A group of students from a children’s and youth sports school went to an international sports camp in the Republic of Serbia. According to the Beryslav District Military Administration, 14 children aged 10 to 15, as well as three coaches, took part in the trip. The program includes training sessions, master classes, and cultural exchange with Serbian athletes.

The project is being implemented with the support of Save the Children, the Ministry of Youth and Sports of Ukraine, and in partnership with Serbian sports organizations. The goal is to promote health, sports integration, and psychological support for children.

The organizers emphasize that this is not the first such initiative and expressed hope for further development of partnerships, including possible return visits by Serbian athletes to Ukraine after the situation stabilizes.

The Beryslav administration and school management express their gratitude to:

The Ukrainian Embassy in Serbia for its diplomatic assistance;

The Save the Children fund for its support;

The Serbian host side for its warm welcome and care.

“Such initiatives give children not only sports, but also faith in the future,” the administration noted.

On July 14, the price of Bitcoin exceeded $120,000 for the first time in history, reaching a peak of $122,571. After that, the price stabilized at around $121,950. The daily growth was about 2–3%, and since the beginning of the year — almost 29%. Analysts attribute the dynamics to a massive influx of capital into Bitcoin-based exchange-traded funds (BTC-ETFs) — over $1 billion daily — and favorable expectations regarding regulation. This refers to the active debate surrounding the Genius Act bill and discussions during Crypto Week.

Institutional players, including giants such as BlackRock and Bitwise, are showing unprecedented activity: from January to July, net inflows into cryptocurrency products exceeded $14.4 billion. Bitcoin is increasingly being treated as a digital analogue of gold — a “store of strength” in times of financial volatility. Technical analysis indicates potential growth to $125,000–131,000 in the coming weeks. If the trend remains stable, the price could reach $200,000–250,000 by the end of the year.

Ethereum is not far behind. ETH updated its five-month high, rising to $3,060. Open interest in Ethereum futures reached $14.25 billion, and ETF inflows exceeded $1 billion. AI-based predictive models see ETH in the $3,000–3,200 range throughout July.

The altcoin market is also showing positive dynamics. XRP rose above $2.80, an increase of 6–7% over the week. The technical picture shows a breakout from the falling wedge formation, opening the way to $3 and possibly $4.35 as early as July. Solana is trading at $160–167, with potential to reach $186–200, while Cardano (ADA) is near $0.725 and showing an upward trend to $0.77. Investors are showing growing interest in assets such as CELO and DOGE, as well as new staking ETFs, particularly those based on Solana.

The total capitalization of the crypto market is approaching $3.8 trillion. Despite geopolitical instability, the market is showing a clear bullish trend. Central bank digital initiatives, including digital currency pilots (CBDCs) in Australia, are creating a favorable backdrop for further growth in crypto assets. Against this backdrop, Bitcoin is increasingly consolidating its status as a reserve asset, prompting large institutions and companies to withdraw significant amounts from traditional assets in favor of digital ones.

Research on the construction industry in Eastern and Southeastern Europe – countries of growth and decline

According to the results of the Eastern European Construction Forecasting Association (EECFA) 2025 summer report, there is a significant stratification of construction dynamics across regions.

Here is an updated overview by country:

• Turkey: significant growth of ~19% is forecast, driven by large infrastructure and state-subsidized construction projects.

• Romania: the industry is expected to grow by ~15%, thanks to housing forecasts and support from the EU.

• Bulgaria: steady growth of ~8.5%, based on infrastructure and civil construction projects.

• Slovenia: moderate but stable growth of ~7%, despite a preliminary decline.

• Serbia: will continue its steady rise — ~5%, thanks to major projects, including EXPO 2027, as well as transport and housing initiatives.

• Ukraine: despite the war, the outlook is positive, thanks to large-scale reconstruction and infrastructure programs.

• Croatia: expected moderate growth of ~2.3%.

Countries with decline or stagnation

• North Macedonia: forecasts a decline of ~3.4% due to a slowdown in investment.

• Bosnia and Herzegovina: a decline of up to ~–6.2%, reflecting economic difficulties.

• Albania: expected sharp decline to ~–7.9% due to weak investment potential and economic uncertainty.

EECFA (Eastern European Construction Forecasting Association) is an association that publishes semi-annual reviews and forecasts for the region’s construction markets.

The review covers countries in Southeast Europe, the EU, and countries with economies in transition. The forecast covers both residential and infrastructure construction, as well as projects in the healthcare, education, and industrial sectors.

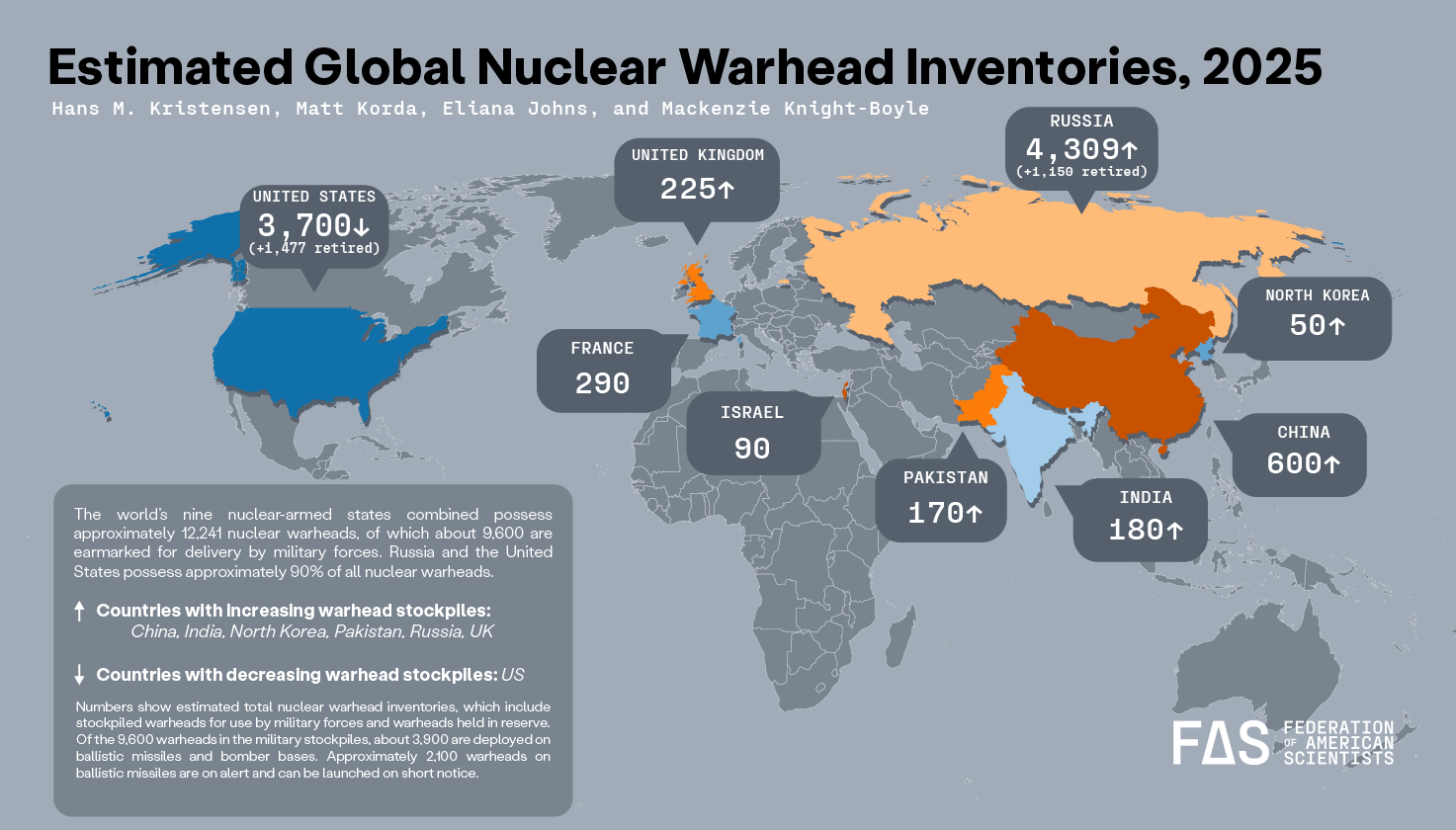

Over the past eight decades, the world has come a long way from the creation of the first nuclear warheads to the formation of a multi-level global deterrence system based on nuclear balance. According to an analysis conducted by the Experts Club information and analytical center based on statistics from the Federation of American Scientists (FAS), the most rapid growth in the number of nuclear weapons occurred between 1945 and 1986. After the first atomic bombs were tested in the US in 1945, the Soviet Union joined the race, and by the 1950s, an arms race had begun, in which the US had the upper hand in the early stages, with over 3,000 warheads.

This period was marked by global confrontation within the framework of the Cold War, an arms race, and the active expansion of the nuclear club.

In the 1960s, the USSR gradually caught up with the US in terms of numbers and eventually surpassed it. The race peaked in 1986, when the total number of nuclear warheads in the world reached a record high of almost 70,000, of which more than 40,000 belonged to the Soviet Union.

After the end of the Cold War in the 1990s, the US and Russia initiated a large-scale reduction of their arsenals, removing some of the warheads from combat duty or disposing of them in accordance with international agreements. By 2023, the total number of nuclear warheads in the world had decreased to approximately 12,500, of which about 9,600 are active, while the rest are in reserve or awaiting dismantlement.

Today, there are nine countries in the world that officially possess nuclear weapons. The largest arsenals are held by Russia (5,889 units) and the United States (5,244 units). China is actively building up its nuclear capabilities and already has about 410 warheads. France and the United Kingdom have 290 and 225 units, respectively. India and Pakistan have about 170 and 165 warheads, respectively, and Israel has an estimated 90. North Korea is estimated to have up to 30 warheads, but its potential is considered highly uncertain due to the country’s secrecy. South Africa is a special case, as it is the only country that voluntarily renounced nuclear weapons, completely dismantling its arsenal in the 1990s.

“The dynamics of change in nuclear capabilities demonstrate the extraordinary flexibility and, at the same time, vulnerability of the global security system. For many years, nuclear weapons have been not only an element of deterrence but also an instrument of political blackmail, allowing individual states to influence the international agenda. Today, we are seeing an alarming trend: despite the overall reduction in stockpiles in leading countries such as the US and Russia, certain countries — primarily China and North Korea — are demonstrating growing ambitions, indicating a potential return to the arms race. And if the international community fails to develop effective control and limitation mechanisms, we risk facing a new phase of nuclear confrontation, which will be even more dangerous due to the presence of unstable regimes, technological breakthroughs, and cyber threats,” comments Maxim Urakin, founder of the Experts Club analytical center.

In conclusion, it should be emphasized that the current nuclear security architecture needs to be revised. The conditions of the new geopolitical reality require not only maintaining parity, but also creating international mechanisms capable of preventing the proliferation of nuclear weapons and reducing the risk of their use in new types of conflicts. Without global dialogue, transparency, and trust, the future of global security will remain under threat.

For more information, visit the Experts Club YouTube channel.

In the winter of 2025, Vertex Pharmaceuticals presented the results of the first large-scale study (phase I/II) of zimislecel (formerly VX-880), a stem cell-based drug. This experimental treatment aims to restore the cells of the islets of Langerhans in the liver of patients.

The trial involved 14 patients with severe type 1 diabetes and hypoglycemia detection disorders. All participants received a single infusion of zimislecel into the hepatic vein and initial immunosuppressive therapy without glucocorticoids. According to data from one year, 10 out of 12 completely stopped insulin injections, becoming insulin-independent, while the remaining two patients reduced their insulin dose by 92% on average. All participants normalized their HbA1c levels (<7%) and spent more than 70% of their time in the glycemic range of 70-180 mg/dL.

Side effects:

• Neutropenia was observed in 3 patients;

• Two fatalities were recorded: one from cryptococcal meningitis (off-protocol), the other from severe cognitive pathology unrelated to treatment.

The discontinuation of insulin therapy in 83% of participants is a very significant achievement, indicating the possibility of restoring endogenous insulin secretion. The American Diabetes Association (ADA) called the data “unprecedented” after three stages of presentation at the ADA-2025 conference in Chicago.

However, it should be noted that the study was small (12–14 participants) and short (12 months); large-scale control experience is needed. Data on long-term efficacy, safety, and commercial affordability are not yet known.

Phase III has now begun, with approximately 50 patients expected to participate. The next results are expected at the end of the year, after which the FDA application process will begin.

The drug is positioned as a breakthrough “functional remission” for a group of patients with severe diabetes and a tendency to hypoglycemic events. If its effectiveness is fully confirmed, it will be a global revolution in the treatment of type 1 diabetes.