The first four months of 2025 in the cryptocurrency market were marked by high volatility, shifts in investor sentiment and increased influence of macroeconomic factors. Despite short-term corrections, the market retains the potential for growth in the second quarter.

Total capitalization and market dynamics

Peak capitalization: $3.8 trillion (January 18, 2025).

Quarterly low: $2.7 trillion (end of March 2025).

Current capitalization: $2.97 trillion (as of April 29, 2025).

Bitcoin’s share: 63.56% of total capitalization.

The 18.6% decline in capitalization in the first quarter was due to macroeconomic uncertainties, including trade tariffs and interest rate fluctuations.

Market leaders and outsiders

Leaders:

FARTCOIN: up 100% for the week of April due to increased demand for meme tokens.

Hyperliquid (HYPE): up 30% after breaking the downtrend.

Curve DAO (CRV): up 20%, recovering above the 20-day EMA.

Outsiders:

Pi Network (PI): down 36% due to selling pressure.

Story Protocol (IP): Down 25%, continuing decline since late March.

Jupiter (JUP): Down 23.5%, hitting a new low.

Key trends

Bitcoin dominance: increase to 63.56%, indicating investors’ preference for more stable assets.

Declining market activity: average daily trading volume fell 27.3% in the first quarter, reflecting investor caution.

Macroeconomic impact: trade tariffs and US Federal Reserve policy put pressure on the market, causing short-term corrections.

Near-term outlook

Analysts expect that the market could recover in the second quarter of 2025, especially if the macroeconomic situation stabilizes. Bitcoin is seen as a potential safe haven asset amid economic uncertainty. However, investors should be prepared for continued volatility and keep a close eye on macroeconomic indicators and regulatory developments.

Binance Research, the analytical division of the world’s leading blockchain ecosystem Binance, has published a report for August 2024 that highlights the main trends shaping the cryptocurrency market.

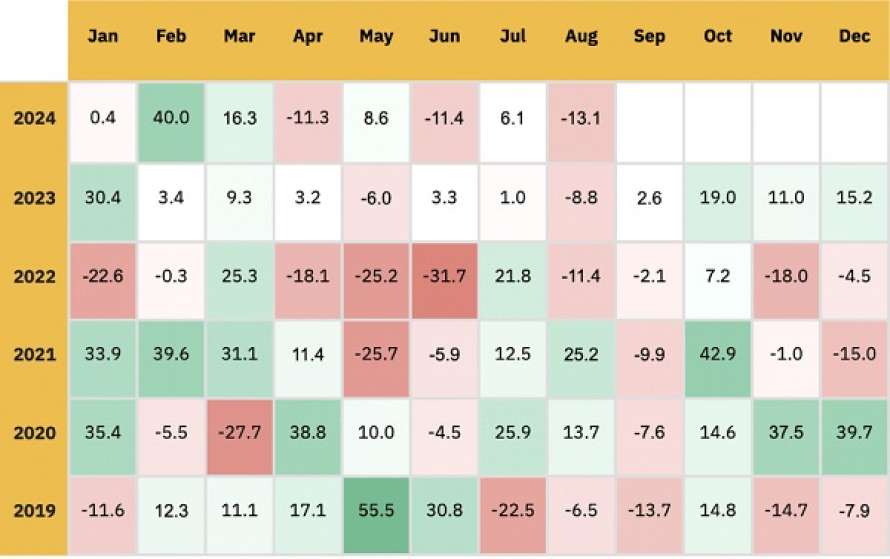

Cryptocurrency market dynamics in August 2024

In August 2024, the cryptocurrency market experienced a significant drop of 13.1% of the total market capitalization. It was triggered by global macroeconomic problems and weak unemployment in the United States, which increased fears of a recession. The Bank of Japan’s decision to raise interest rates on August 5 caused significant disruptions in global stock markets. Asian indices, such as the MSCI Asia Pacific and Japan’s Nikkei 225, were particularly affected, suffering sharp losses throughout the day. This volatility also spread to the cryptocurrency market, leading to liquidations of more than $819 million in one day.

Source: CoinMarketCapAs (as of August 31, 2024)

Despite this “quick crash,” the market began to stabilize after US Federal Reserve Chairman Jerome Powell hinted at a possible interest rate cut in September. In addition, the U.S. Bureau of Economic Analysis revised its second-quarter GDP growth rate to 3%, which exceeded expectations.

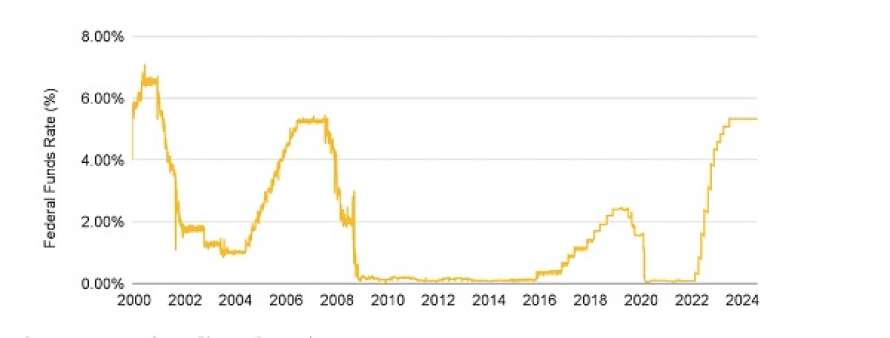

Expected rate cut: a signal for economic growth and lower unemployment

The US federal funds rate was at its highest level since 2001 after a significant rate hike cycle between March 2022 and July 2023. After holding rates steady for 8 consecutive meetings, all eyes are on a rate cut at the next meeting on September 17. -18. For context, the Fed adjusts the target federal funds rate in line with economic conditions. This is done to fulfill their dual mandate of maintaining stable prices (i.e., keeping inflation under control) and supporting maximum employment. Now that inflation in the US has come down significantly from its highs and is rapidly approaching its 2% target, the Fed has turned its attention to unemployment. The hope is that lowering the target rate (i.e., the price of credit) should lead to a new influx of money into the economy, which could lead to more hiring and improved employment figures.

Source: macrotrends.net, Binance Research (as of August 31, 2024)

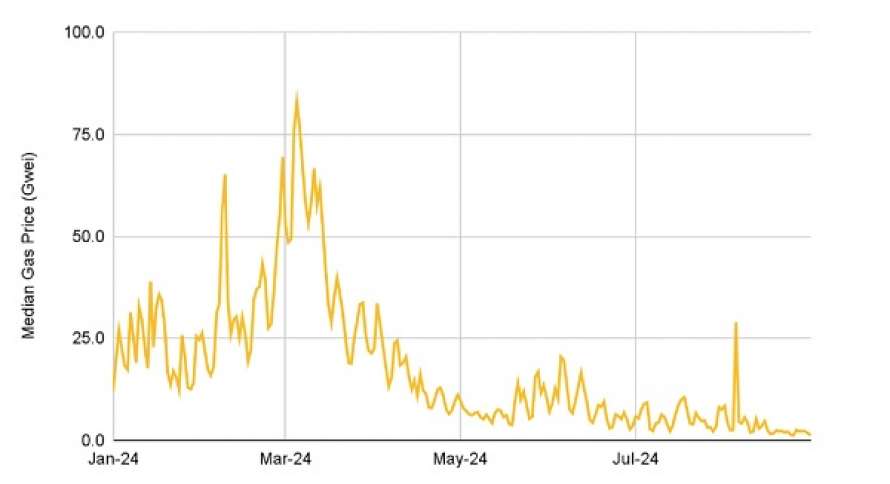

Historic decline in Ethereum fees: impact of the Dencun update and reduced network activity

Transaction and smart contract fees on the Ethereum network at the Layer-1 level have reached their lowest levels in more than five years, with several low-priority transactions costing one gwey or less in recent weeks. The decline in fees can be attributed to reduced network activity and the introduction of blobs during the Dencun update in March, which not only reduced fees at the Layer-2 level but also reduced congestion at the Ethereum Layer-1 level, thereby contributing to the overall decline in fees.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

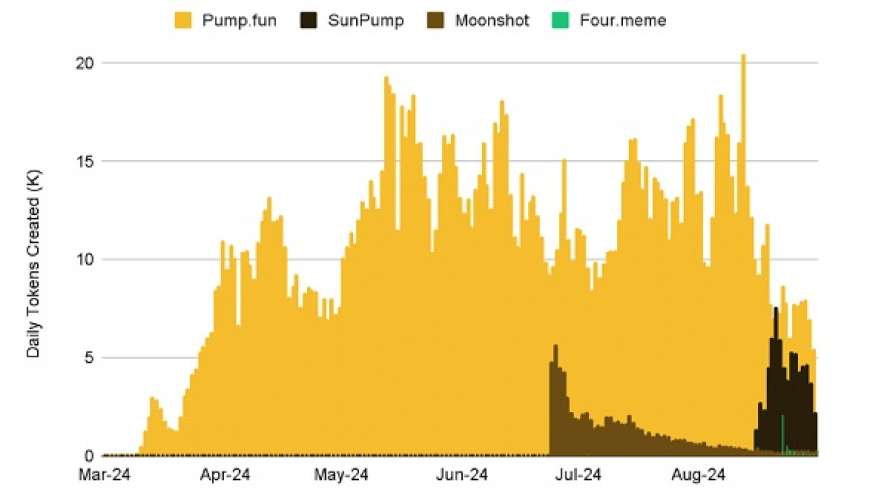

Pump.fun maintains leadership among meme coin launch platforms despite growing competition

Despite the emergence of competitive meme token platforms, Pump.fun remains the leader, setting a new record this month with more than 20 thousand tokens created in a single day. The platform has already launched nearly 2 million tokens and has been powering more than 60% of daily transactions on Solana-based decentralized exchanges since mid-August. As competition intensifies, it will be interesting to see if Pump.fun can maintain its dominant position as the leading meme token launch platform.

Source: Dune Analytics, Binance Research (as of August 31, 2024)

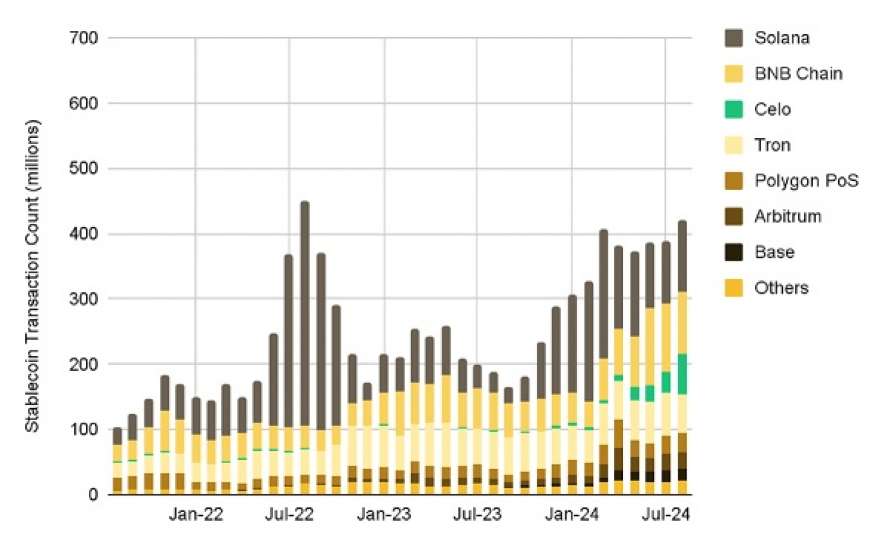

The stablecoin market continues to grow: new transaction records in the CELO and Solana ecosystems

The stablecoin market continues to grow rapidly, with the number of transactions approaching historic highs. Significant growth is observed in the CELO and Solana ecosystems. While the supply on USDT CELO has quickly reached the USD 200 million mark, Solana is leading the way in terms of transaction volume, helping PayPal’s PYUSD reach a market capitalization of USD 1 billion. As stablecoins gain popularity around the world, it is important to keep an eye on how macroeconomic factors and regulatory changes will affect the development of this sector.

Source: Binance Research (as of August 31, 2024)

The full report is available here.

About Binance

Binance is the world’s leading blockchain ecosystem and cryptocurrency infrastructure provider with a suite of financial products that includes the largest digital asset exchange by volume. Trusted by millions of people around the world, Binance’s platform aims to bring the freedom of money to users and has an unrivaled portfolio of crypto products and offerings, including: trading and finance, education, data and research, social good, investment and incubation, decentralization, infrastructure solutions, and more. For more information, please visit: https://www.binance.com.

Source: https://lenta.ua/kriptovalyutniy-rinok-u-serpni-analiz-vid-binance-research-163691/

U.S. authorities have charged one of the most notorious figures in the crypto industry, FTX Group founder Sam Bankman-Friede. He faces up to 115 years in prison for what prosecutors classify as “the largest financial fraud in American history.”

Another U.S. official compared FTX to a house of cards, which investors managed to present as “one of the safest buildings in the cryptocurrency market.” What Bankman-Fried, who was detained in the Bahamas, will say about this in court is a matter for the future, but for now his position is that he was not aware of the asset diversion operations.

On Nov. 8, 2022, when the cryptocurrency exchange Binance announced its intention to buy the assets of rival FTX outside of the U.S., it seemed like the deal could be a game changer for the industry and one of the most important events in its history. Shares of another crypto platform, Coinbase Global, plummeted 11 percent on news of the merger. “This is a big deal,” Bernstein analyst Harshita Rawat wrote. – While Binance and FTX do not directly compete with Coinbase, we believe this merger marks a tectonic shift in the competitive landscape.”

As early as Nov. 10, a tectonic shift was indeed emerging, but of a very different nature. “As a result of corporate due diligence, as well as in light of recent news about mismanagement of customer funds and reports of an investigation by US authorities, we have decided to abandon plans to acquire FTX.com,” Binance reported. In turn, Bankman-Fried told investors that the exchange needs funding of up to $ 8 billion amid the massive withdrawal of clients from the site, wrote the Financial Times, citing its sources.

Investors who invested in FTX, all understood. Investment firm Sequoia Capital said it now considers the value of its investment in the crypto platform to be zero. Sequoia bought a stake in FTX for $213 million in 2021, when the exchange was valued at $25 billion.

Another day later, on November 11, FTX initiated its own bankruptcy. Bankman-Fried resigned. By court order the company was headed by John Ray III.

FTX had been issuing its own tokens, trading under the ticker symbol FTT. They had a combined value of $9.6 billion at their peak in 2021 and $3.5 billion on the eve of bankruptcy, Forbes wrote. Their buyers received certain financial preferences in FTX transactions, and within the Bankman-Frieda group of companies, it now appears, they could be used as collateral for lending. The exchange, which attracted customer funds, made loans under such a scheme to another Bankman-Frieda company, Alameda.

The U.S. Commodity Futures Trading Commission (CFTC) considers that these transactions represented “a limitless line of credit that allowed Alameda to take billions of dollars out of customer assets at FTX.” According to the SEC, client money was used to make “venture capital investments, luxury real estate purchases and large political donations.” To whom the latter were intended, the SEC report did not specify.

Another claim is that investors were defrauded. According to the SEC filing, FTX had raised more than $1.8 billion (including $1.1 billion in the U.S.) from them since May 2019 in exchange for an equity stake in the exchange. FTX investors included BlackRock, Sequoia Capital and Ontario Teachers’ Pension Plan, among others.

Now these actions formed the basis of the charges brought against Bankman-Fried by the U.S. Justice Department. Among other things, he is charged with conspiracy to commit fraud, misappropriation of funds of FTX exchange customers, including for personal use, writes the Financial Times. The implementation of the fraud scheme Bankman-Frieda began in 2019, since the founding of FTX, and continued until its collapse in November 2022, according to the text of the indictment. Collectively, he faces up to 115 years in prison.

In addition to the agencies mentioned, the Bankman-Fried case is being handled by the Federal Bureau of Investigation and the prosecutor’s office. According to Manhattan prosecutor Damian Williams, they are all working “around the clock” to get to the bottom of what happened in “one of the biggest financial frauds in American history.”

For his part, Ray, now dealing with FTX as a court-appointed receiver, said the scheme carried out was not “sophisticated.” He said it was a “routine embezzlement” of funds.

“We suspect that Sam Bankman-Fried built a house of cards based on deception, telling investors that it was one of the safest buildings in the cryptocurrency market,” SEC Chief Gary Gensler said.

Bankman-Fried, on the other hand, has insisted in recent weeks that he was unaware of the details of what Alameda was doing. It had its own chief executive, Caroline Allison, the FTX founder said.

The collapse of FTX had many implications for the cryptocurrency industry. As reported by The Wall Street Journal, citing data from research firm CryptoCompare, global funds investing in cryptocurrency assets in November recorded an outflow of $19.6 billion. From Binance, according to the Financial Times, investors withdrew more than $1 billion. Bitcoin – the most popular cryptocurrency – fell to a 2-year low.

Bankman-Fried was watching from the Bahamas, where FTX was also registered. Here, according to Reuters, luxury real estate was bought for the exchange’s founder himself, his parents, Stanford law professors, and other top executives in the group. Attorney James Bromley said that almost $300 million was spent for this purpose, Kommersant wrote.

Now Bankman-Fried is detained in the Bahamas at the request of the United States authorities. A local court denied his request for bail, saying that he could abscond and therefore must remain in custody. The judge scheduled a hearing on his potential extradition to the United States for Feb. 8, Bloomberg reported.

Meanwhile, Ray, who now manages what’s left of FTX, says it will take months to trace the fate of the withdrawn assets, and he is skeptical about the outcome of the search. “We won’t be able to recover all the losses,” Rey says.

A concept of regulating transactions with cryptocurrencies names the National Commission for Securities and the Stock Market of Ukraine the main regulator on the cryptocurrency market and authorizes the commission to license cryptocurrency exchanges and cryptocurrency exchange points, according to materials posted on the website of the commission. In particular, it is proposed that the National Commission for Securities and the Stock Market will classify and define tokens as financial tools, regulate the exchange and purchase and sale of cryptocurrency through cryptocurrency exchanges, as well as Initial coin offerings (ICO).

At the same time, according to the concept, State Financial Monitoring Service is authorized to supervise cryptocurrency exchanges, and the Ministry of Finance and the State Fiscal Service – to supervise payment of taxes on income from operations with cryptocurrencies.

In addition, the concept proposes to define the concept of a cryptocurrency and a token. In particular, the token is proposed to be considered a “centralized or decentralized unit of accounting, which is based on mathematical calculations using a computer network and has cryptographic protection.” “Cryptocurrency is a token that functions as a way of exchanging and preserving value,” the commission said on the website.

CRYPTOCURRENCY MARKET, NATIONAL COMMISSION, REGULATOR, STOCK MARKET