The Parliamentary Committee on Finance, Taxation and Customs Policy is preparing a draft law on additional taxation of net interest income or excess profits of banks, which is likely to come into force in 2024 and bring UAH 10 billion to the budget annually, Committee Chairman Danylo Hetmantsev told Forbes Ukraine.

“It’s not an easy question, we are still evaluating it,” Deputy Governor of the National Bank Serhiy Nikolaychuk commented on the proposal on Facebook.

It is noted that parliamentarians are considering two options for taxation: a tax on all net interest income received for the year at a relatively small or medium rate, or a tax on the difference between net interest income in the reporting year and the average value for the last three to four years.

“For example, in Spain, it is 4.8%,” Mr. Hetmantsev said, referring to the first option.

He clarified that in this country, net commission income of banks is also taxed. “But this is not our story: banks have not yet reached the pre-war level in this regard,” the head of the Financial Committee said.

Commenting on the second option, Mr. Hetmantsev noted that the rate should be high. “For example, in Lithuania, 50% of the difference between net interest income in the base year and its average value over the previous four years is taxed at 60%,” he explained.

According to the committee chairman, the option of taxing all net interest income earned during the year is more optimal.

Mr. Hetmantsev added that he proposes to introduce this tax temporarily: from January 1, 2024, for two years.

He noted that the main motivation for the innovation is the need for additional funding for defense spending.

According to the head of the Finance Committee, the draft law is ready, and after consultations with the Ministry of Finance, the National Bank, specialized associations and the President’s Office, it will be submitted to the Verkhovna Rada.

Mr. Hetmantsev added that there have been no consultations with the market yet. “Although it is not difficult to predict the position of banks,” he said.

As reported, the profit of operating Ukrainian banks in January-June 2023 amounted to UAH 67.65 billion, while the banks ended the same period last year with a net loss of UAH 4.65 billion. This figure is a record high for the first half of the year: the previous highest net profit for the first half of the year was in 2019 – UAH 31.04 billion, compared to UAH 23.79 billion in 2020 and UAH 30.08 billion in pre-war 2021.

According to the NBU, net interest income increased by 40.8% to UAH 93.62 billion in the first half of 2023, commission income by 22.3% to UAH 25.60 billion, and the result from revaluation and purchase and sale transactions increased by 35.8% to UAH 16.30 billion.

Record profits also allowed banks to pay a record corporate income tax in the first half of this year – UAH 12.44 billion, compared to UAH 1.21 billion in the first half of last year and UAH 2.5 billion in pre-war 2021.

In an op-ed in NV on Friday, National Bank Deputy Governor Sergiy Nikolaychuk reiterated the regulator’s position that accusations of overpayment on certificates of deposit are “fundamentally false, manipulative, and dangerous.” He emphasized that the main goal is to achieve price stability and tie up the high liquidity of the banking system caused by the war.

According to him, in the first 7 months of this year, the NBU paid UAH 48.6 billion on certificates of deposit, compared to UAH 40.3 billion last year and UAH 6.3-10.7 billion annually in 2015-2021, but the average daily balance on certificates of deposit increased to UAH 411.4 billion by August this year, from UAH 215.7 billion at the end of 2022 and UAH 145.4 billion at the end of 2021.

Ukrainian President Volodymyr Zelensky signed the law No. 8401, canceling the 2% flat tax and bringing back documentary checks and PPO control, said the head of the specialized parliamentary committee Daniil Getmantsev.

“Bill 8401 has become a law. Use it,” he wrote in telegrams.

As reported, the Verkhovna Rada on June 30 adopted the law № 8401, one of the important structural beacons of the program with the IMF, on the abolition of the 2% single tax from August 1 and the return of documentary checks and PPO control.

Later, MPs from the inter-factional association “Reasonable Policy”, as well as the factions “Servant of the People” and “Batkivshchyna” registered three draft resolutions in the Verkhovna Rada to cancel the results of voting for this document in the second reading and as a whole, but they were rejected.

Mining and metallurgical group Metinvest in January-June of this year, including associated companies and joint ventures, transferred more than UAH 6.3 billion of taxes and fees to the budgets of all levels in Ukraine.

According to the company’s press release on Monday, despite the full-scale Russian invasion of Ukraine, Rinat Akhmetov’s Metinvest remains the backbone of the country’s economy.

It is specified that, in particular, for January-June this year Ukrainian enterprises of Metinvest paid more than 1.5 billion UAH of unified social contribution, almost 1.5 billion UAH of personal income tax and more than 1 billion UAH of profit tax.

In addition, significant sources of filling the state and local budgets of Ukraine were payment for the use of subsoil – UAH 872 million, payment for land – UAH 589 million and environmental tax – UAH 302 million, the press release said.

In the second quarter of 2023, the group transferred to the Ukrainian budget more than 3.8 billion UAH, which is 51% more than in the first quarter of this year. In particular, for April-June compared to January-March 2023, Metinvest enterprises increased payment of unified social contribution by 12%, up to UAH 813 million, personal income tax – by 26%, up to UAH 819 million, income tax – by 45%, up to UAH 643 million.

In April-June-2023, the fee for subsoil use increased 4 times, to UAH 698 mln, land fee – by 4%, to UAH 301 mln, environmental tax – by 23%, to UAH 167 mln.

Metinvest CEO Yuriy Ryzhenkov noted that with the start of the big war, the group gave up tax benefits to which it is entitled under the law and pays taxes in full.

“We understand that our resilience and endurance adds to the state’s ability to hold the blow in economic, defense and social areas. We will continue to be a point of support for the country, the army and Ukrainians. We will help as much as necessary – both before and after the victory”, – emphasized the top manager, who is quoted by the press service.

It is also reminded that taking into account associated companies and joint ventures, in the first quarter of 2023 Metinvest paid more than 2.5 billion UAH of taxes and fees to budgets of all levels in Ukraine, and in 2022 – 20.5 billion UAH.

“Metinvest is a vertically integrated group of mining and metallurgical companies. The group’s enterprises are mainly located in Donetsk, Luhansk, Zaporizhzhya and Dnipropetrovsk regions.

The main shareholders of the holding are SCM Group (71.24%) and Smart Holding (23.76%), jointly managing the holding.

Metinvest Holding LLC is the management company of Metinvest Group.

Bali authorities have decided to levy a tourist tax on foreigners from 2024, with the funds to be used to preserve cultural heritage, The Jakarta Post reported.

“Bali attracts millions of foreign visitors every year, and the island is trying to capitalize on its popularity to replenish the treasury and protect cultural heritage. From 2024, foreign tourists traveling to Bali from abroad or other parts of Indonesia will be charged a one-time tax of $10,” the Post writes.

As the newspaper notes, payment of the tax will be made through an electronic payment, which will have to be made before arrival on the island.

Bali Governor Wayan Koster believes that the new levy will not lead to a decrease in tourist traffic.

“I don’t think the numbers will be lower. We plan to use the revenue from the tourist tax to preserve the environment and culture, build better infrastructure to make traveling to Bali more comfortable and safe,” he explained.

In 2022, more than 2 million foreign tourists visited Bali, but since the beginning of 2023, the island has seen an increase in violations of cultural norms and migration laws by foreign tourists, so the authorities no longer want to develop mass tourism.

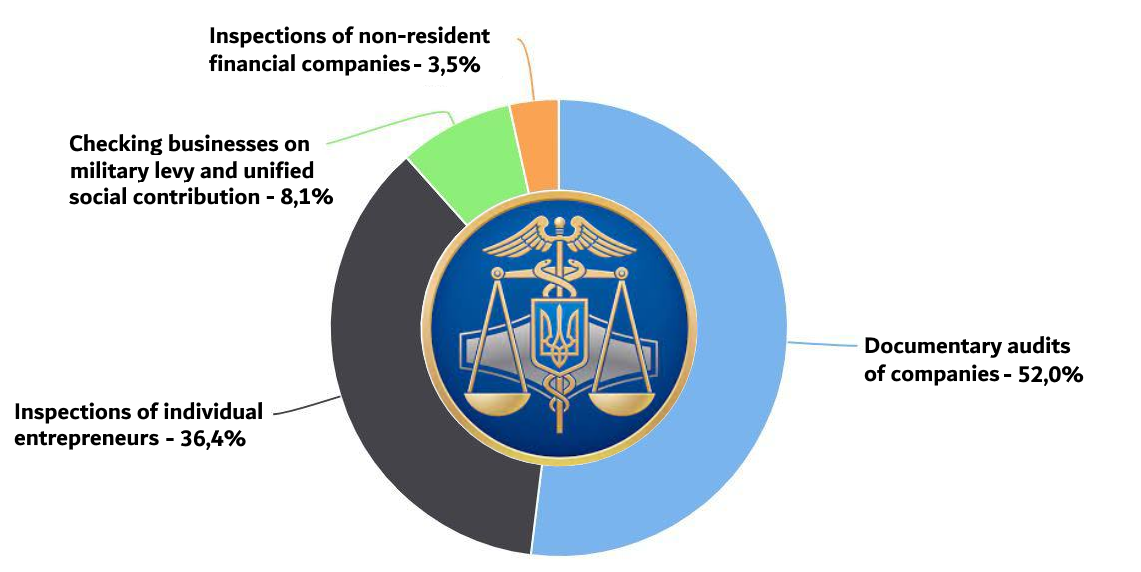

Scheduled business audits by state tax service in 2023

Source: Open4Business.com.ua and experts.news

Italy plans to introduce 26% tax on profit from cryptocurrencies. The government will charge tax if the profit exceeds 2 thousand euros.

Taxpayers have already received letters demanding to indicate the value of their crypto-assets as of January 1, 2023 in the declaration and pay a tax of 14%.