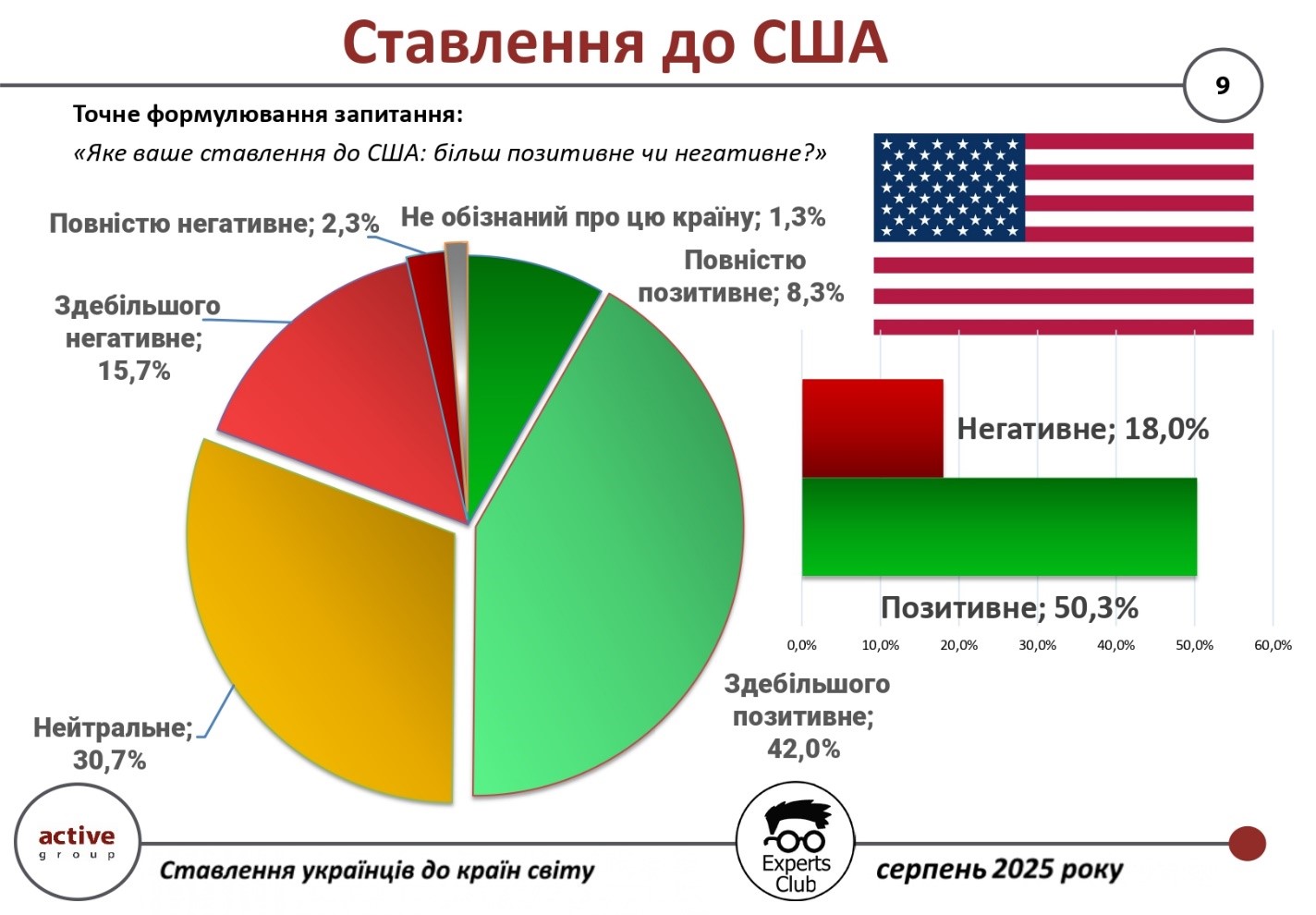

The United States remains the main strategic partner in the world for Ukrainians, but there is still a significant segment of critical and neutral attitudes in society. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 50.3% of Ukrainian citizens have a positive attitude towards the United States (42.0% – mostly positive, 8.3% – completely positive). Only 18.0% of respondents expressed a negative attitude (15.7% – mostly negative, 2.3% – completely negative). Another 30.7% of Ukrainians are neutral, and 1.3% said they were not sufficiently aware of the country.

“The United States remains a key ally for Ukraine in the military, political, and diplomatic spheres. However, the trade and economic dimension is also worth noting: in the first half of 2025, bilateral trade exceeded $2.85 billion, of which exports from Ukraine amounted to $544.5 million and imports from the United States exceeded $2.31 billion. The negative balance of $1.77 billion shows a high level of dependence on American goods, but at the same time indicates the scale of cooperation and the importance of the United States for our economy,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, emphasized that sociological indicators reflect a complex but stable system of trust.

“Ukrainians highly appreciate the US assistance in the war and international politics. Despite some critical assessments, half of the citizens perceive the United States positively, and almost a third remain neutral. This means that the United States continues to be the No. 1 country for Ukrainian society in the security dimension, and economic cooperation only strengthens this position,” he added.

The survey was part of a comprehensive study of international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video is available here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN, USA

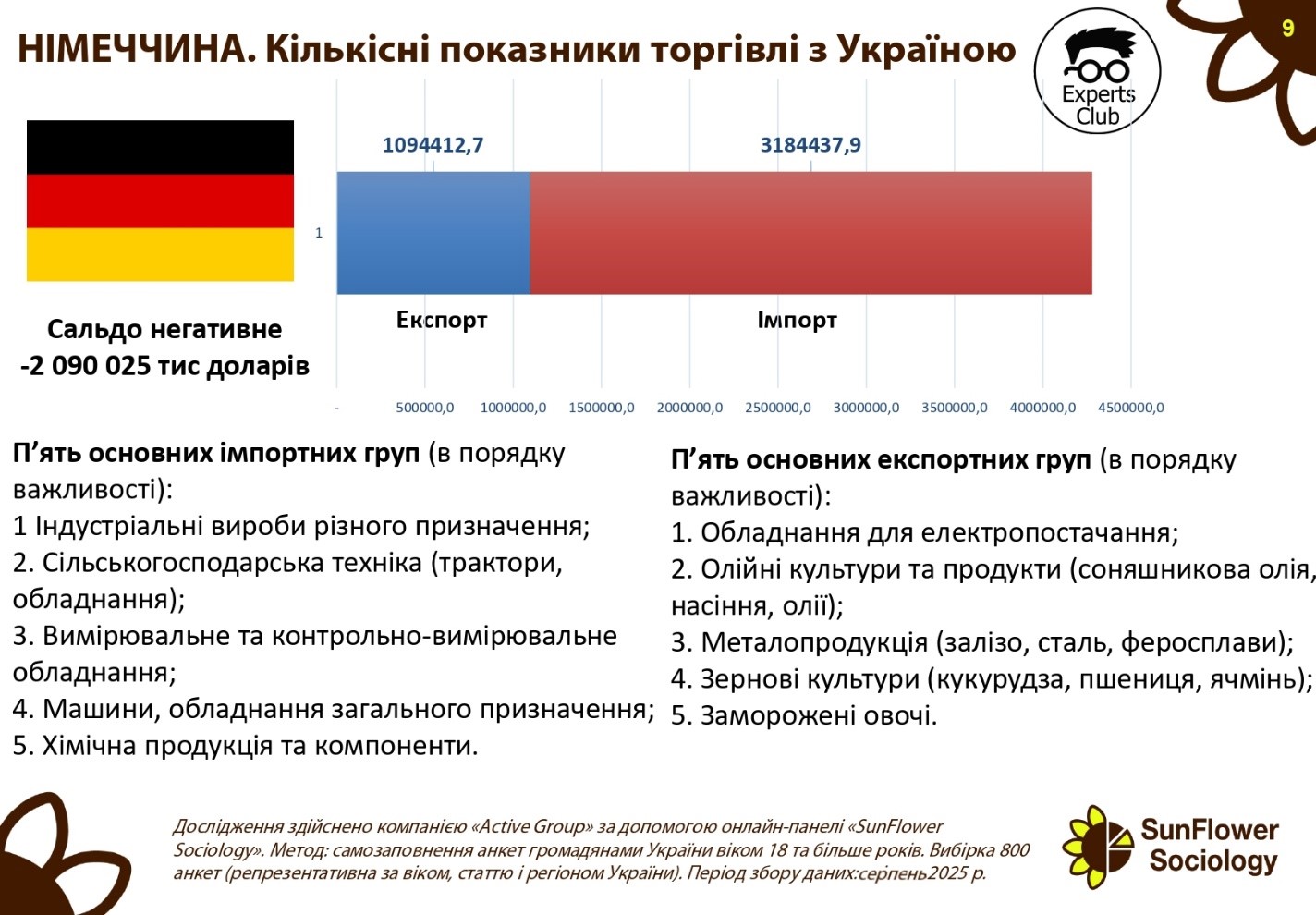

Germany is one of the countries that enjoy the greatest trust and sympathy among Ukrainians. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 76.7% of Ukrainian citizens have a positive attitude toward Germany (51.3% are mostly positive, 25.3% are completely positive). Only 4.0% of respondents expressed a negative attitude (3.3% – mostly negative, 0.7% – completely negative). Another 18.7% of Ukrainians are neutral, and 1.0% admitted that they do not know enough about this country.

“For Ukrainians, Germany is first and foremost a guarantor of stability in the European Union, a country that made a huge contribution to supporting Ukraine during the war. At the same time, economic cooperation is also essential: in the first half of 2025, bilateral trade exceeded $5.63 billion, of which Ukrainian exports amounted to $1.58 billion and imports from Germany exceeded $4.05 billion. The negative balance of about $2.5 billion demonstrates that we import more than we export, but this reflects the high demand for German technology and equipment,” said Maksym Urakin, founder of Experts Club.

In turn, Oleksandr Poznyi, co-founder of Active Group, emphasized that the positive attitude of Ukrainians goes far beyond the economy.

“Germany is viewed as a strategic ally in the political and security dimensions. Hundreds of thousands of Ukrainian refugees have found refuge there, and large-scale financial and military assistance plays a key role in the stability of our country. The combination of these factors explains why more than three-quarters of Ukrainians have a positive attitude towards Germany and why this country remains among the absolute leaders of trust in our society,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video is available here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, GERMANY, Poznyi, SOCIOLOGY, TRADE, URAKIN

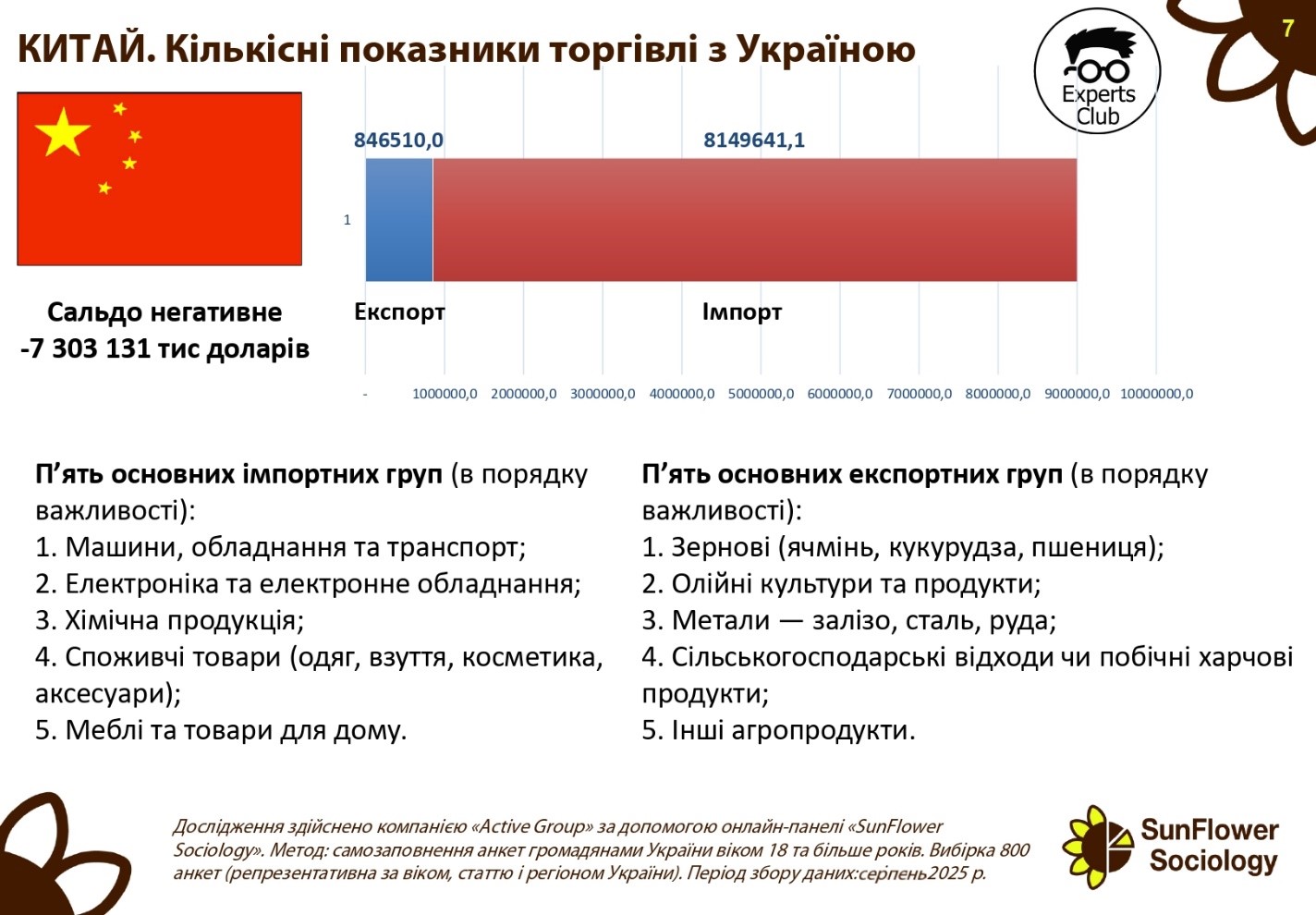

The attitude of Ukrainians toward China remains complex and controversial: a neutral position prevails, but among those who have decided, negative assessments significantly outweigh positive ones. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 44.7% of Ukrainian citizens expressed a neutral attitude toward China. At the same time, 40.7% of respondents indicated that their assessment was negative (30.0% – mostly negative, 10.7% – completely negative). Only 12.0% of Ukrainians have a positive attitude toward China (8.3% – mostly positive, 3.7% – completely positive). Another 3.0% of respondents admitted that they did not know enough about the country to express their own opinion.

“Negative attitudes toward China among Ukrainians are primarily related to its foreign policy stance, which many people find ambiguous in the context of global events. However, the economic factor is extremely important: in the first half of 2025, China remained Ukraine’s No. 1 trading partner. Our exports to China amounted to more than $846 million, while imports exceeded $8.1 billion. This means that China’s influence on the Ukrainian economy is extremely significant, and it is simply impossible to ignore it,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, drew attention to the importance of separating economic interests from public perception.

“The survey shows that Ukrainians are not ready to unequivocally perceive China as an ally. For many, it remains an alienated state, and a significant share of negative assessments is explained by the global political context and lack of trust. At the same time, economic cooperation is so extensive that it could become the basis for a gradual change in public opinion in the future,” he added.

The poll is part of a broader study that analyzes international sympathies and antipathies of Ukrainians in the current geopolitical environment.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, CHINA, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, URAKIN

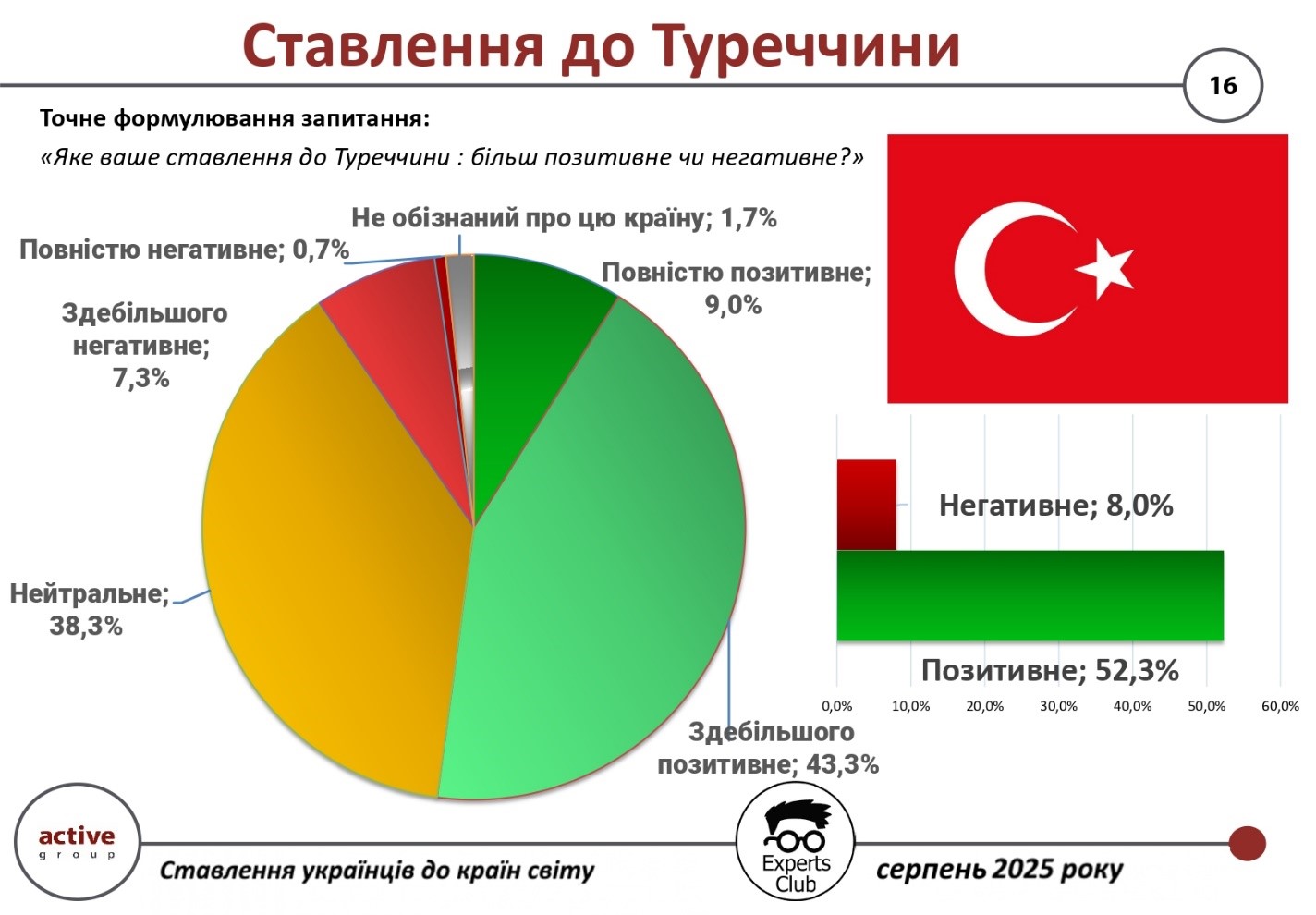

Turkey remains one of the most positively perceived countries in the region for Ukrainians, driven by both political and economic factors. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 52.3% of Ukrainian citizens have a positive attitude towards Turkey (43.3% – mostly positive, 9.0% – completely positive). Only 8.0% of respondents expressed a negative attitude (7.3% – mostly negative, 0.7% – completely negative). Another 38.3% of Ukrainians are neutral, and 1.7% admitted that they do not know enough about this country.

“For Ukraine, Turkey is not just a neighbor across the Black Sea, but a strategic partner with whom we have established close trade and economic ties. In the first half of 2025, the volume of bilateral trade exceeded $4.66 billion, of which exports from Ukraine amounted to more than $2.58 billion and imports from Turkey amounted to about $2.08 billion. The positive balance of more than $500 million shows that these relations are beneficial for the Ukrainian economy,” said Maksym Urakin, founder of Experts Club.

In his turn, Oleksandr Poznyi, co-founder of Active Group, noted that the high level of positive assessments is explained not only by economic factors.

“Turkey is actively supporting Ukraine, which cannot be ignored by society. At the same time, the tourist destination, cultural contacts, and historical proximity through the Black Sea region create an additional level of sympathy among Ukrainians. This allows Turkey to occupy a consistently high position among the countries friendly to Ukraine,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, Poznyi, SOCIOLOGY, TRADE, TURKEY, URAKIN

Poland remains one of the most positively perceived countries by Ukrainians, despite some controversies in bilateral relations. This is evidenced by the results of an all-Ukrainian survey conducted by Active Group in cooperation with the Experts Club information and analytical center in August 2025.

According to the survey, 56.7% of Ukrainian citizens have a positive attitude towards Poland (44.3% – mostly positive, 12.3% – completely positive). Only 12.7% of respondents expressed a negative attitude (11.3% – mostly negative, 1.3% – completely negative). Another 30.0% of Ukrainians are neutral, and 1.0% said they are not sufficiently aware of this country.

“For Ukrainians, Poland is not only a neighbor, but also one of their key economic partners. In the first half of 2025, total trade between Ukraine and Poland exceeded $6.66 billion. At the same time, exports from Ukraine amounted to $3.03 billion, and imports from Poland exceeded $3.62 billion. The negative balance of $591 million does not seem critical, given the scale and strategic nature of cooperation,” said Maksym Urakin, founder of Experts Club.

In turn, co-founder of Active Group Oleksandr Poznyi emphasized that the positive attitude of Ukrainians towards Poland has deeper reasons than just the economy.

“We are talking about historical proximity, support for Ukrainian refugees, and Warsaw’s political solidarity in important international issues. At the same time, the economic dimension only strengthens these relations, making Poland one of Ukraine’s leading partners both in the EU and globally. It is the combination of political, humanitarian and economic components that explains the high level of sympathy in society,” he added.

The survey was part of a broader study of international sympathies and antipathies of Ukrainians in the current geopolitical context.

The full video can be viewed here:

https://www.youtube.com/watch?v=YgC9TPnMoMI&t

You can subscribe to the Experts Club YouTube channel here:

https://www.youtube.com/@ExpertsClub

ACTIVE GROUP, DIPLOMACY, EXPERTS CLUB, POLAND, Posniy, SOCIOLOGY, TRADE, URAKIN

Ukraine has announced a tender to conclude a production sharing agreement (PSA) for the Dobra lithium deposit (Kirovohrad region) to prospect, extract and enrich lithium, niobium, rubidium, tantalum, cesium, beryllium, tungsten and gold for a period of 50 years.

According to a report in the Uriadovyi Kurier newspaper and on the website of the Ministry of Economy, the minimum investment for exploration is the equivalent of $12 million, and for the organization of mining and processing of lithium-containing minerals and other metallic minerals – $167 million, but the final obligations are determined by the results of the tender. The total area of the site is 17.07 square kilometers, the deadline for submitting applications for participation in the tender is December 12, 2025, and the participation fee is UAH 0.5 million.

According to the terms, the maximum share of compensation products that will reimburse the investor for its costs is 70% of the total output until the investor’s costs are fully reimbursed, while the state’s share in profitable products should be at least 4-6%.

The Ministry of Economy clarified to Interfax-Ukraine that comparing such a share of the state in profitable products with a similar indicator for oil and gas PSAs, where it is significantly higher, is not correct, as this is the first PSA in the history of Ukraine for metal ores.

It is noted that the reserves and resources of lithium ores at the site were approved by decisions at the end of 2017 and in 2018 in the amount of C2 and P1 categories – 1 million 218.14 thousand tons (average Li2O content of 1.37%) and P2 – 70.6 thousand tons (average Li2O content of 1.43%).

Separately, the State Commission of Ukraine for Mineral Resources (SCR) noted the presence of prospective and inferred resources of associated mineral components (P1+P2) in lithium ores at Dobra: Ta2O5 – 4.75 thousand tons; Nb2O5 – 8.24 thousand tons; Rb2O5 – 104.07 thousand tons; BeO – 22.08 thousand tons; SnO2 – 4.46 thousand tons and Cs2O – 7.97 thousand tons.

“In addition, by the protocol dated 31.07.2002 No. 35, the resources of cat. P2 for the Novostankuvatske manifestation were estimated: Ta2O5 – 1414.22 tons (0.0127-0.0134%); Nb2O5 – 1734.5 tons (0.0163%); Li2O – 85196.1 tons (0.7541%); Rb2O5 – 9859.3 tons; Cs2O – 1493.6 tons; BeO – 3588.9 tons; SnO2 – 447.9 tons; WO3 – 8862.3 tons (cat. P3; 0.177%); at the Tashlykskoye ore occurrence: Ta2O5 – 480.32 tons (0.0106-0.0854%); Li2O – 13,596.4 tons (0.6291%); Rb2O5 – 1371.9 tons; Cs2O – 345.4 tons; BeO – 447.4 tons; SnO2 – 106.9 tons; Nb2O5 – 903.0 tons (0.0244%); Lutkivske deposit: WO3 – 2292.4 t (cat. P3; 0.101-0.378%); Kontaktovoye ore occurrence: Au – 2.05 t (4.08 g/ton); on the Stankuvatskoye ore occurrence: Au – 1.78 tons (1.3-2.5 g/t). For the Severostankuvatskoye ore occurrence, the operationally estimated Li2O resources are: cat. P1 – 269.93 thousand tons and cat. P2 – 140.82 thousand tons with an average Li2O grade of 1.3548%,” the announcement reads.

The winner of the tender must ensure geological exploration of the subsoil and international audit of reserves at the site within two and a half years and submit materials on the assessment of lithium and other metal minerals reserves to the State Committee for the approval of such reserves.

After the conclusion of the PSA, the investor is obliged, among other things, to prospect, extract and enrich (primary processing) lithium and possibly other metal minerals, and to ensure the comprehensive development and mining of the metal mineral deposit.

In addition, the PSA tender documentation for the first time includes obligations for the investor related to the agreement signed at the end of April this year to establish the US-Ukraine Reconstruction Investment Fund, which has the priority right to invest in new projects for the extraction of rare earth materials and purchase their products.

In mid-June, the head of the President’s Office, Andriy Yermak, said that the development of the Dobra lithium deposit could become the first pilot project in cooperation with the United States.

In early July, the mining investment company TechMet (Dublin), one of the largest investors of which is the US government through DFC, announced its interest in participating in the first PSA tender for lithium mining in Ukraine and, if it wins, building processing facilities with investments of more than $0.5 billion. Recently, a delegation of DFC accompanied by the heads of the Ministry of Economy of Ukraine visited Kirovohrad region.

At the same time, the US-based Critical Metals Corp also claims its rights to the Dobra site, linking them to the transfer of assets from Australia’s European Lithium, which, in turn, received these rights from Ukraine’s Petro-Consulting LLC.