An overstated tariff for energy from renewable sources (RES) in comparison with the market rate leads to significant and problematic payments to investors for Ukraine, which are estimated at $ 10-20 billion until 2029, acting Energy Minister Yuriy Vitrenko has said.

“If to look at the difference between the feed-in tariff and the market price, at least now, and multiply this by conservative estimates of production from renewable sources and multiply this by the term of the feed-in tariff – until 2029, then the amount of compensation from the state budget to investors in green energy will be from $ 10 billion to $ 20 billion,” he said while discussing the economic strategy until 2030.

Vitrenko noted that the feed-in tariff is several times higher than the market price.

“For a developing country like Ukraine, $ 10-20 billion is a significant amount, which is a problem,” he stressed.

The minister also criticized the current system of payments through the energy system operator Ukrenergo, which has no interest in paying for renewable energy sources, since their uneven generation brings it additional problems. According to Vitrenko, such payments should be made through the state budget as a public good in the form of clean energy.

A number of European Business Association (EBA) member companies, which “have Chinese roots,” are concerned about the imposition of sanctions by Ukraine against the Chinese shareholders of PJSC Motor Sich and will temporarily refrain from investing, EBA Executive Director Anna Derevyanko has said.

Chinese investors have temporarily put on hold all the issues related to investing in the country, she said at a meeting of the Global Economic Review of Ukraine association, when its participants raised the issue of these sanctions and their possible consequences for trade and economic relations with China.

According to Andriy Horokhov, the director general of UMG Investments, in 2020 Ukraine was lucky with the conjuncture in agriculture and metallurgy, and a large part of the products of these industries went to China. He added that the Chinese market is also expected to grow in 2021.

“I understand for sure that you have to be more careful with a trading partner with a turnover of about $ 10 billion,” he said.

“If suddenly we make mistakes in this direction, then we will need to understand where we will compensate for our sales markets, given the situation in Europe and the United States and the uncertainty with the pandemic. I hope there will be wise and balanced decisions here, and people will professionally approach this issue,” he said.

The Verkhovna Rada Committee on State Power, Local Self-Government, Regional Development and Urban Planning has supported the renaming of Novhorodske, Bakhmutsky district, Donetsk region, to New York, said Deputy Head of the Committee Oleksandr Kachura (Servant of the People faction).

“Today, at a meeting of the committee of state power and local self-government, it was decided to rename the urban-type settlement Novhorodske, Bakhmutsky district of Donetsk region, to New York,” the deputy wrote on the Telegram channel.

He also noted that the decision was made “on the basis of a motion from Donetsk military-civil administration: the appeal says that this is the historical name of the settlement, which was used until 1951.”

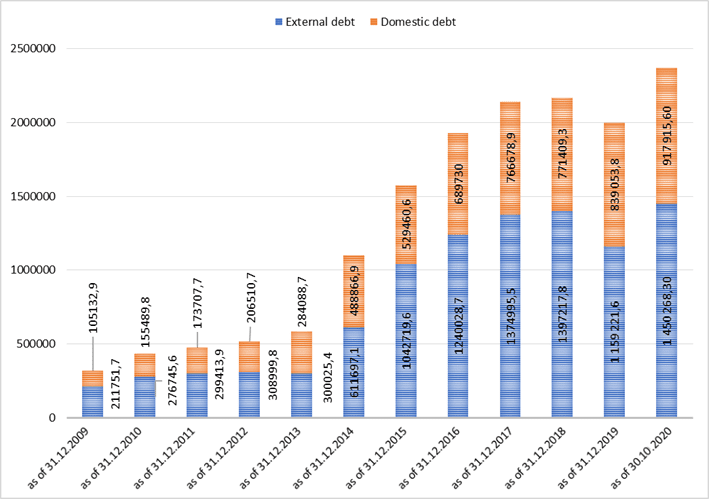

Internal and external debt of Ukraine in 2009-2020.

SSC of Ukraine

Dragon Capital plans in 2021 to return to the rates of investments that were before the pandemic, Dragon Capital Head Tomas Fiala said.

“In the first half of the year, we plan to close five deals together with co-investors and Western funds for about $200 million. We hope to close them in the first half of the year, so we will return to the rates of investments that were before coronavirus [COVID-19],” he said at the EBA Global Outlook meeting hosted by the European Business Association on Thursday.