All foreigners and stateless persons who stay in Ukraine on a legal basis can be vaccinated against COVID-19 following the same procedure as Ukrainian citizens, the Ministry of Health said on Facebook.

According to the report, foreigners and stateless persons who permanently reside in Ukraine, as well as refugees or persons in need of additional protection, have the right to free vaccination. They can book their vaccinations online at the nearest location or vaccination center.

At the same time, for foreigners and stateless persons who temporarily stay on the territory of Ukraine, medical services should be covered at their own expense, voluntary medical insurance funds or from other sources not prohibited by law. The COVID-19 vaccine itself is free of charge.

All foreigners and stateless persons can obtain an International Certificate of Vaccination against COVID-19 in Ukraine.

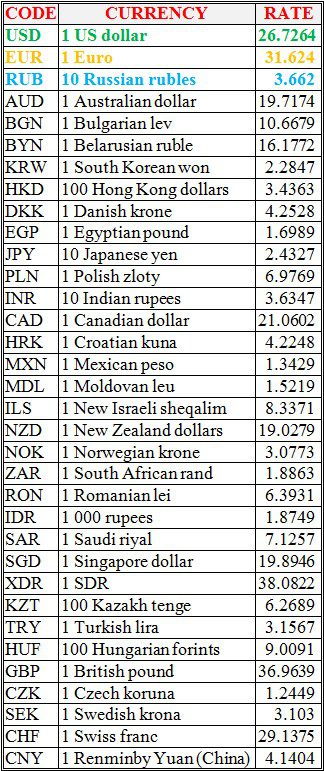

National bank of Ukraine’s official rates as of 10/09/21

Source: National Bank of Ukraine

Verkhovna Rada Chairman Dmytro Razumkov predicts that three or four ministers may be dismissed in the near future.

“I think the figure of three-four is quite realistic,” Razumkov said at a briefing on Friday, answering the question of how many ministers could lose their posts.

A possible future meeting of Ukrainian President Volodymyr Zelensky with Russian President Vladimir Putin will be complicated, said Leonid Kuchma, the second president of Ukraine, ex-head of the Ukrainian delegation to the Trilateral Contact Group (TCG).

“Everything is possible in life. The main thing is the desire of our president … We will be waiting for a signal from the other side. But this meeting is too complicated from all points of view. It seems to me that I could be wrong – the conversation will be in different languages,” Kuchma said in an interview with journalists at the YES Brainstorming forum.

According to him, it is not yet clear whether Putin is ready to meet in the framework of problems that now exist in Ukrainian-Russian relations and to take “specific steps.”

Kuchma added that the big question is whether it is worth “just going nowhere and coming with nothing.”

YES Brainstorming is a new format event for the Yalta European Strategy (YES) in partnership with the Victor Pinchuk Foundation. The topic of the meeting is entitled “After COVID Means Before the Disaster? Steps to Survival.”

The annual meetings of the Yalta European Strategy, a public organization that would facilitate the process of Ukraine’s accession to the EU, have been held since 2004 at the initiative of Victor Pinchuk. YES meetings have become an open platform for discussing new ideas and views on the development paths of Europe, Ukraine and the whole world.

Experts from the US George Washington University will help Ukraine attract external research grants for the implementation of irrigation reform, conduct educational programs through the exchange of specialists and provide the country with technical assistance, the Ministry of Agrarian Policy and Food said on its website on Thursday.

According to it, the relevant agreements were reached during a meeting between Minister of Agricultural Policy Roman Leshchenko and the staff of the George Washington University, which took place in early September.

The parties at the meeting discussed a partnership in which the institution will help Ukraine find external research grants for irrigation reform. The university also intends to conduct educational programs through the exchange of specialists with Ukraine and provide it with technical assistance.

“We need new technologies to change our environmental philosophy, because Ukraine can lose a lot of fertile land without a high level of water management,” the press service of the Ministry of Agrarian Policy quoted Leshchenko as saying.

The minister specified that Ukraine creates conditions for attracting foreign investment and developing public-private partnerships in land relations. According to him, after the opening of the land market on July 1, Ukraine intends to form a legal basis for the activities of the organization of water users and the creation of mechanisms for attracting investments in the construction of a new reclamation infrastructure and the functioning of the existing one.

As reported, the United States may provide Ukraine with a credit line totaling $4 billion for the period 2022-2030 to modernize irrigation infrastructure. The investment project was proposed to the American partners by President Volodymyr Zelensky for consideration during his working trip to the United States last week.

In April 2021, the Cabinet of Ministers called for the restoration of irrigation systems for agricultural lands in the southern regions of the country by the end of this year.

The restoration of the reclamation industry has become a national project until 2024. In 2021, the Ministry of Agrarian Policy launches a pilot project to restore irrigation systems in Odesa, Kherson, Mykolaiv and Zaporizhia regions.

EXTERNAL GRANTS, GEORGE WASHINGTON, LAND RECLAMATION INDUSTRY, REFORM, UNIVERSITY