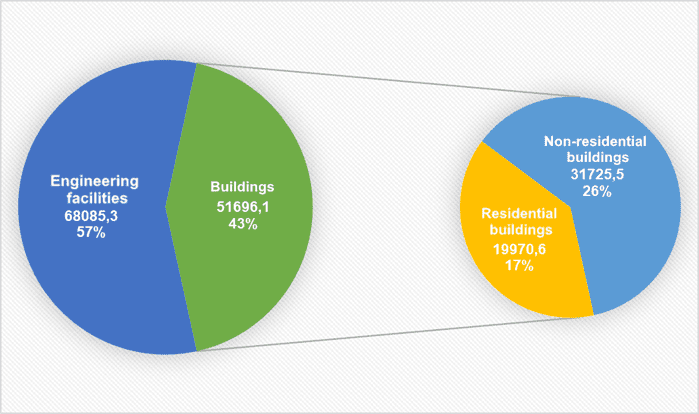

Volume of construction products produced by type in Jan-Sept of 2020 (mln UAH).

SSC of Ukraine

Inspectors of the State Service of Ukraine for Transport Safety (Ukrtransbezpeka), together with the National Police, checked almost 700,000 vehicles in 2020, having drawn up more than 14,000 acts on violation of overall and weight parameters, and accrued more than UAH 137 million of overload fees.

The press service of the Ministry of Infrastructure reported on Tuesday with reference to Minister Vladyslav Krykliy, among the regions at the end of the year, most of the fees was charged in Odesa, Kherson and Kyiv regions.

“In 2020, we declared a battle to overloaded trucks, introduced enhanced weight control and continue work on reforming and digitizing Ukrtransbezpeka to eliminate the human factor. More than 40 WiM systems have been installed. And this year at least 100 WiM will work,” the press service said, citing Krykliy as saying.

According to him, full automation and digitalization of all processes to eliminate the human factor remains the main goal of the ministry in reforming Ukrtransbezpeka. But for the full-fledged launch of the automatic weight control system in Ukraine, the soonest adoption of bills No. 3742 and No. 3743 by MPs is necessary.

“Now the Verkhovna Rada is considering at the second reading bill No. 3743, which provides for the refusal of fare and transfer of responsibility for violation of the overall and weight standards in the plane of the Code of Ukraine on Administrative Offenses. This will simplify the collection procedure and increase the percentage of paid fines,” Head of Ukrtransbezpeka Yehor Prokopchuk said.

Pivdenny Mining and Processing Plant (Pivdenny GOK, Dnipropetrovsk region) in 2020 increased the output of iron ore concentrate by 4.4% compared to the previous year, to 12.798 million tonnes.

According to the company, no sinter was produced last year.

In December, the plant produced 1.064 million tonnes of iron ore concentrate, which is 10.2% more than in December 2019.

Pivdenny Mining and Processing Plant is one of the main producers of iron ore raw materials in Ukraine, concentrate and sinter. It is engaged in the extraction and enrichment of ferruginous quartzites to obtain iron ore concentrate with an iron content of 67.7%, as well as blast furnace sinter with an iron content of 58.18%.

The plant is controlled by the Metinvest Group and Lanebrook Ltd. (the majority shareholder of the Evraz Group), which at the end of 2007 acquired 50% of Pivdenny GOK shares from the Privat Group (Dnipro).

International airport Lviv in 2020 reduced passenger traffic to 878,500 people, which is 60% less than in 2019 (2.218 million people).

The relevant information was provided to Interfax-Ukraine by the press service of the airport.

According to its data, in December 2020 the passenger traffic amounted to 47,900 people (171,900 in December 2019).

In general, in the past year the number of arrival/departure flights from the airport was 9,916 (746 in December 2020), which is 47.4% less than a year earlier – 18,982 (1,441 in December 2019).

At the same time, as noted at the airport, cargo traffic in 2020 grew by 2.2 times, to 2,282 tonnes (257.7 tonnes in December 2020). In 2019, this figure was 1,006 tonnes (147.3 tonnes in December 2019).

According to the press service of the airport, it ended 2020 without losses.

As of January 4, 2021, Ukrtelecom has already installed 45 UTrecharge charging stations for electric transport out of 50 provided in the pilot project in Kyiv and the suburbs.

According to the press service of the company, in Kyiv region the stations have already been installed in Vyshgorod (2 Shevchenko Square), Irpin (120a Severynivska Street), Boryspil (86a Kyivsky Shliakh Street), Vorzel (25 Kurortna Street), and Bucha (22 Ostrovskoho Street).

“The introduction of the service is part of Ukrtelecom’s activities for the efficient use of the company’s resources released as a result of technical re-equipment and modernization of the telecoms infrastructure. Ukrtelecom considers this business area to be promising, including in terms of supporting technologies that do not harm the environment,” the report says.

Ukrtelecom began to provide the service of charging electric vehicles at its own UTrecharge charging stations from January 1, 2021.

Nova Poshta is introducing a new concept of branches, which will provide a full range of services for business clients and will actually replace the operator’s existing cargo branches.

According to the press service of the company, there are plans to open 40 such business branches in 2021 in the cities with the population of over one million people, regional centers and some large district centers.

“Nova Poshta has a lot of business clients – these are e-commerce market players, big business and small entrepreneurs working in various fields. Over the years of working with business, we have already thoroughly studied their needs: they make many shipments, delivering goods of various sizes – from small jewelry to large-sized equipment. They value their time and want to receive high-quality comprehensive services quickly and conveniently. We took all this experience into account when developing the concept of our new branches,” Nova Poshta CEO Oleksandr Bulba said.

The company notes that it is looking for co-investors to build new branches from scratch that will be focused on the needs of business clients. The partnership model is as follows: the investor builds branches at his own expense, and Nova Poshta undertakes to take it on a long-term lease.

“The new business branches will be placed in locations with a high concentration of businesses and developed infrastructure: the presence of access roads, parking for customers, etc. The branch premises will be divided into a front office and a back office. The first will be divided into two zones for processing items: up to 30 kg and over 30 kg. In turn, the back office will have an area for processing parcels and cargo, a packing department and a comfort zone for workers,” the report says.