Ukrzaliznytsia plans to start restoring international passenger traffic in June, according to a message posted on the company’s website on Thursday.

According to it, in particular, preliminary agreements have already been reached on the resumption of railway communication with Austria and Hungary. In addition, negotiations are underway with PKP Intercity and the Polish railway to restore high-speed communication between the countries.

“Now in Ukraine and neighboring countries, there is a stabilization of the situation with the spread of coronavirus infection. This allows negotiations with the railway administrations of neighboring countries to restore international routes. Last week, we examined the readiness of infrastructure in the west of the country, bordering on European countries. There we started a number of projects. Therefore, I can say with confidence that Ukrzaliznytsia is ready to restore these transportations,” the press service quoted acting head of the company Ivan Yuryk as saying.

According to the company, Ukrzaliznytsia has already received approval for the running of Kyiv-Vienna direct cars since June. In addition, there are plans to restore trains running on the Chop – Zahony (Hungary) route. The message states that after the restoration of international passenger traffic, passengers will also be able to purchase tickets to Belarus and back online.

At the same time, Yuryk stressed that control over compliance with anti-epidemiological measures will be strengthened on international routes.

The net profit of Alfa-Bank (Kyiv) in January-March 2021 amounted to UAH 977.9 million, which is 3.3 times more than in the same period in 2020 (UAH 295 million).

According to the bank, net interest income for this period increased by 2%, to UAH 1.415 billion, net commissions – by 10.3%, to UAH 821.5 million.

At the same time, the assets of Alfa-Bank in the first quarter decreased by UAH 15 million, to UAH 97.578 billion, in particular the loan portfolio – by 4%, to UAH 45.93 billion.

The bank’s liabilities decreased by 1%, to UAH 86.96 billion, in particular customer funds – by UAH 108 million, to UAH 73.4 billion.

The bank’s capital in the first three months of the year increased by 10.4%, to UAH 10.62 billion. The charter capital remained at the level of UAH 28.726 billion.

As of March 1, 2021, Alfa-Bank ranked sixth in terms of total assets (UAH 109.94 billion) among 73 banks operating in the country.

Firefly Aerospace Inc., the American rocket and space technology developer, owned by Ukrainian businessman Maksym Poliakov, has completed the first round (A) of venture funding with more than $ 175 million raised (with the planned $ 75 million), the total cost of the company exceeded $ 1 billion.

According to Firefly CEO Tom Markusic, the interest of investors during Round A significantly exceeded the initially planned $ 75 million and in order to meet the demand, the main investor of Firefly – Noosphere Ventures – sold part of shares worth more than $ 100 million to a number of participants in this round and other shareholders, while remaining the majority shareholder.

According to the company, this decision did not affect the strategic management and control of the company.

Following the launch of the Alpha carrier rocket, Firefly plans to raise an additional $ 300 million in investment by the end of 2021 to support the company’s growth plans through 2025, according to a Facebook post by Firefly Aerospace.

Tom Markusic stressed that the implementation of the next investment round, scheduled for 2021, will allow Firefly to fully fulfill its business plan for the development of new spaceships and launch vehicles.

As reported, earlier Firefly Aerospace announced plans to raise $ 350 million to scale production and create a mid-range rocket – Firefly Beta.

K.A.N. (Kyiv) in 2020 reduced its net profit by 24% compared to the previous year, to UAH 98.9 million.

According to the company’s annual report in the information disclosure system of the National Securities and Stock Market Commission, its revenue increased by 8.3% and amounted to UAH 303.6 million.

Uncovered loss in 2020 decreased by 40.6%, to UAH 144.4 million, current liabilities – by 80%, to UAH 51.4 million, long-term liabilities over the year did not change and amounted to UAH 447.9 million.

In general, the assets of K.A.N. last year decreased by 13.5%, to UAH 674.8 million.

K.A.N. established in 2001, it is engaged in the rental and operation of its own real estate. According to the data of the unified state register of legal entities and individual entrepreneurs, the owner of the company is Deverte Holding GmbH (Austria).

The registered capital of К.А.N. for April 2021 is UAH 23,600, the ultimate owner is Oleksandr Spektor (Kyiv).

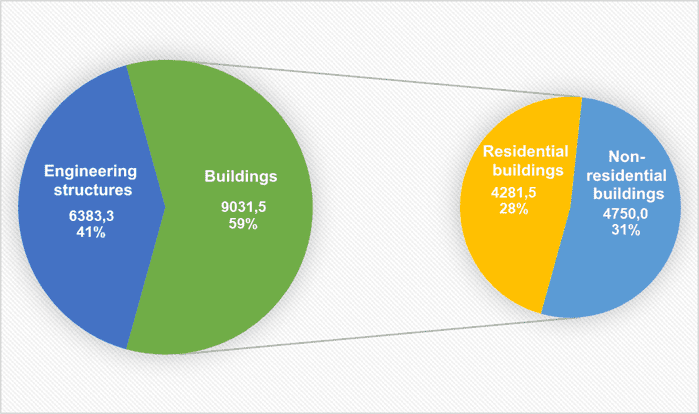

Volume of construction products produced by type in Jan-Feb of 2021 (mln UAH)

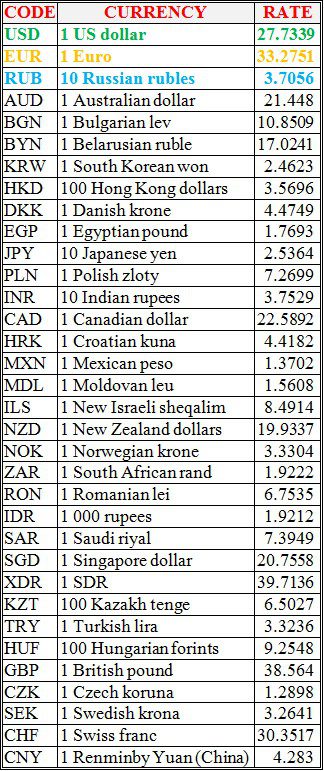

National bank of Ukraine’s official rates as of 06/05/21

Source: National Bank of Ukraine