The first ship with 25 thousand tons of Ukrainian grain has arrived to Ethiopia within the humanitarian program “Grain from Ukraine” of Ukrainian President Vladimir Zelenskyi, the press service of the President said.

“The first ship in the framework of the Ukrainian humanitarian program “Grain from Ukraine” on December 3 arrived in Ethiopia, delivering 25 thousand tons of Ukrainian wheat to the port of Dorale,” – said in the message.

Zelensky announced this program on November 15 during the G20 summit.

The second vessel, the loading of which is completing in the Ukrainian port of Chernomorsk, will go to Ethiopia next week with 30 thousand tons of wheat on board.

The third vessel will deliver 25 thousand tons of humanitarian wheat to Somalia (loading in Odessa port).

“In total, in the framework of the humanitarian initiative “Grain from Ukraine” our state plans to send more than 60 ships to Ethiopia, Sudan, South Sudan, Somalia, Congo, Kenya, Yemen, etc.,” – said in the message.

It is noted that more than $180 mln was attracted for implementation of this program.

Ukraine has deployed 5,200 POPs throughout Ukraine, which have been used by 100,000 people over the past two weeks, Deputy Head of the Presidential Office Kyrylo Tymoshenko said at a briefing in Kiev on Friday.

“We are tirelessly preparing for different scenarios of events, deploying more and more Indestructibility Points throughout the country. Over the past two weeks, 100,000 people have already used them. As of today, 5,248 points have been set up. All the points are provided with generators,” he said.

Thus, 4098 points were equipped by regional military administrations in cooperation with communities, 1028 points were provided by the State Service of Ukraine for Emergencies.

Timoshenko added that there are 1.3 million places for internally displaced persons in 15 regions. According to his data, 89% of them are occupied, most of all – in Vinnitsa, Poltava, Lviv, Cherkasy, Khmelnitsky and Kirovograd regions.

At the same time the largest number of vacancies is in Rivne, Zakarpattia, Odessa, Zhytomyr, Poltava and Volyn regions.

The deputy head of the OP added that the evacuation from the territories of active hostilities continues. Since August 2, 317,800 people have been evacuated, including 76,000 children, 8,000 people with disabilities.

The Antimonopoly Committee of Ukraine (AMCU) allowed Aqua Solar Invest LLC (Bershad, Vinnytsia region) to purchase Kobylovoloki distillery (Kobylovoloki village, Ternopil region), which is part of Ukrspirt, and Vitagro Energy LLC (Gvardeyske village, Khmelnitsk region) was allowed to purchase the Marylivsky distillery (Nagirnyanka village, Ternopil region) from Ukrspirt.

The Committee approved the corresponding permits for the privatized assets at its meeting on December 1.

LLC “Aqua Solar Invest” won the right for privatization of Kobylivolokskyi distillery for UAH 70,25 mln on September 19, 2022.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, the ultimate beneficiaries of “Aqua Solar Invest” with a registered capital of 25 million UAH are Alexander Yaroshenko (25% in the share capital), Lilia Astapova (25%) and Elena Smirnova (25%), while until December 2020 the company was fully owned by Felix Lutsky. The legal entity is engaged in distillation, rectification and blending of alcoholic beverages, while before January 2021 its line of business was real estate trade.

This company already has experience in privatization of assets of state enterprise “Ukrspirt” – in October 2020 it won the online auction “Prozorro.Sells” the right to privatize Bershadskyi distillery for 19.81 million UAH, and in early February 2022 closed the deal to purchase it, having received permission of the AMCU.

The immovable property of the Kobylivolok distillery to be privatized with a total area of 11.5 thousand square meters is located on seven plots of land in Terebovlyansky district of Ternopil region with a total area of 36.95 hectares. The plant includes production buildings, granary, distillery, hangars, pumping stations, greenhouse, starch and malt shops, gas station, etc., as well as the technological equipment and the necessary communications.

The daily capacity of the distillery is 2.7 thousand dal of ethyl alcohol. The company was founded in 1905 and modernized in 2016. Production at the facility has been temporarily suspended.

In turn, Vitagro Energy won the right to privatize Marylivskyi distillery for UAH 150 mln on September 20, 2022.

According to the Unified State Register of Legal Entities and Individual Entrepreneurs, the ultimate beneficiary of Vitagro Energy LLC with a registered capital of 10 thousand UAH is Serhiy Labaziuk, a member of parliament (the Za Maybutne parliamentary faction). The main activity of the company is the production of electricity, but the legal entity may also engage in the cultivation of root crops and melons, as well as auxiliary activities in crop farming.

The company is part of the large Vitagro holding, which is engaged in the production and processing of crops, including fruits and vegetables, dairy farming and pig breeding. The Group cultivates about 85 thousand hectares of land in Khmelnytsky, Ternopil and Rivne regions and has a livestock of 110 thousand pigs.

According to Vitagro’s website, Vitagro Energy was founded in 2018 to develop renewable energy projects. The company has four solar power plants in the Khmelnitsky region on a total area of 29.5 hectares with a total capacity of 12.9 MW, and also works with other sources of renewable energy, such as wind and biomass.

The Marylivsky distillery is located in the village of Nagirnyanka, Chortkivsky district, Ternopil region. The list of assets includes 1518 items of buildings, equipment, movable and other property.

The enterprise is located on three land plots with a total area of 26.6 hectares and consists of an administration building, seven production shops, a bard storage facility, a starch workshop, greenhouses, hangars, warehouses for grain, finished products and alcohol, as well as other constructions and infrastructure facilities.

The distillery was founded in 1928, the maximum production capacity in 2009 was 7300 thousand dal per day.

Thus, the privatization of these two assets of Ukrspirt will allow the State Property Fund of Ukraine to transfer 220.25m dollars to the state budget.

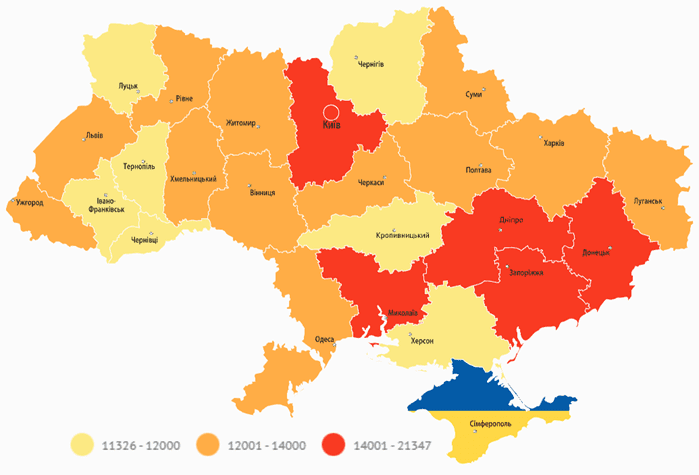

Average salary of staff employees be regions (UAH)

State employment center

Three dry cargo ships carrying corn and sunflower seeds left Ukrainian ports on Friday, the Joint Coordination Center (JCC) reported.

“Three ships left Ukrainian ports on December 2, carrying a total of 106,500 tons of grain and other agricultural products under the Black Sea Grain Initiative,” the report said.

Vessel Aspasia Luck is transporting 63 thousand tons of corn to China, Sea Inspiration is delivering 26.5 thousand tons of corn to Italy. Lady Perla dry-cargo carrier will carry 17 thousand tons of sunflower seeds to Bulgaria.

Three vessels, which passed through the sea humanitarian corridor on December 2, are also on their way to Ukrainian ports.

“As of December 2, the total tonnage of grain and other agricultural products exported from the three Ukrainian ports is 12,713,836 tons. A total of 1,031 vessels have been allowed to move so far: 515 to arrive at Ukrainian ports and 516 to leave them,” the report said.

Ukrainian agrarians harvested 66.32 million tons of major crops from the total area of 16.28 million hectares by December 2, with 2.5 million tons of corn from 0.4 million hectares, including 15.5 million tons of corn from 2.5 million hectares (60% of cultivated areas) in the period November 25 – December 2.

According to the website of the Ministry of Agrarian Policy and Food on Friday, the total area of agricultural land, from which the crops were harvested, increased by 3 percentage points (p.p.) – up to 85% of the previously planned areas.

In terms of crops harvesting of wheat, barley, peas and rapeseed was completed. During the week the volumes of harvested buckwheat remained unchanged (98%), but increased by 1 percentage point for soybeans – to 98%, sunflower – to 97%, millet – to 96%, by 4 percentage points for sugar beet – to 97%, by 7 percentage points for corn – to 60%.

According to Minagropolitiki, the final yield of wheat in the current season amounted to 19.4 million tons from 4.7 million hectares, barley – 5.6 million tons from 1.6 million hectares, rape – 3.2 million tons from 1.1 million hectares, pea – 261 tons from 111 thousand hectares.

In addition, December 2, a total of 15.5 million tons of corn was harvested (+2 million tons per week) from 2.5 million hectares (+0.3 million ha), 9.9 million tons of sunflower (+0.1 million tons) from 4.6 million hectares (+0.1 million ha), 8.6 million tons of sugar beets (+0.4 million tons) from 174 thousand hectares (+8 thousand ha). ha (+8 thousand ha), 3.6 million tons of soybeans from 1.5 million ha (no change), 157 thousand tons of buckwheat (+1 thousand tons) from 115 thousand ha (no change), and 100 thousand tons of millet (2 thousand tons) from 42.9 thousand ha (+0.3 thousand ha).

According to the Ministry, the average yield of all crops in the current season was 44.4 c/ha, including corn – 61.3 c/ha, wheat – 41.2 c/ha, of barley – 35.1 kg/ha, rape – 28.9 kg/ha, soy – 24.2 kg/ha, pea – 23.4 kg/ha, millet – 23.2 kg/ha, sunflower – 21.7 kg/ha, buckwheat – 13.6 kg/ha, sugar beet – 498 kg/ha.

It is reported that farmers of Mykolayiv and Odesa regions have completed the harvesting of all crops. Most cereals and leguminous crops were threshed in Vinnitsa region – 3.7 million tons, followed by Kirovograd region (3.4 million tons) and Dnipropetrovsk region (3 million tons).

As reported, this week, First Deputy Minister of Agrarian Policy and Food of Ukraine Taras Vysotsky told Interfax-Ukraine news agency on the sidelines of the conference “EBA-2022 Infrastructure Day” that the corn harvest this year will be successfully harvested until the spring 2023.

“There are still 11-12 million tons of corn left in the fields. We will be able to harvest it, but depending on weather conditions, it may take several weeks to several months. Ukraine has experience in harvesting it in previous peaceful years. It all depends on weather factors – this crop may be on the fields until spring. Harvesting speed also depends on the weather factor, “- Vysotsky commented on the situation.

Ukraine in 2021 harvested a record crop of cereals, legumes and oilseeds at 106 million tons: cereals and legumes – 84 million, and oilseeds – 22.6 million tons.

A total of 32.4 million tons of wheat, 40 million tons of corn, 10 million tons of barley, 581.5 thousand tons of peas, 191 thousand tons of millet and 110 tons of buckwheat were harvested last year. Sunflower harvest amounted to 16.3 million tons, soybeans – 3.4 million tons and rapeseed – 2.9 million tons.