Experts Club Information and Analysis Center has analyzed the inflation rate in Hungary and its trends in Hungary in recent years. Inflation in Hungary in 2025 continues to decline after record highs in 2022-2023. As of March 2025, annual inflation stood at 4.7%, down from 5.6% in February.

The main drivers of inflation

The decline in inflation is due to stabilizing food and energy prices. However, rising rental prices and services continue to put pressure on the overall price level

Government and central bank measures

The central bank of Hungary maintains the key interest rate at 6.5% to contain inflationary pressures. The government is taking steps to control prices in key sectors of the economy.

Outlook

Experts expect inflation to continue to decline to around 3.5% in 2026, approaching the central bank’s targets

Year Inflation (%)

2000 9,79

2001 9,15

2002 5,26

2003 4,66

2004 6,75

2005 3,56

2006 3,90

2007 7,95

2008 6,06

2009 4,20

2010 4,87

2011 3,93

2012 5,66

2013 1,71

2014 – 0,23

2015 -0,07

2016 0,40

2017 2,35

2018 2,84

2019 3,37

2020 3,33

2021 5,11

2022 14,61

2023 17,13

2024 3,8

2025 4.7 (March)

On April 17, the Patrol Police Department announced its intention to conclude with IC “Guardian” (Kiev) a contract of compulsory insurance of civil liability of owners of land vehicles (MTPL) for 1,585 units.

As reported in the system of electronic public procurement Prozorro, the company’s price offer amounted to UAH 8.147 million against the expected cost of purchasing services of UAH 8.384 million.

The company was the only bidder.

IC “Guardian” is a member of the Presidium of the League of Insurance Organizations of Ukraine. Since January 2020 it has received the status of a full member of the ITSBU, has the right to sell “Green Card” policies.

In October, 2020 by the decision of the general meeting of members of the Nuclear Insurance Pool of Ukraine IC “Guardian” became its member.

IC Guardian, INSURANCE, Motor transport, MTPL insurance, Patrol police

Experts Club Information and Analytical Center has analyzed the inflation rate and its trends in Romania in recent years. Inflation in Romania in 2025 continues to show a moderate decline, while remaining above the National Bank’s target level. According to the National Institute of Statistics, in March 2025, annual inflation amounted to 4.86%, down from 5.02% in February.

Main components of inflation in March 2025.

Food products: price increase by 5.10%

Non-food products: increase by 3.84%

Services: up 6.99%

The greatest pressure on the overall price level is exerted by services, especially health care, education and utilities.

Historical inflation dynamics

To understand current trends, let’s look at the inflation rate in Romania in recent years.

2021: 5.05%

2022: 13.80%

2023: 10.40%

2024: 5.60%

These data show a significant increase in inflation in 2022, driven by global economic turmoil, and a gradual decline thereafter.

According to the European Commission’s forecasts, inflation in Romania is expected to continue to decline, reaching 3.4% by the end of 2025. However, risks related to fiscal policy and possible changes in tax legislation remain.

Romania’s central bank is taking a cautious approach, aiming to reduce inflation without damaging economic growth. With upcoming elections and increased public spending, the scope for further interest rate cuts is limited.

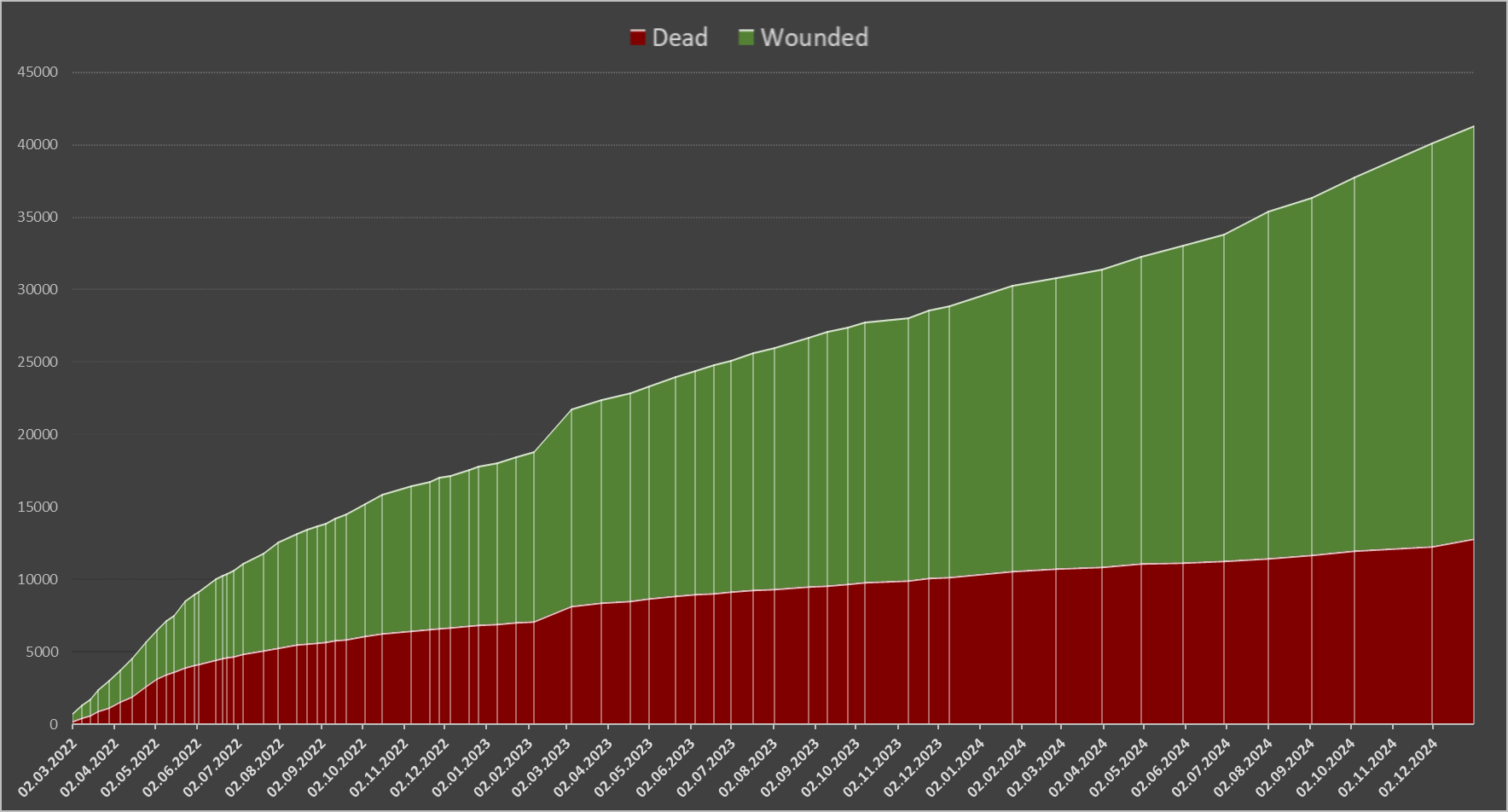

Number of dead and wounded civilians in Ukraine from 24.02.2022 till 31.12.2024 un data

Source: Open4Business.com.ua