“A ”coalition of the determined” has said it is ready to deploy deterrent forces in Ukraine after the war ends, according to a statement on the British government’s website.

“Today, President (of France Emmanuel) Macron and Prime Minister (of Britain Keir) Starmer jointly hosted a virtual meeting of a group of leaders of the ‘Coalition of the Resolute’ with the participation of President Zelensky,” the statement said.

Specifically, the leaders met on Sunday to discuss support for Ukraine and next steps in peace talks following President Donald Trump’s meeting with Vladimir Putin in Alaska.

The statement said the leaders praised Trump’s commitment to provide security guarantees for Ukraine, in which the “Resolute Coalition” will play a vital role through a multinational force in Ukraine.

“They reiterated their readiness to deploy support forces after the cessation of hostilities, as well as to help secure Ukraine’s skies and seas and rebuild Ukraine’s armed forces,” the statement said.

In addition, the leaders reaffirmed their continued support for Ukraine and praised Zelensky’s desire to achieve a just and lasting peace.

Also, Macron and Starmer informed the leaders that they too will travel to Washington tomorrow to meet with Trump and Zelensky.

As reported, Zelensky’s plane has already left for Washington.

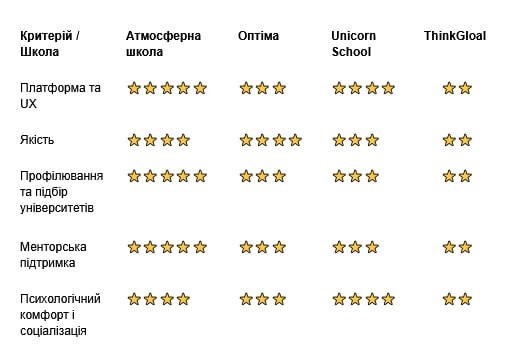

We compare the quality of education, methodology, platform, support and support for the child to help parents make an informed choice.

The Experts Club analytical center has conducted a study and compared the leading online schools in Ukraine according to the most important criteria – from the quality of education to the level of socialization – to show their strengths and differences.

Choosing a school is always about the child’s future. And more and more often, parents are choosing a laptop and their own pace of learning rather than desks and bells. Online education in Ukraine is no longer a forced step – it is now a conscious choice to learn in a new way: with interactive platforms, mentor support, and live meetings, even if children study from different cities or countries.

To help you navigate, we have analyzed the most popular online schools in Ukraine by key criteria:

Average score:

Details of the criteria

Platform and UX

Quality of education: lesson structure and methodology

Profiling and selection of universities

Mentoring support

Psychological comfort and socialization

Conclusion

Online education in Ukraine is developing rapidly, offering parents and children formats ranging from classic programs to innovative models with international diplomas.

Atmospheric School maintains its leadership thanks to its modern platform, flexible methodologies, well-thought-out profiling, and strong mentoring support.

Each school has its own strengths: some offer STEM programs, others offer international certifications or creative communities. Our ranking will help you choose a school where learning will be both effective and comfortable.

https://expertsclub.eu/yak-obraty-onlajn-shkolu-dlya-dytyny-rejtyng-5-najpopulyarnishyh-variantiv/

atmospheric_school, EXPERTS_CLUB, online_education, online_school, quality_education, school_selection

US President Donald Trump wants to meet with Ukrainian President Volodymyr Zelensky first, according to Bild. According to the German publication, citing government sources, Trump will first receive only the Ukrainian president. Zelensky will then be joined by accompanying EU leaders. A working dinner and discussion will take place, lasting several hours in an expanded format.

The reason for the visit is possible negotiations on a peace agreement with Vladimir Putin.

As reported, NATO Secretary General Mark Rutte will also join Ukrainian President Volodymyr Zelensky and European Union leaders at a meeting with US President Donald Trump in Washington on August 18.

On Monday, August 18, Zelensky plans to discuss all the details of ending the war with US President Donald Trump in Washington.

Ukrainian President Volodymyr Zelensky welcomed the US decision to participate in security guarantees for Ukraine and stressed that such guarantees must provide protection on land, in the air, and at sea.

“It is a historic decision that the United States is ready to participate in security guarantees for Ukraine. The security guarantees resulting from our joint work must be truly practical and provide protection on land, in the air, and at sea, and must be developed with the participation of Europe,” Zelensky wrote on Telegram following the meeting of the Coalition of the Willing in Brussels on Sunday.

He called the meeting of the Coalition of the Willing “very useful.” “Clear support for Ukraine’s independence and sovereignty. Everyone agrees that state borders should not be changed by force. Everyone supports that key issues should be resolved with Ukraine’s participation in a trilateral format: Ukraine, the US, and the Russian leader,” the US president wrote.

Also, according to Zelensky, the parties are developing a common view on “what a peace agreement should look like — truly honest, quick, and one that will work.”

According to the press service of the Ukrainian president, this was the seventh meeting of the Coalition of the Willing. It was co-chaired by French President Emmanuel Macron, British Prime Minister Keir Starmer, and German Chancellor Friedrich Merz.

The meeting was also attended by the presidents of Finland, Alexander Stubb; Lithuania, Gitanas Nausėda; Romania, Nicușor Dăncilă; Cyprus, Nicos Christodoulides; the prime ministers of Japan, Suga Yoshihide; Italy, Giorgia Meloni; Norway, Jonas Gahr Støre; Denmark, Mette Frederiksen; Estonia’s Kirsti Mikhal, Canada’s Mark Carney, Ireland’s Micheál Martin, Latvia’s Evika Silina, Australia’s Anthony Albanese, Luxembourg’s Luc Frieden, the Netherlands’ Dick Schoo, Portugal’s Luis Montenegro, Croatia’s Andrej Plenković, Sweden’s Ulf Kristersson, Belgium’s Bart De Wever, Bulgaria’s Rosen Zhelyazkov, the Czech Republic’s Petr Fiala, Iceland’s Kristrún Frostaðóttir, Montenegro Milojko Spajic, Chancellor of Austria Christian Scholz, Vice President of Turkey Cevdet Yılmaz, President of the European Commission Ursula von der Leyen, President of the European Council António Costa, NATO Secretary General Mark Rutte, and Deputy Prime Minister and Minister of Foreign Affairs of Poland Radosław Sikorski.

The chairman of the supervisory board of the Kiev Aviation Institute (KAI) State University and founder of the Kontora Pi public organization, Petr Chernyshov, has announced the names of six of the eight candidates for the position of KAI president.

“Two candidates have decided not to disclose their names at this stage, so we are currently referring to them as Candidate X and Candidate Y. This is their legal right, and we respect it. We are maintaining a balance between the transparency of the process and the human right to privacy until the winner of the competition is announced,” he said in a Telegram channel.

The candidates for the position of president are: Andriy Andrikevich, chairman of the Industry Committee of the Kyiv Chamber of Commerce and Industry, formerly a lecturer in strategic management at Visotsky Consulting; Yuriy Korolev, IT entrepreneur, employee of AJAX, formerly associate professor at the University of Customs and Finance; First Vice-Rector of the State University of Information Technologies and Communications, former Head of the Department of Information Technology Security at the National Aviation University, Alexander Korchenko; Head of the Red Huber NGO; former representative of Ukraine in the European Student Union, Vladimir Ksenich; Acting President of the Kiev Aviation Institute, Ksenia Semenova; Associate Professor of the Department of Automation and Energy Management at the Kiev Aviation Institute, Sergei Tovkach.

Interviews with candidates will be held on August 26 and 27, 2025.

The action plan of the Cabinet of Ministers of Ukraine, which provides for the development of arms production, social support for veterans, and stable economic policy, will be presented on Monday, announced Ukrainian Prime Minister Yulia Sviridenko.

“Tomorrow we will present the government’s action plan – a comprehensive program with specific measures and goals. Our priorities remain unchanged: strengthening the defense forces, developing arms production, social support and programs for veterans, assistance to frontline regions and IDPs, stable economic policy, recovery, and energy security. Everything we do is aimed at supporting Ukrainians,” Svyrydenko wrote on Telegram on Sunday.