More than 15% of sanctioned companies will be under restrictions for life

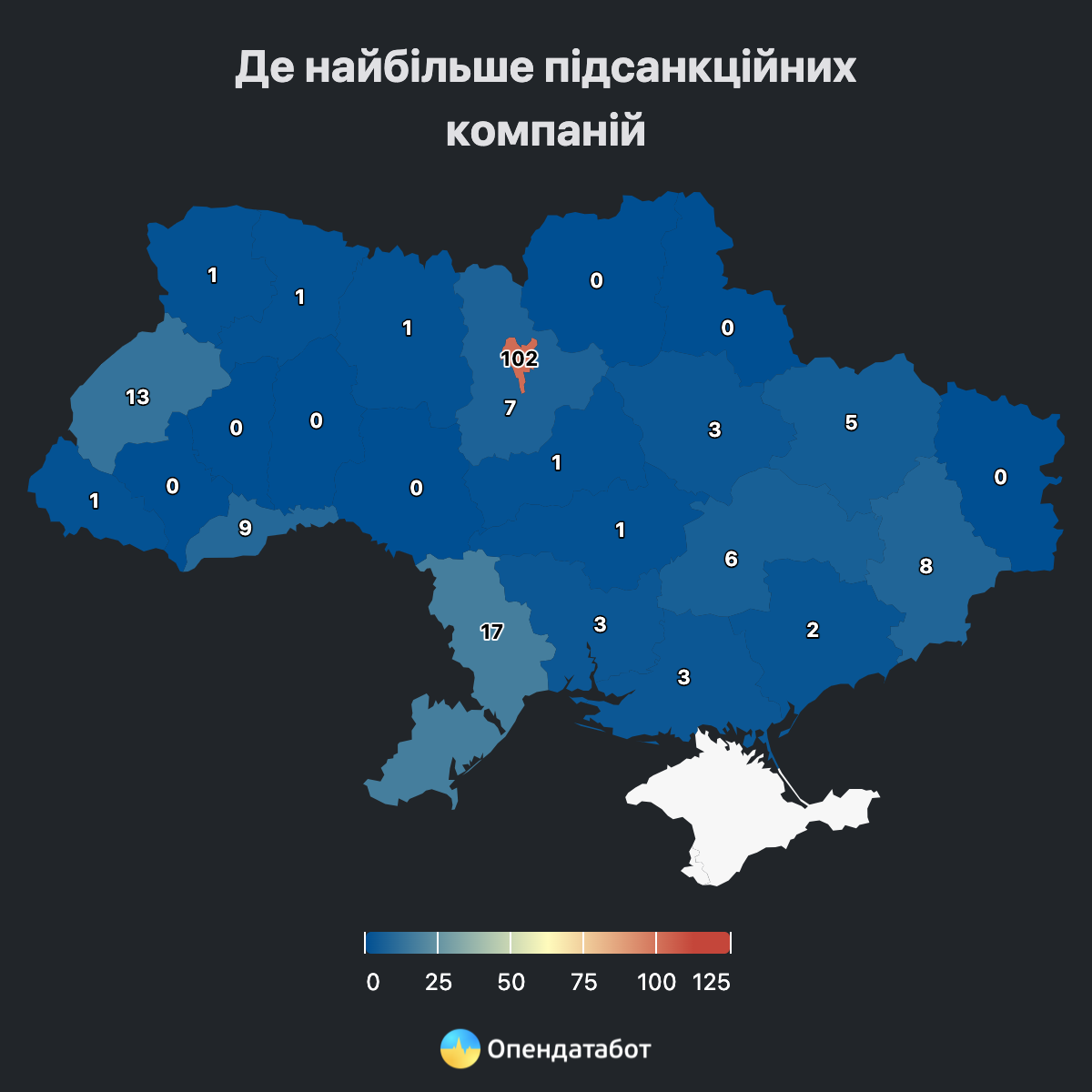

184 companies in Ukraine are currently under NSDC sanctions, according to the National Security and Defense Council of Ukraine. Most of these businesses are located in Kyiv, Odesa, and Lviv. Most often, these companies are engaged in wholesale trade, except for the trade in motor vehicles and motorcycles.

Most of the companies appeared on the sanctions list after a series of updates in 2024. So this year, the number of such businesses has almost tripled: by 119 companies. By contrast, the fewest companies were added to the sanctions list in 2023 – only 10 (5.4%).

Every second company in the total number will be under sanctions until 2027. Another 19.4%, or 36 businesses, will be released from the restrictions no earlier than 2034. The sanctions are in place for an indefinite period of time, with 15.1% or 28 companies.

The majority of these businesses are wholesale trade, except for trade in motor vehicles and motorcycles – 61 companies (33.2%). Another 10.3% are engaged in specialized construction work – 19 companies.

Film production and construction of buildings are in the top three, with 7 companies or 3.8% each.

Most businesses under sanctions are located in Kyiv – 102 in total. There are significantly fewer companies in Odesa region – 17 or 9.2%. Lviv region is also among the leaders in terms of the number of companies – 13 or 7.1%.

Among the sanctioned companies, the top three in terms of revenue in 2023 are as follows:

The sanctions list can only be left if the President of Ukraine signs the relevant decision of the National Security and Defense Council or if the sanctions against the company have expired and have not been renewed. The most profitable businesses that have already left the sanctions list are:

Detailed information about the companies under the NSDC sanctions can be found in the special register of the Openatabot. The relevant information will also be available in the regular company card on our website.

https://opendatabot.ua/analytics/rnbo-companies

Corum Group (DTEK) plans to complete the supply of 400 cast components for powered supports to the largest mining company in Europe Polska Grupa Górnicza SA (PGG) by the end of March this year, Corum wrote on Facebook.

According to the statement, the first batch under the contract, the cost of which was not disclosed, has already been supplied to the customer. Cast components are produced by Corum Svitlo Shakhtaria plant (Kharkiv).

“These components will cover the Polish partner’s need for missing components for the production of powered roof support sections,” the statement said.

Corum recalls that it has been cooperating with PGG since 2018, and three mines of this company (Sośnica, Piast-Ziemowit and Mysłowice-Wesoła) use more than 400 Corum support components.

Corum Group is part of the energy company DTEK Energy and is the largest manufacturer of mining equipment in Ukraine.

The key clients of the company are 14 largest mining holdings, whose assets include 150 mines and open pits.

Daniel Tonkopiy, co-founder of the Ukrainian electric bike company Delfast, expects support from President of Ukraine Volodymyr Zelensky to build a plant for the production of Ukrainian electric bikes.

He wrote on his Facebook page that he plans to establish a serious production of tens of thousands of electric bikes a year with a design and engineering bureau, production of metal, plastic, electrical and electronic components, battery assembly, software development and much more, which is necessary for the production and assembly of electric vehicles.

“I presented our project to the president, told him that the Mexican police ride our bikes. Zelensky immediately offered his help in transferring Ukrainian police officers to our electric bikes: “We will help, you can contact me. Yes, directly. My team will help,” Tonkopiy said, citing the president as saying.

He also said that Zelensky announced his readiness to help Delfast to build a plant for the production of electric bikes, presumably in Kyiv region.

Delfast already has a confirmed demand for tens of thousands of bikes from customers around the world, Tonkopiy said.

Former U.S. Department of State Special Representative for Ukraine, Kurt Volker, has become an independent member of the board of directors of BGS Rail, which operates in Ukraine, since September 1, U.S.-government funded Radio Free Europe/Radio Liberty has reported.

According to it, BGS Rail is registered in Ukraine. Avia Solutions Group expects Volker’s participation to strengthen the company’s presence in the market.

“By using his vast experience gained in previous positions, we believe that his arrival to the company will further expand Avia Solutions Group’s global reach and strengthen BGS Rail’s position as one of the market’s leading service providers,” the group’s statement reads.

It is noted that Avia Solutions also has in its disposal a comment made by Volker, who points to the opportunity to strengthen the Ukrainian economy in his new work.

“By working with Avia Solutions Group in its development of BGS Rail, I see an opportunity to strengthen Ukraine’s economy, build world-class services, and create jobs for Ukrainian citizens. This goes hand-in-hand with Avia Solutions Group’s global strategy of building world-class services and market position,” he said.

Volker served as Special Representative of the U.S. Department of State for Ukraine in 2017-2019.

Swedish Embracer Group AB Holding (“Embracer”), through its wholly-owned subsidiary Saber Interactive, has entered into an agreement to acquire 100 percent of Kyiv/Malta-based 4A Games Limited (“4A Games”) famous for Metro 2033, Metro: Last Light и Metro Exodus games.

The deal amounts to $45 million, of which $25 million is paid in cash and $20 million in shares (50% of which will be unblocked in a year, and another 50% in two years), the Embracer reported on its website.

In addition, 4A Games will receive up to $35 million ($15 million in cash and $20 million in shares) if the publisher’s goals are met within five years. The total amount of the deal could be as big as $80 million.

At the same time, it is expected that gross sales of 4A Games’ games for 2020 will bring about EUR 20 million, and the studio’s operating profit will be EUR 12 million.

“Through the acquisition, Saber Interactive onboards a reputable team of over 150 people across two studios in Malta and Ukraine as well as best-in-class internally developed and owned First-Person-Shooter (FPS) technology to the Group,” the Embracer says.

“Embracer Group and Saber Interactive are the perfect partners for 4A Games and for our next phase of growth. Together we will continue to build on the Metro franchise and will focus on bringing a multiplayer experience to our fanbase. We look forward to building a new and even more ambitious AAA IP in the near future,” the company quoted Dean Sharpe, CEO 4A Games, as saying.

Embracer Group was formerly known as THQ Nordic AB. One of the subsidiaries; THQ Nordic GmbH shared the same name and trademark as the parent company, THQ Nordic AB (publ). The THQ Nordic GmbH brand and company will continue to operate as a global video game publisher and developer. The Group has an extensive catalogue of over 160 owned franchises, such as Saints Row, Goat Simulator, Dead Island, Darksiders, Metro, MX vs ATV, Kingdoms of Amalur, TimeSplitters, Satisfactory, Wreckfest and World War Z amongst many others.

With its head office based in Karlstad, Sweden, Embracer Group has a global presence through its five operative groups: THQ Nordic GmbH, Koch Media GmbH/Deep Silver, Coffee Stain AB, Amplifier Game Invest and Saber Interactive. The Group has 31 internal game development studios and is engaging more than 3,500 employees and contracted employers in more than 40 countries.

Embracer Group in the first quarter of fiscal year 2020 (April-June) reported an 81% increase in revenue up to SEK 2.069 billion ($238.3 million at current exchange rates), and its EBITDA grew 2.5 times – up to SEK 965.2 million.

The shareholders of Arsenal Insurance (Kyiv) insurance company at a meeting on June 26 decided to increase the charter capital of the company from UAH 121.5 million to UAH 202.5 million via a closed additional placement of shares.

According to information in the publicly available database of the National Securities and Stock Market Commission of Ukraine, 120,000 shares with a nominal value of UAH 675 per share will be additionally sold for a total of UAH 81 million.

The report also notes that the received financial resources in the form of cash will be placed on current accounts and bank deposits in the ratio of 30% to 70%. The shares of the company, on which the decision on the issue was made, do not provide for the possibility of conversion.

As reported, the company’s shareholders at a meeting on April 24, 2020 considered the issue of increasing the charter capital of the company from UAH 77.4 million to UAH 121.5 million by increasing the nominal value of shares from UAH 430 to UAH 675 (for one ordinary registered share) due to sending part of profit to the charter capital.

Arsenal Insurance is among the top three largest insurance companies in Ukraine and is number one among insurers with Ukrainian capital. Every day the company makes over UAH 2 million of insurance payments. The partners of the Ukrainian company are the leading European reinsurers: HannoverRe, PolishReinsuranceCompany, SCOR SE, Gen.

According to the information on the company’s website, chairman of the board Serhiy Avdeyev owns 24.5% of Arsenal Insurance, Maksym Tuz owns 21%, Kostiantyn Tuz some 9%, Oleksandr Solop holds 17.5%, Anatoliy Solop 12.51%, Hennadiy Moldavsky 9.99%, and Maryna Avdeyeva some 5.5%.