The U.S. dollar was declining against major world currencies in trading on Thursday.

The DXY index, which shows the U.S. dollar value against six major world currencies, fell 0.08% to 105.57 points. A day earlier it had risen to 105.88 points, the highest level since December 1, on hawkish statements from Federal Reserve (Fed) chief Jerome Powell, MarketWatch notes.

He said that Fed management has not yet decided how much it will raise the benchmark interest rate at the March meeting. That will depend on statistical data on inflation and employment, which the Fed has yet to assess. Powell said the Central Bank is ready to accelerate the pace of monetary tightening if U.S. economic activity does not begin to slow. That said, the final rate level is likely to be higher than previously thought, he said.

Prime rate futures prices point to the likelihood of a 50 basis point hike at the end of the March meeting, according to Trading Economics.

The euro is trading at $1.0553 in the morning versus $1.0544 at the end of last session.

The value of the single European currency is now around 144.40 yen compared to 144.82 yen on Wednesday. The dollar exchange rate is 136.81 yen against 137.35 yen at the end of the previous trading day.

The WSJ Dollar indicator, which tracks the dollar’s movement against 16 currencies, declined 0.13%.

The pound is trading at $1.1855 compared to $1.1844 on the previous trading day. The euro is at 0.8901 against 0.8902 a day earlier.

Oil is stable Thursday after declining in the previous two sessions.

Traders are assessing data on changes in fuel inventories in the U.S., as well as statements of Federal Reserve Chairman Jerome Powell.

The Fed has not yet decided on the amount by which it will raise the benchmark interest rate at the March meeting, said the head of the U.S. central bank. This, he said, will depend on statistical data on inflation and employment in the U.S., which the Fed has yet to assess.

May futures for Brent crude oil on London’s ICE Futures Exchange were quoted at $82.66 a barrel as of 7:03 a.m., the same as at the close of previous trading. The contracts were down $0.63 (0.8%) on Wednesday.

The price of WTI April futures decreased by $0.02 (0.03%) to $76.64 per barrel at electronic auctions of New York Mercantile Exchange (NYMEX). At the end of previous trading the cost of contracts has fallen by $0.92 (1.2%) to $76.66.

U.S. commercial oil inventories fell 1.69 million barrels to 478.51 million barrels last week, according to a weekly report from the Energy Department. This is the first decline in 11 weeks.

Gasoline reserves decreased by 1.13 million barrels, while distillates increased by 138,000 barrels.

Experts were expecting oil reserves to rise by 1.6 million barrels, gasoline reserves to decrease by 2 million barrels and distillates by 1.3 million barrels.

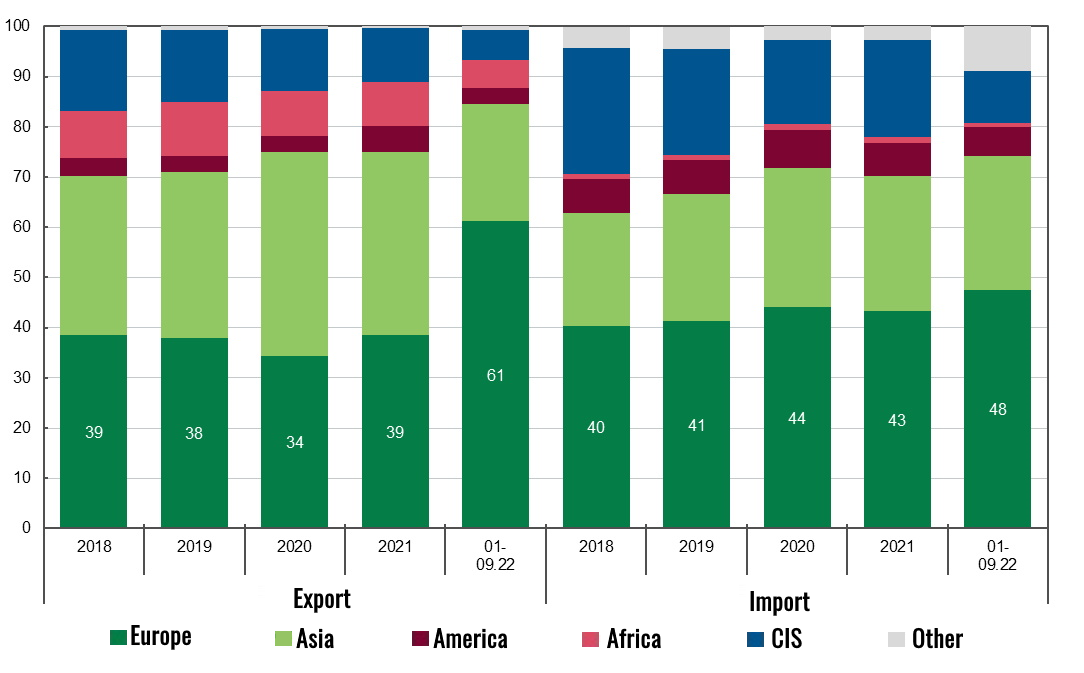

Geographical structure of foreign trade in goods in 2018-2022 (%)

Source: Open4Business.com.ua and experts.news

In a March report, the U.S. Department of Agriculture (USDA) increased its forecast for corn exports from Ukraine in the 2022/2023 marketing year (MY, July-June) by 1 million tons from February data to 23.5 million tons from 22.5 million tons, while for wheat it kept its estimate at 13.5 million tons.

The U.S. Department of Agriculture said in a report on its website Thursday that its forecast for corn production for the current MY is maintained at 27 million tons and wheat at 21 million tons.

Also in the March forecast, the estimate of transitional corn balances in Ukraine at the end of 2022/2023 MY was reduced by 1 million tons to 2.39 million tons from 3.39 million tons, and by 0.04 million tons for wheat to 4.17 million tons from 4.21 million tons.

At the same time, the estimate of domestic consumption of corn in Ukraine in 2022/2023 MY remained at 5 million tons, and wheat – 4 million tons.

In general, the forecast of fodder grain exports in Ukraine in 2022/23 MY in the March forecast was increased by 1.1 million tons – to 26.03 million tons from 24.93 million tons in February, and the forecast of its production was kept at 34.16 million tons.

Since the beginning of 2022/2023 marketing year (July-June) and until March 3, Ukraine exported 32.54 million tons of cereals, including 18.8 million tons of corn (-1% compared to the same period a year earlier), 11.38 million tons of wheat (1.58 times less), 2.06 million tons of barley (2.73 times less), 16.1 thousand tons of rye (10 times less) and 100.5 tons of flour (+47.8%).

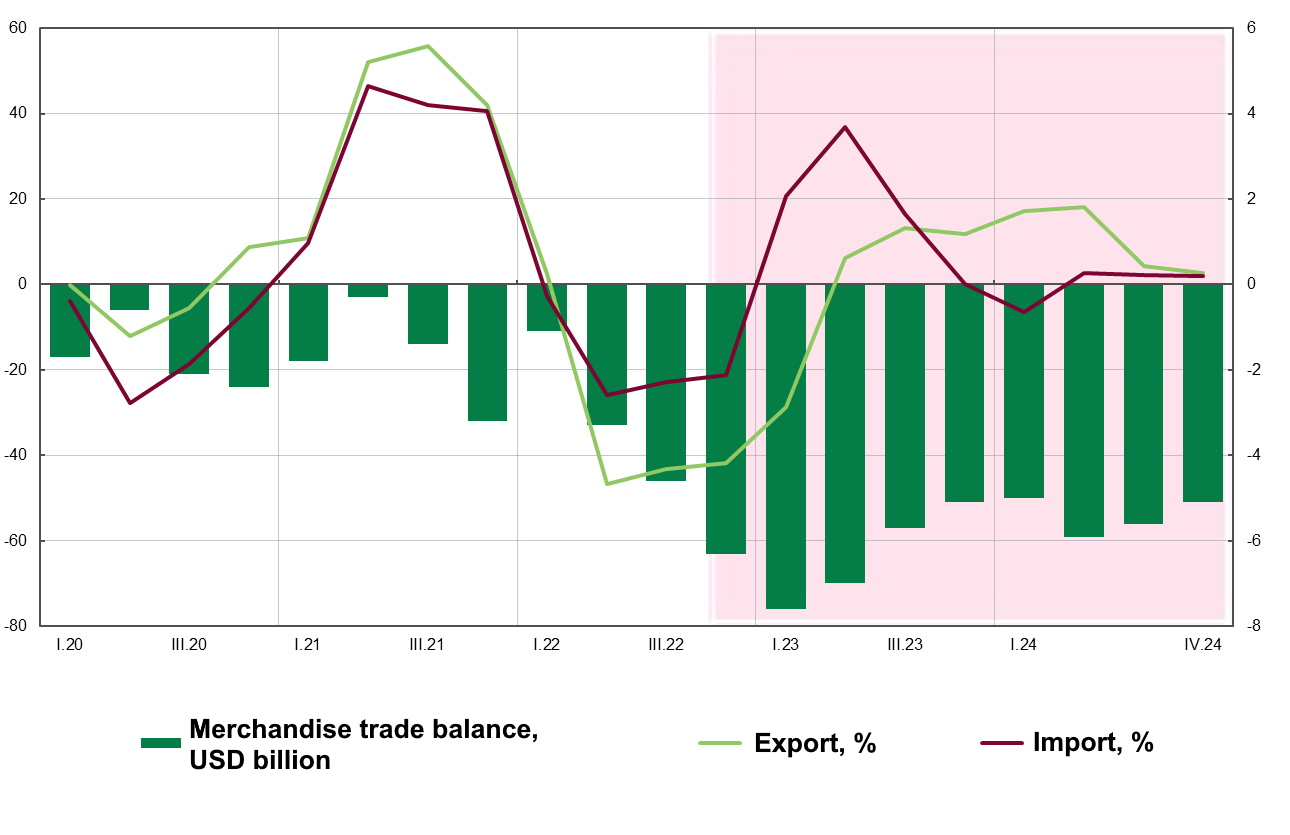

2022-2024 goods trade balance forecast (USD bln)

Source: Open4Business.com.ua and experts.news

State-owned PrivatBank in January 2023 received UAH 6.316 billion in net profit, Oshchadbank – UAH 2.242 billion, which amounted to 57% of all profits earned in January by 60 profitable Ukrainian banks.

According to the data published by the National Bank of Ukraine on its website, the top five leaders are also two banks with foreign capital: Raiffeisen Bank – UAH 715.8 million, Sense Bank (formerly Alfa Bank) – UAH 680.5 million and state Ukreximbank – UAH 623 million.

Three other banks with foreign capital: OTP Bank – 617.6 million UAH, Ukrsibbank – 605.3 million UAH, Citibank – 544.9 million UAH, FUIB – 499.1 million UAH and Universal Bank (mono) – 378.5 million UAH were slightly behind.

As for the most loss-making bank in January, it was Forward Bank, owned by Russian Rustam Tariko, which the National Bank considered insolvent on February 8 – UAH 298.3 mln with an increase of reserves by UAH 291.8 mln.

In January, seven banks worked with losses, although the banks formed almost 4 billion UAH of additional reserves (PrivatBank took the biggest losses – 824.4 million UAH).

After the growth of assets of all banks by 91.6 billion UAH in December 2022, in January they increased only by 18.2 billion UAH, including at Ukreximbank – by 14.1 billion UAH, while PrivatBank even decreased by 5.48 billion UAH.

Due to the increase of the National Bank on January 11, the mandatory reserve requirements and permission to form up to half of them at the expense of government bonds, banks’ investment in government securities in the first month of the year increased by 20.9 billion UAH. The largest increase in portfolios was demonstrated by Oshchadbank (UAH 7.397 billion), Raiffeisen Bank (UAH 3.171 billion), FUIB (UAH 2.279 billion), Ukrgasbank (UAH 2.067 billion), Ukreximbank (UAH 1.688 billion), and Universal Bank (mono) – UAH 1.578 billion.