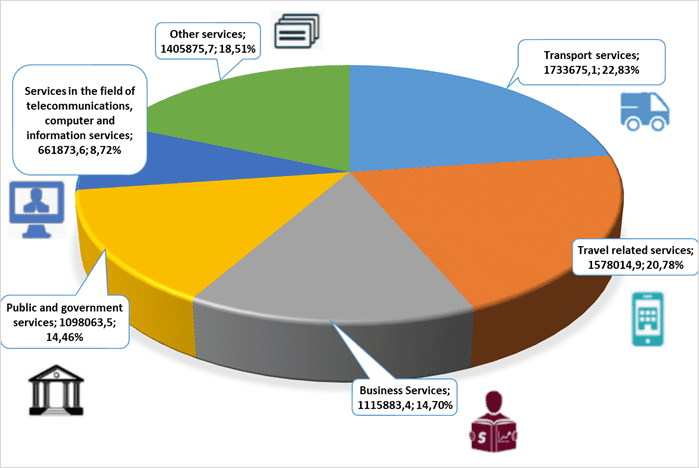

Structure of import of services in Ukraine in 2021

SSC of Ukraine

Minister of Foreign Affairs of Ukraine Dmytro Kuleba discussed with German Foreign Minister Annalena Baerbock the issues of toughening sanctions against the Russian Federation and strengthening the defense capability of Ukraine, and also thanked the German side for refusing to a demand of the Russian Federation to pay for energy in Russian currency.

“I spoke with Annalena Baerbock and thanked Germany for refusing to pay for Russian natural gas exports in rubles. Emphasized the need to impose new stiff sanctions on Russia. Informed on the frontline developments. The need to further strengthen Ukraine’s defense capabilities is urgent,” Kuleba wrote on Twitter on Saturday.

Ukrainian Foreign Minister Dmytro Kuleba had a conversation with Moroccan Foreign Minister Nasser Burita.

“Ukraine and Morocco maintain friendly bilateral relations, and we look forward to their further strengthening in all areas, including food security, trade expansion and cooperation within international organizations,” Kuleba wrote on Twitter.

As reported, President of Ukraine Volodymyr Zelensky on Thursday, March 31, signed a decree by which he recalled the Ukrainian ambassador to Morocco.

“There are those who work together with everyone for the defense of the state. In order for Ukraine to win back its future. We appreciate the work of each such person. And there are those who waste time just to remain in office. Today I signed a decree to recall such a person, to recall such an ambassador from Morocco,” the president said.

The Russian side at the talks with Ukraine agreed that the referendum is the only way out in the process of recognizing the country’s neutral status, David Arakhamia, head of the Ukrainian delegation at the talks, said during a telethon on Ukrainian television on Saturday.

“The Russian side agreed that this would be the only way out of this situation,” he said.

Answering the question what will happen if the transition to a neutral status is not supported by the people of Ukraine, Arakhamia said that “the treaty will then not have legal force, and we will either return to a state of war, perhaps, or return to new negotiations.”

Ukraine has stopped power unit No. 1 of the Khmelnytsky NPP, which remained in operation after power unit No. 2 was taken out for repair, as a result of which only seven of the 15 existing power units are operating in the power system, the International Nuclear Energy Agency (IAEA) reported, citing the Ukrainian nuclear regulator SNRIU.

According to the IAEA’s daily report on Ukraine on its website late on Saturday evening, the agency explained the shutdown of the remaining power unit by taking it out for scheduled repairs.

“Seven reactors are operating in the country, including two at the Russian-controlled Zaporozhye Nuclear Power Plant, three at the Rivne Nuclear Power Plant and two at the Yuzhno-Ukrainian Nuclear Power Plant. Other reactors have been shut down for regular maintenance, including both units of the Khmelnytsky Nuclear Power Plant,” the statement said.

As reported, since February 18, KhNPP power unit No. 2 was shut down for scheduled preventive maintenance, lasting approximately 92 days.

According to the IAEA, power unit No. 2 of the Rivne NPP was recently put into repair, after which 8 out of 15 power units remained in operation.

Earlier, NNEGC Energoatom reported that three ZNPP power units were put into reserve after the station was occupied by Russian invaders, only one is under repair.

Khmelnytsky NPP consisting of two power units (VVER-1000) with a total capacity of 2000 MW is located in Netishyn (Khmelnytsky region).

In total, there are 15 power units in Ukraine equipped with water-cooled power reactors with a total installed electrical capacity of 13.835 GW.

Presidents of Ukraine and Russia Vladimir Zelensky and Vladimir Putin “with a high degree of probability” will meet in Turkey, head of the Ukrainian delegation at the talks David Arakhamia said during a telethon on Ukrainian television on Saturday.

According to him, Turkish President Recep Tayyip Erdogan “called both us and Vladimir Putin yesterday, and he seemed to confirm for his part that they were ready to organize a meeting in the near future.”

“Neither the date nor the place is known, but we believe that the place with a high degree of probability will be Istanbul or Ankara,” Arakhamia said.