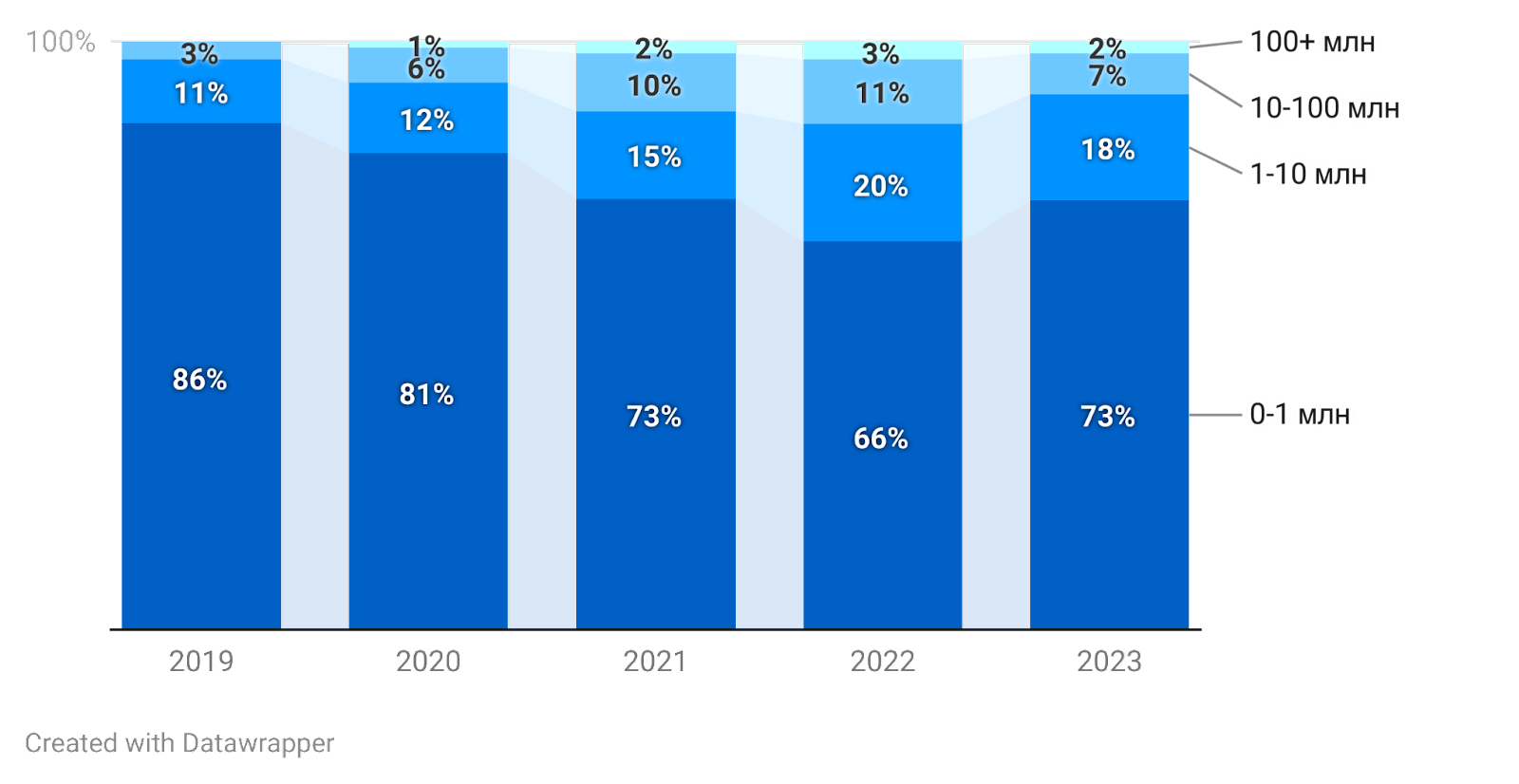

Businesses are interested in assets of different sizes, but the vast majority of lots sold through privatization cost up to UAH 1 million.

Distribution of successful auctions by the final value of the privatized object

In 2020, the share of auctions where the sale price of an asset was up to UAH 1 million reached a maximum of 86%. At the same time, in 2022, the share of auctions with the final value of the object from UAH 1 to UAH 10 million and even in the range of UAH 10-100 million increased significantly. Last year, the trend went in the opposite direction again: the number of assets sold for up to UAH 1 million began to grow.

It is also important to understand the overall economic context in Ukraine. A sharp drop in the hryvnia exchange rate, the crisis in many markets, the occupation of territories, and many other things have affected the ability of businesses to operate. This has hit small businesses particularly hard, as their already scarce material resources have been significantly depreciated and other problems have been added.

The return of demand for inexpensive, small state assets suggests that small and medium-sized businesses are resuming activity and continuing to grow after the first shocks of the full-scale invasion.

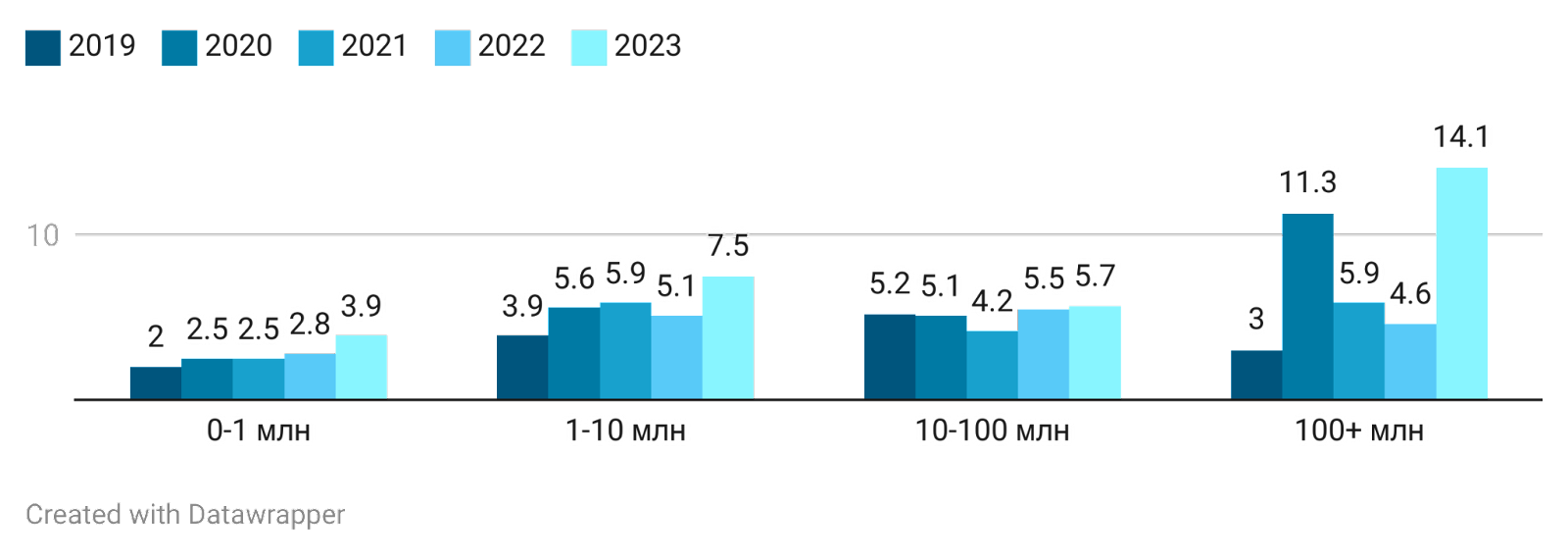

The average number of bidders in privatization auctions, relative to the final value of assets

At the same time, large market players are also interested in large state-owned assets when they come up for sale. Thus, in 2023, an average of 14.1 bidders participated in auctions with a sale price of more than UAH 100 million. At the same time, the average competition in auctions up to UAH 1 million last year amounted to 3.9 participants.

Efficiency of privatization processes

Overall, privatization auctions attracted thousands of players from different markets. The highest number of bidders, namely 2035, was in 2023. This is 3.3 times more than in 2022 and almost twice as many as in 2021. In 2020, this figure exceeded 1340 bidders. And in 2019, when privatization had just intensified, there were about 800 of them.

Legislative changes, business activity, competitive bidding, and their transparency and openness have helped to increase the efficiency of privatization processes. At the same time, the State Property Fund has also changed its approach in recent years and improved the process of preparing objects for sale. Information about the availability of state assets for privatization was disseminated through various communication channels to draw attention to these lots. In general, all information about the current lots, how to participate in the auction, and the results of privatization is collected on a separate special resource.

The Fund has developed a mechanism for sorting (triage) state assets, depending on their condition and market needs. The property that has no value or exists only on paper will be liquidated or bankrupt. Those objects that can work for the benefit of the economy in private hands will be privatized.

Effective steps taken by the SPFU and the interest of private investors have yielded results: in 2023, the share of successful auctions increased many times over compared to previous years.

Increase in the share of successful SPFU auctions

The lowest rate of successful auctions was recorded in 2021-2022: it was 17% of all announced auctions. Therefore, the peak result of almost 47% last year is a difference of 2.8 times.

Over the past 5 years, privatization has become more efficient, increased revenue, and attracted the attention of more and more entrepreneurs. This proves the success of Ukraine’s privatization strategy, when the state, instead of subsidizing unprofitable assets, gives them a new life and helps generate funds for the state budget at a time when the survival of our country depends on these revenues.