Smart Holding, a large Ukrainian investment and industrial group and international investor, announced a change of owner, which until recently was former MP Vadym Novinsky, as a result of the completion of another round of the current restructuring.

“As part of the restructuring, Smart Holding founder Vadim Novinsky decided to transfer the assets to a trust. The relevant Smart Trust and Step Trust agreements were concluded in November 2022 and registered with the Cyprus Securities and Exchange Commission,” the group said on its website on Monday.

According to it, the trustees were highly qualified fiduciary administrators appointed in accordance with the licensing conditions of Cyprus law.

“Accordingly, the fiduciaries (trusts) fully own, control and manage the Group’s assets… According to the foregoing, as of the current date, Vadim Novinsky has no beneficial interest in the Group and exercises no control over the Group’s activities or processes,” the information notes.

According to it, Novinskiy, who has not participated in the management of Smart Holding since 2013, decided to concentrate his activity on private interests.

As reported, the President of Ukraine Vladimir Zelensky decree of December 1, 2022 introduced the decision of the National Security and Defense Council “On certain aspects of the activities of religious organizations in Ukraine and the application of personal special economic and other restrictive measures (sanctions)”, which sanctions were also applied to Novinsky.

The sanctions package includes 12 types of imposed restrictions, in particular, full blocking of assets, a ban on trade operations, deprivation of all state awards and insignia, a ban on taking capital out of Ukraine, etc.

In a statement, Smart Holding stresses that it continues to work as usual, it is led by a professional management team, conducting business in conditions of economic and civil crisis caused by the war with Russia.

The information indicates that representatives of the trust, as the beneficial owner, together with Smart Holding management are finalizing a new corporate governance structure and management structure for Smart Holding in accordance with best international practices, and are in the process of selecting new board members.

“Smart Holding has a mission to support the Ukrainian economy to withstand the devastation of war. The group will be actively involved in the post-war reconstruction of the country. We also have ambitious investment goals as part of our international development strategy. We believe that with the accumulated talent and experience in the management team, the company will renew its assets and become stronger”, – Smart Holding CEO Yulia Kiryanova was quoted in the report.

Smart Holding is one of the largest investment groups in Ukraine and one of its main assets is a 23.76% stake in the mining and metallurgical holding Metinvest. Group companies also invest in other assets of mining, metallurgy, oil and gas, agriculture, shipbuilding, real estate and energy sectors. The holding’s strategy is aimed at effective management of a diversified portfolio of investments in order to increase its value in the long term, according to its website.

PrJSC “Marganets Mining and Processing Plant” (MGOK, Dnipropetrovsk region), following the results of work in 2022, reduced the production of manganese concentrate by 41.2% compared to the previous year – to 324 thousand tons.

According to the information of the enterprise, MGOK, like other mining and metallurgical enterprises of Ukraine, has been going through difficult times for more than 10 months. Due to the outbreak of a full-scale war, many enterprises could not operate at full capacity, and some stopped their activities.

At the same time, already in March, a difficult situation developed at MGOK: almost all production plans were adjusted, since many employees of the plant, especially longwall miners, were drafted into the ranks of the Armed Forces of Ukraine.

“However, having more or less stabilized its work, having developed the necessary production plans and actions for their implementation, MGOK continued its mining activities, and it completed 2022 quite successfully,” the company’s information states.

At the same time, it is noted that the main indicator of the successful activity of MGOK is the work of the Grushevskaya enrichment plant (GOF), which produces manganese concentrate – the main source of profit for the enterprise. However, due to the active conduct of hostilities and a number of other reasons, since October 2022, the GOF has accepted raw manganese ore mined by the mines and the quarry of the plant, only for storage. During the last period of last year, specialized repair teams were engaged in the repair of equipment and equipment of the factory.

“In this regard, the “minus” from the total production of concentrates amounted to 2.8 thousand tons – in total in 2022, a little more than 324 thousand tons of concentrate (99.1%) were produced, and from the additional production, the plant worked with a “plus” in 32 tons – in total, 732 tons of concentrate (104.6%) were withdrawn from the enrichment tailings,” the company says.

According to the company’s data, MGOK worked with a “plus” of 31.45 thousand tons in the treatment of raw manganese ore, having extracted 894.5 thousand tons of ore through the joint efforts of the shops, with an adjusted plan of 863 thousand tons. Thus, all mines and the Grushevsky quarry fulfilled their annual plans for the extraction of raw manganese ore.

Thus, mine No. 3/5, with a plan for 2022 for the extraction of ore in the amount of 73 thousand tons, despite the somewhat unstable operation of the shop and the work of only one cleaning team, exceeded the target by 2.7 thousand tons. Tunneling work was not carried out by this underground mining shop during 2022, since the tunneling team was transferred earlier than planned to excavate mine workings at mine No. 14/15.

Mine 9/10 achieved its planned volumes for the extraction of raw manganese ore for 2022 by 102.7% – in total, just over 309 thousand tons of ore were mined.

The cleaning team of mine No. 14/15 for 2022 mined 233.5 thousand tons of raw ore, against the planned 226.9 thousand tons.

Grushevsky quarry, with a plan for ore extraction of 273.3 thousand tons, produced 286.598 thousand tons.

As reported, MGOK produced 551.43 thousand tons of concentrate in 2021 (at the level of 2020).

MGOK develops the eastern part of the Nikopol manganese ore deposit (Grushevsko-Basansky site). The plant, in particular, includes four operating mines, including one under construction, one quarry – Grushevsky, and a processing plant.

According to the company at the end of June 2022, the largest shareholders of PrJSC are Couttenmax Holdings Limited, Mosfilia Investments Limited and Humax Enterprises Limited, each owning 23.89% of PrJSC each, as well as Fianex Holdings Limited (all Cyprus), which owns 24% shares.

The authorized capital of PJSC “MGOK” is UAH 366.625 million, the par value of the share is UAH 0.25.

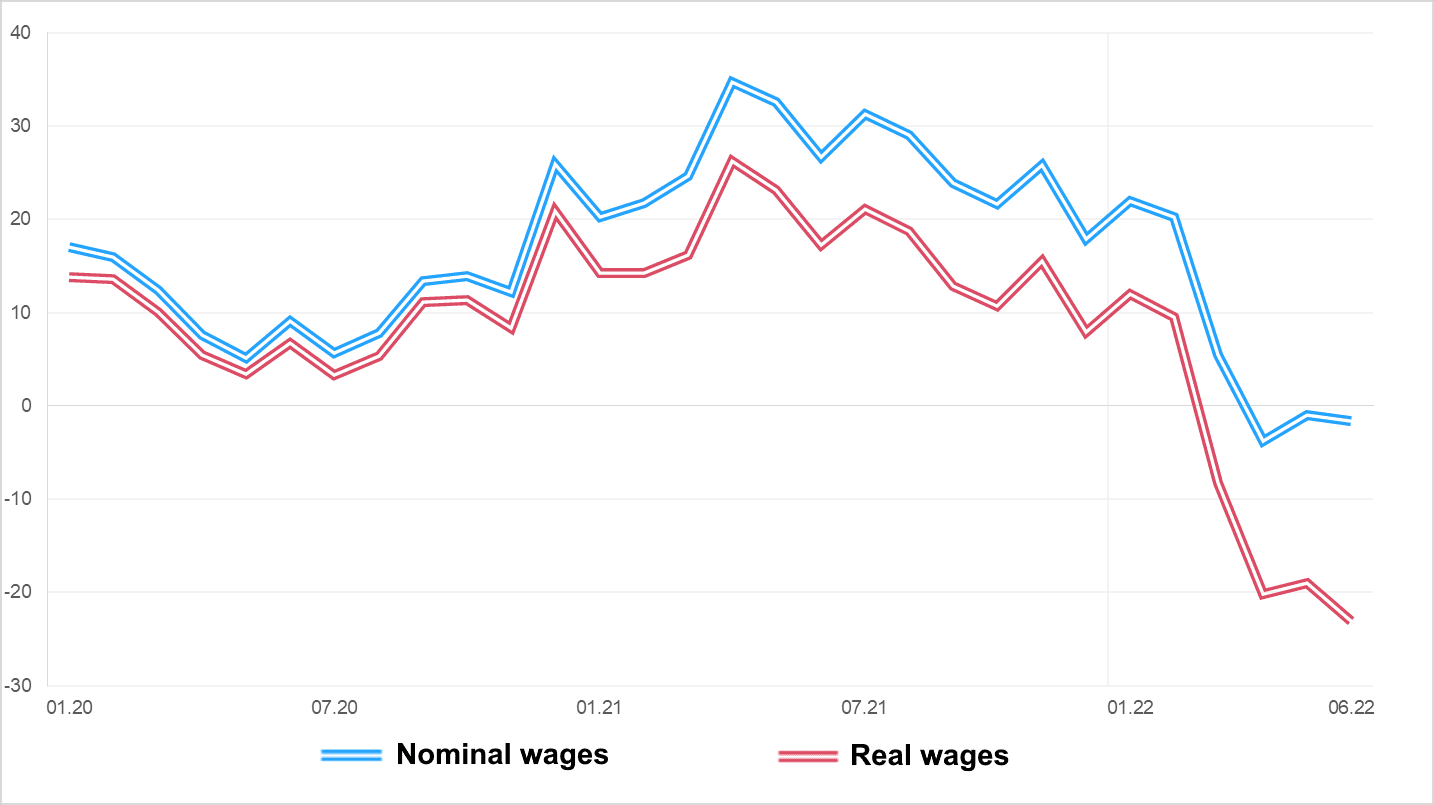

Dynamics of changes in level of wages in Ukraine for 2020-2022 (%)

Source: Open4Business.com.ua and experts.news

In January-November 2022, the coke-making division of Kametstal (formerly Dniprovsky Coke Chemical Plant, Kamenskoye, Dnipropetrovsk Region) of Metinvest Mining and Metallurgical Group reduced its output of metallurgical coke by 27.7% year-on-year, to 365 thousand tons.

As a company representative told Interfax-Ukraine, in November the company produced 30 thousand tons of metallurgical coke.

Meanwhile, in January-November 2022 the gross coke output at 6% moisture amounted to 420,000 tons, including 34,000 tons in November.

In 11 months-2021, the plant produced 505 thousand tons of coke, including 43 thousand tons in November.

In 11 months 2022 the plant was supplied 581 thousand tons of coals and concentrate, including 490 thousand tons of domestic coals, 36 thousand tons from the Russian Federation (before the war) and 55 thousand tons from the United States. In November, 56,000 tonnes of coking coal of Ukrainian production were supplied.

As reported, holding plants in Ukraine for 11M-2022 decreased the production of gross coke 6% moisture by 58.1% compared to the same period in 2021 – up to 3.66 million tons. At the same time in November, 235 thousand tons of gross coke, including metallurgical coke – 204 thousand tons, during this period production of metallurgical coke was 3.14 million tons.

Currently, Yuzhkoks, Kametstal, DMZ (“Dneprokoks”), Zaporizhkoks and coke-chemical production at ArcelorMittal Kryvyi Rih are in operation.

During 11 months of 2022, 4.254 million tons of coal concentrate was supplied to domestic coke plants (11 months-2021 – 11.834 million tons), including Ukrainian production – 2.853 million tons, 623.9 thousand tons were imported from Russia (before war), 65.4 thousand tons from Kazakhstan (before war), Poland – 36.3 thousand tons, Czech Republic – 38.8 thousand tons, USA – 448.6 thousand tons and Australia – 187.3 thousand tons. Including 308 thousand tons of concentrate supplied in November, of which Ukrainian production – 299 thousand tons.

Ukraine in 2021 decreased coke output by 1.3% compared to 2020 – down to 9.543 million tons.

“Kametstal” was created on the basis of PJSC “Dneprovskiy Coke Chemical Plant” (DKHZ) and the CEC of PJSC “Dneprovskiy Metallurgical Plant” (DMK).

According to the report of the parent company of Metinvest Group for 2020, Metinvest B.V. (Netherlands) owned 100% of DKHZ shares.

Hryvnia median price per sq.m. in new buildings rose by 38% in Kiev and by 33% – in the capital region for the year, according to a study of the portal of new buildings LUN. In the capital in January-2022 the median price rose from 34.7 thousand UAH / sq.m. to 48.2 thousand UAH / sq.m. in January-2023, in the region – from 20.9 thousand UAH / sq.m. to 28 thousand UAH / sq.m.

According to the LUN portal, in January-2023 in Odessa the median price of objects under construction increased by 48% – from 25.2 thousand UAH / sq. m. to 38.4 thousand UAH / sq. m, in the Odessa region by 68% – from 18.8 thousand UAH / sq. m. to 30.7 thousand UAH / sq. m.

The record price increase is in Lviv, where the median price for the year increased by 80% – from 25.5 thousand UAH / sq. m. to 46.7 thousand UAH / sq. m. In Lviv region real estate rose in price by 66% – from 17 thousand UAH / sq. m. to 28.9 thousand UAH / sq. m.

The U.S. Department of Agriculture has lowered its forecast for global rice production in 2022-2023 due to deteriorating crop prospects in China and a number of other leading medium-grain rice-producing countries.

Global rice production is expected to be 502.97 million tons, lower than the December forecast (503.27 million tons) and previous years’ results (514.95 million tons in the 2021-2022 season), the agency said in a review.

Significant production declines in the 2022-2023 marketing year are expected in major medium-grain rice producing and exporting countries, including the United States, Australia, and the European Union.

In the U.S., due to drought weather in California, production of medium- and short-grain rice could drop 31% from the 2021-2022 crop year and be at a record low since the 1972-1973 season, the nation’s Agriculture Department forecasts. Rice prices on the domestic market have jumped 50% from last season’s level. Export prices are also on the rise, which could result in exports being the lowest on record since 1998-1999. Historically, the largest export markets for U.S. rice have been Japan and South Korea. They remain key markets as required under the WTO, but limited volumes have been tendered in recent tenders due to declining interest from suppliers, given reduced supply and rising U.S. prices.

The country’s rice production forecast was lowered to 5.09 million tons from the December estimate of 5.22 million tons, exports to 2.15 million tons from 2.25 million tons.

In the EU in the season 2022-2023 is expected to fall by 25% rice production, the figure may be the lowest since the season 1984-1985. The main producers of rice in the EU (80% of the volume) are Spain and Italy, and both countries have faced severe drought and lack of water for crops. Rice production in the EU is expected to be 1.29 million tons compared to 1.72 million tons last season, exports will decrease slightly (to 400 thousand tons from 440 thousand tons). At the same time, imports of rice to the EU may turn out to be a record, amounting to 2.7 million tons. Historically, long-grain rice has historically accounted for the bulk of supplies, but in recent years the share of medium-grain rice imports has been growing.

China, which is the world’s largest producer of medium-grain rice, could cut production to 145.95 million tons in the 2022-2023 crop year (the previous estimate was 147 million tons from 148.99 million tons last season. Despite some decrease in harvest, prices are likely to remain competitive in the world market, given the impressive stocks. The forecast for Chinese rice exports for the 2022-2023 season is 2.2 million tons (estimate unchanged). The main importers of Chinese rice are Asian and African countries.

The world’s largest rice exporter, India, could deliver 20.5 million tons to world markets this season, the forecast was raised from the December estimate of 20 million tons). Also, the U.S. Department of Agriculture raised its forecast for India’s rice production by 1 million tons to 125 million tons.

Rice export estimates from Thailand and Vietnam remained unchanged at 8.5 million tons and 7.4 million tons, respectively.

The forecast for global rice exports in 2022-2023 was raised to 54.38 million tons from 53.76 million tons.