Switzerland organized another batch of humanitarian aid for the population of Ukraine in the form of 40 heaters and the same number of generators, according to the Ministry of Foreign Affairs of Switzerland.

“The materials were collected in Switzerland by the Swiss Agency for Development and Cooperation (SDC), which also organizes transport. The possibility of sending additional relief materials is being considered,” the report said.

The agency reported that trucks with this equipment left for Ukraine on December 23. The shipment is part of a broader action plan to help the people of Ukraine survive this winter.

It is noted that Switzerland already delivered thirty generators last week.

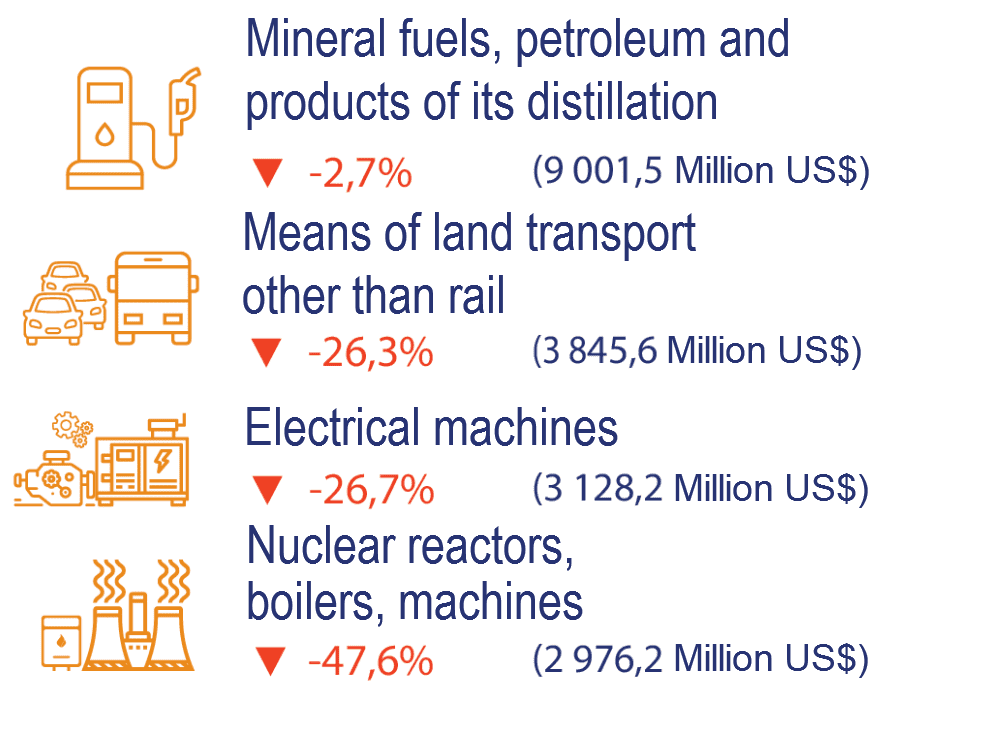

Import of goods in Jan-Sep 2022 in most important positions and in relation to same period in 2021

SSC of Ukraine

Ukrainian President Volodymyr Zelensky said that ten African states where Ukraine will open new embassies next year have already been determined.

“We are resetting relations with dozens of African countries. Next year we have to strengthen it. Ten states where new Ukrainian embassies in Africa will be opened have already been determined. We have also developed the concept of the Ukraine-Africa Trading House with the opening of its representative offices in the capitals of the continent’s most promising countries,” Zelensky said at the Ukrainian ambassadors’ conference “War and New Horizons in the World” on Friday.

The President stressed that “in addition to the existing representation of Ukraine in ten countries in Africa, together with new embassies and trading houses, it is necessary to achieve representation in thirty countries of the African continent.”

At the same time, the head of state noted that global growth is impossible without relations with other parts of the Global South as well.

“Latin America, India, other Asian countries, including China and Southeast Asia, the entire Indian and Pacific island region. Ukraine must find a format for its leadership in strategic processes in each of these regions, and the role of Ukraine’s diplomatic corps will be decisive,” Zelensky said.

Auction house Christie’s summed up the results of the year and said that he was able to achieve the best annual turnover in its entire 256-year history – $ 8.4 billion. It is 17% higher than last year’s result and more than its main competitor – home Sotheby’s, which also showed a record sales of $ 8 billion.

Auctions brought Christie’s $7.2 billion, another $1.2 billion was earned on private sales. The auction house, headed by CEO Guillaume Cerrutti, was able to achieve these outstanding results, despite the difficult macroeconomic situation in the world caused by rising inflation and instability on the world political stage.

Cerutti referred to the “stability of the art and luxury markets, the extraordinary success of some of the major collections, including the unforgettable sale of Paul Allen, and the expertise and hard work of the entire auction house team. Allen was one of the co-founders of Microsoft on a par with Bill Gates. In 2009, he signed a “Giving Pledge,” according to which most of his fortune would go to charities upon his death. Allen passed away in 2018, and his art collection, which included masterpieces from Botticelli to Van Gogh, sold for a record $1.7 billion in 2022.

Among the best deals of the year was the record sale of the Shot Sage Blue Marilyn portrait of Marilyn Monroe by American pop art classic Andy Warhol. It went under the hammer for $195 million and set a record as the most expensive work of any artist sold at auction.

The number of buyers from North and South America increased this year at Christie’s auction, while Asian collectors bought less frequently.

Nevertheless, according to French billionaire François Pinault, whose holding company Artemis owns the Christie’s house, Asian buyers played a “decisive role” in the overall success of record sales of the Allen collection.

The Cabinet of Ministers of Ukraine has decided to increase humanitarian aid to Africa and Asia by an additional 21,000 tons of corn or wheat, and also changed the terms of their delivery from CIF (sender pays cargo insurance) to FOB (delivery of goods before loading on board the ship).

According to the representative of the Cabinet of Ministers in the Verkhovna Rada Taras Melnychuk in his Telegram channel, the relevant decision was taken at a government meeting on Friday.

Earlier, in November, the government passed resolution No. 1313, approving the allocation of 900 million UAH to the Ministry of Internal Affairs of Ukraine (MIA) for its constituent State Emergency Service (SES) to purchase in Ukraine and subsequent delivery to the Republic of Sudan, Republic of Yemen, Republic of Kenya and Federal Republic of Nigeria of up to 64 thousand tons of corn or wheat grain. In addition, Ukraine undertook to send at least 125 thousand tons of wheat and corn (quality not lower than the 3rd class).

Thus, taking into account the decree adopted on 23 December, the four countries will receive from Ukraine up to 210 thousand tons of grain.

Ukraine in January-November this year, Ukraine has reduced the export of semi-finished products of carbon steel in physical terms by 70.6% compared to the same period last year – up to 1 million 824.586 thousand tons.

According to statistics released by the State Customs Service (SCS), in monetary terms, exports of semi-finished products of carbon steel during this period decreased by 69.4% – to $ 1 billion 147.436 million.

In addition, Ukraine imported 5,558 thousand tons of such products in January-November, which is 84.7% less than in January-November 2021. In monetary terms, imports decreased by 84.9% to $3.634 million.

As reported, Ukraine in 2021 decreased exports of semi-finished carbon steel products in volume terms by 9.5% compared to 2020 – up to 6 million 776.44 thousand tons. In monetary terms, exports of semi-finished carbon steel products for the year increased by 48.8% – to $4 billion 93.02 million. The main exports were shipped to Italy (30.90% of deliveries in monetary terms), Turkey (12.77%) and the Dominican Republic (8.02%).

In addition, Ukraine imported 38.97 thousand tons of such products in 2021, which is 2.6 times more than in 2020. In monetary terms, imports increased by 3.9 times – up to $25.95 million. Imports were from the Russian Federation (97.73% of supplies), Turkey (1.15%) and Uzbekistan (1.08%).