On Tuesday, the hryvnia exchange rate in the cash market strengthened by more than 1 UAH/$1, to a level of about 39 UAH/$1, at which it stayed on the first day after the National Bank refixed the official rate from UAH 29.25/$1 to 36, 57 UAH/$1.

According to market participants, at present in some non-bank exchangers in Kyiv it is already possible to buy a dollar a little cheaper than UAH 39/$1, while most banks still offer a selling rate of UAH 39/$1 or worse.

According to the “Minfin” resource, on Thursday morning Raiffeisen Bank declared a selling rate of UAH 38.8/$1, Universal Bank – UAH 38.9/$1, while PrivatBank – UAH 39.15/$1, while the best buying rates are now do not exceed UAH 38.4-38.5/$1.

On the cash “gray” market on Thursday morning, according to the Ministry of Finance, the dollar was quoted: buying – UAH 38.4 / $ 1, selling – UAH 39 / $ 1, having won back UAH 0.1-0.2 after falling by 1.1 -1.3 UAH the day before.

Oleg Gorokhovsky, co-founder of monobank, said that in the first day after the launch on Tuesday evening, about $9 million were sold in the application for buying non-cash currency for placement on a deposit for a period of three months and 11.273 thousand contracts were concluded with a total number of bank customers of about 6 million.

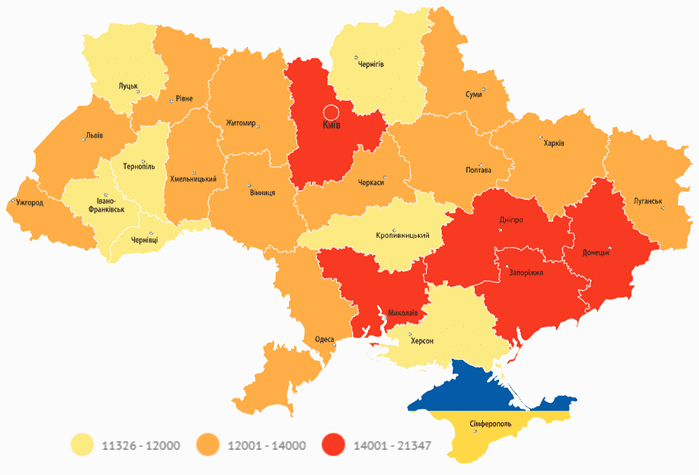

Average salary of staff employees (UAH)

State employment center

Zaporizhia Ferroalloy Plant (ZFP) in January-June of this year reduced its output by 49.4% compared to the same period last year, to 49,110 tonnes.

As the Ukrainian Association of Ferroalloy Producers told Interfax-Ukraine, over six months, ZFP reduced production of silicon manganese by 41.6%, to 17,320 tonnes, ferrosilicon – by 57.4%, to 16,620 tonnes, and ferromanganese – by 46.2%, to 13,650 tonnes.

The enterprise also reduced production of metallic manganese by 49.7%, to 1,520 tonnes.

In June, 4,180 tonnes of ferroalloys were produced.

Earlier, Pavel Kravchenko, head of the ZFP board, told the agency that the company continued to operate, although it had reduced production volumes. At the same time, the plant is experiencing difficulties with the provision of consumables, as well as with the shipment of products.

Primary registrations of new commercial vehicles (including trucks and special vehicles) in Ukraine in July increased by 38% compared to June of this year, to 593 units, Ukravtoprom reports.

According to a message on the Association’s Telegram channel, at the same time, compared to July last year, the market has decreased by 65%.

As reported, in June this year, this market decreased by 7% by May 2022 and by 3.4 times by June 2021 to 429 units.

According to Ukravtoprom, Volkswagen showed the best result in July with the registration of 66 cars (in July last year, the brand was in fifth place in the rating with 110 cars, in May 2022 it sold only 45 cars).

Second place belongs to Volvo – 65 registrations, third – to MAN with 64 cars.

Renault, the leader of last year’s July and May of this year, dropped to fourth position with 45 cars (against 417 a year earlier), and Hyundai closes the TOP-5, in the standings of which there are 43 cars.

According to Ukravtoprom, in January-July 2022, 3.8 thousand new commercial vehicles were registered in Ukraine, which is 2.2 times less than in the same period last year.

In turn, the AUTO-Consulting information and analytical group, analyzing separately the market for light commercial vehicles (gross weight up to 3.5 tons) and the truck market, notes that the first in July sharply (by 81%) decreased by July last year – to 289 units ., while the second “demonstrated record sales.”

In a message on the website, experts note that the position of the new market leader in light commercial vehicles (LCV) Volkswagen is significantly strengthening – in July it occupied 25% of this market segment with sales growth of 55% by July 2021.

Hyundai came in second place, ahead of Renault by one car.

At the same time, according to the group’s assessment, after the departure of Belarusian MAZ and Russian KAMAZ, the market for heavy-duty vehicles began to transform and European trucks seized the leadership.

In particular, Volvo Trucks became the leader with a share of 18.8%, MAN became the second with a share of 18.5%, and Scania was the third.

“In general, over seven months, the truck market in Ukraine decreased by 43.6%, but in July it was possible to minimize the fall to 33.6%. The market is recovering and recovering and showing the best recovery rates among the entire car market,” AUTO-Consulting notes.

The forecast for the harvest of grain and oilseeds in Ukraine this season has been improved by approximately 5-7 million tons – up to 65-67 million tons from 60 million tons, according to the website of the government portal on Wednesday.

It is specified that the increase in the harvest forecast was announced by the Minister of Agrarian Policy and Food Mykola Solsky during a conference call between Prime Minister Denys Shmyhal and the heads of regions.

In turn, the Prime Minister noted that in the context of the Russian military invasion in Ukraine, 12 million tons of new crop grain have already been harvested from a total area of 3.5 million hectares.

Shmyhal also announced the emergence of additional opportunities for grain exports due to the unblocking of the Odessa seaport under the Istanbul Agreement on the export of agricultural products from Ukraine, concluded on July 22 under the auspices of the UN.

“In total, in June we exported 3.2 million tons out of 5 million tons (pre-war monthly volumes – IF-U) that were required. Exports are gradually growing both by rail, by road, and through the Danube ports. Sea ports will significantly expand these opportunities and farmers will receive new opportunities for the sale of products. The state is doing everything necessary for this,” the Prime Minister’s government portal quotes.

Shmygal also noted the recently introduced grant program for the development of horticulture, greenhouses, the development of processing and micro-enterprises, under which over 5,000 applications have already been submitted and processed, and this week the first applicants will receive state support.

As reported, the US Department of Agriculture in the July report predicts the harvest of Ukrainian wheat in the 2022/2023 marketing year (MY, July-June) at the level of 19.5 million tons, its export – 10 million tons, domestic consumption within the country – 10.2 million tons . The corn harvest is estimated at 25 million tons, export – 9 million tons, domestic consumption – 10.7 million tons.

In early July, the Ukrainian Grain Association (UGA) increased the forecast for the harvest of grains and oilseeds in Ukraine in 2022 by 4.4% compared to the May forecast, to 69.4 million tons from 66.5 million tons.

According to her forecasts, in 2022 the wheat harvest is expected at the level of 20.8 million tons (+8.3% to the organization’s May forecast); 27.3 million tons of corn (+4.6%); 6.6 million tons of barley (forecast kept); 9 million tons of sunflower (forecast kept); 2.2 million tons of soybeans (+4.7%); 1.5 million tons of rapeseed (+13.3%).

Energoatom and American Westinghouse are launching an internship program for Ukrainian nuclear scientists in the United States, within which more than 60 specialists and graduates of nuclear specialties will study AP1000® technology.

“Westinghouse Electric and Energoatom announced today a partnership, thanks to which more than 60 Ukrainian nuclear scientists and senior students will be able to take internships and get opportunities for development,” the company said on the Telegram channel on Wednesday.

The multi-year hands-on AP1000® technology training program will begin in the fall of 2022 at Westinghouse’s US headquarters. Upon completion of the training course, newly minted AP1000® technology technicians will have numerous opportunities to apply their engineering, technical and process support skills to new unit construction projects using this technology in Ukraine, in particular at the newly established Westinghouse Engineering and Technology Center in Kyiv, Energoatom said.

Specialists will also be trained to provide critical support for future decommissioning programs at Ukrainian nuclear power plants, the company added.

According to Oleh Boyaryntsev, Executive Director for Human Resources at Energoatom, the most talented and promising young professionals and graduates of leading Ukrainian universities will be selected for the internship.

“Thanks to the Westinghouse training program, Ukrainian specialists and students will receive a unique experience for development in the nuclear industry as we begin to implement AP1000® projects throughout Ukraine,” David Durham, president of Westinghouse Energy Systems, is quoted in the message.

He stressed that the opening of Westinghouse facilities for current and future Ukrainian nuclear scientists strengthens the company’s close partnership with Energoatom and Ukraine.

As reported, in June 2022, Westinghouse and Energoatom expanded agreements for the supply of nuclear fuel for all operating Ukrainian nuclear power plants and construction of nine AP1000® power units.