The unusual card made its debut during a women’s cup match between Portuguese teams Sporting and Benfica. During the game, one of the fans fainted, and medical personnel from both clubs rushed to his aid. That’s when referee Catarina Campos showed both teams the white card.

The new cards are the opposite of yellow and red: the usual brightly colored cards are used as punishment for infractions, while the white cards reward players for sportsmanship.

Afterwards, fans of both clubs began to applaud, supporting the referee’s decision.

The white cards were part of an initiative of Portugal’s National Plan for Ethics in Sport, adopted to encourage fair play. The initiative was taken over by the Portuguese Football Federation. So far, only in this country have the new cards become commonplace.

The match in which Benfica beat Sporting 5-0 to reach the cup semi-finals was marked not only by the debut of the new card, but also by record attendance for women’s soccer in Portugal. About 15,000 people came to watch the game.

Agroholding Agrotrade exported about 500 thousand tons of grain in 2022, including 343.8 thousand tons of its own harvest, 147 thousand tons of agricultural products from third parties and 5.4 tons of organic products.

According to the Facebook page of the agrarian group, it exported most of all wheat and corn, while rye, sorghum, soybeans, rape and barley were also shipped abroad.

“Agrotrade noted that last year, due to Russian aggression, it was forced to look for new export routes, shipping grain by rail to Europe bypassing blocked Ukrainian seaports. However, in the second half of 2022, most of the agricultural products were shipped through the ports of Greater Odessa under “grain agreements.”

“Exports continue, although the grain corridor works very slowly. Up to nine ships per day are served. Exports are slow due to insufficient number of inspections. That is, grain exports could be more intensive if steamships could call at the terminals more often. Taking into account all the difficulties that exporters faced this year, we are satisfied with the results of our work,” Agrotrade quotes its director of foreign economic activity Andrei Booth.

Agrotrade Group is a vertically integrated holding of a complete agricultural cycle (production, processing, storage and trade of agricultural products). It cultivates over 70 thousand hectares of land in Chernigov, Sumy, Poltava and Kharkov regions. Profile crops – sunflower, corn, winter wheat, soybeans and rapeseed. It has its own network of elevators with a single storage capacity of 570,000 tonnes.

The Group also produces hybrids of corn and sunflower seeds, barley and winter wheat. A seed plant with an annual capacity of 20,000 tons of seeds was built in 2014 on the basis of the Kolos seed farm (Kharkiv region). In 2018, Agrotrade launched its own brand Agroseeds on the market.

The founder and CEO of Agrotrade is Vsevolod Kozhemyako.

Ukraine from the beginning of 2022/2023 marketing year (July-June) to January 27, 2012 and January 27, 2012 exported 25.99 million tons of cereals, including 14.69 million tons of corn (56.5% of total shipments), 9.4 million tons of wheat (36.2%) and 1.8 million tons of barley (6.9%).

According to the website of the Ministry of Agrarian Policy and Food on Friday, the rate of grain exports since the beginning of the current MY is 30.86% lower than the same period of the previous MY, as 37.6 million tons were delivered abroad from July 1, 2021 to January 27, 2022. At the same time, the previous maximum rate of exports was achieved on January 9, 2023, when the lag from last year’s values was the lowest for the entire MY, 29.61%.

According to the agency, this week corn exports began to lag behind last MY for the first time since the start of the 2022/2023 MY, with 14.69 million tons delivered to foreign markets by January 27, 2023, compared to 14.95 million tons on January 27, 2022. In addition, Ukraine exported 9.4 million tons of wheat (1.78 times less than the same period last year), 1.8 million tons of barley (3.02 times less), 12.5 thousand tons of rye (12.2 times less) and 80.8 tons of flour (+28%) from the beginning of 2022/2023 MY.

It is specified that Ukraine exported 3.24 million tons of cereals, including 2.07 million tons of corn, 990 tons of wheat, 173 tons of barley and 11.8 thousand tons of flour since early January.

As follows from the Ministry data, during the period of January 20-27, 121.1 thousand tons of cereals per day were supplied to the foreign markets, whereas during the preceding period of January 9-20 – 140 thousand tons/day, January 2-9 – 121.7 thousand tons/day, December 21 – January 2 – 196.4 thousand tons/day on average, and December 14-21 – 134.3 thousand tons/day. Thus, the average daily rate of exports during the reporting period January 20-27, decreased by 13.5% compared to the previous period January 9-20.

As reported, Ukraine exported 48.51 million tons of grain and leguminous crops in 2021/2022 MY, which is 8.4% higher than in the previous MY, despite the full-scale invasion of Russia and the difficulties with the export of agricultural products due to the blockade of Ukrainian sea ports. 18.74 million tons of wheat (12.6% more than in 2020/2021MY), 23.54 million tons of corn (+1.9%), 5.75 million tons of barley (+35.9%), 70.9 thousand tons of flour (-44.1%) were supplied to foreign markets.

Ukraine in 2020/2021 MY exported 44.72 million tons of grain and leguminous crops: 16.64 million tons of wheat, 23.08 million tons of corn, 4.23 million tons of barley, 126.9 thousand tons of flour and 18.4 thousand tons of rye.

In 2019/2020, Ukraine exported 56.72 million tons of grain and leguminous crops.

Canadian Defense Minister Anita Anand announced Thursday that Ottawa will deliver four Leopard 2 tanks to Ukraine.

“Defense Minister Anita Anand said Canada will transfer four German-made Leopard 2 tanks to Ukraine in the coming weeks,” the Toronto Star reports.

Canada will transfer spare parts and ammunition along with the equipment, as well as train the Ukrainian military in the use of the tanks. The paper said that Anand allowed for the possibility of additional deliveries of Leopard 2 tanks to Ukraine.

Canada has a total of 112 tanks of this model.

The German authorities decided the previous day to transfer the first batch of 14 Leopard 2 tanks to Ukraine. Berlin will also give its allies permission to deliver Leopard 2 tanks to Ukraine. In addition, on Wednesday, US President Joe Biden announced his decision to send Ukraine 31 M1 Abrams tanks.

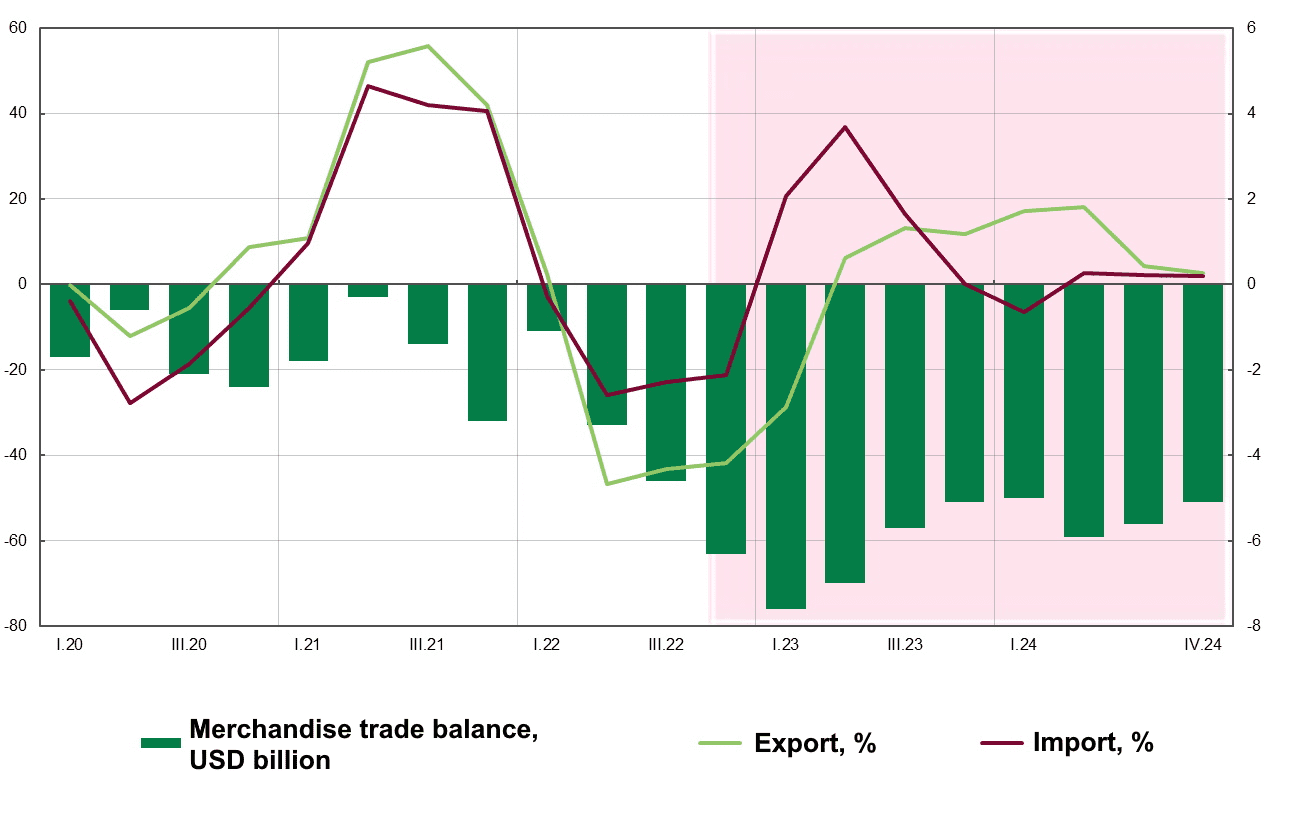

2022-2024 goods trade balance forecast (USD bln)

Source: Open4Business.com.ua and experts.news

Stock indices of the largest Asia-Pacific countries are mainly gaining on Friday following the U.S. stock market dynamics.

The stock exchanges in Mainland China continue to remain closed on the Spring Festival (the beginning of the new year according to the lunar calendar).

The growth of optimism in Asian markets was also supported by the U.S. statistics published the day before, which showed that the economy remains flexible, despite a significant tightening of monetary policy by the Federal Reserve (FRS).

According to preliminary data from the U.S. Commerce Department, the country’s GDP rose 2.9% year-over-year in the fourth quarter after climbing 3.2% in the previous quarter. The consensus forecast by analysts, cited by Trading Economics, suggested economic growth had weakened to 2.6%.

The Nikkei 225 Index was up 0.05% by 7:09 a.m.

The leaders of the price growth are the securities of the chemical company Shin-Etsu Chemical Co. Ltd. (+4.2%), industrial robotics manufacturer Yaskawa Electric Corp. (+3.7%) and Chiba Bank Ltd. (+3.6%).

Shares of carmaker Toyota Motor rose 0.4% and consumer electronics maker Sony gained 1%.

Hong Kong’s Hang Seng index was down 0.01% by 7:16 a.m.

Shares of solar panel maker Xinyi Solar Holdings Ltd. (-3.5%), computer maker Lenovo Group Ltd. (-3%) and home appliances and electronics maker Haier Smart Home Co. Ltd. (-2.3%).

Shares of retailer Alibaba Group Holding Ltd. fell 1.3% while JD.com Inc. rose 1.8%.

South Korea’s Kospi was up 0.7% by 7:14 a.m.

The stock price of one of the world’s largest chip and electronics maker Samsung Electronics Co. is up 1.1%, the share price of automaker Hyundai Motor is down 0.6%.

Australia’s S&P/ASX 200 index added 0.3% for the day.

Australia’s producer price index rose 0.7% quarter-over-quarter in the fourth quarter of 2022, compared with a 1.9% increase in the third quarter. The index was up for the tenth consecutive quarter, but the rate of increase was the slowest since the second quarter of 2021, Trading Economics wrote.

BHP and Rio Tinto, the world’s largest mining companies, rose 0.6% and 0.4%, respectively.

Fortescue Metals Group Ltd. shares gained 0.04%. The company said it shipped a record volume of iron ore in the fourth quarter while cutting production costs compared with the previous three months.