Ukrainian transport companies carried 939.3 million people in January-April 2020, which is 34.1% less than a year ago, the State Statistics Service has said.

The authority said that passenger turnover of transport companies over the period totaled 19.3 billion passenger/km, which is 39.6% less than a year ago.

According to the State Statistics Service, in January-April of this year, 28 million passengers used rail transport (including transportation by the city electric train), which is 43.1% less than in January-April 2019, and 394.7 million passengers (35.1% less) travelled by road.

Air transport decreased passenger transportation by 41.2%, to 2 million people.

In addition, according to the State Statistics Service, in January-April 151.6 million passengers used trams (a decrease of 26.6% compared with the same period a year earlier), subways carried 139.2 million people (a decrease of 41%), and trolleybuses some 223.8 million passengers (30.5% down).

Passenger transportation by water decreased by 96.2% and amounted to around 10,000 people.

According to the service, the indicators are given without taking into account the temporarily occupied territory of Crimea, Sevastopol and part of the temporarily occupied territories of Donetsk and Luhansk regions.

PJSC Farmak pharmaceutical company (Kyiv) will use the German scientists’ protocol of clinical trials of the antiviral medicine efficiency, produced by Farmak for coronavirus (COVID-19) treatment, the company’s press service said with reference to Chairperson of the Supervisory Board of Farmak Filya Zhebrovska.

“This medicine was tested apart from human trials and showed good results. We need to come to clinical trials and conduct them, so that in the autumn we know that this medicine is effective and it can fight COVID-19. German scientists helped us indeed. They have prepared the clinical trial protocol correctly, so that we can investigate if this medicine is working according to all necessary criteria. This is a big, hard and expensive work,” she said.

Zhebrovska said that the antiviral medicine, which efficiency against COVID-19 Farmak plans to test, is also being studied by foreign research centers.

“There are good studies on our antiviral medicine at Oxford and Frankfurt universities,” she said.

Zhebrovska said that significant financial funds are needed for the development of COVID-19 vaccines, which Ukraine and the Ukrainian pharmaceutical companies do not currently have.

“The European Investment Bank organized a consortium together with the WHO and allocated EUR 7.6 billion for the development of vaccines for COVID-19. Neither Farmak, nor Ukraine, unfortunately, have such financial capacities. Perhaps we can join to these works at some stage,” she said.

Farmak is the leader in the pharmaceutical market of Ukraine in terms of sales. It exports products to 20 countries.

Minister for Foreign Affairs and Trade of Ireland Simon Coveney, during a telephone conversation with Ukrainian Foreign Minister Dmytro Kuleba, confirmed his intention to open the Irish Embassy in Ukraine by the end of 2020, the press service of the Ministry of Foreign Affairs of Ukraine reports.

“The opening of the Irish Embassy in Kyiv is an important milestone in our relations. We also expect that the Irish business mission will arrive in Ukraine by the end of the year. We need to quickly and efficiently develop trade and attract Irish investment in Ukraine,” the press service of Ukrainian Foreign Ministry quoted Kuleba as saying on Wednesday.

Kuleba also noted the consistent support by Ireland for the sovereignty and territorial integrity of Ukraine, including in the framework of international organizations.

The ministers exchanged information on overcoming the consequences of the COVID-19 pandemic and measures taken by the governments of both countries to return to everyday life.

PJSC Agrarian Fund financed UAH 233 million under the forward program for agricultural producers, purchasing 72,000 tonnes of grain crops.

According to a report on the company’s website on Tuesday, the spring forward program of the company will last as long as applications from producers arrive.

“To date, PJSC Agrarian Fund funded agricultural producers for UAH 233 million by purchasing 72,000 tonnes of grain. Yes, this is not enough compared to previous years, but the forward program has not yet been completed, and contracts will be concluded while applications from agrarians arrive,” acting Head of the Agrarian Fund Bohdan Bunchuk said.

Under the terms of the 2020 forward program, financing is provided in mineral fertilizers and cash. Funds in the financing structure can be up to 50% of the contract amount. The collateral is the grain of the 2020 harvest.

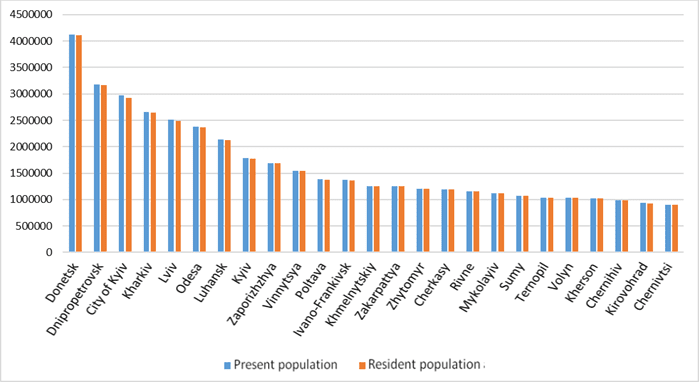

Ukrainian population by regions as of March 1, 2020 (graphically)

The cost of staying in three- and four-star hotels in Odesa has decreased by half compared to the same period in 2019 and averages UAH 650 per day ($24), founder of Ribas Hotels Group Artur Lupashko has told Interfax-Ukraine.

“Today, the average price in three- and four-star hotels is UAH 650 per day ($24) in Odesa. This is an unprecedented low rate over the past 20 years. In the same period last year, such a room cost at least twice as much and was three times more expensive in 2013,” Lupashko said.

According to his estimates, the expected decline in gross income and net profit of hotels will be 20-40% in 2020 compared to the indicators in 2019.

“The positive dynamics can continue in cottage-type hotels and recreation centers, which have been in high demand since April and have increased in price in some cases up to 50%. Some of them have already been booked for the whole summer by guests who, as a rule, spent the summer in Cyprus, Spain, Italy,” he said.

However, hotels do not count on guests from other countries in 2020.

“The vast majority of Belarusian tourists were in the resort budget hotels. According to information available today, guests from Belarus will not be allowed to Ukraine this year. Most likely, these may be guests from Moldova and Turkey in the second half of the year. However, the share of such tourists will be minimal and will not have significant influence on the market,” the expert said.

Ribas Hotels Group collaborates (management and booking) with 25 hotel and restaurant complex facilities (beach and ski hotels, hostels and recreation centers), two of which are its own. The company’s portfolio includes Wall Street Hotel business hotel, Bortoli city mini-hotel (all are located in Odesa), Richard hotel complex (Hrybivka), Kyparys park hotel (Yuzhne), Seazone mini-hotel (Karolino-Buhaz), a chain of youth hostels Friday and others.

The total number of rooms of the chain was 1,234 rooms in various forms of cooperation at the beginning of 2020.

Ribas Hotels Group provides integrated management, exclusive booking, franchising and design services.

Ribas Hotels Group LLC was established in 2017. According to the unified register of legal entities, individual entrepreneurs, director and owner of a 100% stake in charter capital of the company is Lupashko.