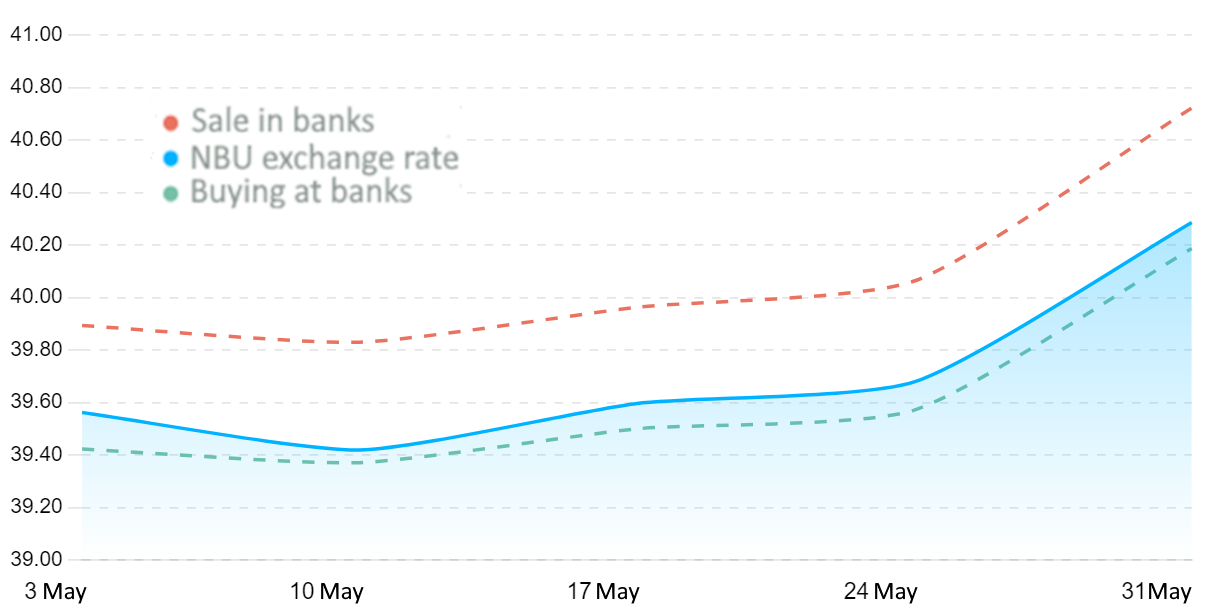

Quotes of interbank currency market of Ukraine (UAH for $1, in 01.05.2024-31.05.2024)

Source: Open4Business.com.ua

Astarta Agro-Industrial Holding, the largest sugar producer in Ukraine, supplied 1.26 million tons of agricultural products to foreign markets in the 2023-2024 marketing year, the company’s press service reported on Facebook.

According to the report, the agricultural holding exported 512 thousand tons of corn, 375 thousand tons of wheat, 140 thousand tons of sugar, 125 thousand tons of meal, 43 thousand tons of soybean oil, 45 thousand tons of rapeseed and other agricultural products.

The main consumers of corn were Spain, Egypt, Italy, and Ireland. Spain, Indonesia, Romania, Portugal, and Italy were the main consumers of wheat. Sugar was supplied to the markets of Europe, the Middle East and Africa. Meal and soybean oil were exported to Hungary, Poland, the UAE, Romania, and Saudi Arabia. The main consumers of organic products are Switzerland, the Czech Republic, France, and Germany.

In total, Astarta’s agricultural products were exported to 46 countries, the agricultural holding summarized.

In 2023, Astarta, the largest sugar producer in Ukraine, reduced its net profit by 5.0% to EUR 61.9 million, and its EBITDA decreased by 6.1% to EUR 145.77 million, while revenue increased by 21.3% to EUR 618.93 million.

Astarta CEO Viktor Ivanchik’s family currently owns 40.68% of the company. Fairfax Financial Holdings is also a major shareholder with 29.91%, and another 2.12% of shares belong to the company itself and were previously bought back as part of a buyback.

According to the National Bank of Ukraine, as of October 1, 2023, Credit Agricole Bank ranked 11th in terms of total assets (UAH 100.36 billion) among 63 operating banks in the country, with 141 branches. The bank is fully owned by French Credit Agricole SA.

The article collects and analyzes the main macroeconomic indicators of Ukraine. In connection with the entry into force of the Law of Ukraine “On Protection of the Interests of Business Entities during Martial Law or a State of War”, the State Statistics Service of Ukraine suspends the publication of statistical information for the period of martial law, as well as for three months after its termination. The article analyzes open data from the State Statistics Service, the National Bank, and think tanks.

Maksim Urakin, PhD in Economics, founder of the Experts Club think tank and Director of Development and Commerce at Interfax-Ukraine, presented an analysis of macroeconomic trends in Ukraine and the world based on official data from the State Statistics Service of Ukraine, the NBU, the UN, the IMF, and the World Bank.

Macroeconomic indicators of Ukraine

According to the Center’s founder, Maksim Urakin, gross domestic product growth in May 2024 compared to May last year was approximately 3.7%.

“This figure is lower than the April and March levels, which amounted to 4.3% and 4.6%, respectively, due primarily to a drop in electricity generation. At the same time, the positive value of GDP change is related to exports and demand in the construction industry, as well as the recovery in metallurgy and machine building,” Urakin said.

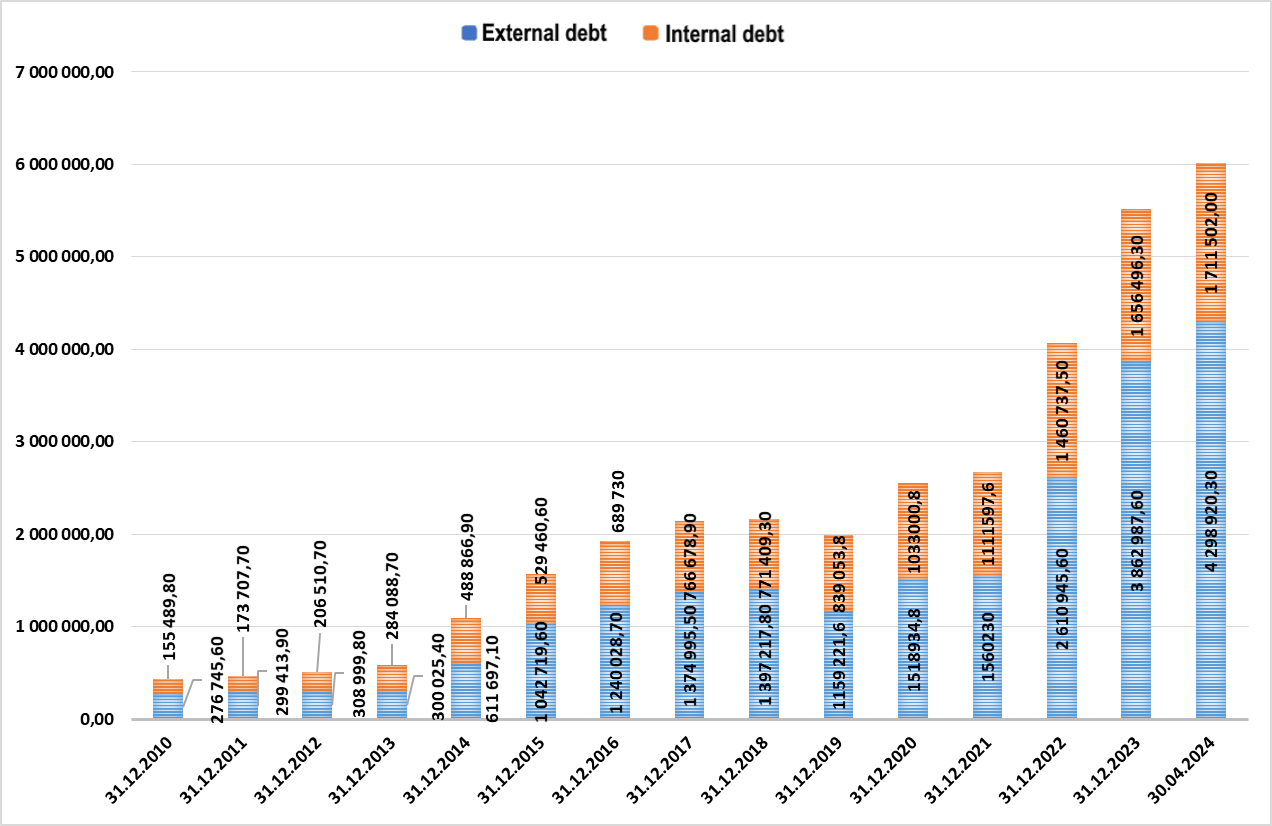

Also, according to Urakin, the total public debt of Ukraine, after reaching a new historical high in April, decreased by $0.53 billion (0.3%) in May and amounted to $150.99 billion. Inflation in Ukraine increased to 0.6% in May compared to 0.2% in April in annualized terms, which is generally in line with the NBU’s target range.

Global economy

Maksim Urakin cited the World Bank’s (WB) forecast, according to which the global economy is expected to grow by 2.6% in 2024 (the earlier forecast assumed growth of 2.4%), and up to 2.7% in 2025-2026.

“In emerging economies, the average annual GDP growth rate in 2024-2025 is expected to reach 4%, which is slightly lower than last year. Growth in low-income countries will accelerate to 5% in 2024 compared to 3.8% in 2023. At the same time, developed countries are expected to grow by 1.5% in 2024 and by 1.7% in 2025,” the expert emphasized.

He also added that the growth prospects of the world’s poorest countries remain ambiguous.

“They face a heavy debt burden, reduced trade opportunities and other factors that negatively affect their economies. These countries need to find ways to stimulate private investment, reduce public debt, and improve education, healthcare, and basic infrastructure,” Urakin said.

According to the founder of the Experts Club, although food and energy prices have declined in all regions of the world, core inflation will remain high in the medium and long term.

JSC CB PrivatBank has put up for sale through the OpenMarket electronic trading system (SE SETAM of the Ministry of Justice of Ukraine) the shopping center “Pryozernyi” in Dnipro. The sale of one of the largest and most attractive shopping centers for retail development in Dnipro is part of the bank’s program of selling non-operating real estate under a transparent and open bidding procedure.

Built in 2009, Priozernyi shopping center is the third largest shopping center in Dnipro (over 32 thousand square meters) and has six above-ground floors and an underground floor with a parking lot and a shelter for visitors during air raids.

“PrivatBank has successfully defended in court the ownership of the Priozerny shopping center, which was transferred to the bank’s balance sheet as collateral for loans before the bank’s nationalization,” says Olena Yevtushenko, Head of Real Estate Management at PrivatBank. – “Retail is not a banking business, so today we are offering a very interesting object at an open auction that can become one of the leaders in the market of retail and entertainment services.

“SETAM has successful experience in selling similar lots from the balance sheets of banks across Ukraine, including PrivatBank. For our part, we guarantee open access to all those wishing to participate (citizens and business representatives) in the auction and an open bidding process,” said Oleksandr Mamro, CEO of SETAM.

The unique advantages of Priozerny shopping center are its convenient location in the city center near the Central Market and railway stations. Also, Priozerny shopping center is currently the only shopping center in the city that has both retail space, office and warehouse space, as well as entertainment and sports areas with swimming pools and a SPA zone.

Depending on the format and size of the outlets, the shopping center can have up to 100 tenants. The shopping center has six elevators and four escalators, a central entrance equipped with a ramp, underground parking for 100 cars, as well as a ground parking lot with 40 parking spaces.

The starting price of the lot is UAH 430,060,700.00 including VAT. The date of the electronic auction is August 28, 2024 (lot No. 556963), the guarantee fee for participation: 5% of the initial sale price of the property (UAH 21,503,035), which will be credited to the sale price.

The lot consists of a shopping center with a total area of 32,408.7 sq.m. located at 1 Maidan Ozernyi (Bobrova) Str., Dnipro, and 12 land plots. In addition to the lot price, the successful bidder is obliged to purchase fixed assets worth UAH 2.2 million including VAT.

Detailed information and conditions of participation in the auction are available here.

Ovostar Agro Holding proposes that its shareholders waive the payment of dividends for the year 2023 and allocate the entire net profit of $44.975 million to the retained earnings reserve.

According to the company’s announcement on the Warsaw Stock Exchange, the relevant issue is on the agenda of the annual shareholders’ meeting scheduled for August 21.

Other issues include the re-election of one of Ovostar’s three non-executive directors, Markiyan Markevich.

As reported, the company last paid interim dividends for 2022 of EUR3.6 million at the rate of EUR0.65 per share, but then refused to pay the final dividend.

Ovostar Union is a vertically integrated holding company, one of the leading producers of eggs and egg products in Ukraine. “In 2023, Ovostar increased its net profit by 7.4 times to $45 million, EBITDA by 4.5 times to $50.4 million, and revenue by 20% to $162.5 million.

In mid-June 2011, the group’s holding company, Ovostar Union N.V., conducted an IPO of 25% of its shares on the WSE at PLN62 per share ($22.78 at the then exchange rate) and raised $33.2 million.

At the end of May this year, the majority shareholders of the agricultural holding, CEO Boris Belikov and board member Vitaliy Veresenko, who own 65.93% of the shares, announced that they, together with Fairfax Financial Holding, had accumulated 95.45% of the shares in the agricultural holding and were ready to buy out the remaining 4.55% of the shares held by minority shareholders. During the announced voluntary buyout at a price of PLN70 (about $17.5) per share, they acquired another 56,027 shares, or 0.934%, and now own 96.383%.

“The offerors intend to exercise the squeeze-out right … in order to acquire 100% of the company’s shares at a price of PLN70 per share,” Ovostar said in early July, recalling its delisting plans.

Currently, Ovostar shares are listed on the stock exchange at PLN68.6 per share.

Internal and external debt of Ukraine from 2010 till April 2024

Source: Open4Business.com.ua