More than 28 thousand self-employed people are currently registered in Ukraine, according to the State Tax Service. This is a record figure for the last 5 years. The number of self-employed has increased by 1.1 thousand since the beginning of the full-scale reform. Over UAH 292 million of tax has already been paid by professionals engaged in independent professional activities in the first five months of 2025. The largest number of such professionals is in Kyiv, Dnipro and Odesa regions.

As of the beginning of June 2025, 28.3 thousand professionals engaged in independent professional activities – i.e. self-employed – were registered in Ukraine. These are lawyers, private teachers, translators, architects, notaries, psychologists, artists, scientists, doctors, and other professionals who do not have the status of a sole proprietor but work independently.

This is a record figure for the last five years. The peak number of such specialists was previously recorded in November 2021 – 27.9 thousand. However, in December, their number decreased by 700 people, after which the figure began to grow again, albeit with a pause in the first months of the full-scale invasion. Since the beginning of the full-scale invasion, the number of self-employed professionals has increased by 1,100, or about 4%.

It is worth noting that the Unified Register of Lawyers alone currently contains more than 71 thousand professionals. However, not all of them are registered as self-employed, but, for example, they can work in law firms or associations, or work as private individuals.

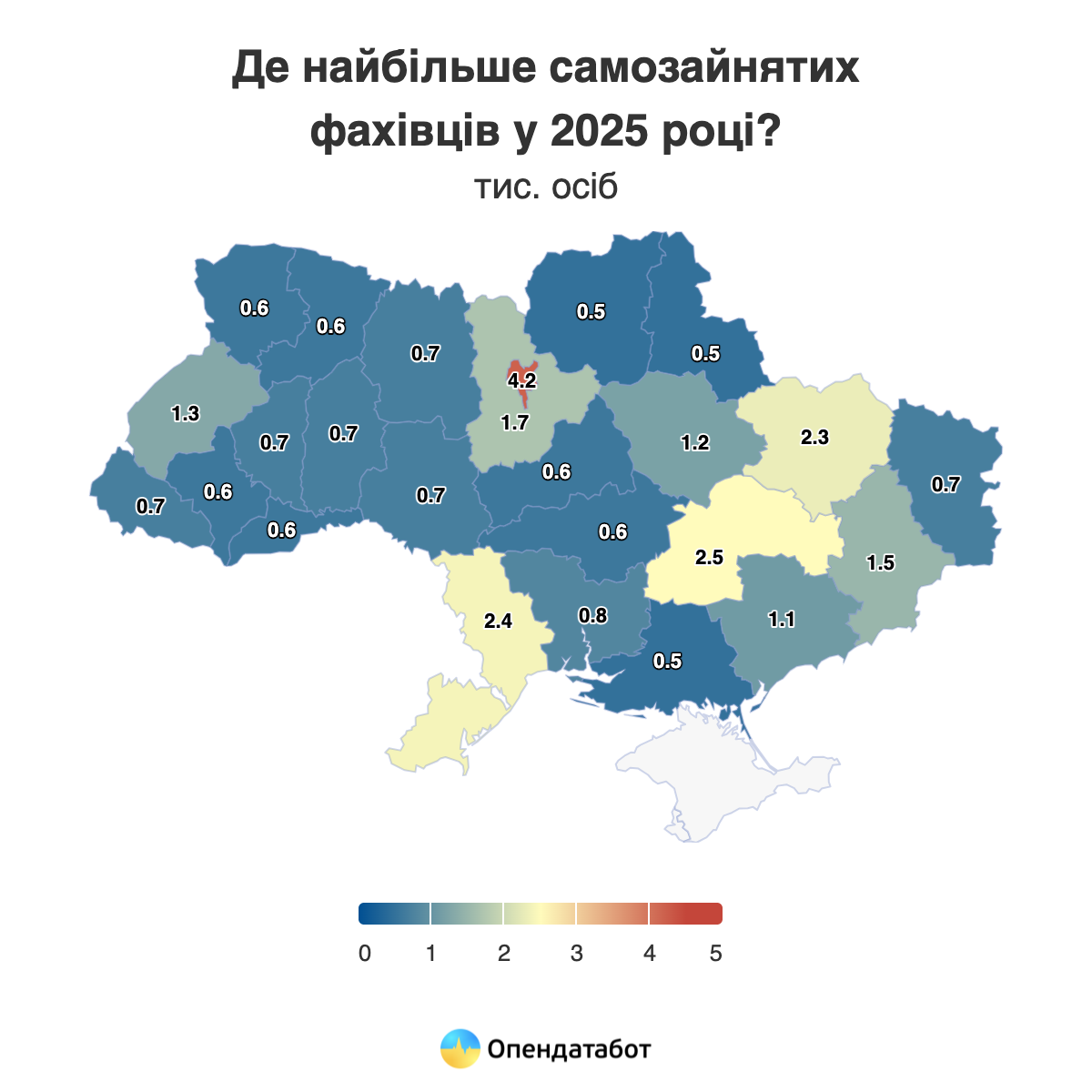

The largest number of such specialists works in Kyiv – 4.2 thousand people. This is followed by Dnipropetrovs’k region – 2.5 thousand and Odesa region – 2.4 thousand.

The self-employed paid UAH 292.29 million in taxes to the budget in the first five months of 2025. This is 33% more than in the same period last year. It is worth noting that the amount of taxes paid in Kherson, Volyn, and Kyiv regions almost doubled. In total, such specialists paid UAH 603.16 million in taxes in 2024. This is 1.6 times more than in 2023 and 1.2 times more than before the full-scale campaign.

The leaders in terms of taxes paid are Kyiv – UAH 140.5 million (23% of the total amount), Lviv region – UAH 49.8 million (8%), and Dnipropetrovs’k region – UAH 49.6 million (8%). However, while in Lviv region this amount was paid by 1.3 thousand people, in Dnipropetrovs’k region 2.5 thousand self-employed people paid almost the same amount.

On average, one self-employed person in Lviv region paid UAH 38 thousand in taxes in 2024. In Kyiv – UAH 33 thousand, in Vinnytsia region – UAH 31 thousand. The lowest average amounts were in Luhansk, Donetsk, and Kherson regions.

However, these calculations are conditional – it is impossible to give an accurate estimate, because it is not known how many of the people who are certified as self-employed actually work and earn income.

It is worth noting that independent professionals account for only 1.4% of all self-employed persons in Ukraine (together with sole proprietors). Their share of tax revenues is only 0.6% of the total amount paid by the self-employed.

Banks regularly check the self-employment status of their clients, which is important for assessing their financial profile, taxation, and regulatory compliance.

Opendatabot offers a service that allows you to check whether a person is an entrepreneur or self-employed, as well as to receive a corresponding statement.

Context

In April, the Cabinet of Ministers approved a draft law on the introduction of an international automatic exchange of information on income received through digital platforms. It provides for the taxation of self-employed people’s income received from activities on digital platforms such as Uklon, Bolt, OLX, Prom, Rozetka, etc.

https://opendatabot.ua/analytics/self-employed

The fixed real estate tax is more effective for community development than the share contribution, which was abolished by Law No. 132-IX for projects that began construction after January 1, 2021, Olena Shulyak, chairwoman of the Parliamentary Committee on the Organization of State Power, Local Self-Government, Regional Development and Urban Planning, told Interfax-Ukraine.

Shulyak, one of the authors of Law No. 132-IX, emphasized that communities already had a compensatory alternative at the stage of abolishing share contributions, namely a fixed real estate tax. This tool has a much higher potential for solving infrastructure problems, is easier to administer, and has much lower corruption risks than the share contribution.

“In fact, the share of equity participation in local budget revenues was very small – about 1%. These funds were not used for the construction of new kindergartens, schools and other infrastructure, and their intended purpose was not controlled. So, we have a real estate tax. I won’t say that it is a universal compensator, but now we see that it is already many times higher,” Shulyak said.

According to her, in 2020, local budgets received UAH 5.7 billion from this tax, in 2021 – UAH 7.8 billion, in 2022 – UAH 7.1 billion, despite the war, in 2023 – UAH 9.1 billion, in 2024 – UAH 10.7 billion, in 2025 (as of now) – UAH 4.3 billion.

“Regarding share contributions, we see the following figures: in 2020, the share participation funds amounted to UAH 1.4 billion, in 2021 – UAH 572 million, in 2022 – UAH 134 million, in 2023 – UAH 134 million again, in 2024 – UAH 199 million, and this year (as of now) – UAH 159 million,” the committee chairman cites the data for comparison.

Shulyak noted that equity participation as a tool has long been ineffective, and that is why it was abolished by law. However, according to her, this does not mean that communities do not have the right to defend their interests in court when it comes to cases that fall under the old legislation.

“Indeed, some communities, in particular Kyiv, remain active in legal disputes over equity participation. We are talking about situations where facilities received permits before 2020 but were completed later. In such cases, the legal basis for the claims is most often Article 1212 of the Civil Code of Ukraine – on unjustifiably retained property. As for other communities, we do not yet have centralized statistics on the number of lawsuits,” she said.

At the same time, in her opinion, if the agreement on the payment of equity participation was not concluded before the law on its abolition came into force, such charges are groundless.

Speaking about projects where the participants have changed during this time, Shulyak noted that if the new construction customer carries out construction in accordance with the construction permit issued to the previous customer before January 1, 2021, there are no grounds for non-payment of the share participation. However, if the construction permit was issued later than this date, the share participation is not paid.

“If the construction customer is implementing a completely new project – in terms of functionality, etc. – then in this case it is more expedient to terminate the previous permit and obtain a new one. Thus, the new permit will be obtained after January 1, 2021, and the construction customer will not have any obligations to pay the equity participation,” Shulyak recommends.

Montenegro is one of the most affordable countries in Europe in terms of real estate prices and one of the easiest in terms of legal formalities for foreigners. In recent years, it has become particularly popular among citizens of the CIS and EU countries due to its mild climate, sea, prospects for price growth, and loyal tax policy. However, when buying an apartment or house, it is important to understand what taxes and fees you will have to pay.

Main taxes when buying real estate in Montenegro

Rate: 3% of the market value of the property as determined by the tax authorities (not always the same as the price in the contract).

The tax is paid once, within 15 days after the conclusion of the agreement and submission of documents to the tax office.

Rate: 21%, already included in the contract price.

In this case, the property transfer tax (3%) is not levied.

Property ownership tax

The rate is set by municipalities and usually ranges from 0.1% to 1% of the cadastral value (depending on the location, type, and condition of the property).

For example:

Apartment in Budva or Kotor — approximately 0.25–0.5%

Properties on the coast and in tourist areas are taxed at a higher rate

The tax is paid once a year, usually by the end of March.

Important: a penalty is charged for late payment.

Additional costs

Renting real estate: taxes for the owner

If the property is rented out, the owner is obliged to:

Obtain a short-term rental permit from the municipality.

Keep a register of guests and pay tax:

Fixed tax on rental income — 9%.

Plus tourist tax per guest — approximately €1 per night.

From 2024, compliance with these requirements will be actively monitored (introduction of electronic accounting systems).

Example

Apartment in Budva for €150,000, purchased from a private individual:

Property transfer tax: 3% = €4,500

Annual property tax (0.4%): €600

Notary + registration fees: ~€1,000

In case of rental: income tax — 9% of profit

Montenegro offers a relatively simple and predictable tax system for real estate. One-time tax on purchase — 3% or 21% (for new construction), annual tax — low. Rental income is taxed at a moderate rate but requires compliance with formalities.

Source: http://relocation.com.ua/property-taxes-in-montenegro-what-buyers-need-to-know/

In January-April 2025, Naftogaz Group companies paid ₴30.3 billion in taxes, which is more than in the same period of 2024, when ₴28.4 billion was paid.

“In April 2025, ₴7.1 billion was paid. Of this amount, the group transferred ₴6.4 billion to the state budget and ₴692 million to local budgets,” the company said on Monday.

As emphasized by Naftogaz CEO Roman Chumak, the group’s enterprises demonstrate stable tax payment dynamics, contributing to the country’s financial stability.

“Since the beginning of the year, the group has provided 7.6% of all tax revenues to the budget,” he said.

As reported, the net profit of the Naftogaz group for 2024 amounted to almost UAH 38 billion. According to last year’s results, the group’s enterprises paid UAH 88.6 billion in taxes to the general budget, of which UAH 81.8 billion went to the state budget and UAH 6.8 billion to local budgets.

In addition, Naftogaz of Ukraine paid UAH 15.7 billion in dividends to the state in 2024.

In March, the State Tax Service (STS) began actively monitoring money transfers to the bank accounts of Ukrainians who sell goods online. The tax authorities recorded 1.4 million transactions totaling 1.6 billion hryvnia in less than a month. Additional attention was drawn to 11,000 Ukrainians who received more than 50 transfers to their accounts. The average check for such transactions was 1,142 hryvnia.

The Tax Service recorded 1.4 million transactions totaling 1.6 billion hryvnia in less than a month, from March 1 to 20. Eleven thousand people who received more than 50 transfers in 2025 came under scrutiny.

On average, there were 127 transfers per person during this period. However, in some cases, the number of transactions per recipient reached several hundred. At the same time, the average check for such transactions was 1,142 hryvnia.

It should be noted that on March 1, 2025, the State Tax Service (STS) began actively monitoring money transfers to the bank accounts of Ukrainians who sell goods online. The new control tool — access to the RRO data accounting system — allows for the automatic identification of individuals and entrepreneurs who systematically receive funds but are not registered as entrepreneurs or do not use cash registers.

Currently, the STS has not brought such persons to justice. However, the risks for violators are serious. For example, the fine for operating without registration can range from 17,000 to 85,000 UAH with confiscation of property. Additionally, up to 200% of the value of goods or services that were sold without using a cash register.

In general, monitoring covers individuals who regularly receive funds for goods/services (especially through marketplaces or social networks) and sole proprietors who have not registered a cash register, although they are required to do so.

At the same time, the Tax Service does not take into account one-time sales of personal items through OLX or similar platforms or marketplaces.

https://opendatabot.ua/analytics/dps-personal-research

In February of this year, Naftogaz Group paid UAH 5.8 billion in taxes, which is 9.4% more than in the same period in 2024, the company said on Thursday.

In particular, the state budget received UAH 5.2 billion, while in February 2024 this amount was UAH 4.8 billion. At the same time, UAH 530 million was paid to local budgets (UAH 506 million, respectively).

“Despite all the challenges of the war and constant attacks on the energy infrastructure, Naftogaz ensures the country’s energy stability and support for the national economy,” said Roman Chumak, the head of the group, as quoted in the report.

As reported, in the first month of 2025, Naftogaz Group companies paid UAH 5.2 billion in taxes to the state budget, which is 7.1% less than in January 2024 (UAH 5.6 billion). At the same time, tax payments to local budgets increased by 14.5% to UAH 591 million in January compared to the same period last year.

According to the results of 2024, Naftogaz Group companies paid UAH 88.6 billion in taxes to the general budget, including UAH 81.8 billion to the state budget and UAH 6.8 billion to local budgets.

In addition, in 2024, NJSC Naftogaz of Ukraine paid UAH 15.7 billion in dividends to the state.