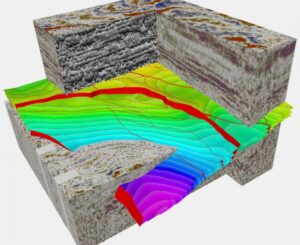

Over three years, JSC Ukrnafta explored 1,330 square kilometers using 3D seismic exploration to expand its resource base and improve the accuracy of geological modeling.

“One of the main strategic objectives is to increase hydrocarbon reserves,” the company said in a statement.

To this end, Ukrnafta is investing in modern geophysical research, which makes it possible to identify new promising reservoirs and plan drilling more efficiently.

According to Yuriy Tkachuk, acting chairman of the board of Ukrnafta, in 2025, the total area of 3D seismic exploration will be approximately 750 square kilometers.

“The field phase has already been completed at two fields, another is in progress, and research at three new fields is planned by the end of the year. This is consistent work that ensures long-term stability of production,” he said.

The company emphasized that Ukrnafta was the first in Ukraine to apply wireless 3D seismic technology in mountainous conditions. This approach makes it possible to work in difficult geological conditions, minimizes environmental impact, reduces the duration of field work, and ensures higher accuracy of geophysical data. The results obtained form the basis of digital geological and hydrodynamic models that help predict production dynamics and make informed technical decisions.

In 2026, the company plans to continue 3D seismic exploration at the most promising fields.

Ukrnafta is Ukraine’s largest oil production company and operates a national network of gas stations. In March 2024, it took over the management of Glusco’s assets and currently operates a total of 663 gas stations. It holds 92 special permits for industrial development of deposits. It has 1,832 oil and 154 gas production wells on its balance sheet.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the company’s corporate rights, which belonged to private owners, to the state, and they are currently managed by the Ministry of Defense.

Ukrnafta’s net profit for 2024 was UAH 16.38 billion.

PJSC “Ukrnafta” on October 3 announced its intention to conclude a contract with IC “Arsenal Insurance” for services of compulsory insurance of civil liability of owners of motor vehicles (MTPL).

As reported in the system of electronic public procurement Prozorro, with the expected cost of acquiring services of 489.8 thousand UAH, the company’s price offer amounted to 190.2 thousand UAH.

The tender was also attended by insurance companies “Oranta” with the offer of UAH 290,4 thousand, “Universalna” – UAH 313,1 thousand, SG ‘TAS’ – UAH 440 thousand, IC “Kraina” – UAH 440,8 thousand.

UKRNAFTA gas stations’ “points of invincibility” will assist Ukrainians during power outages.

As a result of Russia’s massive missile and drone attack on energy facilities, a significant number of consumers in Kyiv, Kyiv, Donetsk, Dnipropetrovsk, Cherkasy, Chernihiv, Kharkiv, Sumy, Poltava, and Odesa regions are without power. To stabilize the situation, emergency power cuts are currently in place in these regions. Energy companies are currently working to restore a stable power supply.

All 663 of our gas stations continue to operate — you can refuel your car there, as well as purchase fuel for your generator.

360 gas stations are operating in “resilience mode”: additional generators have been installed there, and you can:

• warm up;

• drink hot tea or coffee;

• charge your phone;

• access the internet.

Take care of yourself and your loved ones!

Addresses of points of resilience at UKRNAFTA gas stations.

JSC “Ukrnafta” is the largest oil production company in Ukraine and operates the largest national gas station network, UKRNAFTA. In 2024, the company took over the management of Glusco’s assets. In 2025, it completed an agreement with Shell Overseas Investments BV to purchase the Shell network in Ukraine. In total, it operates 663 gas stations.

The company is implementing a comprehensive program to restore operations and upgrade the format of its network of gas stations. Since February 2023, it has been issuing its own fuel vouchers and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share.

In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the company’s corporate rights, which belonged to private owners and are currently managed by the Ministry of Defense, to the state.

Source: https://interfax.com.ua/news/press-release/1111372.html

Ukrnafta announced which gas stations are operating without electricity and which gas stations have “unbreakable points.”

The enemy has once again intensified its attacks on the country’s energy infrastructure. The Chernihiv region has been hit the hardest, with 307,000 people left without power.

All UKRNAFTA gas stations—the largest single-brand network of gas stations in the country—continue to operate in the event of power outages. In total, there are 663 gas stations throughout Ukraine. There, you can always refuel your car with European-quality fuel.

Of these, 360 gas stations operate in “unbreakable point” mode. They are equipped with additional generators. There, people can warm up, drink hot tea or coffee, charge their phones, and access the internet.

“Massive attacks on energy infrastructure have led to power outages in a number of regions, including Chernihiv, Sumy, and others. The UKRNAFTA gas station network continues to operate even during power outages. We have provided backup power and conditions for visitors so that Ukrainians can refuel, warm up, and stay connected. Thank you to everyone who supports people and works even in the most difficult conditions,” said Yuriy Tkachuk, acting chairman of the board of JSC Ukrnafta.

JSC Ukrnafta is Ukraine’s largest oil producer and operator of the largest national network of gas stations, UKRNAFTA. In 2024, the company entered into asset management with Glusco. In 2025, it completed an agreement with Shell Overseas Investments BV to purchase the Shell network in Ukraine. In total, it operates 663 gas stations.

The company is implementing a comprehensive program to restore operations and upgrade the format of its network of gas stations. Since February 2023, it has been issuing its own fuel vouchers and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share.

In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the company’s corporate rights, which belonged to private owners, to the state, and it is now managed by the Ministry of Defense.

A complete list of addresses of “unbreakable” UKRNAFTA gas stations can be found at: https://www.ukrnafta.com/data/news/2025/Perelik_punktiv_nezlamnosti.pdf

Ukrnafta JSC continues its rebranding program for filling stations acquired from Shell, adding eight more complexes in the Kyiv region to its UKRNAFTA brand.

“The renewal of the UKRNAFTA gas station network continues — we are expanding our presence in the Kyiv region. From now on, eight more rebranded complexes are ready to welcome customers,” the company announced on Facebook.

According to the company, this includes the renovated gas stations on Stolichnoe Highway in the direction of Obukhiv, on the Kyiv-Chop highway within Korostyshiv, and on the Kyiv-Kharkiv highway near Boryspil and within Berezan.

In addition, gas stations in the city of Uzyn in the Bila Tserkva district, in the city of Skvyra in the direction of Zhytomyr, and in the center of the city of Pereyaslav have been rebranded.

“Stop by. Refuel. Relax,” Ukrnafta emphasized.

As reported in August this year, citing former Ukrnafta commercial director Serhiy Fedorenko, Ukrnafta acquired 131 gas stations from Shell, 118 of which are operational, while the rest are located near the front line or in temporarily occupied territories. After closing the deal, the company planned to consolidate its position as the largest network in Ukraine, with the number of its gas stations set to increase by 22% to 663. Its closest competitor, OKKO, has 410 gas stations.

Under the agreement with Shell, Ukrnafta must complete the rebranding of its gas stations, the cost of which is insignificant on a network scale, by the end of February 2026. In turn, the cost of rebranding, which includes the renovation and standardization of gas stations and will take several years, will be significant but justified.

Ukrnafta is Ukraine’s largest oil producer and operates the national gas station network. In March 2024, it took over the management of Glusco’s assets and currently operates a total of 662 gas stations.

The company holds 92 special permits for industrial development of deposits. It has 1,832 oil and 154 gas production wells on its balance sheet.

The largest shareholder of Ukrnafta is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer the company’s corporate rights, which belonged to private owners, to the state, and they are currently managed by the Ministry of Defense.

Ukrnafta’s net profit for 2024 was UAH 16.38 billion.

In the first half of 2025, Ukrnafta JSC earned a net profit of UAH 5.2 billion.

The results of the company’s operations are included in the condensed consolidated interim financial statements of NJSC Naftogaz of Ukraine for the six months ended June 30, 2025. The review of these statements is conducted by KPMG. As part of the audit, KPMG Audit performed procedures to review the financial information of Ukrnafta.

During the same period, Ukrnafta paid UAH 14.8 billion in taxes, duties and customs payments to the state budget and transferred UAH 5 billion in dividends.

Since the company was taken over by the state in 2022, a total of UAH 68.1 billion of taxes, duties and customs payments and UAH 15.3 billion of dividends have been paid.

“Despite the challenging security situation and all the related difficulties, Ukrnafta continues to work effectively for the energy sustainability of our country. I am grateful for the support and constructive decisions of our shareholders – Naftogaz of Ukraine and the Ministry of Defense of Ukraine, the Supervisory Board, the Government and our partners. Special thanks to the entire team of more than 20,000 employees for their diligent and efficient daily work,” said Yuriy Tkachuk, Acting Chairman of the Executive Board of Ukrnafta.