The volume of new supply on the warehouse and logistics real estate market in Ukraine in 2021-2022 will amount to 364,000 sq m, while about 200,000 square meters is to be commissioned in the market of Lviv and the region, according to a study by Alterra Group.

“The leader is Lviv, where it is planned to put into operation about 200,000 square meters. In Kyiv, it is planned to introduce those projects that were predicted back in 2019 and 2020. In the regions, most of the premises planned for commissioning by developers are occupied by post offices and logistics companies,” Dmytro Kovalchuk, the co-owner of Alterra Group, said during the web conference on the analytics of the warehouse real estate market.

So, in Kyiv, the volume of new supply in 2021-2022 will amount to 71,400 square meters, among the planned projects, in particular, are the warehouse FM Logistic (17,000 sq m), Sun Factory 2 (23,400 sq m), Makarovsky of ADG developer (15,000 sq m).

Among the objects in Lviv are the expansion of the Protec warehouse in Zymova Voda by 40,000 sq m, the warehouse Lvivsilmash (42,200 sq m), a project from Galileo Logistic (45,000 sq m), Port Lviv Logistic Center (40,000 sq m).

According to the company, postal operators will continue to actively develop, the total construction volume of which will be about 158,000 square meters. Among the projects announced in 2021 is the expansion of the Nova Poshta network in Dnipro, Odesa, Kyiv with a total area of projects of 37,000 square meters, the construction of Ukrposhta logistics terminals in Kyiv, Kharkiv, Lviv, Dnipro and Odesa (22,000 sq m each), the expansion of the distribution center Mist Express in Lviv to 11,000 sq m.

Alterra Group is engaged in complex services for commercial real estate, development and consulting. The company’s portfolio includes 31 projects with a total area of 117,500 square meters.

The net loss of state-owned Ukreximbank (Kyiv) in 2020 amounted to UAH 5.6 billion against a net profit of UAH 63.62 million in 2019, chairman of the bank’s board Yevhen Metsger has said in a column published by the Interfax-Ukraine agency.

According to him, in the fourth quarter of 2020, the bank’s net loss amounted to UAH 3.4 billion, which is 1.5 times more than in the corresponding period of 2019 (UAH 2.21 billion).

Metsger explained that Ukreximbank entered 2020 with a number of problems, in particular, a structural deformation of the balance sheet, a weak foreign exchange position, a significant amount of overdue debt, a pool of expensive borrowings in foreign markets, which led to the formation of a loss.

According to him, these problems were caused by political factors, and in the context of the pandemic, they were intensified by macroeconomic challenges.

In addition, the banker said that the bank’s operating model was set to automatically generate losses, in particular, the volume of loan bookings regularly exceeded operating income by an average of 50%.

“And this accumulated portfolio of toxic assets caused constant pressure on the financial result. Firstly, a sufficient level of reserves was not formed for it, and secondly, it does not generate interest income for the bank. Over 2020, expenses to cover expected losses from the credit risk of non-performing assets amounted to UAH 4.3 billion,” Metsger explained.

State-controlled Oschadbank (Kyiv) in 2020 issued 4,000 car loans for a total of UAH 1.9 billion, which is 11.8% more than in 2019 (UAH 1.7 billion), the press service of has bank has said.

The bank reportedly issues car loans for up to seven years and with a minimum advance payment of 10%.

It is indicated that Oschadbank cooperates with more than 500 dealer centers throughout the country.

According to the bank, among the cars that were purchased on credit from Oschadbank, the favorites in 2020 were Toyota, Mazda, Suzuki, Nissan, Skoda, Hyundai, Kia, Volkswagen, Mercedes, Honda, Subaru, Renault, Peugeot and Fiat.

Oschadbank was founded in 1991. According to the National Bank of Ukraine, as of October 1, 2020, in terms of total assets (UAH 266.29 billion) Oschadbank ranked second among 74 banks operating in the country.

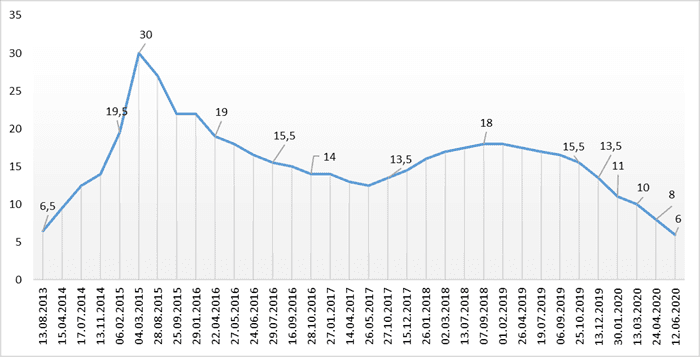

Dynamics of changes in discount rate of NBU.

NBU

The European Investment Bank (EIB) invested over EUR 1 billion in Ukraine in 2020 alone. This represents an increase of more than 50% compared to 2019, the press service of the bank has reported.

“We delivered record investment of over EUR 1 billion in Ukraine in 2020, focusing our operations on support for conflict-affected regions of eastern Ukraine, sustainable and green infrastructure, digitalization, innovation and business recovery after COVID-19,” the press service said, citing EIB Vice-President Teresa Czerwińska, who is responsible for operations in Ukraine.

She said that Ukraine is the main recipient country of EIB investments in the Eastern Neighbourhood, accounting for more than 60% of the EIB’s lending activity in the region and supporting the European Union’s policies in its neighbourhood.

According to the report, total EIB investment in Ukraine has now reached EUR 7.5 billion.

The EIB financed small and medium-sized enterprises (SMEs) to ensure they can survive the crisis and continue to provide jobs. It also invested in infrastructure rehabilitation and development, innovation and improvements in public transport and key public services such as education and the postal service.

In 2020, the EIB supported 75 SMEs and mid-caps and helped sustain close to 18,500 jobs in Ukraine.