Ukrainian companies in 2025 have noticeably stepped up the implementation of artificial intelligence solutions, but the growth is limited by the lack of specialized specialists and access to infrastructure with NVIDIA GPUs, which have become the “de facto standard” for AI projects. Volodymyr Bjelov, Country Director of GigaCloud in Ukraine, writes about this in his column for Interfax-Ukraine.

According to him, the demand for AI is becoming a key driver of cloud services, but at the same time the requirements for security and business continuity are growing, which shifts the focus from pilots to industrial implementations.

GigaCloud is a Ukrainian cloud provider (part of GigaGroup), founded in 2016. The company provides IaaS/PaaS services, virtual data centers, redundancy and continuity solutions (DR/BCP) and GPU clouds. The infrastructure is hosted in data centers in Ukraine and the EU (Kiev, Lviv, Warsaw) with TIER III/IV compliance; the provider has VMware Cloud Service Provider (Premier) statuses and is registered in CSA STAR Registry, portfolio – over 1.5 thousand customers.

https://interfax.com.ua/news/blog/1096980.html

AI-projects, NVIDIA GPUs, UKRAINIAN BUSINESS, Volodymyr Bjelov

How Ukrainian business migrates during the great war

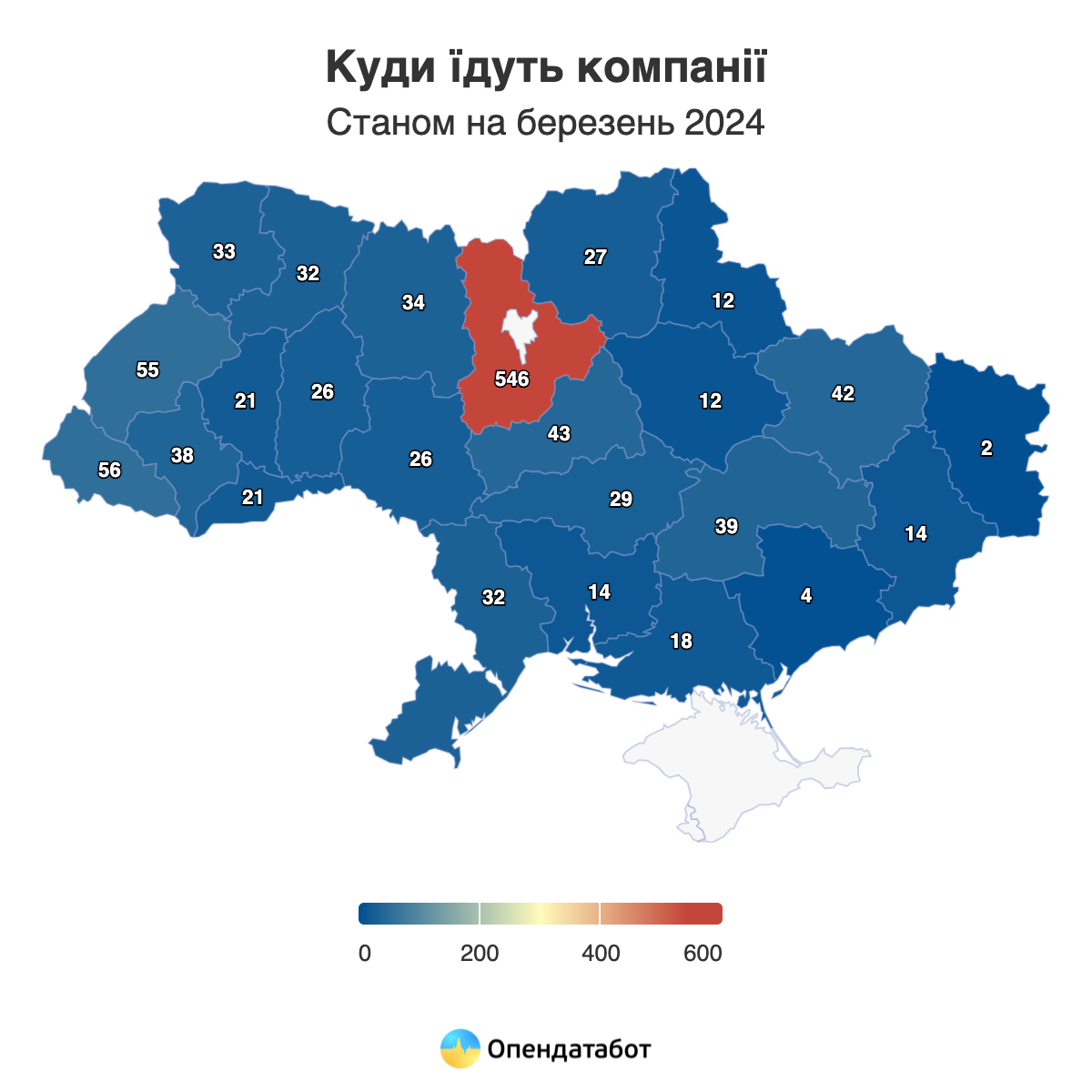

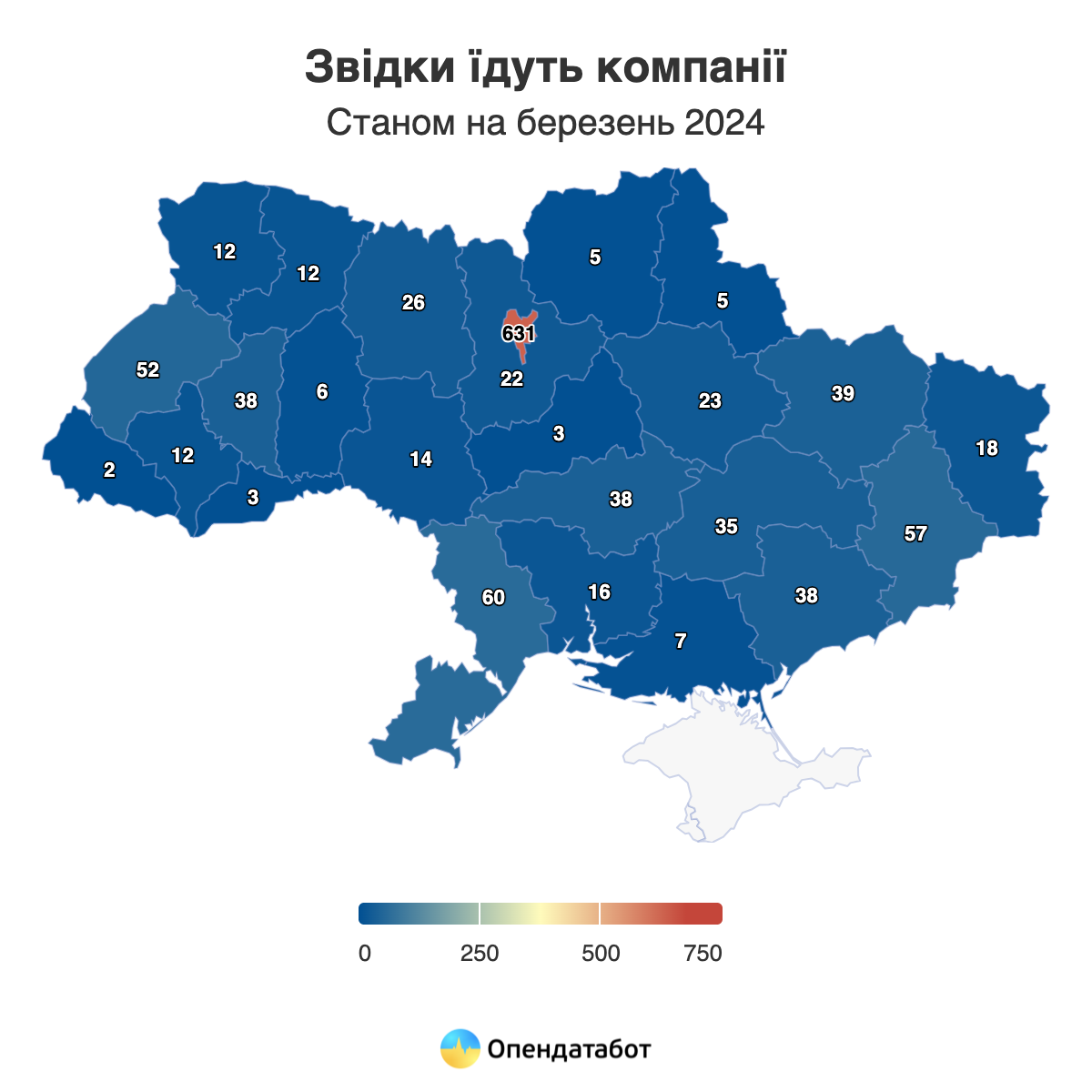

Almost 19 thousand companies have relocated since the beginning of 2022, according to the Unified State Register. Kyiv and Zakarpattia regions were the most popular destinations for business. Among all companies, wholesalers relocate most often.

Of the total number of companies that have changed their location since the start of the full-scale war, just over 1,000 have moved from the city to the region. Half of them – more than 600 companies – moved from Kyiv, and another 60, or 5.1%, from Odesa region.

Kyiv region is the most popular choice for relocation – 546 relocations. This is almost every second business relocation since the start of the full-scale war. The most popular route was from Kyiv to Kyiv region: 359 relocations. In fact, 30% of all cases when businesses relocate to the region are on this route.

Other routes were less popular. For example, the routes from Lviv to Kyiv region and from Kyiv to Zakarpattia are in second and third place, with 2.7% and 2.6% respectively (30-32 companies).

The leaders in relocations were companies engaged in wholesale trade – 344 relocations (29.3%) and the transportation industry – 92 relocations (7.8%)

Ukroliya LLC with a turnover of over UAH 4 billion became the largest company to change its location. The company moved from Kyiv to Poltava region. Kyiv-Atlantic Ukraine LLC, with a turnover of over UAH 2 billion, also left Kyiv region, but to Cherkasy region.

Kercher LLC with a turnover of more than UAH 1 billion closes the list of top business migrants, as the company changed its place of registration to Kyiv region.

“We started preparing for the move 7 years ago – we bought land and started construction in the Kyiv region in 2020, which was interrupted by the Russian attack and partial occupation of the region. Within 4 months after the liberation of Kyiv region, the company resumed construction, so at the end of 2023, our team moved into a new space. In general, the location of the company outside the city, in the regions, is part of the philosophy of the Kercher brand throughout Europe,” comments Nadiya Kreposna, marketing manager at Kercher.

Despite problems with finding workers, rising prices of raw materials and physical threats, Ukrainian businesses are optimistic about the future, 44% of surveyed enterprises are ready to invest in their development or recovery, these are the results of the February New Monthly Enterprises Survey (#NRES) of the Institute for Economic and Policy Research (IEP).

“Businesses are quite optimistic about investment given that a full-scale war is ongoing. For example, 42% of businesses believe that now is more or less a favorable time to invest in equipment. For comparison, at the beginning of 2015, when the ATO was in an active phase, the share of such enterprises amounted to only 14%”, – commented the results of the study, Eugene Angel, a senior researcher at the IEI.

The IEI also pointed out that business is gradually coming out of the state of complete uncertainty and begins to make plans for the future: in February 2024, only about 15% of business owners and managers could not give an answer about their business plans for the next six months, while a year ago there were about 40% of them.

At the same time, the level of uncertainty in the perspective of two years is still quite high – about 50% of respondents.

“A significant decrease in the number of those who find it difficult to make plans for the next six months indicates that optimism is returning to Ukrainian businesses. Moreover, the share of enterprises operating at 100% capacity is gradually increasing: in February 2023 there were 6% of such enterprises, now there are already 15%. But, of course, it is difficult for businessmen to make plans for the long term (2 years) in the conditions of war”, – said Oksana Kuzyakiv, Executive Director of IEI.

According to the published data, for the second month in a row the Business Activity Recovery Index (BAI) decreased – by almost 10 p.p. – From 0.43 to 0.34. As for its components, the share of enterprises that reported that their business activity was better than in the previous year decreased from 56.0% in January to 44.8% in February, nothing changed for 44.0% (30.9% in January), the share of those for whom the situation was worse than a year ago remained without significant changes for several months in a row (13.1% in January and 11.2% in February).

According to the survey, the main obstacles to investment are economic uncertainty, political instability and insufficient corporate profits.

As for the obstacles to doing business, February 2024 saw some changes in the list of obstacles: the assessment of rising prices for raw materials and commodities rose from 46% to 49%, and labor shortages rose from 41% to 46%, which respectively moved them to the 1st and 2nd places.

At the same time, the obstacle “not safe to work” dropped from 1st to 3rd place, although its value decreased slightly from 46% to 45%.

Estimates of power outages dropped from 26% to 24%, which is only the 7th most important obstacle, while corruption and pressure from law enforcement agencies ranked even lower in the survey.

In February, compared to January, the share of enterprises operating at full capacity slightly increased – from 13% to 15%, while the share of non-operating enterprises remains unchanged for half a year and amounts to 2% of respondents.

The survey emphasizes that the share of positive assessments of the government’s policy to support business is 8% and has remained unchanged for more than half a year, while 55% (58% in January) assess it neutrally, and 18% negatively (16% a month earlier).

IEI specialists also recorded a slight decrease in problems with finding labor: qualified workers are difficult to find for 31% of surveyed entrepreneurs (32.4% in January), and unskilled workers – for 26.5% of respondents (27.4% a month earlier).

The monthly IEI survey in February involved 542 Ukrainian enterprises located in 21 out of 27 regions of Ukraine. The field stage of the 22nd wave of the survey lasted from February 19 to February 29, 2024.

DEVELOPMENT, INVESTMENT, New Monthly Enterprises Survey, NRES, RECOVERY, UKRAINIAN BUSINESS

Ukrainian and foreign business, ready to invest more than EUR12 mln, will receive tax benefits, regulatory relief and support at the level of project implementation, Prime Minister Denys Shmygal said.

“Actually one of the key tasks in the economic sphere for this year is to increase foreign investment in Ukraine. For this purpose we are working with partners. For this purpose insurance of military risks has been launched. We constantly improve conditions for investment projects. Today we will adopt a decree improving the mechanism of state support for large investment projects,” Shmygal said at a government meeting on Friday.

According to him, Ukrainian and foreign business, which is ready to invest more than EUR12 million and create new jobs, will receive maximum support and special conditions, in particular, tax benefits, regulatory relief, and support at the level of project implementation.

“Today’s decree concerns a new approach to the preparation of a feasibility study of an investment project. We remove and simplify a number of provisions, including the necessity of economic analysis, the revision of the social assessment of projects, as well as we weaken the requirements of financial solvency of the applicant,” Prime Minister said.

Shmygal emphasized that all these decisions have a single goal – to launch more investment projects, which will create more jobs and strengthen communities and the economy.

FOREIGN BUSINESS, tax benefits, UKRAINIAN BUSINESS, Денис Шмигаль

Italian cement producer Buzzi, through its subsidiary Dyckerhoff GmbH, has reached an agreement to sell part of its business in Eastern Europe to CRH, a leading provider of building materials solutions, for EUR0.1 billion, according to an official website on Tuesday.

As clarified in the release, the deals include a business in Ukraine and assets for the production of ready-mix concrete in Eastern Slovakia. Completion of the deal in Ukraine depends on obtaining the necessary regulatory approvals and is expected in 2024.

Buzzi Unicem SpA (Italy) combines businesses producing cement, concrete, sand, crushed stone, etc. The main activity of the group is the production of cement, which is produced in its own enterprises in Germany, the USA, Luxembourg, the Czech Republic, Poland, Russia and Ukraine. Dikerhoff Cement Ukraine PJSC, the Ukrainian branch of Buzzi, has branches set up at Volyn-Cement (Zdolbuniv, Rivne region) and YuGcement (Olshanske, Mykolaiv region) plants. The group also operates in the ready-mix concrete sector in Kiev, Odessa and Nikolaev.

Buzzi operates six ready-mix concrete plants in Eastern Slovakia.

It was reported in March 2023 that Italian cement producer Buzzi Unicem was listed by the National Agency for Prevention of Corruption (NAPC) as an international sponsor of war. Buzzi operates in Russia through OOO SLK Cement, which owns two cement plants, Sukholozhskcement and Korkino, a terminal in Omsk and the transport company Cemtrans. According to the NAZK, the company is one of the five leaders of the Russian cement industry.

Irish CRH Plc, the largest manufacturer of building materials in the world, in Russia owned six plants of building mixes, announced its withdrawal from the Russian market.

CRH entered the market of Ukraine in 1999, acquiring Kamenets-Podolsky cement plant in Khmelnitsky region. At the moment CRH also includes Odessa cement plant and Nikolaevcement (Lvov region).

A separate direction of CRH business in Ukraine is the production of concrete and reinforced concrete products. PoliBeton Energo’s Bila Tserkva Concrete Plant is a specialized enterprise that produces supports for power transmission lines. The PoliBeton concrete unit in the north of Odessa joined CRH in 2020.

US-based Development Finance Corporation (DFC, formerly OPIC), an agency of the US federal government, has announced its readiness to lend to Ukrainian businesses within individual projects in amounts ranging from $1 million to $1 billion each, Deputy Economy Minister of Ukraine Oleksandr Hryban said.

“The DFC agency is ready to lend to projects in Ukraine for amounts from $1 million to $1 billion. For the sake of Ukraine, they made an exception and are ready to issue loans even if an American investor is not represented in Ukrainian business,” he said.

At the same time, this information is not yet available on the DFC website. The press release of the corporation says that its head Scott Nathan within the framework of the 77th UN General Assembly last week joined a meeting chaired by President of Poland Andrzej Duda and with the participation of Prime Minister of Ukraine Denys Shmyhal. At the meeting, representatives of Polish and Ukrainian business circles discussed efforts to restore the Ukrainian economy in light of the devastation caused by Russia’s unprovoked war.

According to Hryban, DFC is ready to support Ukraine with several different financial instruments, in particular, to provide coverage for credit risks, including political and war ones.

In addition, the official added that DFC is ready to issue free financial grants to those companies that are recognized as promising, but which have not yet passed an international financial audit.