PJSC “Production Association “Stalkanat” (Odessa) on the results of work in January-March this year, increased net profit in 2.2 times compared with the same period last year – up to 77.304 million UAH.

According to the interim report of the company, net income for this period decreased by 3.2% – to UAH 701.047 mln.

Undistributed profits amounted to UAH 234.019 mln as of March 31, 2023.

As reported, in 2022 “Stalkanat” received a net profit of 325.073 million UAH against a slight loss a year earlier, while 2021 ended with a net loss of 309 thousand UAH.

The general meeting of shareholders, held on September 3, 2021, decided to separate PJSC Stalkanat-Silur and create a new company – PJSC Stalkanat with the transfer of its property, rights and obligations according to the approved distribution balance sheet.

PA Stalkanat-Silur PJSC (Odessa) previously had two branches – in Odessa and Khartsyzsk, Donetsk region on the NKT. On December 1, 2016, the company’s management officially notified about the shutdown of the company’s branch in Khartsyzsk – a relevant announcement was published in the Uryadovy Kurier newspaper. Later, the management of PAO Stalkanat-Silur PJSC stated about the seizure of the company’s branch in Khartsyzsk on NKT and sent a corresponding statement to the National Police.

The charter capital of PJSC Stalkanat is UAH 17.736m.

Dneprometiz PJSC (Dnipro) of Ukrainian businessman Serhiy Tihipko following the results of work in January-March this year received a net profit of UAH 17.581 million, while the company finished the same period of the last year with a net loss of UAH 8.645 million.

According to the interim report of the company, in the first quarter of 2023 net income increased by 54% up to UAH 683.802 mln.

At the same time, the undistributed profits of the company by the end of March 2023 amounted to UAH 257.664 mln.

As it was reported, Dneprometiz in 2022 decreased its net profit six times compared to the previous year – up to UAH 25.572 mln, net income increased by 1.1% – to UAH 2.474.397 mln.

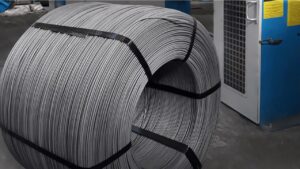

“Dneprometiz produces metalware of low-carbon steel. The company has a capacity of 120 thnd mt of products per year.

According to the NDU for the fourth quarter of 2022, T.A.S. Overseas Investments Limited (Cyprus) holds 98.6578% shares of Dneprometiz.

The charter capital of Dneprometiz is UAH 83.480 mln and the par value of the shares is UAH 68.08.

Solvent banks in Ukraine in January-March 2023 received UAH 34 billion in net profit against UAH 152 million loss in the same period of 2022, the National Bank of Ukraine said on Friday.

“The main factors of the sector’s profitability are the growth of income as a result of the gradual resumption of banking activities and relatively insignificant volumes of additional provisioning,” it pointed out on its website.

Only five banks out of 65 in the first quarter were unprofitable with an aggregate loss of UAH 40 million.

According to the NBU, in March, the net profit of banks rose to 12.58 billion UAH from 6.78 billion UAH in February.

It is pointed out that banks for the quarter increased operating income by 48% year-on-year, including net interest income rose by 41% year-on-year, despite a significant increase in interest expenses as a result of higher interest rates on deposits.

Net fee and commission income for the period, according to the NBU, increased by 20% compared to the result of the first quarter of 2022.

In March compared to February, net interest income increased by 40.4% to 38.16 billion UAH, net commission income – by 14.7%, to 23.7 billion UAH, while interest expenses increased only by 17.4% – to 7.93 billion UAH, and commission expenses even decreased by 15.8% – to 3.02 billion UAH.

“Banking volumes are resuming with the gradual resumption of economic activity, including after the shelling of energy infrastructure in late last year – early this year,” the regulator stated.

It added that the banks’ profitability is also boosted by the positive result of currency buying and selling operations, which was 2.3 times higher year-on-year in the first quarter.

Net operating profit before deductions to reserves doubled in 1Q 2023 year-on-year – to UAH 45.9 billion, while the rate of deductions to reserves against losses from asset transactions fell compared with 1Q of the previous year in 5.6 times, in particular in reserves against loans – 10 times.

During the quarter the deductions increased only by UAH 3.81 billion, including UAH 1.29 billion in March, and in total since the beginning of a full-scale invasion of Ukraine by Russia, banks formed reserves for credit losses of UAH 108 billion.

The National Bank states that the return on equity sector on April 1, 2023 amounted to 58% against -0.25% a year ago.

The profit tax accrued for the quarter – UAH 6.72 billion – exceeded the corresponding annual figure for the historically most profitable year 2021, the regulator said.

Agro-industrial group Ovostar Union, one of the leading producers of eggs and egg products in Ukraine, has earned a net profit of $6.09 million in 2022, which is 3.7 times higher than in 2021.

According to the company’s report on the Warsaw Stock Exchange, its revenue for the year0 increased by 1.7% to $135.63 million and gross profit by 67.2% to $22.77 million.

EBITDA was up 96% to $11.1 million and operating income 5.9 times, to $7.29 million, it said.

“Steadily rising egg and egg product prices in the second half of 2022 provided better margins than in previous years,” the report notes.

“Ovostar added that its cost of sales fell 22 percent to $86.6 million as a result of lower production volumes and a sharp drop in local prices for poultry feed components such as wheat and corn, caused by limited grain exports due to fighting in the country.

The group also noted that its total debt for 2022 was down 15% to $10.9 million, net debt became negative – “minus” $1.4 million – from $10.4 million, and free cash flow quintupled to $12.2 million.

The holding company of the group – Ovostar Union N.V. – in mid-June 2011, it floated 25% of its shares on the WSE and raised $33.2 mln. Its majority shareholding is owned by Prime One Capital Limited, controlled by its chief executive B. Belikov and chairman of the board Vitaliy Veresenko.

In 2022, Ovostar reportedly reduced egg production by 9% to 1.55 bln eggs and sales by 6% to 1.08 bln eggs.

At the same time, sales of dry egg products decreased by one-third to 2.13 thousand tons, liquid – by 26%, to 10.62 thousand tons.

Ukrgraphite (Zaporizhia) increased its net profit by 42.9 times in January-March this year as compared to the similar period of the previous year – up to UAH 70.723 mln.

According to the interim report of the company, in the first quarter the company decreased its net profit by 11% – to UAH 437.326 mln.

The undistributed profits of the company as of the end of the first quarter of this year amounted to UAH 3 bln 776.257 mln.

As it was reported, Ukrgraphit reduced net income in 2022 by 41.4% compared to the previous year – to UAH 1 billion 545.562 million and received a net profit of UAH 52.584 million, while it ended 2021 with a net loss of UAH 317.539 million.

“Ukrgraphite is Ukraine’s leading manufacturer of graphitized electrodes for electric steel-making, ore-thermal and other types of electric furnaces, commodity carbon masses for Soderberg electrodes, carbon-based lining materials for metallurgical, machine-building, chemical and other industrial complexes.

According to the National Depository of Ukraine (NDU) as of the fourth quarter of 2022, Intergraphite Holdings Company Limited (Bermuda) owns 23,9841% of PrJSC, C6 Safe Group Limited (Cyprus) – 72,0394%.

The authorized capital of PrJSC – 233,959 million UAH, nominal value of 1 share – 3,35 UAH.

Ukraine’s largest car-building enterprise, Dneprovagonmash JSC (DVM, Kamianske, Dnipro region), controlled by businessman Sergiy Tigipko’s TAS Financial and Industrial Group, ended the first quarter of 2023 with a net profit of UAH 37.04 million against a loss of UAH 18.07 million in January-March 2022.

According to the company’s interim financial statements published in the National Securities and Stock Market Commission’s (NSSMC) information disclosure system, net sales revenue increased by 32% to UAH 396.92 million.

In January-March, the company increased its gross profit by almost 12 times to UAH 59.47 million, generating UAH 37.82 million in operating profit against a loss of UAH 16.06 million.

Compared to the beginning of this year, DVM reduced current liabilities by 27% to UAH 217.62 million, while long-term liabilities increased by 12.6% to UAH 59.34 million.

The report does not include the number of railcars produced and sold in the reporting period.

“Dneprovagonmash is one of Ukraine’s leading freight car design and manufacturing companies. Its annual production capacity is 9 thousand units.

As reported, DVM’s net income for 2022 increased by 77.3% to UAH 1 billion 108.7 million, with net profit of UAH 48.64 million compared to a loss of UAH 111.3 million a year earlier. At the same time, sales of railcars increased by 35% to 623 units, and production by 21% to 577 units.

TAS Group was founded in 1998 by businessman Tigipko. Its business interests include the financial sector (banking and insurance) and pharmacy, as well as industry, real estate, and venture capital projects.