The Board of Directors of IDS Ukraine Group, which produces mineral water under Morshynska and Mirgorodska brands, decided not to accrue or pay dividends for 2022 and decided to direct all available funds to charitable purposes, the holding said in a press release on Wednesday.

“The company’s management and non-sanctioned shareholders fully share the state’s just desire to protect the economy and the country. That is why, back at the beginning of the full-scale invasion, it was decided to forgo dividends in 2022 and direct all available funds to charity,” the document states.

According to the press release, 100% of the corporate rights of the group’s shareholders have now been seized and transferred to the National Agency for the Detection, Search and Management of Assets Derived from Corruption and Other Crimes (ARMA) because of the sanctions imposed on its shareholders with Russian citizenship. At the same time, according to IDS Ukraine, more than 50% of the holding’s securities belong to persons to whom sanctions were not applied – citizens of Great Britain, Georgia and Ukraine.

The press release notes that IDS Ukraine provided more than UAH 100 mln of charitable aid in 2022; in particular, it transferred water in excess of UAH 67 mln for the needs of military personnel, the wounded, displaced persons and residents of de-occupied territories. In addition, the holding continues to pay salaries for a hundred and fifty of its mobilized employees, as well as buying for them ammunition and equipment.

“For their part, the non-sanctioned shareholders of the company, even though the state grossly violates their property rights, consider the provision of charitable assistance in 2023 as one of the priority areas of the companies. Only in January 2023, 120 thousand liters of water were transferred to Kherson, and the total amount of transferred products already this year is about 500 thousand liters,” the mineral water producer summarized in a press release.

As earlier reported, on February 10 ARMA announced a competition for the selection of a manager for arrested assets of IDS Ukraine, which produces and sells mineral water under brands Morshinskaya, Mirgorodskaya and Borjomi.

Earlier, Marko Tkachuk, the general director of IDS Ukraine, said in response to Interfax-Ukraine news agency inquiry that the transfer of corporate rights of the company worth more than UAH 10 billion to ARMA will not affect the economic activities of the group. He also reminded that the decision about the transfer of corporate rights of the sanctioned IDS shareholders with Russian citizenship to ARMA was made by Kiev Shevchenko District Court on November 9 and 11, 2022.

On November 23 last year, the Bureau of Economic Security of Ukraine (BES) reported about the arrest of corporate rights of the Russian shareholders of the IDS Ukraine in order to avoid their withdrawal from Ukraine of the assets of seven enterprises for the production and sale of drinking water. According to the BEB, these enterprises are actually owned by them through a non-resident offshore company under their control.

IDS Ukraine is a Ukrainian group of companies founded in 1996, the largest national producer of bottled water. The holding includes Morshynsky mineral water plant “Oskar”, “Mirgorod mineral water plant”, the distribution company “IDS” and water delivery operator “IDS Aqua Service”.

GK owns trade marks Morshinskaya, Mirgorodskaya, Alaska and Aqua Life.

A new privatization auction for the sale of the Bilhorod-Dnistrovskyi Commercial Sea Port (NCSP, Odesa region) is scheduled for March 13. The starting price of the property has been halved from UAH 187.57 million to UAH 93.78 million, according to the property’s page on the State Property Fund’s website. According to the published information, the acceptance of bids from buyers will end at 20:00 on March 12, and the next day at 12:30 an English auction will be held with a minimum bid step of UAH 937,871.2.

As reported, the first auction for the sale of the port with a starting price of UAH 187.57 million scheduled for March 3 did not take place, the probable reason for the failure of the auction is the absence of at least two bids.

Earlier, the Fund noted that the port is unprofitable, but since 2022, the company “plays an important role in ensuring global food security as a logistics center for ports on the Danube.” According to the head of the SPF, Rustem Umerov, the port has great potential for the development of Ukrainian exports and needs investment in development.

According to the SPF, in 2019-2021, the net loss of the Bilhorod-Dnistrovskyi ICC amounted to approximately UAH 23.5-28.5 million, and in January-September 2022 – UAH 2.9 million. The volume of sales of products (works, services) for the period of 2019-nine months of 2022 amounted to UAH 80.8 million, including UAH 9.2 million for export.

The total overdue accounts payable amounted to UAH 104.6 million, including UAH 13.66 million in salary arrears. As of December 1, 2022, the debt to the State Tax Service amounted to UAH 59.6 million, including UAH 57.9 million in tax debt and UAH 1.7 million in penalties.

The terms of the port sale stipulate that the port must pay off its wage and budget arrears within six months in the amount that will be available as of the date of transfer of ownership of the privatization object. In addition, during the same period (six months), the employees of the privatized enterprise may not be dismissed at the initiative of the buyer or its authorized bodies, except in cases where the employee commits actions provided for in paragraphs 3, 4, 7, 8 of Part 1 of Articles 40 and 41 of the Labor Code.

Since April 1, 2022, Bilhorod-Dnistrovskyi seaport has been used as a logistics center for ports on the Danube. It receives cargo by truck and then ships it in railcars. In May of the same year, the company started shipping grain, transshipping iron ore pellets and transshipping metal products. In the six months after the reopening, cargo transshipment at the MTP increased 100 times compared to 2021. The port received more than 10 thousand trucks and shipped 4 thousand railcars by rail, which significantly eased the load on the country’s road infrastructure to the ports of Izmail and Reni (Odesa region). All products were exported.

Founded in 1971, Belgorod-Dniester Commercial Sea Port specializes in transshipment of timber, mineral fertilizers, iron ore pellets, metal products, and grain cargo. According to its charter, its core business is auxiliary water transport services.

The port’s balance sheet includes nine vessels of the port fleet, 47 units of road and 4 units of rail transport, 18 portal cranes and special equipment: 41 forklifts, four excavators, three bulldozers, a pneumatic crane, and a compressor. A part of the port’s property (28 items, including real estate and vehicles) is leased with the expiration date of the existing lease agreements being 6.09.2027. The port has six registered land plots with a total area of 65.63 thousand hectares.

According to the decision of the Odesa Customs Service, a temporary customs control zone has been established on the territory of the port facilities.

Vessels enter the port through the 1.5 km long approach channel of the offshore part of the Dniester-Tsaregorod estuary and the 14.5 km long Dniester-Liman part. The depth of the approach channel is 3 m (passport depth is 3.4-4.5 m). The single property complex is located on the territory of 64.4 hectares at the following addresses: 81 Shabska Street, Bilhorod-Dnistrovskyi, Bilhorod-Dnistrovskyi district, Zatoka village, 93 Zolotyi Bereg Street, Bilhorod-Dnistrovskyi district, Zatoka village, 1 Primorskaya Street.

Earlier, the SPF sold the integral property complex of the Ust-Dunay port for UAH 200 million on the Prozorro electronic platform. During the auction, its price tripled.

Dobrobut” medical network has opened a clinic on the left bank of Kiev in the building where “Boris” clinic used to be located.

As Igor Mazepa, co-owner of Dobrobut, reported on his Facebook page, the area of the 8-storey clinic after the reconstruction amounted to 10 thousand square meters.

“We had been planning this opening for two years, but first covid-19, then the war, made adjustments to our ambitious plans. But in spite of everything, we opened a new multi-profile hospital “Dobrobut” on the left bank of Kiev,” Mazepa wrote.

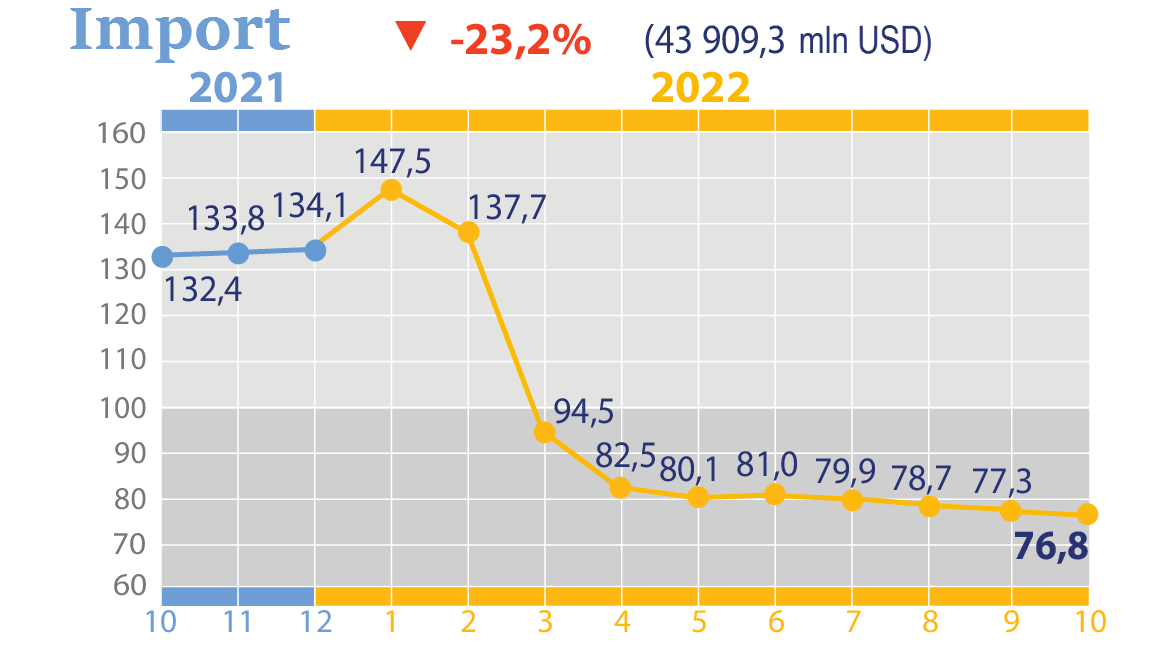

Import changes in % to previous period in 2021-2022

Source: Open4Business.com.ua and experts.news

The European Bank for Reconstruction and Development (EBRD) may grant Ukrzaliznytsia (UZ) a EUR200mn emergency support loan under sovereign guarantees.

As stated in a statement on the bank’s website on Tuesday, the bank’s board of directors plans to consider the project at a meeting on May 10, 2023.

According to the information, the loan consists of EUR100 mln of emergency financing of UZ capital investments and EUR100 mln of capital structure support.

It is expected that 50% of the loan will be secured by guarantees of G7/EU donors involved in the conditions when local commercial structures cannot guarantee risk covering mechanisms.

It is noted that with the help of the loan, UZ will be able to increase cross-border capacity with the EU by removing bottlenecks in border crossing, as well as to repair the relevant sections of the railroad bed that were damaged due to the full-scale invasion of Russia. With the funding, UZ will not only be able to renew key rail corridors at the border with the EU, but also to purchase rolling stock to provide comprehensive solutions for expanding the capacity of rail corridors with the EU.

“The project will support the company in the current critical issues that need to be addressed to improve operations and connectivity with the EU, continuing to provide a vital service to people and businesses in need of reliable logistics for key Ukrainian exports (including agricultural products) and critical imports,” the project description on the EBRD website said.

Earlier, Fitch Ratings reported that amid negative operating cash flow expectations for UZ in 2023, the company needs financing which could amount to EUR400m, including EUR199m from existing credit lines with the EBRD and EIB and $200m in the pipeline.

At the end of 2022, UZ’s outstanding debt amounted to 39.5 billion UAH, compared to 33.5 billion UAH in 2021, of which Eurobonds accounted for 82.8% and debt in foreign currency – 94.3%.

At the end of January, UZ signed an agreement with the holders of two issues of Eurobonds worth $895 mln on the deferral of coupon payments and repayment for 24 months. Under the agreements, the new maturity date for the $ 594.9mn 8.25% Eurobond is July 9, 2026, and for the $300mn 7.87% Eurobond – July 15, 2028.

As a result of the bond restructuring, the company received a deferral between 2023 and 2025: only 4% of the total debt is due during that period. The main payments are now due in 2026 – 58% of the current total debt (mostly $595mn Eurobonds) and after 2027 – 32% (mostly $300mn Eurobonds in 2028).

An International Monetary Fund (IMF) mission on Wednesday begins discussions with Ukraine’s representatives on a new full-fledged support program involving funding from the Fund.

“The IMF mission led by Gavin Gray begins discussions today with representatives of the Ukrainian authorities on a potential program to be supported by the IMF,” Vahram Stepanian, IMF Resident Representative in Ukraine, said in a statement.

Earlier, Ukrainian Finance Minister Sergei Marchenko announced the work of the IMF mission from March 8 to 15 in Warsaw.

“There we will agree on the terms and conditions, and filling, and volumes, and so on. Now it’s a little early to talk about specific details, because there are a lot of issues of internal discussion of the Fund,” said the head of the Ministry of Finance on March 1.

“I think we will find the necessary solutions so that in April we could have a full-fledged program with the Fund,” said Marchenko.

According to him, so far we are talking about a four-year program, whose task is to make the necessary policy adjustments so that Ukraine, which today spends 50% of its budget on military expenditures and the other 50% financed by the aid of partners, after the war came to a level of “more or less” self-sufficiency.

“The Fund does not yet put forward unbearable conditions that we cannot fulfill. We are talking about program, basic things: ensuring monetary and fiscal stability; reduction of the budget deficit and ensuring an acceptable level of burden on the budget and also good public administration and ensuring best corporate practices. And we are talking about anti-corruption programs, which have traditionally been part of IMF programs,” explained the head of the Ministry of Finance.

Prime Minister Denis Shmygal stated that the amount of the program may amount to $15 billion, of which Ukraine would like to receive $5 billion this year.

As earlier reported, last autumn, when the IMF was not ready to provide substantial financing at once, Ukraine requested a four-month Monitoring Program with Board of Directors (PMB) from the Fund, which the Fund approved on December 20.

An IMF mission concluded in Warsaw on Feb. 17, resulting in a statement that a staff-level agreement (SLA) had been reached to end that program early and move forward with preparations for a new, expanded program involving financing.

Kiev hopes that in the beginning of the second quarter of 2023, the PMB will be replaced by a multiyear extended funding program EFF amounting to about $15 billion, which can cover the gap in covering the $ 38 billion deficit of the state budget-2023, which is now, according to about $5-10 billion.