State-owned PrivatBank in July 2024 reduced its net profit by 2.6% by June – to UAH 6.25 billion and with this indicator headed the top five most profitable banks in the country in July, according to the data of the National Bank of Ukraine (NBU) on its website.

According to them, Privat is followed by state-owned Oschadbank, which in July received 2.18 billion UAH of net profit compared to 0.07 billion UAH in June.

Universal Bank (mono) rounded out the top three, having almost eightfold increased its profit compared to June – up to UAH 0.84 bln.

It is followed by two banks with foreign capital: Credit Agricole and Raiffeisen Bank with UAH 0.62 bln (+28.3% to June) and UAH 0.56 bln (+78%) respectively.

The second five most profitable banks in July were headed by Ukrsibbank, which increased its net profit by 10.1% to UAH 0.55 bln. It also included: City Bank – UAH 0.54 billion, Ukrgasbank – UAH 0.43 billion, FUIB – UAH 0.42 billion and Ukreximbank – UAH 0.38 billion.

In July 2024, net profit of over UAH 100 million was received by three more banks: OTP Bank – UAH 365.3 million, Pivdennyi Bank – UAH 340.7 million and Kredobank – UAH 193.5 million.

At the same time, the three most unprofitable banks in July were formed by Sense Bank with net loss of UAH 65.67 mln, Alliance Bank – UAH 17.81 mln and Pravex Bank – UAH 13.34 mln.

The list of the most profitable banks in general for seven months of this year is also headed by Privat with a large gap – UAH 37.16 billion, followed by Oschadbank – UAH 11.00 billion.

Next in a denser group are Raif – UAH 4.87 billion, Ukrexim – UAH 4.74 billion, FUIB – UAH 4.24 billion, Credit Agricole – UAH 4.22 billion Ukrsib – UAH 3.97 billion and Ukrgas – UAH 3.73 billion.

Six other banks also received net profit over UAH 1 billion for 7 months of this year: mono – UAH 3.19 billion, OTP – UAH 3.00 billion, City – UAH 2.73 billion, Sense – UAH 2.21 billion, Pivdennyi – UAH 1.61 billion and Credo – UAH 1.16 billion.

A-Bank is a little short of this threshold – UAH 0.92 billion, while ProCredit Bank, which follows it, has a net profit of UAH 0.60 billion.

As for unprofitable banks, according to the results of January-July, there are 8 out of 62 banks in Ukraine. The worst indicator is Pravex Bank – UAH 95.79 billion, followed by Industrialbank – UAH 39.00 billion.

At the First Investbank and Motor-Bank, which were transferred to the state from the sub-sanctioned owners following the results of the trial, the net loss for 7 months amounted to UAH 25.69 mln and UAH 14.69 mln, respectively.

Ukrainian banks as of Wednesday issued 288 thousand cards, which will be charged compensation under the state program “National cashback”, said Deputy Prime Minister – Minister of Economy of Ukraine Yulia Sviridenko.

“For two days our partner banks (of the state program “National Cashback”) – it is, in fact, all the largest banks in our state, issued a total of 288 thousand cards,” she said on the air of the national telethon ‘United News’ on Wednesday.

According to Sviridenko, more than 600 manufacturers have already joined the state program, registering 63 thousand goods in the system.

“At the time of the launch of the program, nine retail chains have already credited cashback, somewhere around 40 more are in the process of joining,” the first deputy prime minister said.

She recalled that the cashback program started on September 2 in beta testing mode, which is tentatively to last about a month.

As reported, the Cabinet of Ministers of Ukraine at a meeting on August 20 approved the procedure for granting “National cashback”, according to which Ukrainians will be able to receive compensation for 10% of the cost of goods purchased by them. The maximum amount of cashback is 3 thousand UAH/month, the funds can be spent on medical and utility services, sports, movies, train tickets, donate to the AFU or buy war bonds.

Who are the top 10 banks by profit?

Ukrainian banks earned UAH 40.5 billion in 2024. Despite the increase in taxation, banks managed to earn 19% more than in the same period last year. Only 8 banks out of 63 suffered losses in Q1 2024.

Ukrainian banks earned UAH 40.5 billion in profit after tax in Q1 2024. Despite the fact that the tax rate increased from 18% to 25%, banks managed to earn 19% more than in the same period last year.

There are currently 63 banks operating in Ukraine, including 6 state-owned, 14 with foreign capital, and 43 with private capital. Only 8 banks out of the total number suffered losses this year – UAH 111 million.

The top 10 banks in Ukraine earned UAH 34.22 billion in the first quarter. This is 84% of the total profit of all banks in the country.

During this period, Ukrainian banks paid UAH 10.34 billion in income tax, which is one and a half times more than last year. Privatbank paid almost half of this amount – UAH 4.84 billion.

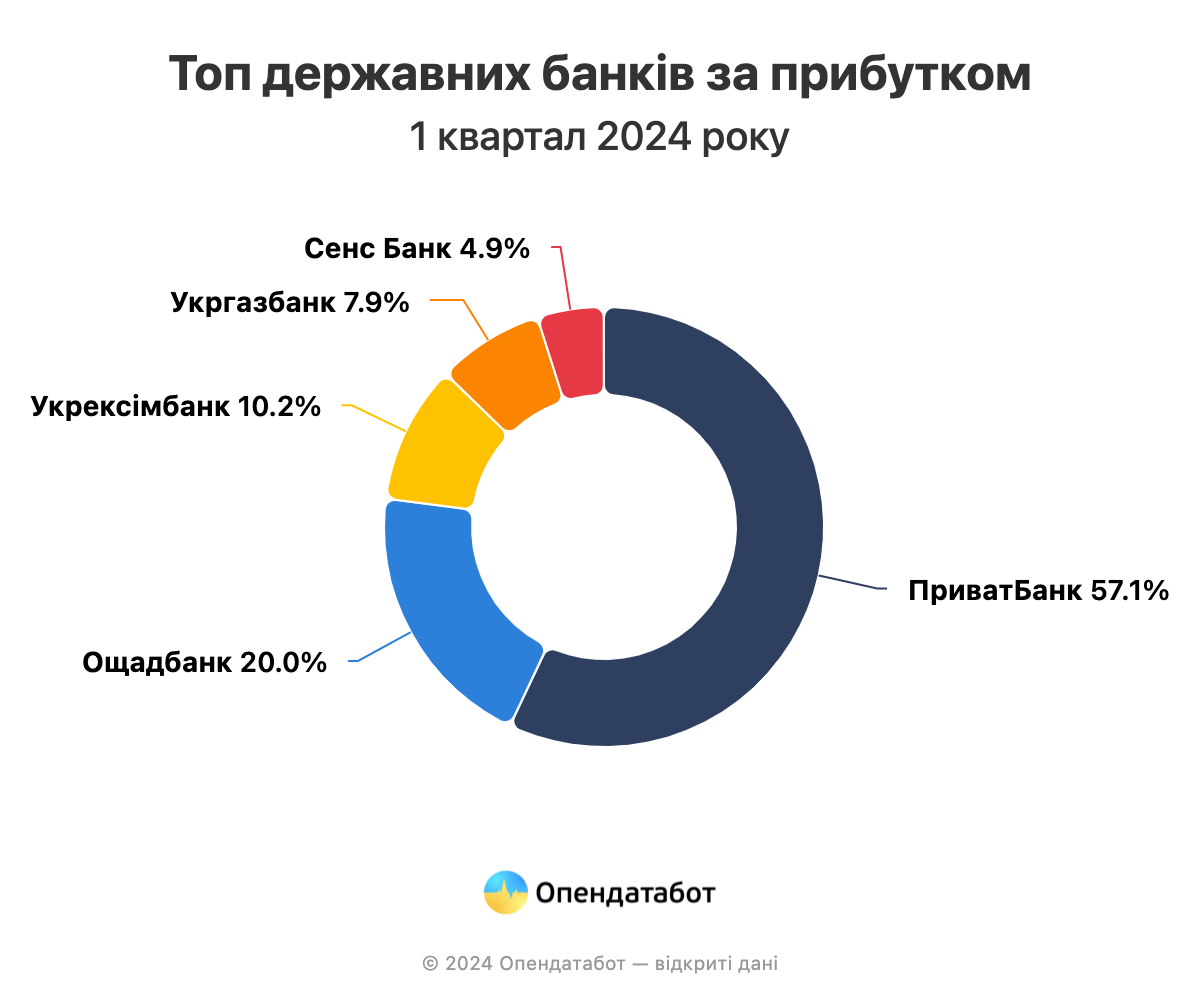

State-owned banks

Privatbank became the leader of the top, earning UAH 13.86 billion in Q1 2024. This is a third of the profit of all banks. However, this is 14% less than in the same period last year – UAH 16.04 billion.

In total, 6 state-owned banks account for 60% of the total profit of all institutions – UAH 24.28 billion. Currently, only the First Investment Bank, which has recently come under state control, suffered a loss of UAH 7.6 million in Q1.

Foreign banks

Raiffeisen Bank remains the leader among banks with foreign capital, having earned UAH 2.53 billion this year. This is 23% more than in the same period of 2023.

Another bank of this group, Credit Agricole Bank, saw its profits for this period increase 20 times compared to the same period last year. This year, the bank earned UAH 2.02 billion compared to UAH 102.9 million in Q1 of last year. This is the largest increase among all Ukrainian banks.

In total, foreign banks earned UAH 10.2 billion, which is a quarter of the total profit. Only one bank, Pravex Bank, suffered a loss of UAH 76.7 million in Q1.

Private capital

FUIB remains the leader of the group of banks with private capital: UAH 2.13 billion of profit for the quarter. This is 38% more than in the same period last year. Together with Universal Bank (Monobank), they received half of the total profit of the banks in this group.

MTB Bank showed the largest increase in profit among private banks: up to 13 times by the first quarter of 2023.

https://opendatabot.ua/analytics/banks-2024-4

Who are the top 10 Ukrainian banks by profit?

Ukrainian banks earned almost UAH 160 billion in pre-tax profit in 2023. This is almost twice as much as before the full-scale invasion. However, banks will have to pay tax, which is almost half of their total profit – over UAH 73 billion.

UAH 159.99 billion of pre-tax profit was earned by 63 Ukrainian banks in 2023. This is 1.9 times more than in 2021.

However, last year’s net profit was much lower – only UAH 86.54 billion. At the same time, this is still 12% more than before the full-scale invasion. Back then, 71 banks made a profit of UAH 77.53 billion.

Almost half of the banks’ profits must be paid as income tax under the new law – 46% or UAH 73.45 billion. For comparison, in 2021, the tax was almost 12 times less: UAH 6.37 billion or 7.6% of profit.

Overall, only 7 banks out of 63 ended 2023 with losses of UAH 245 million.

Currently, the top 10 banks have undergone little change: the ranking includes 5 banks with foreign capital, 4 state-owned banks, and 1 bank with private capital. Together, these 10 banks earned 88% of the total profit – UAH 75.94 billion. And their income tax amounted to UAH 63.18 billion.

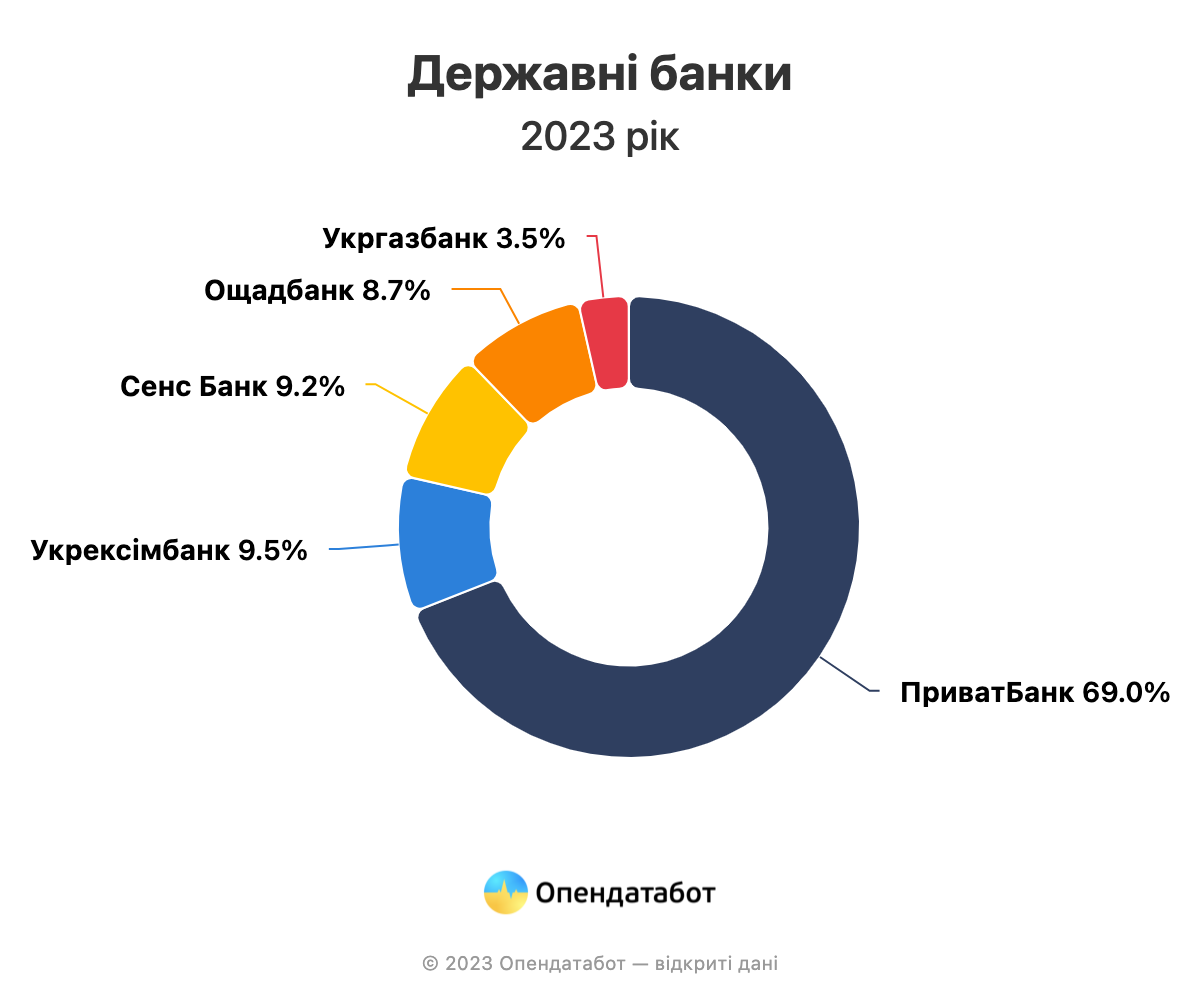

State-owned banks

5 state-owned banks accounted for 63% of the total profit of all banks – UAH 54.71 billion. State-owned Privat is a consistent leader in terms of profit among all Ukrainian banks: UAH 37.76 billion in 2023. This is 8% more than in 2021.

Meanwhile, Oschadbank managed to increase its profit by 4 times last year and received UAH 4.75 billion in net profit. Sens Bank, nationalized in 2023, was also added to the list of state-owned banks.

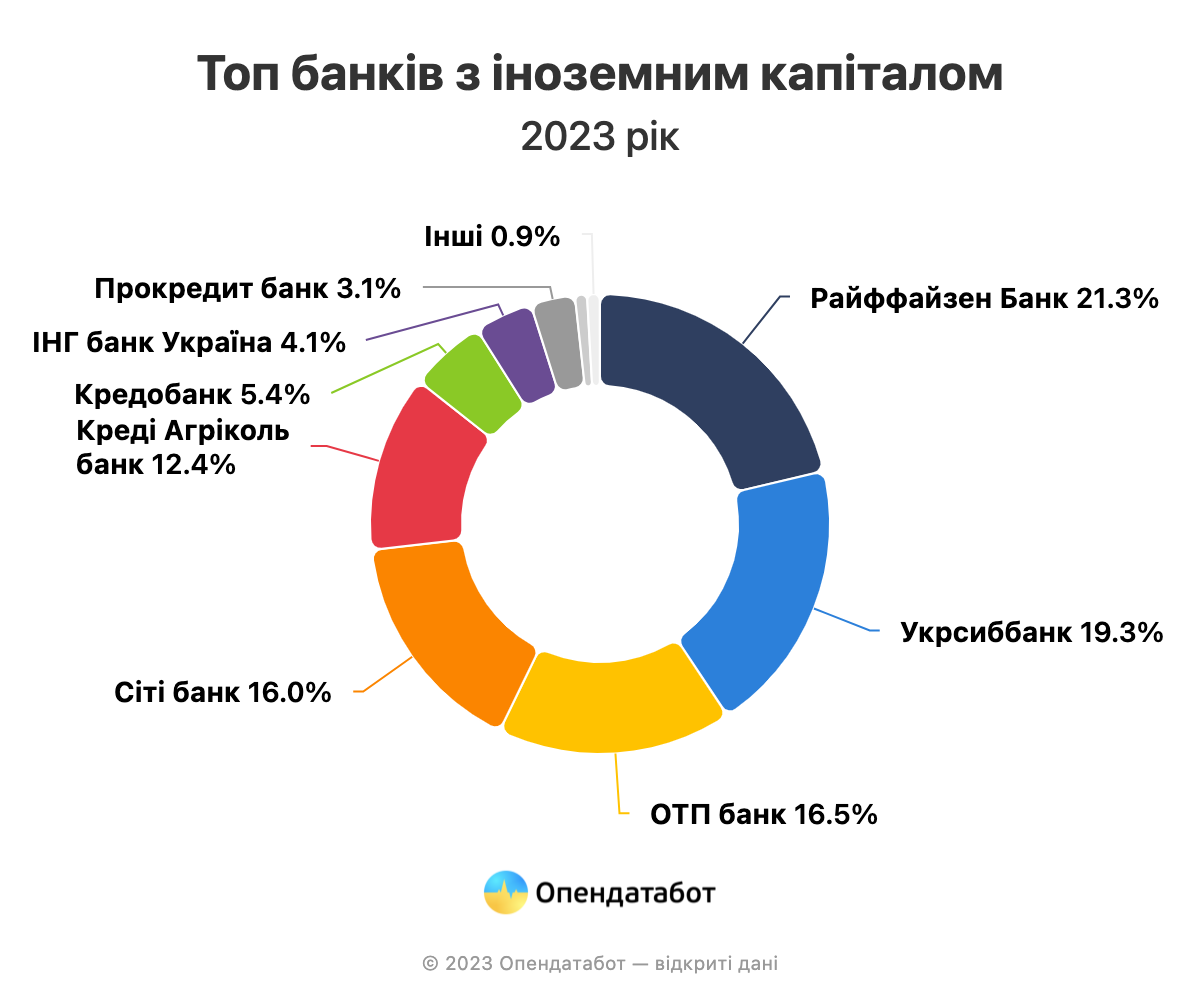

Foreign banks

14 banks with foreign capital earned UAH 22.43 billion. For comparison, 20 banks in this group earned almost the same amount on the eve of the full-scale invasion.

Raiffeisen was the leader in terms of profit last year: UAH 4.78 billion. Together with Ukrsibbank, which almost tripled its earnings compared to 2021, they accounted for 40% of the group’s profit.

Most foreign banks managed to increase their profits last year compared to 2021. Deutsche Bank showed the largest increase: by 18 times.

Private capital

According to the results of the year, private banks are doing the worst. Last year, 44 banks with private capital earned UAH 9.4 billion in profit. This is 25% less than before the start of the full-scale war.

Almost 2/3 of the total profit of this group is accounted for by 2 banks: FUIB, which is the leader of the group – UAH 3.95 billion, which is 5% less than in 2021, and Universal Bank (Monobank), whose profit decreased by 1.6 times in 2021.

https://opendatabot.ua/analytics/banks-2023

foreign banks, private capital, state-owned banks, top 10 Ukrainian banks, UKRAINIAN BANKS

Banks issued 4.42 thousand concessional loans under the state program “Affordable loans 5-7-9%” for UAH 10.27 billion in the last month of 2022, which is 21% or UAH 2.2 billion more than in November 2022, the Ministry of Finance said on its website on Monday.

According to its data, 1.66 thousand such loans worth 8.1 billion UAH were issued in November.

The Ministry of Finance specified that since the start of the program “5-7-9” business entities have received 52.85 thousand loans totaling 165.77 billion UAH from authorized banks, of which almost 34 thousand – from banks in the public sector for a total of 66.26 billion UAH.

It is noted that during the martial law in Ukraine as part of the state program 18.03 thousand loan agreements totaling 76.15 billion UAH (including 13.52 thousand by public sector banks for 39.62 billion UAH) were concluded.

According to the published data, the most credits were granted for war purposes – 38.35 billion UAH, 0.82 billion UAH of credit means were given to entrepreneurs for investment purposes, 6.34 billion UAH were allocated as anti-crisis credits, 4.38 billion UAH were given as refinancing of already received loans and 25.74 billion UAH were loans for agricultural producers.

As reported, the state program “Affordable credits 5-7-9%” with compensation of interest rates by the state was initiated in February 2020 to support projects of Ukrainian micro and small enterprises. Provision of three possible rates – 5%, 7% or 9% – on loans depends on the size of the business and the period of its operation. At the end of October last year the Cabinet of Ministers made changes to the conditions for granting loans under the program “Affordable credits 5-7-9%” and allowed to involve private entrepreneurs with annual income up to UAH 50 mln), also it became possible to fully compensate the rate.

Now 45 banks work with the program “Affordable credits 5-7-9%”.

As the National Bank reported in its Financial Stability Report in late 2022, the prevalence of programs with up to zero rate compensation, rising market interest rates and rapid portfolio growth have significantly increased the government’s financing costs for the program: more than 9 billion UAH must be paid this year instead of the planned 3 billion UAH, resulting in a government debt of 2.6 billion UAH as of early November, which is equivalent to two months of interest compensation and has kept banks from further using the program.

“In conditions of war, government support is a guarantee of business access to credit. So the weighty role of the program will remain in 2023. Since expanding the program will require additional resources, its design should be optimized. Most businesses have already adapted to the war and have resumed production, so an increase in rates should be considered. A separate design is needed for the program for agricultural producers, given the difficulties with the sale of crops due to the destruction of logistics,” pointed out the National Bank.

According to statistics from the NBU, if at the end of 2020, loans provided by the program “5-7-9”, took 5% of the net corporate portfolio of hryvnia, then at the end of 2021 – 18%, and as of December 2022 – 26%.

In turn, head of the Ministry of Finance Serhiy Marchenko reported that the state budget-2023 provides for 14 billion UAH for the program.

The profit of Ukrainian banks in January-August 2022 amounted to UAH 8.4 billion, which is 5.4 times less than in the same period last year (UAH 45.6 billion), the press service of the National Bank of Ukraine (NBU) reported on Thursday.

According to the report, the profit of Ukrainian banks in August amounted to UAH 5.05 billion, which is 37% less than the profit in July (UAH 8.05 billion).

The regulator noted that the income of banks in August increased by 20.3%, and expenses by 17.9%.

According to the regulator, the income of banks for 8 months of this year increased by 32% against the figure for the same period last year – up to UAH 227.5 billion. Including commission income increased by 2.25 times – up to UAH 130.846 billion.

At the same time, the result from the revaluation and from purchase and sale transactions was positive and amounted to UAH 39.617 billion, while for the same period last year it was negative and amounted to UAH 1 billion.

At the same time, the expenses of the banking system in January-August 2022 increased by 72% compared to this indicator in 2021, to UAH 219 billion, including contributions to reserves, by 12.4 times, to UAH 89.4 billion. At the same time, fee and commission expenses increased by 0.8% to UAH 21.93 billion,

As reported, Ukrainian banks doubled their net profit in 2021 to UAH 77.5 billion compared to UAH 41.3 billion in 2020.