The National Bank of Ukraine fined Industrialbank 400,000 hryvnia and six non-bank financial institutions for violating currency legislation in July 2025 for violating legislation in the field of preventing and combating the legalization (laundering) of proceeds from crime, financing terrorism, and financing the proliferation of weapons of mass destruction (AML/CFT). In July 2025, the NBU fined Industrialbank UAH 400,000 and six non-bank financial institutions, and issued a warning to Ukrposhta.

As noted in a release on the central bank’s website, the largest fine—UAH 9,632,850—was imposed on Lineura Ukraine LLC (TM Credit 7), which ranked sixth among non-bank financial institutions in the market with income from financial services of UAH 470.7 million in the first quarter of this year.

The fine imposed on FC Mare LLC amounted to UAH 595 thousand, and on FC Midl LLC, which recently had its license revoked by the National Bank, UAH 340 thousand.

In addition, ProfitGuide LLC was fined UAH 170,000, and Miloan LLC was fined UAH 51,000.

As for Ukrposhta, it received a written warning for violating requirements regarding the improper development and implementation of internal documents in the field of AML/CFT, as well as the lack of procedures sufficient to ensure effective risk management.

As reported on Friday by Forbes Ukraine, the National Bank notified the government of the need to recapitalize Ukrposhta by approximately UAH 820 million, without which the national postal operator will not only be unable to launch a postal bank, but may also lose its license to provide financial services.

On August 8, the municipal enterprise Kyivpastrans announced a tender for compulsory motor third-party liability insurance for owners of land vehicles (OSAGO) of categories D1, D2, 1,145 units.

According to the Prozorro electronic public procurement system, the expected cost of the services is UAH 25.054 million.

Applications for participation in the tender will be accepted until August 18.

Passenger traffic across the Ukrainian border during the week of August 2-8 increased by 1.6% to 778,000, setting a new record for wartime: last year, the highest passenger traffic was also recorded in August, but amounted to 737,000.

According to data from the State Border Service on Facebook, the outbound flow in the tenth week of summer increased from 367,000 to 376,000, while the inbound flow increased from 399,000 to 401,000.

Last weekend, 123,000-129,000 border crossings were recorded daily, and this Saturday, 120,000.

The number of vehicles that passed through checkpoints this week increased from 141,000 to 142,000, while the flow of vehicles carrying humanitarian cargo decreased slightly from 538 to 570.

“With the start of the summer season, passenger traffic through the checkpoints in the Lviv region has increased by 40%, and on weekends the load increases even more – by an average of 16% compared to weekdays,” the Western Regional Administration of the State Border Service said in a statement.

According to the report, the busiest checkpoints are Krakivets, Shehyni, and Ustyluh, with average traffic recorded at Hrushev, Uhryniv, and Rava-Ruska, while the least busy are Smilnytsia and Nizhankovychi.

This Sunday, as of 12:00, according to the State Border Service, the longest queue of 60 cars was at the Ustyluh checkpoint on the Polish border. Thirty-five cars were waiting to cross the border at the Hrushev checkpoint, 30 at the Uhryniv checkpoint, 25 at the Krakivets checkpoint, and 10 at the Shehyni checkpoint.

On the border with Hungary, the longest queue of 30 cars was at the Luzhanka crossing, while at the Vilok and Dzvinkovo checkpoints there were 20 cars each, at Kosino there were 15, and at Tisa there were 5.

At the border with Slovakia, 35 and 25 cars were waiting for inspection at the Uzhgorod and Maly Berezny checkpoints, respectively, and at the border with Romania, there were queues of 60 cars at the Porubne checkpoint and 15 at the Dyakovo checkpoint.

The total number of people crossing the border this year is 5.7% higher than last year: during the same seven days last year, 356,000 people left Ukraine and 380,000 entered, and the flow of cars was also lower – 137,000.

As reported, from May 10, 2022, the outflow of refugees from Ukraine, which began with the start of the war, was replaced by an influx that continued until September 23, 2022, and amounted to 409,000 people. However, since the end of September, possibly influenced by news of mobilization in Russia and “pseudo-referendums” in the occupied territories, followed by massive shelling of energy infrastructure, the number of people leaving exceeded the number entering. In total, from the end of September 2022 to the first anniversary of the full-scale war, it reached 223,000 people.

During the second year of the full-scale war, the number of border crossings out of Ukraine exceeded the number of crossings into the country by 25,000, according to the State Border Service, by 187,000 in the third year, and by 128,000 since the beginning of the fourth year, of which 108,000 were seasonal since the beginning of summer.

As Deputy Minister of Economy Serhiy Sobolev noted in early March 2023, the return of every 100,000 Ukrainians home results in a 0.5% increase in GDP.

In its July inflation report, the National Bank worsened its migration forecast: while in April it expected a net inflow of 0.2 million people to Ukraine in 2026, it now forecasts a net outflow of 0.2 million, which corresponds to the estimate of the net outflow this year. “Net returns will only begin in 2027 (about 0.1 million people, compared to 0.5 million in the previous forecast),” the NBU added. In absolute terms, the National Bank estimates the number of migrants currently remaining abroad at about 5.8 million.

According to updated UNHCR data, the number of Ukrainian refugees in Europe as of July 31, 2025, was estimated at 5.115 million (5.083 million as of July 1), and 5.676 million worldwide (5.643 million).

In Ukraine itself, according to the latest UN data for April this year, there were 3.757 million internally displaced persons (IDPs), compared to 3.669 million at the end of last year.

The Department of Health of the Kyiv City State Administration reports a multiple increase in the number of hospitalizations due to COVID-19 in the Ukrainian capital since the beginning of July.

“If as of July 1, 15 people were in the infectious disease departments of inpatient communal medical institutions, at the moment – 68, 24 of them – children. It is clear that in hospitals get those whose course of illness can not be called mild and who need constant monitoring of medics, serious treatment, oxygen support, etc.,” – reported on the page of the Department in Facebook on Thursday evening.

The post notes that staying in shelters – enclosed spaces with limited ventilation – increases the risk of infection, including COVID-19. “Don’t forget your mask in closed confined spaces…. Wash your hands regularly or use antiseptic. Stay at home and seek medical attention at the first symptoms,” the department advised.

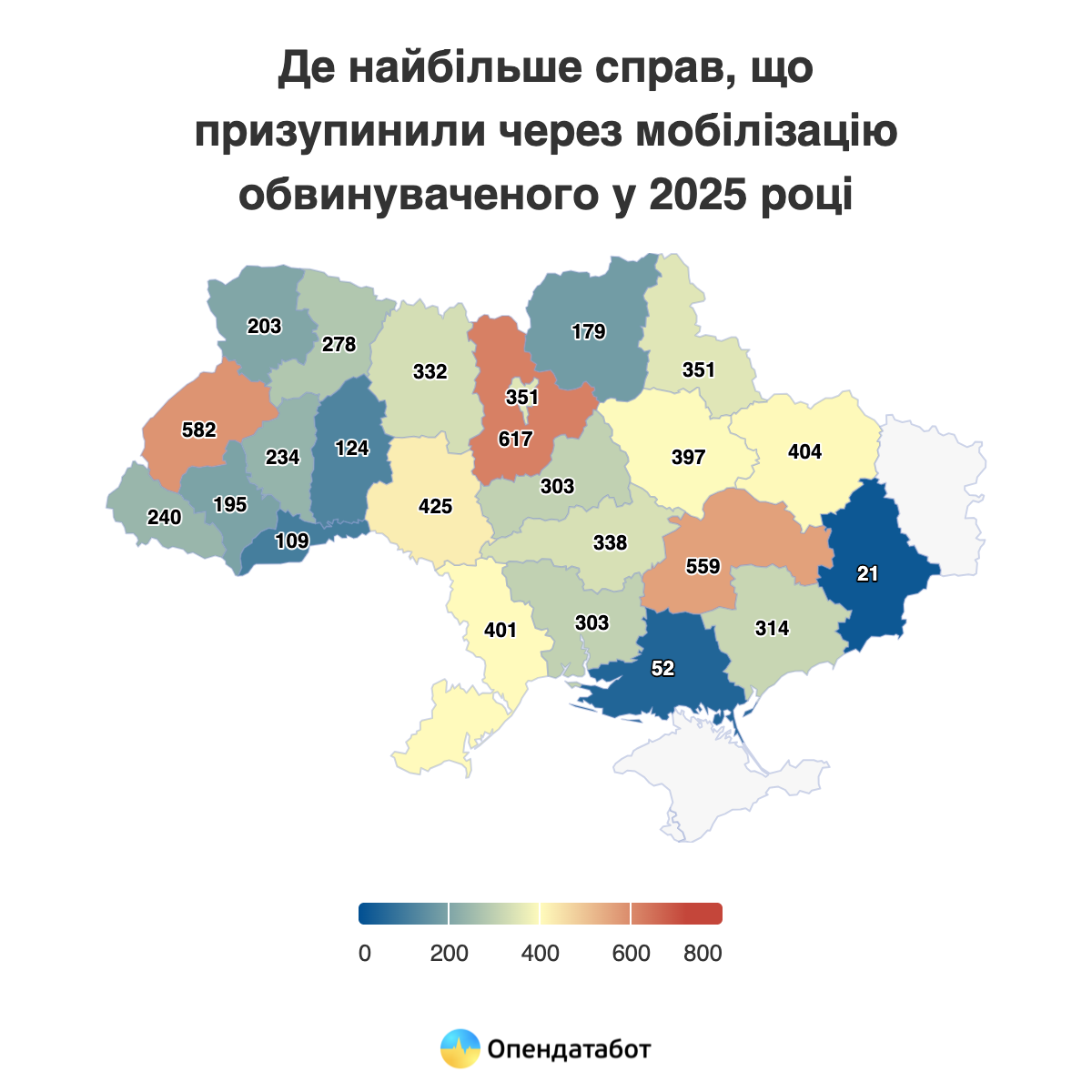

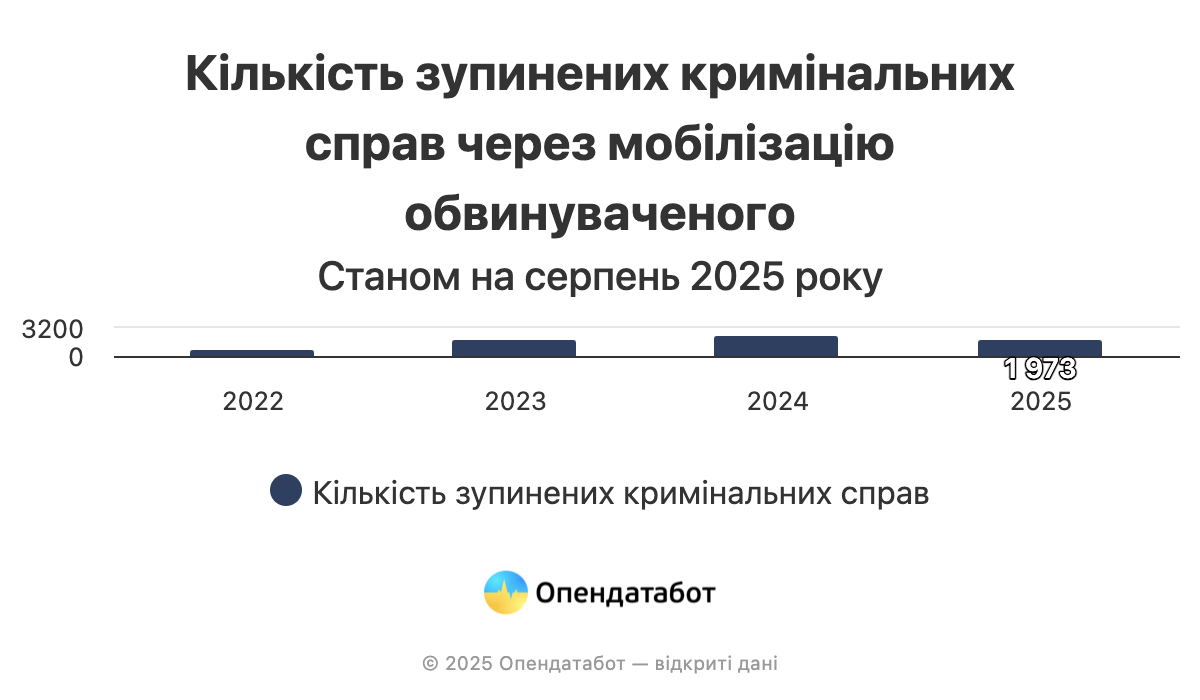

At least 7.3 thousand criminal cases have been suspended due to the defendant’s conscription into the army since the beginning of the full-scale invasion, according to the court registry search engine Babusya. Thus, this year, more than 1,900 cases have been suspended due to the mobilization of the accused. This is almost as many as for the whole of 2023. The largest number of such cases this year is in Kyiv, Lviv, and Dnipro regions.

At least 7,312 criminal proceedings have been suspended due to the mobilization of the accused into the Armed Forces since the beginning of the full-scale invasion. This legal mechanism appeared in 2022, when the Criminal Procedure Code of Ukraine was amended, and since then it has been actively used by the courts.

The number of such suspensions is growing from year to year. For example, 858 cases were suspended in the first year of the full-scale program, and the number of such cases has only increased every year. The record year was 2024, when 2,406 cases were stopped where the accused joined the Armed Forces. This year, there are already 1973 suspended cases.

Most of the decisions to suspend cases due to mobilization were made in Kyiv region – 617. The second place is occupied by Lviv region (582), and the third place is occupied by Dnipropetrovs’k region (559).

It should be understood that the suspension of proceedings is not the same as automatic exemption from liability. However, in fact, the case is postponed indefinitely. This creates an opportunity for abuse – especially in high-profile corruption cases or when it comes to rear-guard positions where participation in hostilities is not required.

That is why the Verkhovna Rada has registered draft law No. 13284, which proposes to amend the Criminal Code and the Criminal Procedure Code regarding the specifics of prosecuting persons called up for military service. In particular, it provides for the possibility of continuing pre-trial investigation and trial of cases on certain categories of crimes, even despite the mobilization of the accused.

The new draft law should also reduce opportunities for abuse of mobilization: the suspension of proceedings should be clearly limited to cases of direct participation of the accused in defense measures, confirmed by a combat order (instruction) issued by the commander of a military unit or subdivision.

“Currently, there is obviously a lack of a mechanism to appeal the suspension of proceedings and resume the proceedings in cases where the court or a party abuses its right. Of course, mobilization should not become a circumstance that offsets the fundamental principles of criminal procedure, in particular, the implementation of the principle of access to justice, competition and inevitability of punishment. However, we should also think about a person who, risking his life, wants to at least whitewash his reputation, but is unable to defend himself in court while at war,” comments Tetiana Popovska, senior associate at Asters.

https://opendatabot.ua/analytics/mobilization-and-court

The Antimonopoly Committee of Ukraine (AMCU) found LLC “Marxoll” (formerly LLC “Dryada Zakhid”) and LLC “Ligna Ukraine” guilty of collusion during their participation in two tenders for the purchase of plastic cassettes (with an estimated value of UAH 34,470,680.00) and the purchase of tags for marking timber (with an estimated value of UAH 26,534,070.00) held by the state-owned enterprise Lesa Ukrainy in 2023 and 2024, the press service of the agency reported.

The committee established circumstances which, taken together, indicate that the companies engaged in anti-competitive concerted actions with the aim of eliminating competition between them during their participation in the aforementioned tenders. The facts revealed showed joint and coordinated behavior by the companies in preparing for and participating in the tenders, as well as communication between them and the exchange of information, the statement said.

The AMCU recognized the actions of Markosoll LLC and Ligna Ukraine LLC as a violation of competition law under paragraph 4 of part 2 of Article 6, and Article 50(1) of the Law “On Protection of Economic Competition,” which led to a distortion of the tender results, and fined them a total of UAH 5,495,260.

The agency recalled that, according to the Law “On Public Procurement,” the basis for refusing to participate in a procurement procedure is the fact that a business entity (participant) has been held liable within the last three years for committing anti-competitive concerted actions related to the distortion of tender results.