The forestry industry in Ukraine by the end of 2022 received a record for the time of independence proceeds from the sale of products in the amount of 23.5 billion UAH, which is 3.1% more than last year’s figures, profit of the industry amounted to 1.3 billion UAH (+30%), and the amount of taxes and fees paid – 8.9 billion UAH (+6.7%).

As the head of the State Agency of Forest Resources of Ukraine Yuri Bolokhovets said in Facebook on Wednesday, the average salary of the department’s employees rose to 20 thousand UAH.

“Even during the war, we did not stop capital investments, which exceeded 800 million UAH. The main priority is the prevention of occurrence and extinguishing of forest fires. Observation towers with video surveillance, fire trucks and modules, 188 cross-country vehicles for patrolling, 165 tractors, 12 units of specialized equipment (excavators, graders, etc.) necessary for implementation of fire prevention measures, forest roads construction”, – he wrote.

Also in 2022 the State Forestry Agency purchased the first two innovative forestry machines, three forestry harvesters, a forwarder and two skidders. Bolokhovets noted that for the first time in Ukraine with ultramodern equipment can be provided the whole technological cycle of forestry, from planting material to harvesting. The department is actively involved in countering the energy crisis: during the year were purchased three lines to produce technological chips and five complexes for wood cutting.

The head of the department noted that this year the activities on protection and reproduction of the state hunting fund were preserved. However, hunting throughout Ukraine has been banned since the beginning of the Russian full-scale invasion, so no funds from users of hunting grounds are temporarily received.

According to Bolohovets, this year the demand for Ukrainian timber has dropped significantly, as the war has almost stopped construction inside the country, and the Russian blockade of the Black Sea ports has led to the closure of Asian markets for Ukrainian exports, and the logistics of timber to Asia through other channels has been unprofitable. At the same time, as a result of the recession, the EU market has been oversaturated with its own products.

As a result, in Ukraine in 2022 the weighted average stock prices for pine logs fell by more than 20%, while the cost of logging has increased significantly, in particular, only the fuel has doubled in price.

“We had to pursue a very flexible policy and be in a constant dialogue with the business. Few people have noticed, but this year not only raw timber, but also lumber for the first time began to be sold through open auctions. We completely abandoned the practice of direct contracts. As a result, we managed to keep the balance: the profitability and logging volumes were reduced, but kept at an acceptable level, and the market and Ukrainian processors were provided with available raw materials,” summed up the head of the State Forestry Agency.

Ukrainian President Vladimir Zelensky has announced a message to the Verkhovna Rada on the external and internal situation of Ukraine

“Soon I will present my view on the implementation of these tasks in the annual message to the Verkhovna Rada on the external and internal situation of Ukraine. I want this message to be not a report, but our conversation with you about the next year,” he said in a video message on Tuesday.

According to him, “This week will be politically important for Ukraine. We’re going into next year and we have to maintain a common understanding of our national goals.”

“Of course, it is the liberation of our land from the enemy, as well as the reconstruction of Ukraine, the return of our people home, the further rapprochement of our state with key partners, the opening of new opportunities for Ukraine in the world – this is the task for the near future. And not only for the state, but also for each of us,” Zelensky said.

The temporary administrative board of the Antimonopoly Committee of Ukraine (AMCU) decided to impose a fine on LLC “Ukrstalpostach” and LLC “Ukrainian Pipe Plant” for collusion in their participation in public procurement.

According to a press release on Tuesday, the case involves eight procurement procedures that were announced by different customers.

“When considering the case, the circumstances were established, which in their totality indicate the commission by the defendants of anti-competitive concerted actions to eliminate competition between them when participating in the tenders. There were irrefutable facts that indicate coordinated behavior of the companies in the preparation and participation in the bidding, communication between them and exchange of information,” – stated in a press release.

According to the AMCU, such concerted actions of public procurement is a violation (Clause 4 Part 2 Article 6, Clause 1 Article 50 of the Law on Protection of Economic Competition).

For collusion LLC “Ukrstallpostach” and LLC “Ukrainian Tube Works” have been fined by the Committee in the total amount of UAH 103,256 million. In particular, “Ukrstallpostach” LLC was fined in the amount of 94,890 million UAH, “Ukrainian Pipe Works” LLC – 8, 366 million UAH.

The US dollar rate was changing little against the euro and the pound during the Wednesday morning session, but demonstrated a considerable rise against the yen amid increasing US government bond yields.

The ICE-calculated index showing the U.S. dollar’s performance against six currencies (euro, Swiss franc, yen, Canadian dollar, pound sterling and Swedish krona) is up 0.1%, as is the broader WSJ Dollar Index.

The dollar/yen exchange rate is up 0.4 percent at 134.08 yen as of 7:48 a.m. ksk, up from 133.50 yen at the end of last session.

The yield on 10-year U.S. government bonds on Wednesday morning is about 3.85%, the highest since early November. The rise in yields is due to fears that China’s successive easing of anti-coverage restrictions could intensify global inflationary pressures, Trading Economics writes.

The dollar also continues to receive support from the Federal Reserve’s (Fed) hawkish mood. The Fed expects to raise its key interest rate to 5-5.25% over the next year and hold it at that level until at least early 2024 to return inflation to its 2% target.

The U.S. rate now stands at 4.25-4.5%, meaning the Fed plans three more hikes of 25 basis points. Many market participants expected the final rate level to be lower and were hoping for a reversal in the Fed’s monetary policy and a rate cut at some point next year.

The euro/dollar pair is trading at $1.0645 versus $1.0642 at the close of Tuesday’s session.

The pound sterling is losing less than 0.1% and is trading at $1.2026 versus $1.2031 the day before.

Sweden will become the fourth European country ready to provide Ukrainian road builders with temporary bridge structures for the resumption of traffic, First Deputy Head of Ukravtodor Andriy Ivko has said.

“Sweden has begun the process of providing assistance to Ukraine to supply critically needed six modular bridges. Currently, preparations are underway to organize transportation,” Ivko said in an interview with the CFTS.

He said that in addition to Sweden, Ukraine received bridge structures from the Czech Republic, France and Norway. And the Czech Republic, in addition to the six temporary bridges already sent to Ukraine, plans to transfer another 12 bridges.

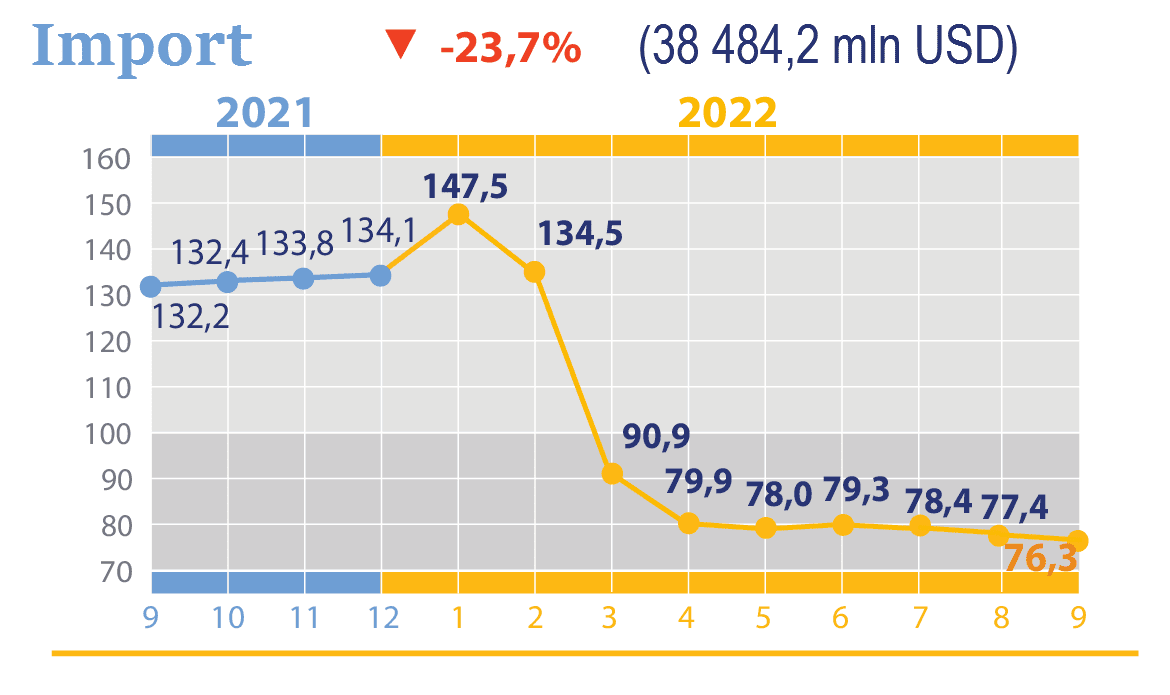

Import changes in % to previous period in 2021-2022

Daten: SSSU