The combined wealth of the 81 wealthiest people exceeds half of the aggregate global figure, a report by charity organization Oxfam shows.

In the last two years, 1% of the richest people in the world have increased their wealth by $26 trillion, while the global figure has increased by $42 trillion, meaning that the wealthiest people accounted for two thirds of the growth, while the remaining 99% of the population altogether increased their wealth by only $16 trillion, according to the report presented at the World Economic Forum in Davos.

This indicates that the rate at which the wealthiest people are accumulating money has accelerated, CNBC noted.

Oxfam International executive director Gabriela Bucher called for higher taxes on the super-rich, saying it was “a prerequisite for reducing inequality and reviving democracy. In her view, changes in tax policy would help address ongoing crises around the world.

“Taxing the super-rich and large corporations is the way out of today’s overlapping crises. It’s time to shatter the convenient myth that tax cuts for the wealthiest result in their wealth somehow ‘trickling down’ to everyone else,” Bucher said.

The richest 1 percent account for 45.6 percent of the world’s wealth; the 50 percent with the least income account for just 0.75 percent, according to Oxfam calculations. Over the past two years, the wealth of billionaires has grown by an average of $2.7 billion a day.

There are only 124 women and five blacks among the 1,000 richest people.

The top personal income tax rates have become lower and less progressive, the report noted. Meanwhile, the average tax rate on the wealthiest in the OECD (which includes 38 nations) has fallen from 58% in 1980 to 42% recently. For the 100 countries, the average is even lower, around 31%.

As a result, many of the richest people on the planet pay almost no taxes. For example, the real tax rate of one of the richest people in history, Ilon Musk, head of electric car maker Tesla, is 3.2%. Another richest man, the head of Amazon.com Inc. Jeff Bezos – pays taxes at a rate of less than 1 percent. Meanwhile, one of the market traders Oxfam works with in Uganda, Aber Kristin, pays 40% of his income in taxes.

KMZ Industries (Karlovskiy Machine Building Plant, KMZ, Poltava region) at the end of 2022 has manufactured and delivered the equipment necessary for the completion of construction of the “dry” port of Alebor Group located on the territory of Hlybotskiy community (Chernivtsi region) near the border with Romania.

According to the Facebook page of the engineering company, KMZ is ordering construction of the first stage of the export grain terminal with a capacity of 30 000 tons and loading capacity of 300 tons per hour.

Altogether Alebor Group is planning several stages of terminal construction for 2023-2024. In the long term, the “Vadul-Siret Terminal” project will transship Ukrainian agricultural products into narrow gauge railroad wagons for subsequent shipment to the Romanian port of Constanta, thus giving exporters an alternative to Ukrainian sea ports.

As reported, the head of Hlybock community Gregory Vanzuryak in August 2022, wrote that the facility will be equipped with silos up to 200 thousand tons and a capacity of handling up to 3 million tons / year.

He said the first phase of the $20 million project, which will be completed in January 2023, will store up to 60,000 tons of crops and transship up to 1.2 million tons of grain annually to Romania.

Vanzuryak noted that the total construction cost of the facility will be $40 million.

Alebor Group in July-2022 announced the purchase of land for the construction of a terminal for transshipment of crops from the wide Ukrainian railroad track to the narrow European railroad track, as well as an elevator with a total capacity of 60 thousand hectares.

Alebor Group was founded in 2014. Its founder is entrepreneur Alexey Kustov.

In addition to Voronivtsi KPP, the group includes Krystyniv KPP (Cherkasy region) and KPP Chestne (Odessa region), as well as trucking companies Boleko (Cherkasy region), Autoera (Odessa region) and a trading division. The total fleet of the companies amounts to 210 grain carriers.

Before the full-scale Russian invasion into Ukraine, the group of companies had the capacity to export 1.2 million tons of grains and oilseeds per year. The total capacity of the three elevators is 315 thousand tons of simultaneous storage.

KMZ Industries produces flat-bottom and cone-bottom silos, flour storage silos, Brice-Baker mine dryers (British design) and chipboards (Ukrainian design), transport equipment (elevator, chain, belt and screw conveyors), separators for grain cleaning, installs and automates elevator equipment and technological processes in grain storages.

In 2020 the plant increased revenue by 35% to 395.26 million hryvnias and made 5.05 million hryvnias of net profit against a loss of 25.37 million hryvnias. In 2021, it planned to increase production by 30-50%.

As of the fourth quarter of 2021, Dragon Capital Investments Limited (Cyprus), whose ultimate beneficiary is Tomas Fiala, owns 80% of KMZ JSC shares, while Variant Agro Bud LLC holds 20%.

Ukraine plans to supply grain to Kenya within the Grain from Ukraine humanitarian initiative. The two countries also agreed to strengthen cooperation in agriculture.

According to the website of the Ministry of Agrarian Policy and Food of Ukraine, the relevant issues were discussed during the meeting of the Deputy Minister Markiyan Dmytrasevych with Franklin Mithika Linturi, the Minister of Agriculture and Livestock Development of Kenya.

According to the ministry, Dmytrosevych said that Ukraine understands the severity of the food crisis in Kenya, where an unprecedented drought in 2022 led to the fact that almost 3 million people in the country are in dire need of humanitarian food aid.

In turn, the representative of Kenya noted that every year it is more and more difficult for local farmers to farm because of climate change. Kenya is trying to take measures to ensure sustainability of agricultural production, in particular, the country is interested in sharing experience with Ukraine in the use of crop technology.

As previously reported, a delegation of the Ministry of Agrarian Policy visited Senegal, Nigeria and Ghana, where they signed a memorandum of cooperation with Senegal in the field of agriculture. In addition, all three countries have expressed a desire to develop cooperation with Ukraine and a willingness to expand their ports to intensify the unloading and storage of Ukrainian grain.

As a result of the visit, Ukraine will supply 25 thousand tons of grain to Nigeria in the coming months within the Grain from Ukraine humanitarian initiative.

By the end of November 2022, more than 30 countries and international organizations joined Grain from Ukraine, raising a total of over $180 million for the purchase of Ukrainian food.

Austria, Belgium, Bulgaria, Great Britain, Hungary, Greece, Estonia, the EU, Ireland, Spain, Italy, Canada, Qatar, Latvia, Lithuania, the Netherlands, Germany, Norway, Poland, Portugal, the Republic of Korea, Romania, Slovenia, Turkey, Finland, France, Croatia, the Czech Republic, Switzerland, Sweden, and the USA, as well as NATO and the UN, have reported on providing financial assistance.

The dollar is slightly falling against the euro and weakly appreciating against the Japanese yen in trading on Tuesday.

The euro/dollar pair was trading at $1.0825 at 8:52 Moscow time, versus $1.0821 at the close of the previous session.

The dollar/yen exchange rate rose 0.07% to 128.66 yen from 128.57 yen at the end of the previous session.

The pound is trading at $1.2195 versus $1.2196 in previous trading.

The index, calculated by ICE, which shows the U.S. dollar trend against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and the Swedish krona), rose 0.18%.

The dollar index is near its lowest level in seven months amid data showing that U.S. inflation slowed in December.

A weakening inflationary pressure in the United States could be the decisive argument for a further slowdown in monetary policy tightening by the Federal Reserve.

Meanwhile, the yuan, which is traded in mainland China, stands at 6.7676/$1 from 6.7336/$1 at the close of the previous session.

China’s economy grew 2.9% year on year in the fourth quarter of 2022, according to data from the State Statistics Office.

Thus, the growth rate slowed significantly from 3.9% in the third quarter.

Analysts on average had expected China’s GDP to rise 1.8% in October-December, Trading Economics reported.

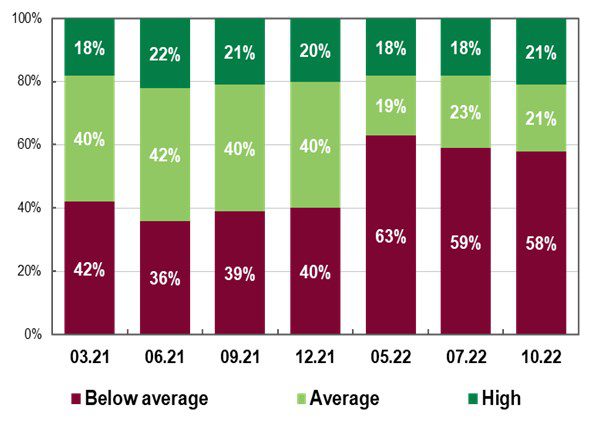

People’s assessment of their well-being in 2021-2022

Source: Open4Business.com.ua and experts.news

A mission of the international atomic energy agency has opened its presence at the Pivdenno-Ukrainian nuclear power plant, an Interfax-Ukraine correspondent reports.

The flag of the IAEA, in the presence of its head Rafael Grossi, was hoisted on the territory of the plant on Monday.

Grossi said the mission was badly needed because of the military situation in Ukraine.

“I am happy to be here. After Zaporizhzhia NPP, we are expanding our presence to other nuclear power plants in Ukraine. Today is the first step, and we will continue to work in this direction,” Grossi said after the flag-raising ceremony.

For his part, Energy Minister Herman Galushchenko welcomed the start of the IAEA mission, saying that it was important because of Russia’s aggression against Ukraine and the threats that the aggressor poses by terrorizing Ukrainians even on New Year’s Eve.

As reported, the IAEA announced the deployment of its permanent missions to three nuclear power plants in Ukrainian-controlled territory – in addition to the PAEC, the Khmelnytsky and Rivne nuclear power plants, and the Chernobyl nuclear power plant area. The IAEA permanent mission has been working for several months at the Russian-occupied Zaporizhzhia NPP, the largest in Europe.