The Kyiv City Council has decided to sell a 0.33-hectare land plot at 8 Harmatna Street in the Solomianskyi district of the capital to Knauf Gypsum Kyiv LLC for the operation and maintenance of the company’s transport shop.

The corresponding draft decision was supported by 77 deputies at the meeting on July 4.

As stated in the draft decision, Knauf Gypsum Kyiv has already paid an advance of UAH 1.4 million under the agreement of August 14, 2023.

At the same time, the balance of the price is UAH 11.9 million, which the company must pay within 10 days after the notarization of the sale and purchase agreement.

According to Opendatabot, Knauf Gypsum Kyiv LLC is owned by the German company Knauf International GmbH (100%).

Knauf is a leading global manufacturer of gypsum and building materials. In Ukraine, the company is represented by two plants for the production of gypsum boards.

As reported, in November 2023, the National Agency for the Prevention of Corruption (NAPC) included German Knauf in the list of international sponsors of war, which has now been canceled.

Former Iranian parliament member Masoud Pezeshkian has won Iran’s presidential election, Tasnim news agency reported.

“The second stage of the presidential election was held on Friday, July 5, and according to the results of vote counting, Masoud Pezeshkian was elected president of the Islamic Republic of Iran,” the report said.

The agency noted that such a conclusion was made, “according to the announcement of the election headquarters spokesman, based on the counting of 30 million 530 thousand 157 votes received from all offices inside and outside the country.”

Earlier, the Experts Club think tank presented an analysis of the most important elections in the countries of the world in 2024, more video analysis is available here – https://youtu.be/73DB0GbJy4M?si=eGb95W02MgF6KzXU.

Subscribe to Experts Club’s youtube channel here – https://www.youtube.com/@ExpertsClub

PJSC Ukrnafta has received applications from six companies for joint development of 15 fields out of 21 offered for investment in 2023, said Denys Kudin, Executive Vice President for Corporate Strategy and Development.

“We have received applications from 6 companies for 15 fields. No one applied for 6 fields, for some fields only one application was received, for others there were two applications, so we have to hold a certain internal competition,” he said during a speech at the IV Energy Law Conference in Kyiv on Friday.

According to him, the largest offer for investment in one field is $100 million, and the smallest is $7 million. Regarding the latter, he clarified that it was the best offer for the smallest field.

“As of this moment, the process (of attracting investors to joint field development – EP) is ongoing. We have passed the stage of accepting and evaluating proposals, finalized the commercial terms as seen by potential investors. The next step is the approval of these terms by our Supervisory Board, review by the interdepartmental commission under the Ministry of Energy, and then approval by the Cabinet of Ministers. This is the process, and we hope to complete it by the end of the calendar year,” said Kudin.

He said that Ukrnafta has proactively approached about 200 companies in the process of looking for investors and has also held talks with a number of companies at industry conferences. Out of this number of potential investors, more than 50 responded, and of these, 35 companies passed the due diligence process and were admitted to the Virtual Data Room with detailed information about the fields.

Kudin added that “the companies submitted proposals on average 1.5 times better than we had developed on our own, having formed their own vision of this five-year initial program.”

Describing the process of finding investors, Kudin noted that the company ranked them by country – in Canada, America, the UK, and the EU – and applied proactively, as well as advertising in the media, on the website, and at all possible industry events.

Regarding the selection of 21 fields, the company’s vice president noted that according to the criteria of the law on production sharing agreements (PSAs), “these are the worst, most difficult to produce, most depleted fields (out of 89 fields of Ukrnafta – EP) that require the use of high-cost, state-of-the-art technologies.” To assess them, 80 years of data were digitized.

Kudin pointed out that despite the war, foreign companies are ready to work in Ukraine and, in particular, to engage in production.

“We are not talking about top public companies where supervisory boards make decisions. For the most part, these are medium-sized private companies with a specific family of owners who continue to manage their business and risk their own money. They are ready to invest $50-60-100 million,” he said, adding that investors are encouraged by the possibility of resolving disputes under English law when concluding PSAs.

In general, he believes that about $10-15 billion should be invested in oil production over the next 10 years to reach annual production of 10 million tons, which would ensure Ukraine’s energy independence in this area.

As reported, at the end of 2023, Ukrnafta informed that 25 companies, including Ukrainian and companies from seven countries in Europe and North America, have already expressed interest in cooperation in the tender for the joint development of 21 fields (applications were accepted until March 1, 2024).

According to the company, the 2P category reserves, i.e. proven and probable reserves of the fields to which Ukrnafta offers access to potential partners, amount to over 12 million tons of oil and over 31 billion cubic meters of gas.

“In 2023, Ukrnafta increased oil and condensate production by 3% (by 39.9 thousand tons) compared to 2022, to 1.4 million tons. Last year, Ukrnafta produced 1.097 bcm of natural and associated petroleum gas, which is 5.8% (60.4 mcm) more than in 2022.

“Ukrnafta is the largest oil producer in Ukraine and the operator of the national network of filling stations. In March 2024, the company took over the management of Glusco assets and operates 545 filling stations – 460 owned and 85 managed. The company is implementing a comprehensive program to restore operations and update the format of its filling stations. Since February 2023, Ukrnafta has been issuing its own fuel coupons and NAFTAKarta cards, which are sold to legal entities and individuals through Ukrnafta-Postach LLC. Ukrnafta’s largest shareholder is Naftogaz of Ukraine with a 50%+1 share. In November 2022, the Supreme Commander-in-Chief of the Armed Forces of Ukraine decided to transfer to the state a share of corporate rights of the company, which belonged to private owners and is currently managed by the Ministry of Defense.

Turkish authorities are set to announce an agreement with Chinese automaker BYD Co. to build a $1 billion company facility in the country, Bloomberg reported.

According to the agency’s sources, Turkish President Recep Tayyip Erdogan will announce it on Monday at a ceremony in Manisa province, where the plant is planned to be built.

The opening of the plant in Turkey could make it easier for BYD, China’s largest electric car maker, to access the European Union market, with which the country has a customs agreement.

The day before, the European Commission imposed additional duties on imports of Chinese electric cars into the EU. For BYD Co. this duty amounts to 17.4%. Previously, the EU already had 10% duties on imports of electric cars from China.

The Turkish market is also of interest to BYD. Last year, cars with electric engines accounted for 7.5% of car sales in Turkey.

On Friday, it became known that the Turkish authorities refused to introduce an additional duty of 40% on imports of Chinese electric cars into the country, which was announced in June. This came after Erdogan’s talks with Chinese President Xi Jinping on the sidelines of the Shanghai Cooperation Organization (SCO) leaders’ meeting in Astana.

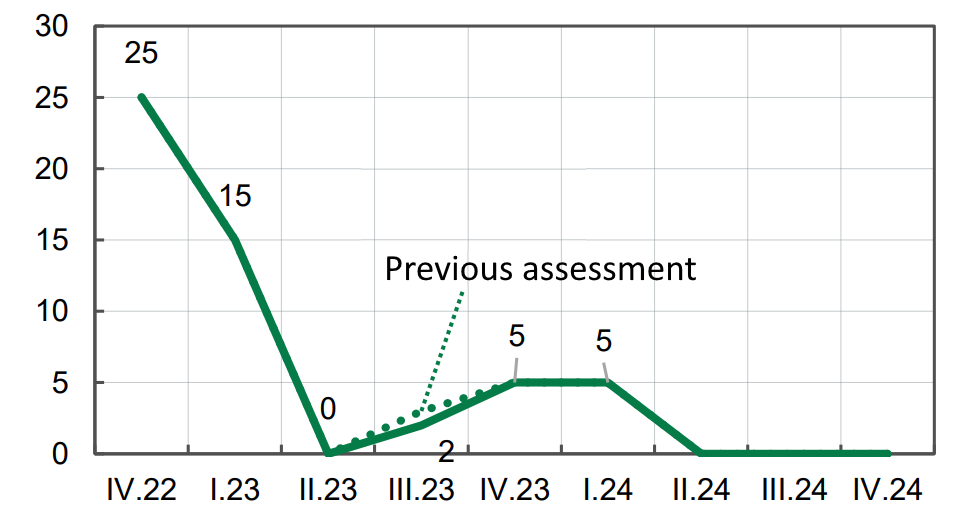

Forecast of power system capacity deficit, %

Source: Open4Business.com.ua and experts.news

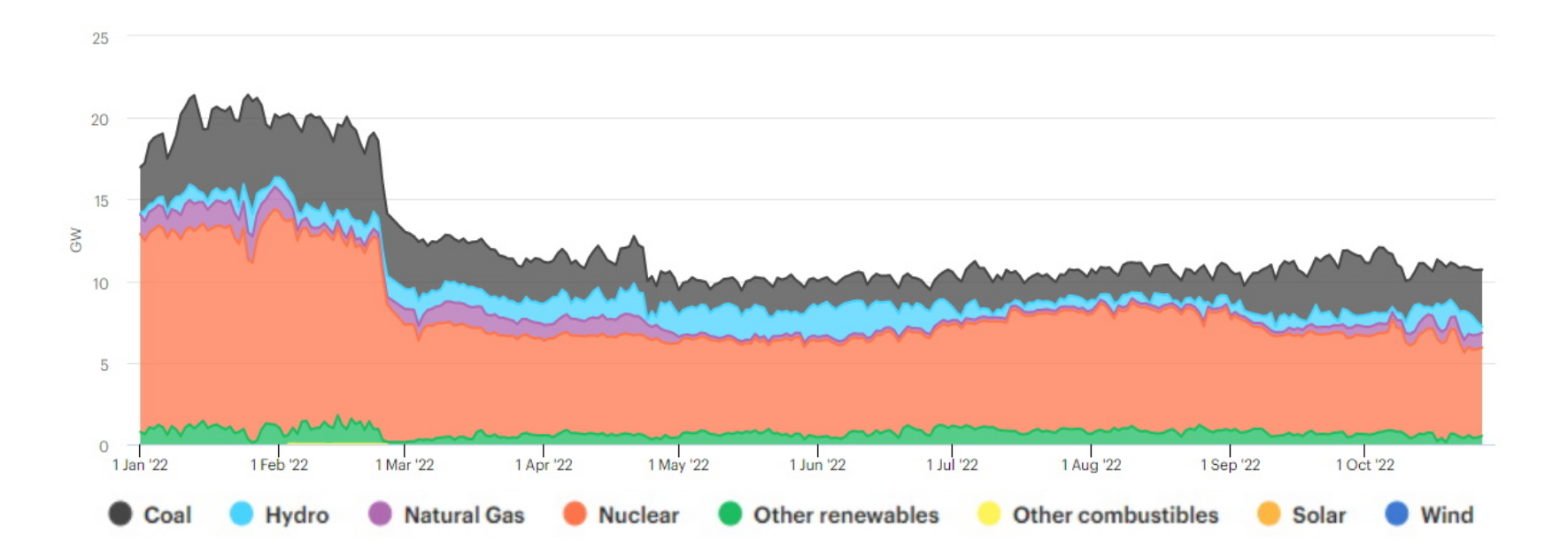

Generation distribution in power system of Ukraine in 2022

Source: Open4Business.com.ua and experts.news