On May 28, 2024, the Embassy of Azerbaijan in Ukraine hosted a reception in Kyiv on the occasion of the 106th anniversary of the establishment of the Azerbaijan Democratic Republic.

It has been 106 years since the establishment of the first democratic, legal and secular state in the Muslim East – the Azerbaijan Democratic Republic (ADR) on May 28, 1918, which was founded by Mammad Emin Rasulzade.

In a tense and complicated socio-political situation, the DDR lasted only 23 months. The independent Republic of Azerbaijan was occupied by the Bolsheviks and only after the collapse of the USSR did Azerbaijan regain its independence for the second time. The Republic of Azerbaijan, which restored its state independence on October 18, 1991, by the relevant Constitutional Act, proclaiming itself the successor of the Azerbaijan Democratic Republic, adopted its state attributes, including the national flag, national anthem and coat of arms.

The solemn event was attended by distinguished guests: foreign diplomats, representatives of the government, Islamic religious leaders, members of the Azerbaijani diaspora in Ukraine, cultural figures and educators.

The Ambassador Extraordinary and Plenipotentiary of the Republic of Azerbaijan to Ukraine, Y.V. Seymur Mardaliyev, addressed the audience with a welcoming speech.

In his speech, the Ambassador focused on the history and present of the Azerbaijan Democratic Republic.

“Today, under the leadership of President Ilham Aliyev, our country is realizing the hopes and ideals of the Democratic Republic of Azerbaijan. Azerbaijan is going through the most grandiose and successful period in its long history and has never been as strong as it is now,” the diplomat said.

The ambassador also noted that Azerbaijan was one of the first countries to provide humanitarian aid since the beginning of the full-scale Russian invasion of Ukraine and is ready to continue to provide this assistance.

Deputy Minister for Foreign Affairs of Ukraine Yevhen Perebyinis expressed greetings on behalf of the Ukrainian government.

Yevhen Perebyinis expressed gratitude to Azerbaijan for its consistent political, humanitarian and military support of Ukraine and expressed hope for further strengthening of the strategic partnership between the two countries.

On February 6, 1992, Ukraine and Azerbaijan established diplomatic relations. The Embassy of Ukraine in Azerbaijan has been operating since May 5, 1996, and the Embassy of Azerbaijan in Ukraine was opened on March 12, 1997.

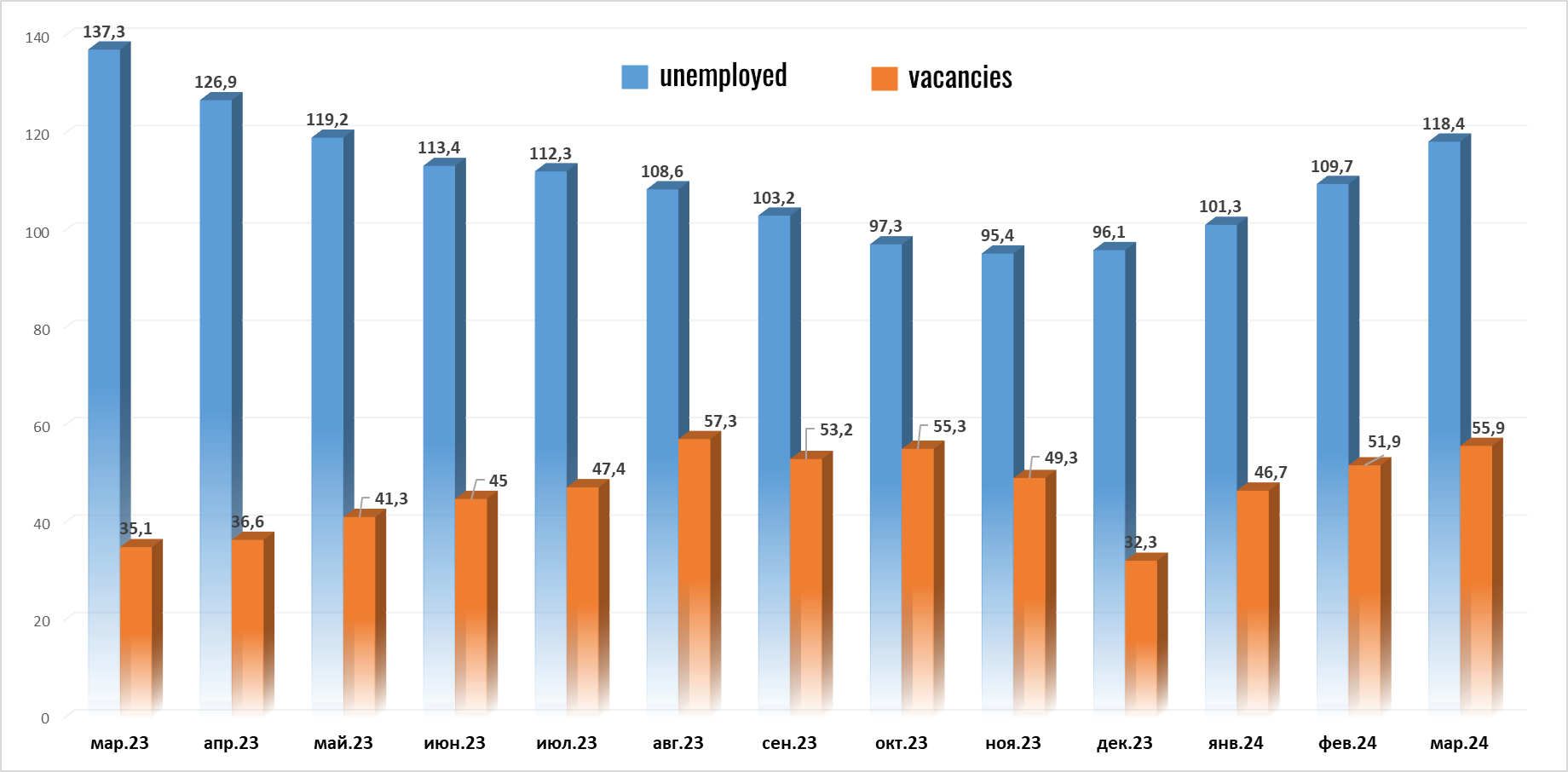

Number of unemployed in Ukraine and job opportunities, 2023-2024

Source: Open4Business.com.ua and experts.news

The Ministry of Finance and the National Bank of Ukraine, after reaching a staff-level agreement (SLA) with the IMF on the fourth review of the Extended Fund Facility (EFF) program, expect it to be approved by the IMF Board of Directors and the disbursement of the fifth tranche of the $2.2 billion program in the coming weeks.

“Ukraine has never reached the fourth review in any IMF program before. Today’s agreements are evidence of our commitment to reforms and changes for our country (…),” Prime Minister Denys Shmyhal commented on the agreement.

Minister of Finance Sergii Marchenko said that the government continues to work on implementing reforms and prioritizes maintaining economic stability and restoring Ukraine’s path to EU membership. He also thanked the IMF team for their efficient and well-coordinated cooperation.

According to the Ministry of Finance, the IMF experts emphasized the importance of the National Revenue Strategy and the implementation of certain of its provisions.

“The National Revenue Strategy is one of the structural beacons of the EFF-IF-U Program, which provides for the gradual implementation of measures aimed at reforming fiscal authorities and mobilizing tax revenues, as well as measures aimed at strengthening public confidence in tax and customs authorities,” the Ministry reminded.

For its part, the NBU noted that the future priorities of cooperation with the Fund will include strengthening banking regulation, supervision, lending, and capital market infrastructure.

In addition, considerable attention will be paid to increasing the level of financial inclusion, especially in the de-occupied territories and in regions close to active hostilities.

“Its low level is a deterrent to economic activity, so the NBU will focus on diagnostic work involving IMF and World Bank experts to develop effective measures,” the regulator said on its website on Friday evening.

The NBU is ready to further ease monetary policy provided that inflation expectations remain stable and hryvnia instruments remain attractive, which will be supported by a flexible exchange rate, the regulator said.

“Further balanced and gradual easing of currency restrictions in accordance with the Strategy should support economic recovery without creating risks to macrofinancial stability,” the NBU said in a statement.

According to the NBU, IMF experts noted that budget financing needs in 2024 remain very high. Given this, budget implementation should take into account financial constraints and the need to restore fiscal and debt sustainability.

“To ensure fiscal sustainability, Ukraine needs to accelerate the implementation of tax reforms and revenue administration envisaged by the National Revenue Strategy,” the press release says.

Among the priorities of the Program implementation, the regulator noted the strengthening of tax and customs administration, as well as strengthening public confidence through anti-corruption reforms and measures to properly protect taxpayers’ personal data.

The Ministry of Justice of Ukraine has collected securities and funds worth more than UAH 1.8 billion from Royal Pay Europe LLC, which is associated with the Russian bookmaker 1xBet, to the state’s revenue.

“Based on the materials of the Prosecutor General’s Office, the Ministry of Justice of Ukraine has collected securities and funds worth more than UAH 1.8 billion belonging to a non-resident company of the Republic of Latvia associated with the aggressor country,” the Prosecutor General’s Office said in a statement on its Telegram channel on Saturday morning.

It is reported that during the pre-trial investigation, it was established that this company has close ties with the Russian bookmaker 1xBet and other entities, and sanctions were imposed on it.

“The sources of funds that were transferred to the bank accounts of the non-resident company, which, among other things, processes betting activities in the territory of the aggressor state, were transfers from Russian and Belarusian financial institutions,” the statement said.

It is noted that the materials of the criminal proceedings became the basis for the Ministry of Justice of Ukraine to file a lawsuit with the High Anti-Corruption Court (HACC) to nationalize the property of this company.

The pre-trial investigation into the financing of actions committed with the aim of forcible change or overthrow of the constitutional order or seizure of state power, change of the boundaries of the territory or state border of Ukraine is ongoing and is being carried out by the State Bureau of Investigation under the procedural guidance of the Prosecutor General’s Office (Article 110-2 of the Criminal Code of Ukraine).

According to the HACC’s Facebook page, on May 31, the HACC panel of judges partially satisfied the claim of the Ministry of Justice of Ukraine against Royal Pay Europe LLC and imposed a sanction on it under paragraph 1-1 of part 1 of Article 4 of the Law of Ukraine “On Protection of Human Rights and Fundamental Freedoms”. 1 Art. 4 of the Law of Ukraine “On Sanctions”.

The HACC recovered cash in the amount of UAH 53 million, EUR 54.316 thousand and USD 3.49 million, as well as securities with a nominal value of UAH 1,258,735 thousand and UAH 494,158 thousand.

Sources: https://t.me/pgo_gov_ua/24160

The Ukrainian government has introduced a quota for exports of poultry and poultry by-products to the EU in the amount of about 137,000 tons starting July 1.

According to Cabinet of Ministers Resolution No. 612 of May 30, published on the government portal, the quota for the supply of poultry meat and edible offal to the EU, including chickens, geese, ducks, guinea fowl (UKTZED code 0207), is set at 133.28 thousand tons, and turkey meat and edible offal (UKTZED code 0207 24-27) at 3.76 thousand tons.

The Ministry of Economy will consider applications for licenses to export these goods to the EU within 10 days. Permits will be issued on the basis of applications and approvals provided by the Ministry of Agrarian Policy.

For the period of martial law, applicants shall prepare and submit documents electronically through the relevant information and communication systems (the Ministry of Economy’s electronic services portal, the Unified State Web Portal of Electronic Services).

The licensing regime for the export of quota goods to the EU is also mandatory if the non-resident counterparty is registered in the EU under a foreign economic agreement (contract).

At the same time, the volume of quotas approved for the commodity item “Meat and edible offal of poultry: poultry chickens, ducks, geese, guinea fowl”, excluding the reserve quota of 1400 tons for new exporters, and for the commodity “Turkey meat and edible offal of turkeys” is distributed by the Ministry of Agrarian Policy among exporters in proportion to the actual volume of their exports to the EU in the first quarter of 2024. Information on the actual export volumes of these products for the first quarter of 2024 must be provided by exporters to the Ministry of Agrarian Policy with supporting documents by June 25, 2024.

The reserve quota of 1400 tons will be distributed among exporters who did not export these products in the first quarter of 2024.

If there is an unused balance of the quota as of November 1, 2024, it is distributed among exporters in proportion to the actual exports of these products to the Member States of the European Union for the three quarters of 2024.

As reported, on May 13, the EU Council finally approved the extension of the autonomous trade measures for another 12 months – until June 5, 2025. At the same time, restrictions have been imposed on the duty-free supply of a number of agricultural products – poultry, eggs, sugar, oats, cereals, corn and honey – in the amount of the average export volume for the period from the second half of 2021 to the end of 2023.

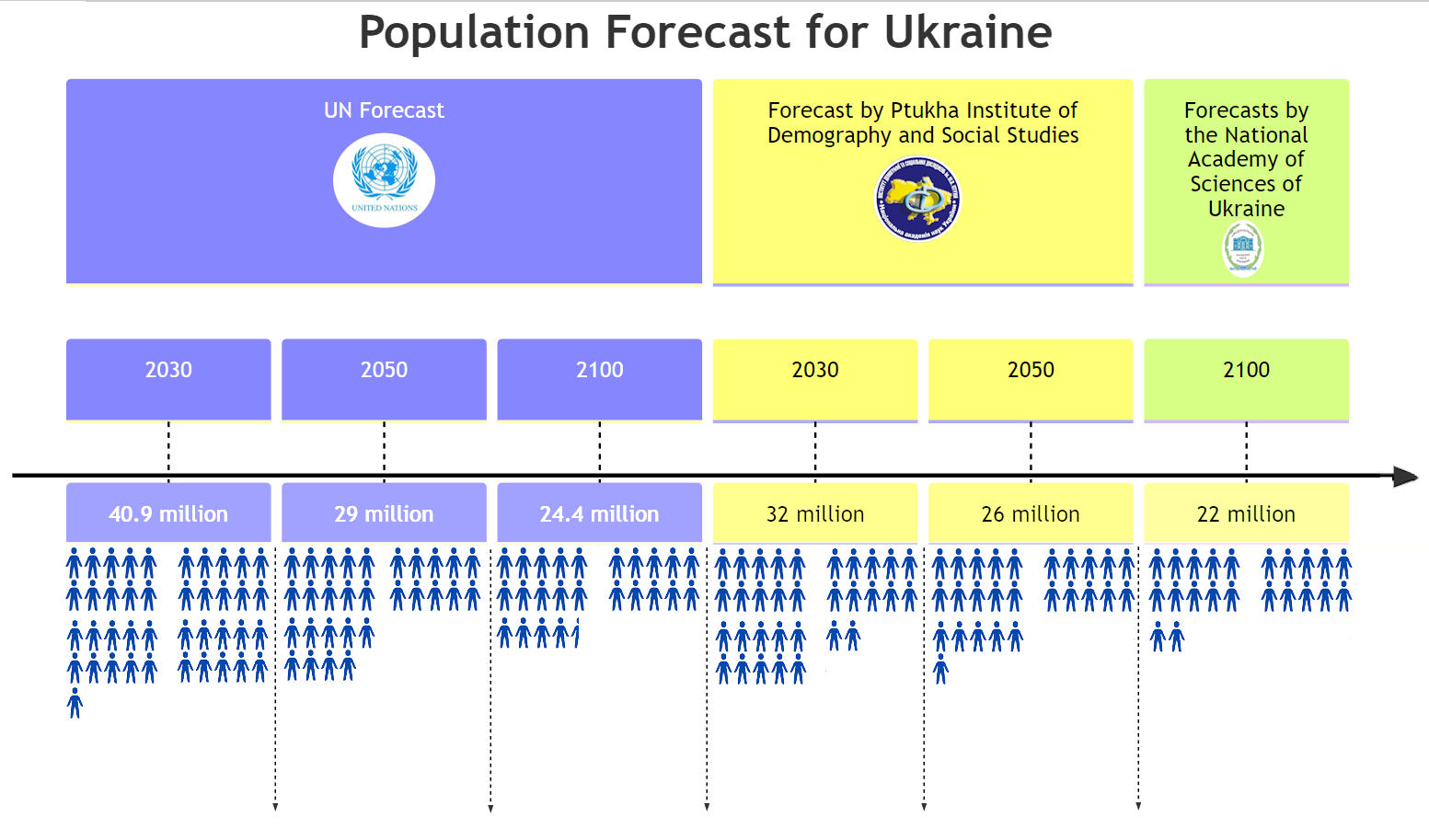

Population forecast for Ukraine in 2030-2100

Source: Open4Business.com.ua and experts.news